Smart Property Investment Analysis

Real Estate Pro Forma Software

Every Investor Needs

Analyse investment properties in minutes instead of hours or days.

Accelerate your portfolio and wealth

Are you sick and tired of being deceived by shady investment property proformas?

Don't fall for the inflated yield claims!

You deserve to know the REAL yield, not some fake number they pulled out of thin air.

When you buy an investment property, what you are

really buying is an income stream

So what you pay for the investment property must justify the potential income & cash flow that it brings in.

Most property investors are oblivious of what this means for their investment decision. With Smart REIA (real estate investment analysis) aka Real Estate Pro Forma, you can not only figure out exactly what your investment is worth today, you can also analyse what it will be worth in

5, 10, 15 or 50+ years from today.

Smart REIA - the real estate pro forma is essentially a real estate investment analysis software that analyses investment opportunities and helps you make the decision based on

facts and numbers rather than hunches.

Flick All That Away And Upgrade Your Game With Our Cutting-Edge

Google Sheets Based ProForma Software

The Ultimate Software Tool Designed Exclusively For

Property Investment Analysis

Which Of These property investment challenges

are slowing you down?

- Like many property investors, do you spend hours trying to find, analyse and compare properties online – creating a confusion of spreadsheets, word docs and hand-written notes trying to find a solid investment?

- Do you worry you may miss things, make mistakes, and put your hard-earned savings at risk?

- Do you feel frustrated when you lose out on properties because you can’t analyse and compare them before another investor snaps them up?

- Do you worry about making decisions without having all the information you need – things like break even ratios, profit and loss, and accurate projections (including yield and capital gains) for the life of the property?

- And like most property investors, do you wish there was a simple, affordable tool to help you analyse and compare properties in minutes instead of hours, so you can accelerate your portfolio and wealth?

Key Technical Specifications

SmartREIA is an advanced real estate investment analysis tool developed on the Google Sheets platform. It is designed to provide investors with rapid, accurate assessments of potential real estate investments. By utilizing optimised algorithms and a streamlined codebase, SmartREIA delivers precise analyses efficiently, enabling investors to make informed decisions quickly.

1. Streamlined and Efficient Codebase

- Number of Lines of Code:

3,093

- Comprises over 3,000 lines of meticulously optimized code.

- Employs efficient programming practices to enhance performance and maintainability.

- Modular architecture facilitates easy updates and scalability.

2. High-Precision Calculations

- Deviation Threshold:

1.00 × 10⁻⁵

- Implements algorithms that maintain a minimal deviation of 1.00E-05.

- Ensures exceptional accuracy in financial computations critical for investment decisions.

- Minimizes computational errors to provide reliable and trustworthy results.

3. Single Iteration Processing

- Number of Iterations:

1

- Designed to achieve precise outcomes in a single iteration.

- Optimizes processing time without compromising on calculation accuracy.

- Streamlines computations to deliver immediate results.

4. Efficient Runtime Performance

- Average Runtime (over 3 tests):

6.4 seconds

- Demonstrates quick execution with an average runtime of 6.4 seconds.

- Balances complex analytical calculations with fast performance.

- Enables users to conduct comprehensive analyses without significant delays.

Technological Innovations

Transforming Google Sheets into a Powerful Investment Analysis Tool

- Advanced Utilization of Google Sheets:

- Enhances the familiar spreadsheet interface with sophisticated analytical capabilities.

- Leverages cloud-based features for real-time collaboration and data accessibility.

- Provides a cost-effective solution without the need for specialized software.

Integration with Google Apps Script

- Custom Scripting Enhancements:

- Extends Google Sheets' functionality through Google Apps Script.

- Automates complex financial calculations and data processing tasks.

- Ensures secure execution within Google's cloud environment for reliability.

Precision Algorithms Tailored for Real Estate Investment

- Specialized Computational Methods:

- Algorithms specifically designed for real estate investment analysis.

- Focus on delivering accurate financial metrics essential for investment decisions.

- Optimize calculations to achieve precision in a single iteration.

User-Friendly Interface and Automation

- Intuitive Design:

- Simplifies complex investment analyses through a user-friendly interface.

- Automates data input and processing to reduce manual workload.

- Provides clear and actionable outputs for immediate decision-making.

Client Advantages

- Accurate Investment Analysis: Delivers high-precision calculations essential for evaluating real estate investments.

- Speed and Efficiency: Provides rapid results, enhancing productivity and enabling swift decision-making.

- Accessible Platform: Built on Google Sheets, offering ease of access and eliminating the need for additional software.

- Customisable and Scalable: Modular codebase allows for customisation to meet specific client needs and scalability for larger projects.

- Cost-Effective Solution: Utilises existing platforms to reduce costs associated with software procurement and training.

Conclusion

SmartREIA represents a significant advancement in real estate investment analysis tools. By integrating a streamlined codebase with high-precision algorithms and efficient performance, it empowers investors to analyze potential investments quickly and accurately. This tool exemplifies how advanced analytical capabilities can be delivered through accessible and familiar platforms, providing both innovation and practicality for real estate professionals.

