Property development costs - detailed breakdown

Make sure you include these costs in your next development budget

Developing a property can be a costly process. There are numerous expenses that come with the territory, from acquiring the land to putting the finishing touches on the building. It's important to have a realistic idea of what these costs will be before you get too far into the project.

Here is a detailed breakdown of all major costs associated with the property development cost budget.

Formulating a project budget is an essential aspect of the loan structure for the property development project. A budget can never be 100 percent accurate because it is nothing more than an initial prediction influenced by the analyst's expertise, education, risk preferences, and expectations.

Variations are common and can be justified perspectives on the project's challenges. After the project is completed, the analyst's goal is to say that the budgeted expenses were close to or somewhat higher than the final actual costs.

There are dozens of property development costs to consider when budgeting development projects. By separating hard and soft costs, you can see where your money is going. It isn't just vital for you as the project owner; it's also crucial if you want to attract investors and take out loans.

Soft costs vs Hard costs incurred during property development

The budget for property development cost is divided into two categories: hard costs and soft costs. Because they are always employed to measure reasonableness and efficiency in development initiatives, it is necessary to understand their distinctions.

What are hard costs in property development projects?

Hard Costs:

In real estate, hard costs are the actual expenses incurred during the construction or renovation of a property, such as the cost of materials and labor.

They consider all of the materials used in the project, including door knobs, refrigerators, wine coolers, and washer-dryers. All labour directly linked to the physical building is included in hard costs.

Demolition is considered an upgrade to a place and is a hard cost, like planting the surrounding grounds or building a parking lot.

A hard cost is a sum paid by the developers to the construction managers or general contractors.

What are soft costs in a property development project?

Soft Costs:

In real estate, soft costs are not related to property purchase or construction but are associated with its overall management, marketing, and sale.

Soft costs are almost all development costs not included in the hard cost category (except the buying price of a home). Legal fees, engineering and architectural fees, surveying fees, real estate and mortgage recording taxes, loan interest, insurance premiums, and brokerage fees are just a few examples.

Be careful that some specialists will describe an item as a soft cost while others may classify it as a hard cost. Fines, payments to professionals who confirm municipal regulations and codes work, and some engineering fees are examples.

You can compare job expenses to those on projects you've underwritten and possibly others in your department's loan portfolio if the budget is divided into hard and soft costs and adjustments are made to the gray areas. Make sure the comparisons are for comparable line items.

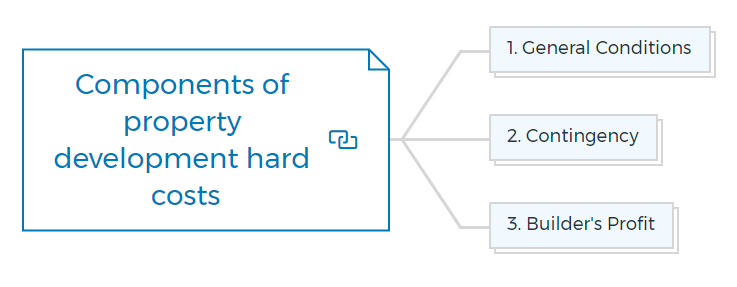

Components of property development hard costs

The Construction Specifications Institute (CSI) has produced 16 defined divisions for hard costs. Classifications or subdivisions inside each division allow the budget to be as detailed as needed for each end-user.

Each subdivision can function as a separate line item. A line item is a category of work or materials assigned a dollar cost in a budget. Each category is represented by a row or line that forms a cost list. The budget for the real estate project is detailed in this list.

The general conditions line, the contingency line, and the builder's profit line are three hard cost line items that require special attention. If certain lines are missing from the budget, you should ask why.

1. General conditions

The general conditions category includes development costs that are broad in the scope required to complete the project, may or may not result in the completion of actual work, and cannot be ascribed to a specific trade.

They cover the costs of a construction office trailer, tool sheds on or off-site, salaries for the construction manager, and a crew of handymen who work directly for the property developer.

Cleaning, office supplies, telephone and administrative charges during construction, copying fees, messenger services, and general operating costs are all included in the general conditions costs.

General conditions are typically paid using the percentage of completion method, dependent on the total property budget. You can advance them in equal monthly sums over the loan's tenure.

