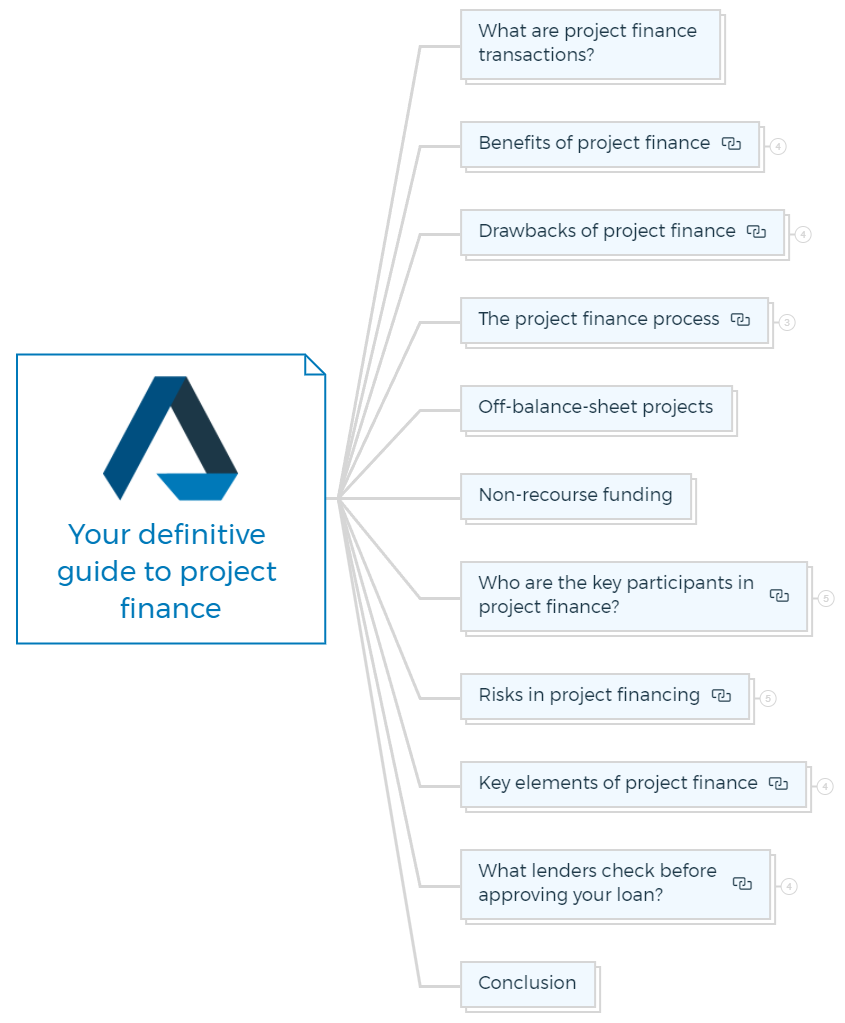

Project finance funds large-scale project development like infrastructure and industrial plants. A project-specific SPV is created for this financing method. The SPV raises funding from equity investors, debt providers, and multilateral development banks for project building and operation.

In this guide to project finance, we will delve into the concept of project finance, how it works, and its benefits and drawbacks. We will also explore some critical elements of project finance, including risk management, financing structures, and complex contract arrangements.

Key Takeaways

What are project finance transactions?

Project finance is a method of financing large-scale development projects where the funding for the project is raised through a separate legal entity aka SPV (special purpose vehicle) that is created solely for that project.

In project finance, lenders assess the risks and possible profitability of the project before making a loan based on the project's anticipated cash flows. A group of investment partners is involved in project financing, and they are paid back based on the project's cash flow.

This type of financing is often used for large-scale projects that require significant upfront capital, such as infrastructure projects, power plants, or real estate developments.

Public-Private Partnerships (PPPs) have become an increasingly popular way of financing and managing projects for infrastructure sectors.

Project finance allows investors to limit their exposure to the risks associated with the project, while also allowing the project to access the necessary funding.

Sponsors of project funding are financial institutions that accept risk. The project may be sponsored by businesses in the same sector, contractors, the government, or other public entities.

With this form of project financing, the investors are paid back by the project's cash flows rather than the sponsors' creditworthiness. Banks, private equity firms, and other financial institutions might be among the investors.