Input Cells:

Blue Cells -- Designated for user inputs.

Editable Cells with Protections:

Orange Cells -- Users can edit these cells; however, they contain formulas to prevent re-entering data manually.

Restrictions:

- Users should only edit blue and orange cells.

- All updates are managed by scripts, as calculations are hard-coded to maintain integrity and consistency.

Here's How Smart REIA Works

Hassle Free With Speed & Accuracy in 285 Seconds

without ever opening another spreadsheet

Launching Smart REIA Version 7.0

Begin by launching the latest version of Smart Real Estate Investment Analysis (REIA) 7.0. Older versions, including SFC 5.0, are being phased out.

Timestamp 00:01

Save and Refresh

Learn to use the “Save and Refresh” function frequently to save changes and refresh the inputs. Input cells are blue, while black and gray cells are for calculations.

Timestamp 00:31

Managing Subscriptions

Check your subscription status at the bottom of the interface. If needed, manage your subscription by clicking on the “Manage Subscription” link.

Timestamp 01:02

Creating and Managing Sheets

Click on “Create New” to generate a new sheet. Ensure that pop-ups are allowed in your browser to see the new sheet.

Timestamp 01:33

Using the Sidebar

Open the Smart REIA 7.0 sidebar to activate the sheet and begin your analysis. You can save sheets with different inputs to compare various financing options.

Timestamp 02:06

Customizing Currency and Units

Customize the currency symbol and unit of measurement according to your location and preference. Save and refresh after making changes.

Timestamp 02:37

Introduction to Smart REIA

Learn why Smart REIA is essential for property investors, providing insights into investment property costs and cash flow analysis.

Timestamp 00:00

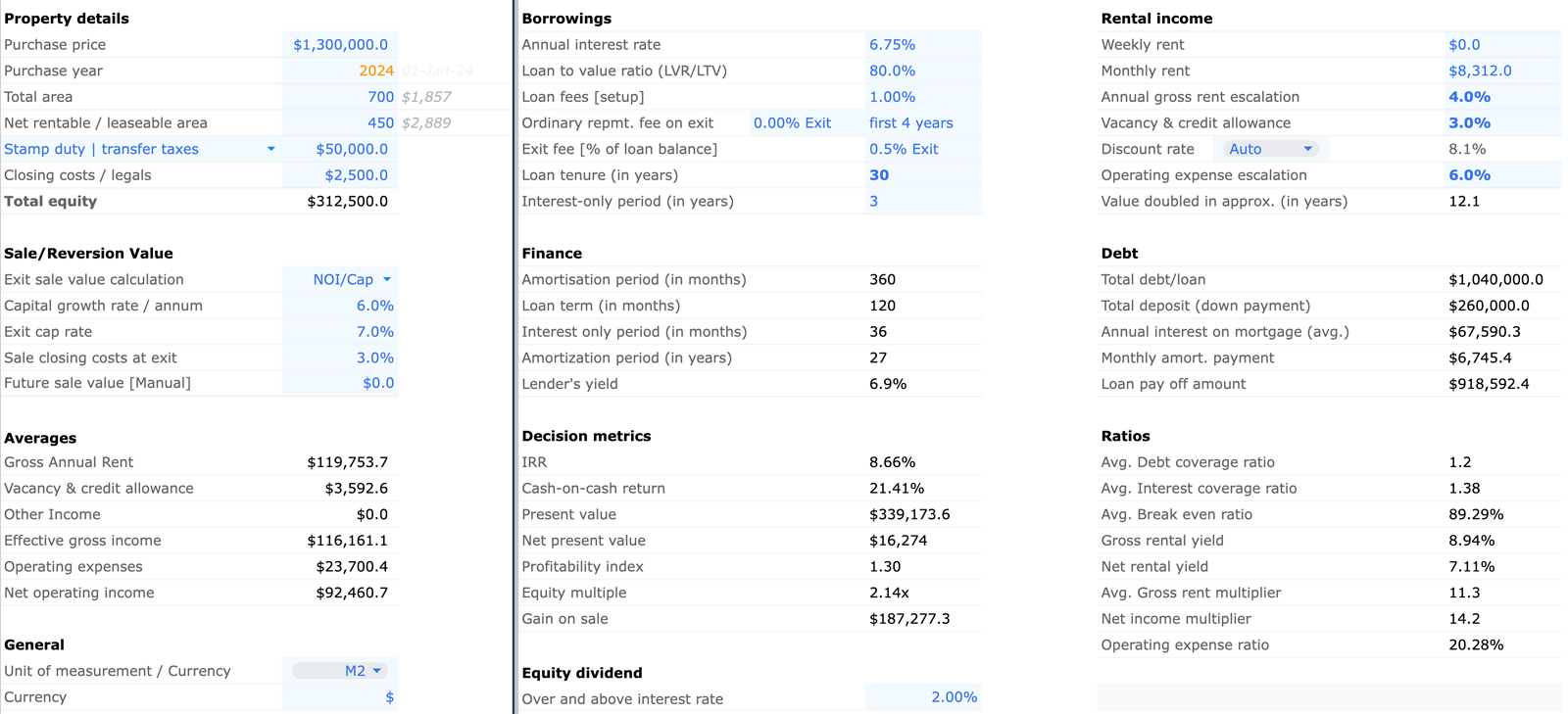

Entering Property Details

Start by entering the basic details of the property, including address, analysis period, purchase price, purchase year, total area, and rentable area.