For example, a 24-month loan with a $2 million general conditions line will advance $83,333 per month:

$2 million/24 months = $83,333.

The general conditions budget typically accounts for 5 to 10% of the total hard cost budget of property development. You should question anything outside that range.

2. Contingency

The contingency line is used to finance unplanned and unknown future expenses known as overruns in the construction business. Anyone who has visited a building site can grasp the business's intricacy and dynamic nature.

It is naive and pragmatic not to expect adjustments and overruns even on minor development projects. Overruns can result from a variety of events and activities. For example, there can be

- Oversights and omissions of detail in the plans and specifications due to unfamiliarity with municipal laws and regulations, resulting in changes and delays.

- Design changes due to a change of mind about the materials, layouts, or construction details.

- Subcontractors who perform subpar work that must be repaired or replaced.

- Accidents that cause damage to already completed work.

- Materials and fixtures may be delivered late or become unavailable due to shortages or unacceptable lead times from order to delivery.

- Delays due to subcontractors not performing on time.

- Mistakes in coordinating the trades and materials that must work together on the job.

The majority of cost overruns and delays are minor, but they can erode a contingency line when added together. A local requirement to use heavier sheetrock in a common-way corridor that was not specified in the plans, can be an extremely costly surprise.

The impossibility of obtaining a specified type of ousted air handler must be replaced with a more expensive equivalent air handler.

The hiring of a security firm as a result of a random vandalism incident, the failure to obtain a $300 Saturday work permit, causing a building inspector to issue an order to stop work at the development site, forcing all trades to leave the job early in the morning, and a window design in a designated landmark building that causes manufacturing delays because the landmark agency repeatedly requisitions.

Even if they appear to be justified, you should avoid requisitions seeking relatively substantial amounts under the contingency line. Early or mid-construction overruns might reduce the contingency reserve to the point that it becomes unbalanced, putting the loan at risk.

The best thing you can do is follow your consulting engineer's recommendations and use your judgment to keep contingency line drawdowns to a minimum early in the project to avoid depletion.

Rather than permitting drawdowns from the contingency line, the borrower must expend more equity. You can partially compensate the borrower later if the job is proceeding well and contingency funds appear to be sufficient to meet future obligations.

Like the general conditions line, the contingency line should be 5 to 10% of the total hard cost real estate budget.

3. Builders profit

Depending on how the budget is presented and how the job is managed and done, there may or may not be a line for the builder's profit. If the borrower also works as a general contractor, it may factor their profit into several of his budget line items. They will work without earning a profit as a builder in such circumstances.

Instead, they'll deduct their gains from the project's revenues when it earns net sales or leasing income. This expense should be accounted for whether or not it is listed. You should inquire about it if you don't see it.

Like the general conditions and contingency budget lines covered earlier, the builder's profit line is in the range of 5 to 10% of hard costs.