What is SPV?

SPV stands for Special Purpose Vehicle, a separate legal entity created solely for a specific purpose, such as financing a project.

One of the key benefits of using an SPV in project finance transactions is the ability to structure the financing in a way that minimises the risks to investors and lenders.

Project financing is typically used to support significant industrial or infrastructural projects that require construction, such as adding a transportation system or power-producing plant.

Unexpected construction or environmental issues might cause project failure, making them risky. Project financing offers large cash for early costs, making it suitable for such projects.

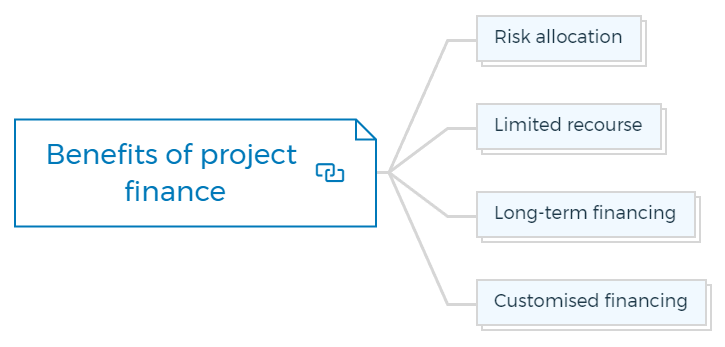

Benefits of project finance

Large-scale project funding has various advantages:

Risk allocation

Project finance allocates risks to the best-equipped parties. Investors and lenders only face risks they can handle.

Limited recourse

Project financing lenders can only recoup their investment from project assets and cash flows, not the sponsor's general assets.

Long-term financing

Traditional financing methods may only work for short-term projects that demand substantial resources. Project finance provides longer-term funding that matches the project's income stream.

Customised financing

Project finance provides for project-specific funding. Senior, mezzanine, or equity debt may be used.

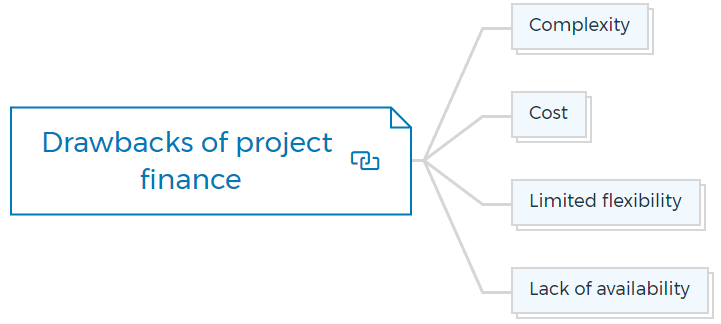

Drawbacks of project finance

Project finance has certain drawbacks:

Complexity

Project finance transactions are a type of loan that is used to fund large projects, like building a power plant or a highway. However, these loans are more complicated than regular loans because they require a lot of expertise to put together and manage.This might take longer and cost more than typical borrowing.

Cost

Due diligence, legal fees, and other upfront expenditures are expected in project financing transactions. These costs can be substantial, particularly for smaller projects or projects in emerging markets.

Limited flexibility

Project finance models are significantly less flexible than standard financing arrangements when restructuring or refinancing debt. This makes project and market change harder to handle.

Lack of availability

Project funding may not be accessible for high-risk or low-revenue ventures. This restricts investors and lenders, making funding harder.

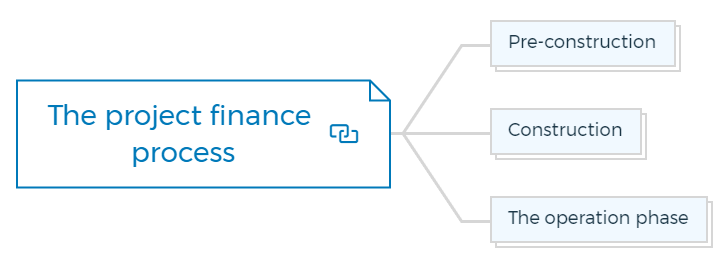

The project finance process

There are three stages in the project financing process -

Pre-construction

- Determine project viability.

- Assess market demand for the project's goods and services by conducting a market analysis.