Timestamp 00:31

Adding Transfer Taxes and Closing Costs

Input additional costs such as stamp duty, transfer taxes, capital improvements, and closing costs, which are essential for accurate property analysis.

Timestamp 02:10

Understanding Sale Reversion Value

Learn about sale reversion value, which estimates the property’s selling price at the end of the analysis period, using either a growth rate or cap rate method.

Timestamp 03:11

Calculating Exit Sale Value*

Calculate the property’s future sale value by selecting an exit cap rate or manually entering an expected sale price, ensuring a realistic projection of returns.

Timestamp 05:14

Setting Borrowing Assumptions

Start by entering your borrowing assumptions, including the annual interest rate, loan-to-value ratio, and any applicable loan setup fees. Adjust exit fees based on your loan terms.

Timestamp 00:00

Choosing Loan Terms

Set the loan term, typically 30 years for residential properties, and specify any interest-only periods. This will influence your monthly payment calculations.

Timestamp 01:35

Entering Rental Income

Input the rental income, either as a weekly or monthly amount. Ensure you select one option to avoid errors, and estimate the annual rent escalation.

Timestamp 02:37

Adding Vacancy and Credit Allowance

Include a vacancy and credit allowance, typically around 3%, to account for potential rental income fluctuations. Adjust the discount rate as needed.

Timestamp 03:38

Understanding Discounted Cash Flow (DCF)

Learn about the DCF method for valuing a property, which discounts future cash flows to present value based on a discount rate.