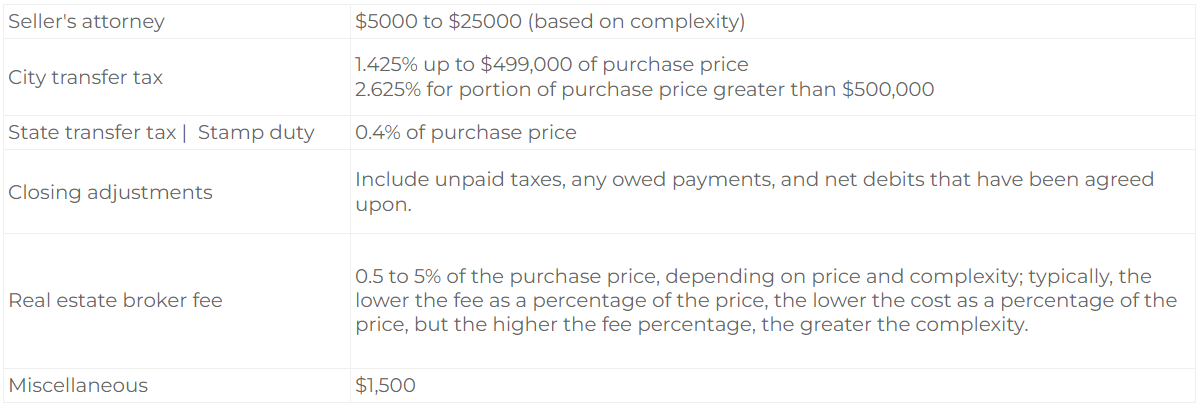

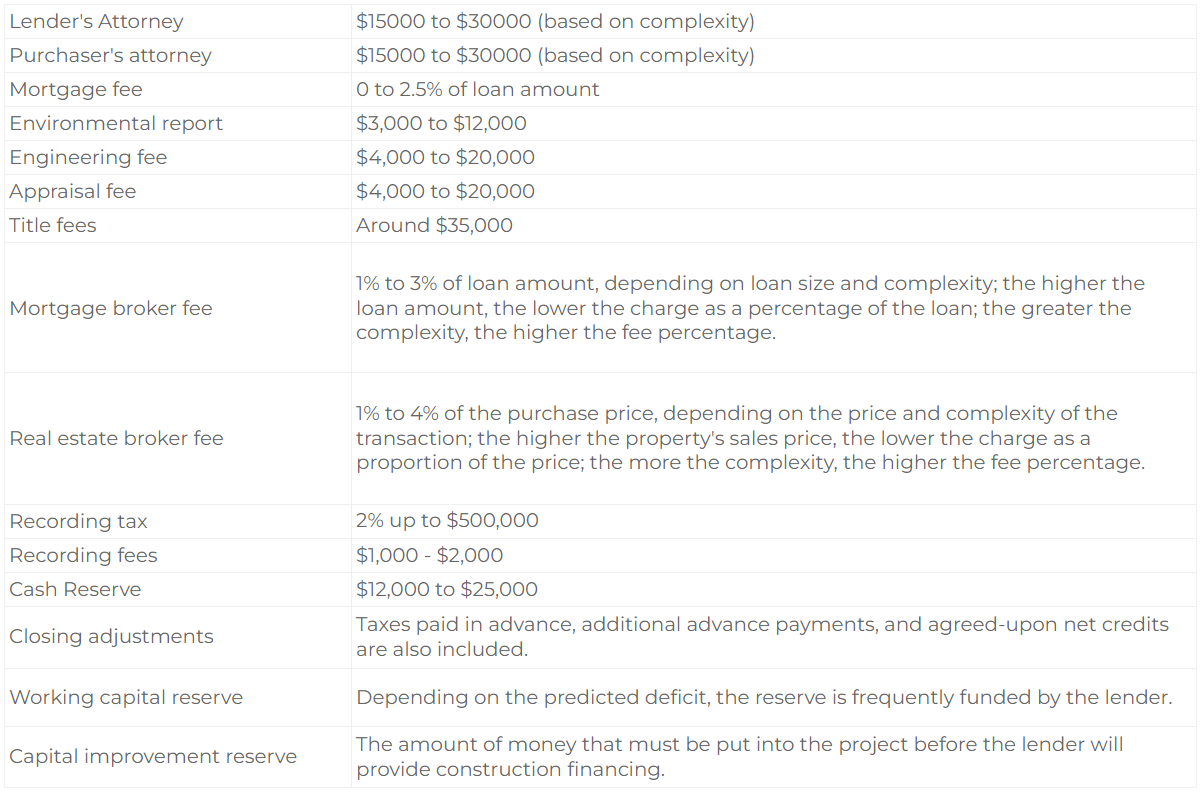

What are the closing costs of a property development project?

Most development loans require you to make your initial advance at the loan closing. Suppose the loan contains a property acquisition component. It is not uncommon for the advance to consist entirely of closing expenses, which are soft costs, distinct from any cash paid toward the property purchase price.

Closing fees vary greatly depending on the state and municipality where the property is situated.

For example, in a city, where costs are generally high, taxes and fees are a percentage of the purchase price and mortgage. It makes closing costs a big part of the total cost of buying a property.

The following fees are included in a city closing for a $12 million property purchased with a $10 million mortgage loan:

Sellers Cost

Purchaser Costs

The total costs of purchasing a home are far higher than the agreed-upon contract purchase price between the buyer and the seller. Using the list above, you can ensure that the borrower's preliminary closing forecasts are reasonably accurate.