- Create a project plan including a timeframe, budget, and finance.

- Get regulatory clearances.

- Negotiate supplier-customer contracts.

Construction

- Getting finance from lenders and investors.

- Start project construction.

- Manage construction risks and progress.

Learn More

The operation phase

- Start the project's activities and generate revenue from it.

- Manage the project to achieve financial and operational goals.

- Manage risks associated with ongoing operations of the project.

Off-balance-sheet projects

Off-balance sheet funding funds initiatives without impacting the sponsoring firm. It finances significant projects when the company's balance sheet cannot sustain further debt.

Special purpose vehicles (SPVs)—legal entities that own and run the project—provide off-balance sheet funding. The sponsoring firm doesn't guarantee the SPV's assets and obligations.

Off-balance sheet finance avoids debt covenants and provides funds that regular debt financing may not. It might be costly and complicated to structure.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

Non-recourse funding

Non-recourse financing gives the lender no recourse to the sponsor's assets beyond the project. It reduces the sponsor's financial risk and increases the lender's project risk in project finance.

Limited recourse, project finance bonds, and mezzanine financing are non-recourse. Due to lender risk, non-recourse lending costs more. It reduces sponsors' financial risk if the initiative fails.

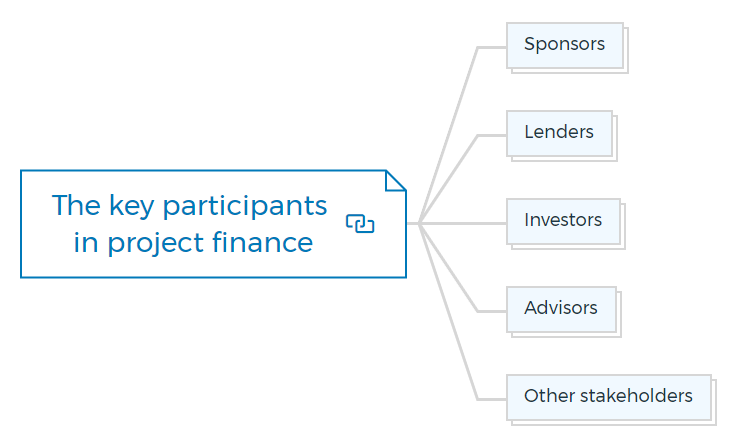

Who are the key participants in project finance?

Many critical players make project financing successful. These participants are -

Sponsors

Sponsors start the initiative and provide early financing. They find, develop, and bring together investors, lenders, and advisers.

Lenders

Lenders are financial institutions or banks that supply project debt finance. They assess the project's feasibility and risks and give funding.

Investors

Investors are the entities that provide equity financing to the project. They receive a share of the project's profits and are also exposed to the risks involved.

Advisors

Lawyers, accountants, engineers, and consultants advise project stakeholders. They organise the project, get resources, analyse its feasibility, and offer legal, financial, and technical advice.

Other stakeholders

Contractors, suppliers, regulators, and governments are stakeholders involved in the project.

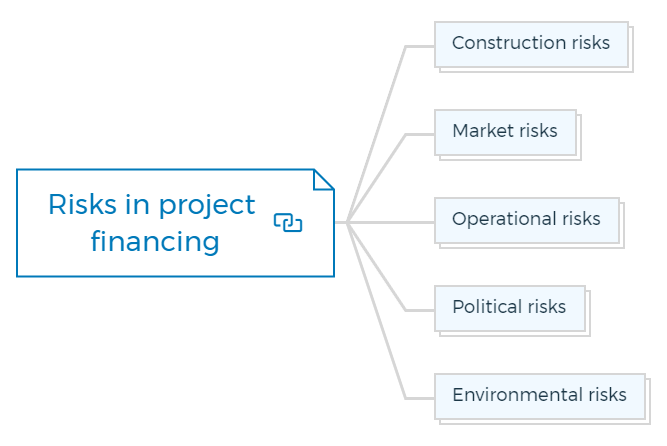

Risks in project financing

Project finance transactions come with multiple risks that can affect profitability and viability. The risk factors for such transactions include:

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

Construction risks

Delays, cost overruns, and construction problems can impact project profitability.

Market risks

It includes a change in commodity prices, currency rates, taxes, and interest rates that affect project cash flow.