Timestamp 04:43

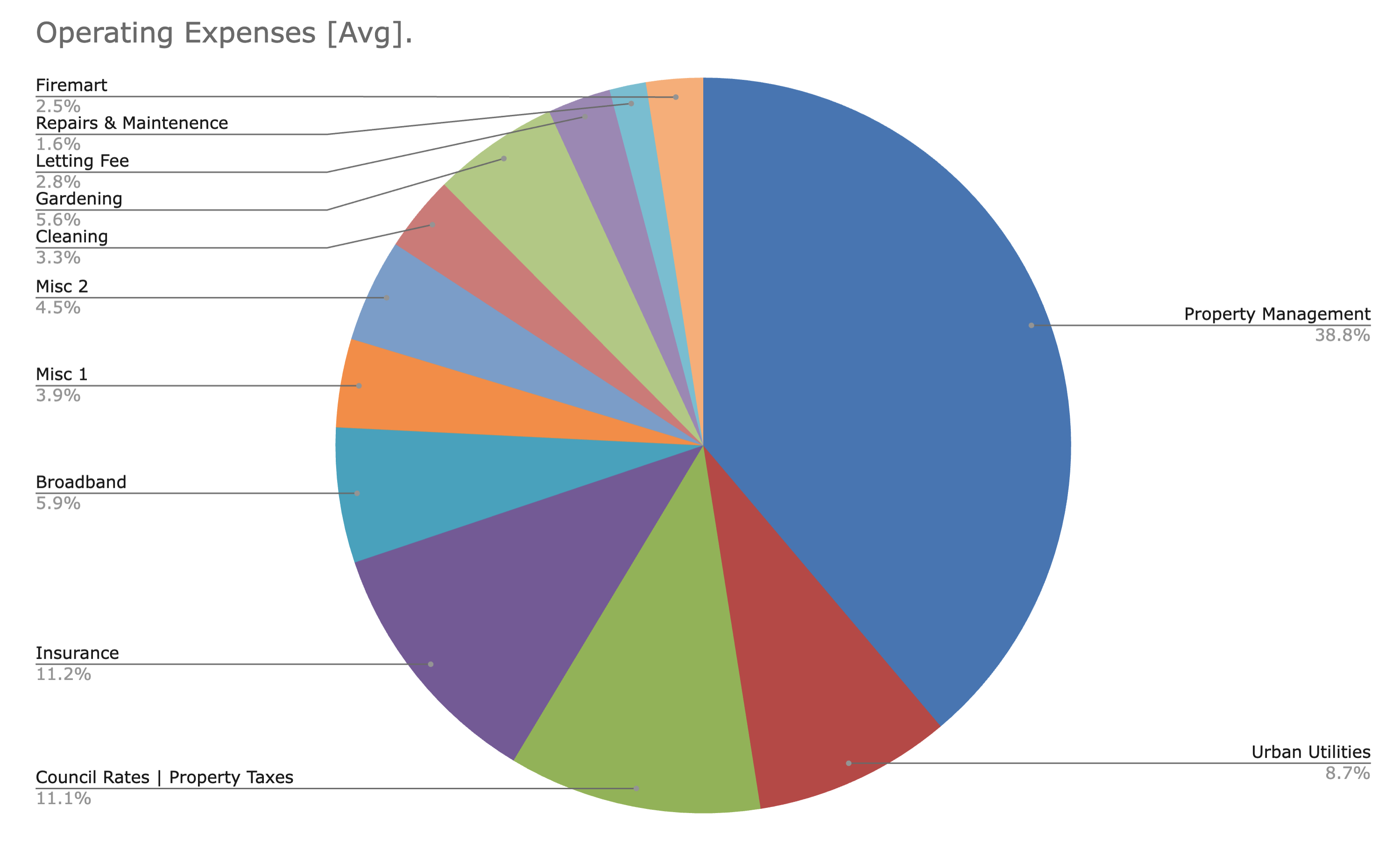

Calculating Operating Expenses

Set your operating expense escalation rate, typically in line with inflation or CPI, to project future expenses accurately.

Timestamp 06:48

Incorporating Equity Dividend

Factor in the equity dividend, which accounts for the risk of the interest rate and helps calculate the weighted average cost of capital for the project.

Timestamp 07:40

Finalising Borrowing and Income Assumptions

Review and adjust all assumptions to ensure accurate projections of net present value, discounted cash flow, and overall project feasibility.

Timestamp 08:23

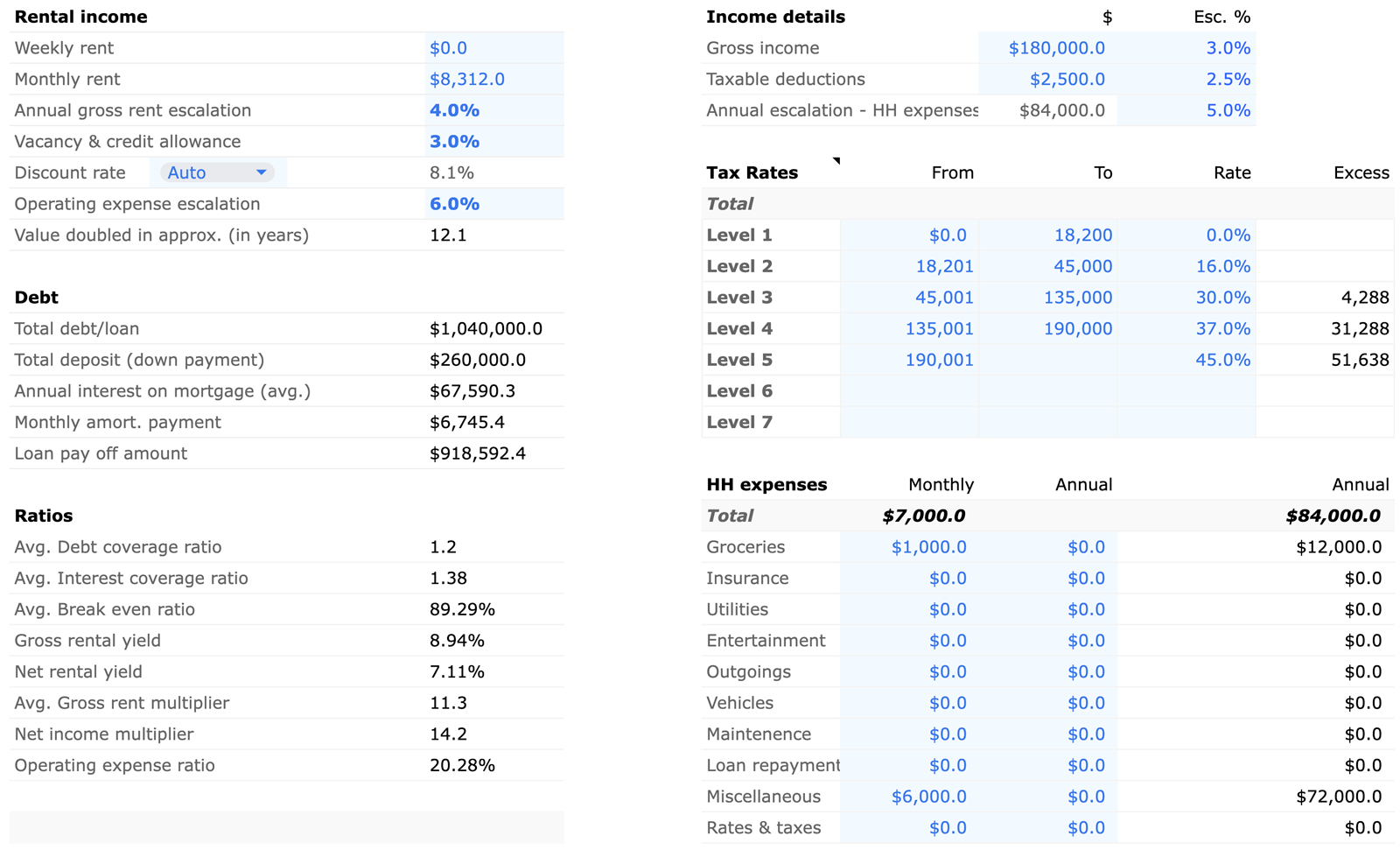

Understanding the Income Section

Start by entering your gross income and any assumptions about its escalation over the analysis period, such as annual raises in line with the Consumer Price Index (CPI).