Closing statements might be challenging to comprehend, especially if you are unfamiliar with the transactions involved. They should, however, become more familiar and easier to read after a few closings.

Regrettably, closing statements are not prepared until after the closure, taking many weeks. As a result, a closure statement is a reference to examine how funds were spent, refunded, and escrowed rather than a budgeting tool.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

How to determine the interest carry costs

After you've gone over the closing fees, look at how much interest carry is allocated.

You should consider several factors such as -

- The amount of the loan will be outstanding.

- The time it will take to finish the job and obtain a certificate of occupancy.

- The time it will take for the project to generate positive operative cash flows.

- The time it will take for sales or rental revenues to pay down the loan.

- If there is a takeout lender, the time it will take to trigger that funding source.

Interest expense forecasting is far from a precise science. The factors aren't predictable in any way.

Considering these factors and using the example below to compute interest carry, a simple rule of thumb is treating up-front advances as completely paid from the loan's start (property acquisition).

Then, for the first year, add 60% of the hard and soft cost sections of the loan facility, and for the second year, add 80% because that is usually the average amount that will be outstanding until completion. Then, carry the entire debt from the estimated completion date until the scheduled pay-down from a sale or takeout.

If there will be partial sales or revenues, reduce the loan balance by the estimated percentage reductions in the loan when paydowns occur.

Interest carry calculation example:

Loan amount (A) - $20,000,000

Acquisition portion (B) - $9,000,000

Construction portion (C) - $11,000,000

Construction duration (D) - 18 months

Paydown duration (E) - Six equal monthly paydowns through sales

Average interest rate (F) - 7.5%

1. At loan closing

(B) X (D) X (F) = $9,000,000 X 18 months X 7.5%/12 months = $1,012,500

2. Construction phase

First year [(A) - (B)] X (D) X (F) X 60%

Second year [(A) - (B)] X (D) X (F) X 80%

= ($20,000,000 - $9,000,000) X 60% X 7.5%

= $4,950,00

= ($20,000,000 - $9,000,000) X 80% X 6 months X 7.5%

= $39,600,00

3. From construction completion

(A) X (F) X (E) X 1/2 = $375,000

Total interest carry - 1+2+3 = $5,842,500

The simple interest carry should be approximately $5,842,500

Will the budget be under or over actual property development costs?

The borrower's motivations for reducing or increasing the expense budget are contradictory. Each has advantages and disadvantages.

Under budget in real estate

The borrower may frequently predict a low-cost property development budget to put up less up-front equity. They can then hope that money will emerge throughout or towards the end of the job due to expected equity sources, a lender's loan increase, or anticipated cost savings.

Another benefit of submitting a low-cost budget in real estate is that it will result in project predictions that show a better profit margin. A lender will be more interested in this.

Over budget in real estate

The borrower may overestimate the budget to qualify for a higher loan in some cases. Then, as the job develops, if additional expenses arise that were not budgeted, the lender will have funds ready to cover part, if not all, of them.

Unfortunately, less scrupulous borrowers may be able to take out equity through periodic loan advances concealed in line items like general conditions or contingencies, thus reducing their equity and lowering their risk.

With an overinflated budget, a developer can recoup all his investment and make a profit in the end.

The lender's bias in the property development budget

Many lenders have discovered that their top credit officers tend to reduce the underwriter's recommended loan amount on a commercial mortgage in the notion that this method decreases loan risk.

Regardless of how logical or valid the property development costs budget is, it can happen. Lenders' biggest concern is that the borrower will receive money from construction loan advances rather than earnings.

The borrower will thus have a lower motivation to focus on, invest in, and work through challenging conditions if things go wrong. It increases the lender's risk of being stuck in an expensive issue loan workout.

This policy may be beneficial for loans secured by existing income-producing assets. Lowering the loan amount lowers the loan risk by increasing the borrower's equity and lowering the lender's loan-to-value ratio.

Unfortunately, under lending frequently has the unintended consequence of increasing the risk for development loans. When the borrower requires operating money to keep the building project on track, they may be unable to obtain it.

If someone fails to pay contractors or professionals who, for example, can cause a project to slow or even shut down, the consequences can be severe. In addition, ill will might be developed with a borrower who could otherwise generate significant future business for the lending institution.