Operational risks

Technical failures, environmental issues, accidents, and regulatory changes might affect project operations.

Political risks

Government policy changes, expropriation, and any form of public instability can affect project profitability.

Environmental risks

Natural catastrophes and climate change might affect the project's profitability.

Project financing requires risk management to identify and reduce risks to protect stakeholders.

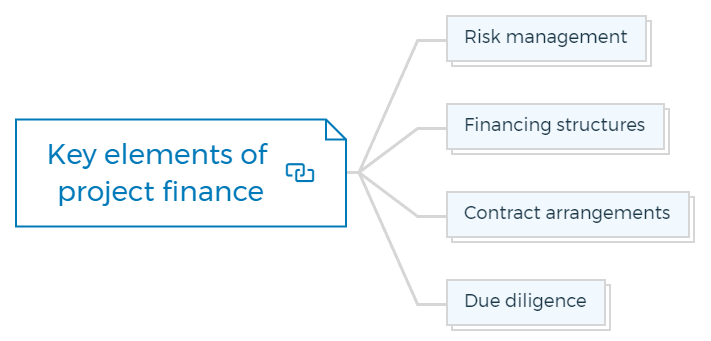

Key elements of project finance

Project financing performance depends on various factors:

Risk management

Project finance involves thorough risk management to detect, analyse, and reduce project risks. This involves identifying technical, commercial, legal, and financial risks and developing mitigation solutions.

Financing structures

Project finance transactions involve complicated financing arrangements that balance the interests of property investors, lenders, and the SPV. These arrangements generally incorporate various loan and equity financing and sophisticated inter-creditor agreements.

Contract arrangements

Project financing transactions need to negotiate and write complicated construction, operations and maintenance, and power purchase agreements. These contracts ensure project longevity.

Due diligence

Project financing agreements involve technical, commercial, legal, and financial due diligence to determine project feasibility. Due diligence identifies, quantifies, and mitigates project risks.

What lenders check before approving your loan?

Before accepting a construction loan, lenders do several checks, searches, and risk assessments. Here is a simple checklist for you to get ready -

Borrowers details

All banks are sponsor-focused. Banks lend to individuals, whereas others lend based on infrastructure assets or property. To prepare, consider the following:

- Principals and critical staff profiles and CVs describing how they will help the project succeed.

- Comprehensive group chart or "tree" so the lender knows the organisation, participants, financial contributions, and entitlements.

- Correct Asset and Liability disclosures for each sponsor. Instead of waiting for a title search to disclose ownership, advise whether an asset is owned jointly or by another business in your group.

- Balance Sheets and P&L Statements for all associated corporate entities.

- Project history, including financial results.

Detailed project feasibility

Submit all key project documents for the major assumptions, including valuation, QS cost assessment, and agency sales and marketing submissions if presales do not cover payments to a lender.

Group cash flow

A 12-month group cash flow with assumptions indicating how your organisation may satisfy its financial obligations.

Include additional projects/business obligations (if any). This, together with your financial papers, reassures the lender about your financial ability to handle the unexpected and shows you fully grasp your existing and future financial situation and commitments.

Credit history

This one puts players in trouble. Please don't disguise prior failures, primarily if they resulted in a bankruptcy or formal credit arrangement.

Conclusion

Project finance is essential for big infrastructure and industrial plant developments. Project-specific finance through an SPV reduces investor and lender risk. Project financing transactions are complicated. Risk allocation, restricted recourse, long-term finance, and customised financing are their advantages.

Key participants in project financing include sponsors, lenders, advisers, and investors. Public-private partnerships are becoming more popular in infrastructure sectors, and understanding the issues involved in such transactions is essential.

Overall project finance can help fund large-scale initiatives, and this guide to project finance provides an excellent starting point for those interested in this financing mechanism.

Looking to improve your financial skills and quickly evaluate potential development projects? Look no further than the One Minute Feaso development feasibility tool.

With Feaso, you can run numbers on potential projects in under one minute, giving you the insights you need to make informed decisions about your investments.

Whether you're a seasoned developer or just getting started in the industry, One Minute Feaso can help you streamline your complex financial analysis and drive better business outcomes.

So why wait? Try One Minute Feaso today and take your development projects to the next level.

FAQs