Timestamp 00:01

Entering Taxable Deductions and Household Expenses

Input any taxable deductions and estimate household expenses. Set escalation rates for both to match expected inflation or changes in your financial situation.

Timestamp 01:02

Adjusting Tax Brackets

If applicable, customize the tax brackets based on your location by entering the correct rates for different income levels.

Timestamp 02:04

Calculating Monthly and Annual Expenses

Enter detailed household expenses such as groceries, insurance, and utilities. Use the “Save and Refresh” function to update the calculations and ensure accuracy.

Timestamp 03:07

Adjusting the Analysis Period

Start by setting the analysis period for your property investment. Adjust the duration and press “Save and Refresh” to update all related calculations.

Timestamp 00:00

Setting Gross Operating Income

Enter the annual gross rent escalation percentage to model how rent will increase over time. You can also manually adjust the rent for specific years.

Timestamp 01:03

Including Other Income Sources

Add any additional income sources, such as vending machines or parking fees, to your gross operating income. This will give a complete picture of the property’s income.

Timestamp 02:36

Calculating Effective Gross Income

Review the calculated effective gross income, which accounts for vacancy and credit allowances. This figure represents the total income you can expect from the property.

Timestamp 03:07

Entering Operating Expenses

Begin by inputting your operating expenses, such as insurance, broadband, and miscellaneous costs. These values are entered annually.

Timestamp 00:00

Setting Escalation Rates

Adjust the escalation rates for your operating expenses. You can apply a standard rate or manually override it for specific years.

Timestamp 01:04

Customizing Escalation Rates for Specific Expenses

If needed, manually adjust the escalation rate for a particular year or expense. This will override the default rate applied.

Timestamp 02:05

Reviewing Operating Expenses Summary

After entering all necessary inputs, review the operating expenses summary to ensure everything is correctly escalated and calculated.

Timestamp 02:40

Entering Capital Improvements and Depreciation

Start by manually entering any capital improvements (CapEx) and depreciation on the property. This includes both real property depreciation and improvements.

Timestamp 00:00

Adding Amortization and Closing Costs

Input any amortization and closing costs related to the property. Include any interest income generated during the period as well.

Timestamp 01:01

Reviewing Internal Rate of Return (IRR)

Analyze the internal rate of return (IRR) for each year of holding the property. This helps determine whether the investment is worthwhile based on your assumptions.

Timestamp 01:35

Publishing and Sharing the Report

Once all data is entered, you can publish the summary report. This allows you to share the analysis with others and review the automatically generated graphs and breakdowns.

Timestamp 02:36

Understanding Decision Metrics

Begin by exploring the different decision metrics that help determine whether to proceed with a project. These include averages, comparisons, and key financial indicators.

Timestamp 00:00

Comparing Properties

Learn how to compare different properties side by side by creating multiple copies of the same feasibility study and adjusting assumptions for each scenario.

Timestamp 01:03

Finance Assumptions and Ratios

Understand the financial assumptions and ratios, such as lender’s yield, debt coverage ratio, and break-even ratio, which are critical for evaluating the feasibility of the project.

Timestamp 02:06

Analyzing Key Metrics: IRR, Cash on Cash Return, NPV

Review key metrics like Internal Rate of Return (IRR), Cash on Cash Return, and Net Present Value (NPV), which provide a snapshot of the project’s financial health.

Timestamp 03:07

Capitalization Rate and Rental Yields

Examine the property’s capitalization rate, exit value cap rate, and rental yields, which help estimate future income and potential sale value.