The "arbitrary" loan reduction can strain the borrower-lender relationship, leading to anger that they may never resolve.

On the other hand, the lending institution may be better protected if there is a minor overloan position. The borrower is free to concentrate on completing the job rather than looking for a small quantity of money.

Even if there's a chance the borrower will withdraw part of their equity, it's better to err on the side of lending a bit more than a little less.

How to evaluate the borrower's real estate budget?

After examining many loan offers, you should know how much a project should cost in terms of hard and soft costs per square foot in various geographic areas.

Suppose your financial institution makes development loans on apartment buildings, office buildings, warehouses, and strip centers. In that case, you should learn how much a "typical" apartment building, office building, warehouse, and strip center costs per square foot in the areas where you lend and your financial institution operates.

Once you've mastered this skill, you'll be able to assess new proposals and ask more educated inquiries more effectively. It can help you avoid becoming too engrossed in a lengthy underwriting review on a potential loan that later turns out to be unsuitable.

If you think a potential deal is favourable, but the borrower's predicted costs look unusually high or low, you'll be better able to inquire why.

Review budget line item

After forming an overall opinion, go over each budget line item for reasonableness. Starting with the "easier" known and calculable things, such as amounts set aside for the property's purchase price and closing charges, including those related to the loan.

Because they depend on a percentage of the loan or the purchase price, you can quickly check items like transfer taxes, mortgage taxes, brokerage fees, and recording fees.

Fees for both your institution and the borrower's attorneys, appraisal expenses, and inspecting engineer fees can all be approximated pretty correctly based on your department's previous closing experience.

After you've gone over the easier closing charges, go over regular operational expenses, including real estate taxes, energy bills, security, management, lease-up or sales costs, and marketing costs.

A review of previous loan proposals and appraisals of similar projects in the area, the municipality where the project is located, and, if necessary, discussions with appraisers and brokers who practice and work in the area where the property is located can all provide benchmarks for these costs.

If revenue is expected during construction due to remaining tenancies, new leases, or the purchase of a portion of the property, make sure the expenses associated with those revenues are budgeted for.

Deal with the consulting engineer for the lender

In the case of construction lending, the lender hires a consultant engineer with experience in construction and hard costs. They could be an in-house employee, but are more likely to come from an outside firm that specializes in the subject.

The most crucial aspect of a hard cost budget validation is an engineer's written assessment of the borrower's hard cost estimates. To ensure that the engineer has not just rubber-stamped the developer's initial proposal, you should always query a few particular areas of his assessment.

In addition, asking questions shows the examining engineer and their firm that you anticipate a high degree of expertise and responsiveness.

How to estimate the hard cost budget in property development?

You should be aware that property developers and contractors utilize a variety of approaches to arrive at cost estimates when analyzing the borrower's hard cost budget and the engineer's report. All are supported by commercial software from a variety of vendors.

The viability of a project is determined using a top-down approach at the start. A broad overall hard cost number is calculated based on previous experience with criteria such as the kind, size, general construction, and location of the planned structure.

For example, a residential property development might cost $520 per square foot in hard costs. Because there are fewer bathrooms and kitchens to install, minor plumbing to install, and less partitioning, an office building in that city may only cost $230 per square foot in hard expenditures.

In the first case, the hard costs of constructing a 100,000-square-foot residential structure are $52 million.

From the underwriting and loan approval procedure to the delivery of the commitment letter, the top-down strategy is the method you'll use the most. An appraiser's principal method is also the top-down approach.

A more precise estimate separates components and systems and calculates their costs based on the size of the structure and the function of each system.

Example:

A 23-ton air-conditioning system is required for a 3,500-square-foot retail space with 14-foot-high ceilings, a 2,500-square-foot cellar with 9-foot-high ceilings, and 180 square feet of doors and windows.

Condensers, evaporators, pipes, ducting, and electrical work are all part of the system. The cost of each tonne of air-conditioning capacity is $5,000. As a result, the air-conditioning system will cost $115,000.

23 tons X $5,000/ton = $115000.

The take-off approach of the property development cost budget is the most comprehensive, with a high level of information based on the estimator's objective, expertise, and software.

It is utilized by contractors and property developers when calculating an exact cost is critical to their success.