Timestamp 04:11

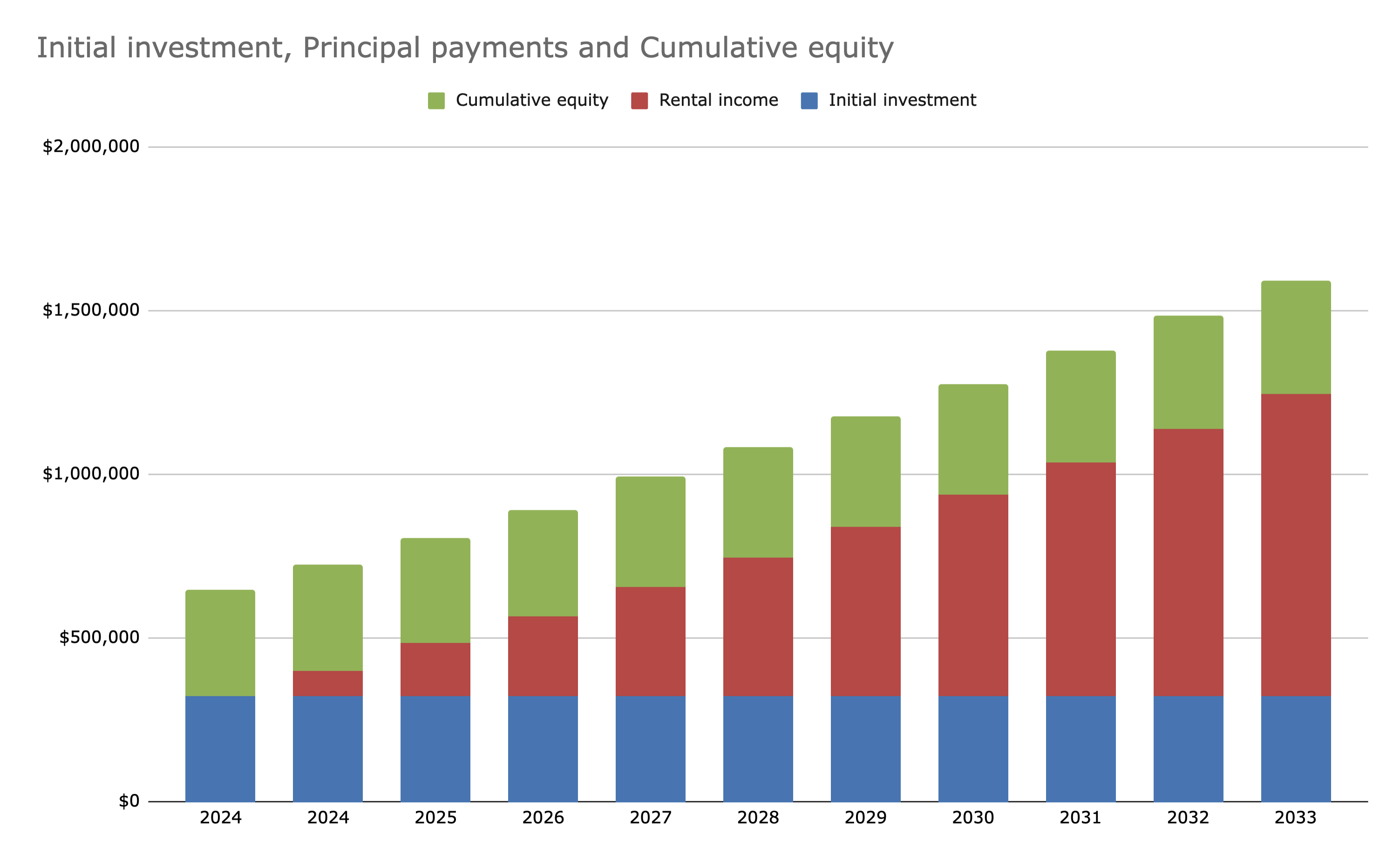

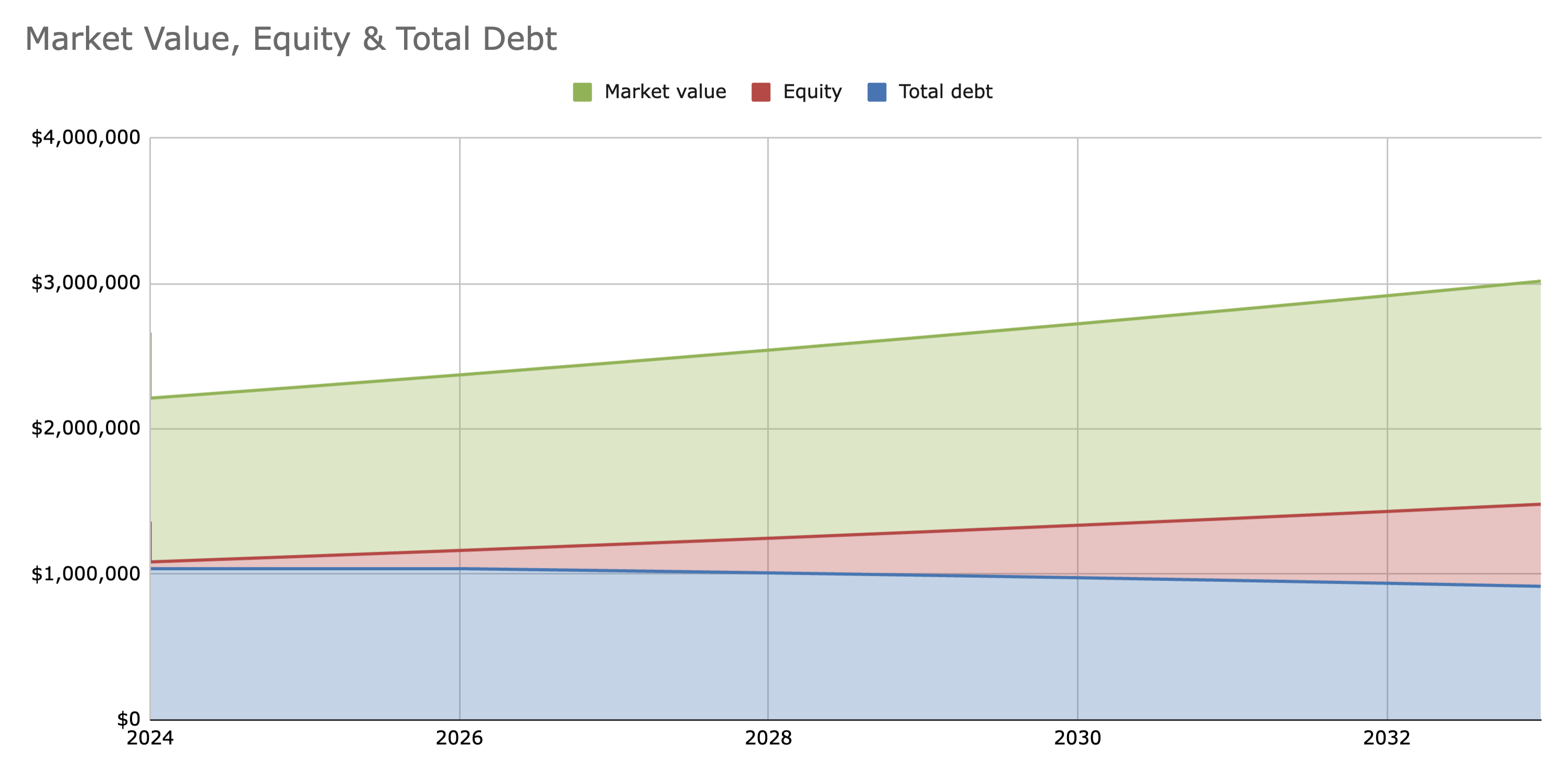

Growth on Equity Return

Learn how to assess the growth on equity return, which shows how much equity is being built up over time and the return generated from it.

Timestamp 05:13

Understanding Cash Flow and Debt Service

Delve into the cash flow from operations, debt service, and net cash position, which combine property income and taxable income to give a complete financial picture.

Timestamp 06:26

Using the IRR Matrix

Explore the IRR Matrix to determine the best time to sell the property for maximum return, based on the internal rate of return over different holding periods.

Timestamp 07:17

Adjusting Analysis Based on NOI Cap Rate

Learn how to adjust the analysis using the NOI cap rate to reflect changes in property value and potential sale proceeds.

Timestamp 08:33

Calculating Profit Before Tax and Discounted Cash Flow

Review the final calculations for profit before tax, discounted cash flow, and the two different IRRs, which help in making an informed decision.

Timestamp 10:02

Smart REIA - Real Estate Pro Forma

With Smart REIA, you can easily duplicate a project by selecting "Save as", change assumptions, holding period, expenses, interest rates etc. without having to re-enter the data and compare results of the same or different properties to make a decision.

Because each pro forma can be published, you can open any number of tabs in your browser window to compare "any" number of properties and see how they will perform with different assumptions.

Smart Real Estate Investment Analysis The

Real Estate

Pro Forma Software Walkthrough

Why Smart REIA - Is Better Than

Cumbersome Excel Templates?

With so many real estate pro forma softwares and excel templates on the market can it be confusing. And the last thing you need is another waste-of-money tool sitting on your laptop. Here is a brief summary of some of the powerful (and unique) features included in

Smart REIA (Real Estate Investment Analysis)

The Real Estate Pro Forma Software

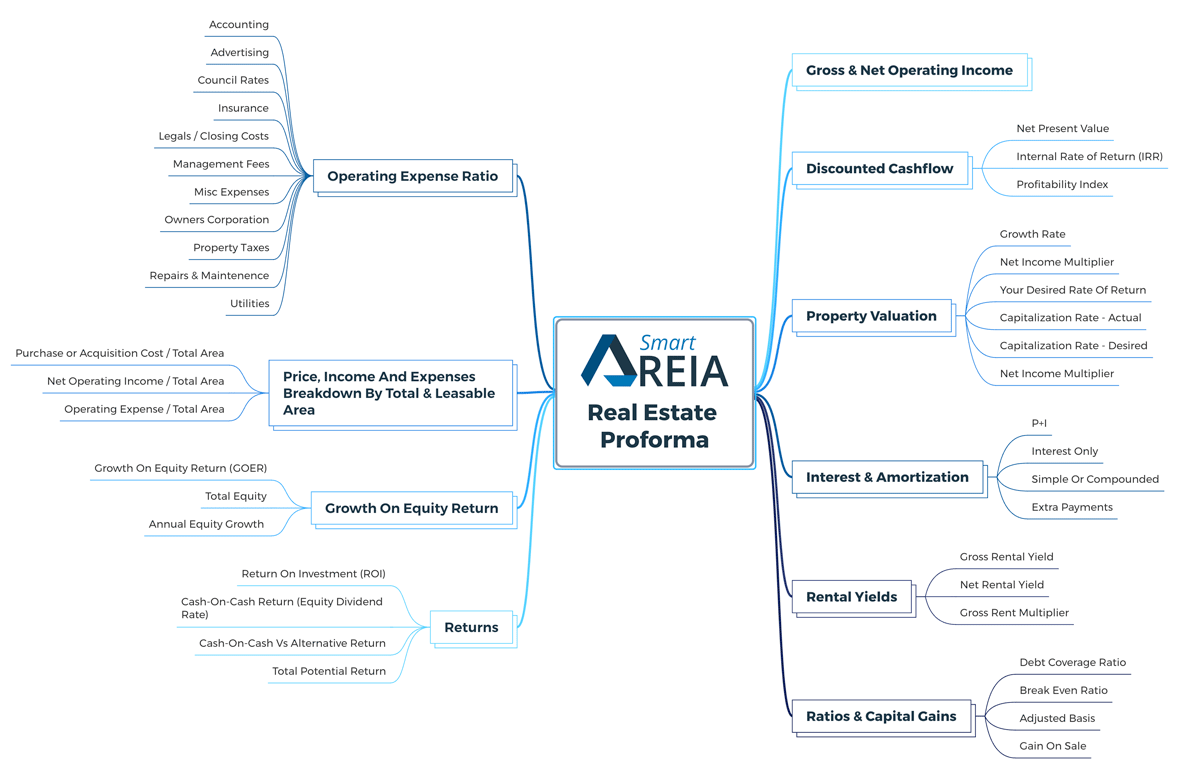

Calculates True Value

One of the keys to choosing a solid investment property is knowing (upfront) what cash flow the property will provide over the life of ownership, including operating cash flows as well as sale proceeds.

A present value (PV) of future cash flows gives you the actual value in today’s dollars so you can easily compare multiple properties and ensure you never pay more than what the property is worth.

Calculates True Profit

When choosing a property, only a few investors go beyond considering the basic figures like purchase price, rental return, and likely capital gains.

Often resulting in nasty surprises like negative cash flows that stall your portfolio because your equity position does not allow you to continue investing.

Smart REIA, factors in all expenses, including vacancy rates, to give you the breakeven ratios and true profit of a property (over its life) so you can plan with confidence.

Calculates Interest And Amortization

How you structure the purchase and finance of your investment is just as important as the property you choose.

Smart REIA: real estate pro forma software allows you to compare finance options, including interest only, principle plus interest (and different combinations), payment schedule, compound interest, and the effect of ad-hoc and delayed payments.

This gives you an accurate profit and loss statement for each property.

Calculates Ratios And Gains

Sadly, too many investors calculate capital gains incorrectly, failing to include improvements, depreciation and gain on sale.

Smart REIA: real estate pro forma software not only includes these essential factors, it gives you a break-even and debt coverage ratio to satisfy lenders, making it easier for you to get finance.

Calculates Yield And Returns

Smart REIA: real estate pro forma software shows you all profit scenarios, including return on investment (ROI), internal rate of return, cash-on-cash (equity dividend return), cash-on-cash vs alternative return, and total potential return so you know exactly where you stand before you sign anything.

Calculates Equity Growth

Too many investors hit a plateau because their equity position prevents them from moving ahead with more investment properties.

Smart REIA: real estate pro forma software gives you your equity position at any point including total equity, equity growth, and growth on equity return so you can plan the growth of your entire portfolio and accelerate your wealth.

Calculates Rental Yields

Comparing yields on different types of properties can be as confusing.

Smart REIA: real estate pro forma software calculates different types of rental yields and gives you an apple-to-apple comparison so you know which property will put more in your pocket.

Comparative Analysis

Smart REIA: Real estate pro forma software gives you the ability to compare as many properties with as many different assumptions as you prefer with a click of a button.

Simply click, duplicate, edit assumptions where necessary, publish and compare cash flows and project summaries side by side within a few seconds.

Works In Any Country For Residential And Commercial Property

Smart REIA: Real estate pro forma software takes just minutes to use and gives you a comprehensive analysis and comparison for both residential and commercial property.

And unlike other programs that only work in their country of creation, smart REIA allows you to manually add tax, depreciation and government charges to its calculations so it works in all counties.

The Real Estate Investment Analysis Software

Smart REIA (Real Estate Investment Analysis) software makes it easy for you to create real estate proforma and professional-looking sharable cash flows and more at the click of a button

without having any experience whatsoever.

- Makes it easy to create or duplicate pro-formas - Immediately!

- Stop relying on your Excel sheet or, worse, a financial modeller to sell your listings.

- Become an astute realtor with Smart REIA - No experience required!

- Instantly rise above all other Realtors using Excel pro-formas, you know your clients will question anyway

- Uncover the "yellow brick road" path to streamline your proforma-creating process for each new property with a click of a button.

- STOP worrying about formulas and the integrity of your excel template