The property developers will have the advantage of contractors who have submitted bids based on take-off estimates. Based on the final bid, they will determine their final budget.

Units and costs are combined into small aggregates and then multiplied to get a total cost.

For example, all of the costs associated with installing a piece of 5/8-inch thick sheetrock add up to $25.50. After reviewing the designs, the estimator multiplies the $25.50 figure by the number of 5/8-inch sheetrock panels he believes are required.

Further refinements divide each work into units (linear feet, quantity, capacity, labor, energy, equipment, and so on) and multiply the number of units by the projected unit cost. When all products are added together, you can calculate the total cost.

The units are estimated from the plans ("taken off") and then compared to the specifications, which specify materials and procedures.

For Example,

The estimator will calculate the cost of each 4-inch by 8-inch piece of 5/8-inch-thick sheetrock and the average time (labor) and material cost of taping, sanding, and priming following installation.

After bringing all of these parts together, the estimated cost will be $25.50. If it is decided that 1,000 sheets of sheetrock are required after collecting dimensions from the designs and calculating waste, the budget for this item will be $25,500 ($25.50 X 1,000).

The takeoff procedure takes a long time. It is not a necessary exercise for all professional developers, even though it gives a well-founded and defendable estimate. The method is also subject to errors and manipulation due to the numerous underlying assumptions (future labor prices, supply costs, etc.).

The change in the property development cost budget

As cost estimates are refined, the allocation of the loan amount between and within the hard and soft cost categories frequently varies from loan approval to loan close and release of cash.

If the budget shrinks somewhat and "extra funds" become available, you can securely transfer them to line items like interest and contingency. Since the lender controls the discharge of surplus funds, the lender's risk is low.

If the borrower does not requisition the money, they are protected against overruns and will not have to pay interest on the surplus funds. However, if the project's cost falls dramatically (which is extremely rare), the loan amount should be decreased to stay within your institution's loan-to-cost ratio.

Initial budgets are frequently increased throughout time. Complexity and awareness rise when more detail is added to and handled in project planning. Costs frequently rise as a result of this.

For example, the cost of drywall may rise because a thicker partition is required for fire safety. The ventilation system may require a "makeup air" unit to avoid air pressure problems, appliance brands may need to be upgraded to compete with local brands, or a separate sales office with a finished model unit is now deemed necessary.

What should be your loan amount?

Budget rises are more common among less experienced borrowers, who are prone to underestimating a project and under budgeting it. Those borrowers may not realize that increasing the pledged loan amount is extremely difficult, if not impossible after a loan is accepted.

It is because it raises red flags among senior management and senior credit personnel in most firms when a borrower comes back for extra money before the loan closes after it has been approved.

For example, suppose the borrower is employing leverage (mezzanine financing) and isn't particularly liquid. Top management may be concerned about the borrower's capacity to complete a project financially if unforeseen costs arise later.

Or, regardless of the borrower's financial situation, they may second-guess themselves, your underwriting, and the borrower's construction skill, expertise, budget, and cost containment capacity.

It is especially true if the proposed loan is significant and must be reviewed by senior management, maybe requiring the approval of a senior credit committee or even the institution's board of directors.

The original permission may not be maintained when brought to another round of inspection. That is to say; the loan proposal can be rejected a second time. This could be a source of professional embarrassment for you.

In some situations, your aversion to reintroducing a loan for a more significant amount may be in the borrower's best interests. Let the borrower know that you must fill the gap with equity rather than debt if costs exceed the due amount.

When analysing a loan proposal, don't assume that just because the budget is presented in a different format than you're used to, the borrower is inexperienced, or something is wrong with it.

A budget can be created in various ways, with different styles and elements. It is particularly true at the first loan proposal stage, when the developer or their representative may create the property development budget rather than an architect, construction consultant, or estimator.

As mentioned earlier, budget divisions and subdivisions frequently evolve in tandem with project specifications. When working with a seasoned borrower, the budget may grow in complexity but not content.

Bottom line

The bottom line is that a well-executed cost budget is the key to any successful property development. Whether you are over budget or under budget, it is important to understand why this has happened and how it will impact your overall returns.

Mastermind your next development project with Property Mastermind Course. Enroll now and get ready to control your financial future!

FAQs