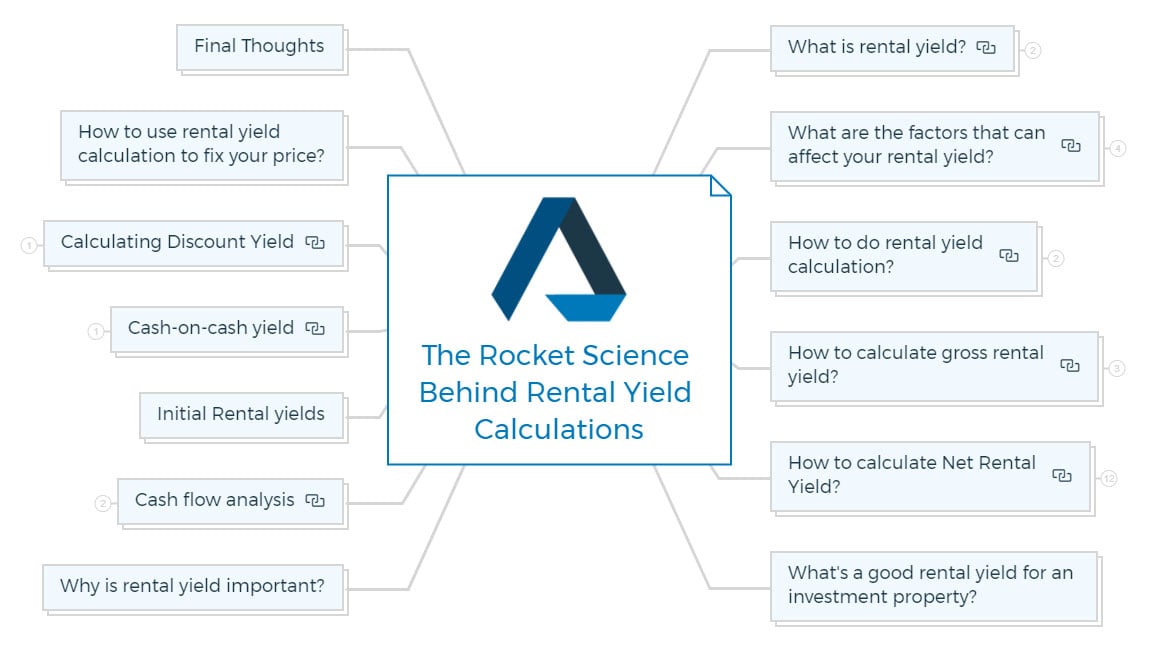

Rental yield calculations made easy

Rental yield calculations are at the heart of property investing, and every property owner should have a thorough understanding of how they work and what goes into them. But what are the correct calculations to employ, and what should your target returns be?

This article will walk you through the most typical property yield calculations, how to perform them, and when to utilise them.

Key Takeaways

What is rental yield?

Rental yield measures how much rental income you earn relative to the property's purchase price. It's usually a percentage or a rental income percentage, and it helps landlords determine whether their rental property is a good investment.

In simple words, the rental yield is the percentage of return on an investment property that a landlord receives from renting out their property.

The higher the rental yield, the more cash flow an investor can expect to earn. That's why properties with high rental yields are often popular with investors.

There are two main types of rental yield:

Gross rental yield

Gross rental yield is a percentage that represents the annual rent price of a property divided by the property's purchase price.

Gross rental yield is an important real estate metric to consider when investing in rental properties. It can indicate how much return on investment (ROI) you can expect to earn. A higher gross rental yield usually corresponds to a higher ROI.

When considering investment properties, do your research and compare different properties' gross rental yields. It will help you make profitable investment decisions and maximise your ROI.

Net rental yield

After accounting for all operating expenses, net rental yield is the overall return on investment real estate that an investor can expect to receive from a rental property.

The net rental yield formula is used to calculate this investment property return. It considers rental vacancy rates, repair and maintenance costs, mortgage interest payments, and property taxes.

A property investor often uses the net rental yield to compare different properties or asset classes.

For example, an investor might compare the net rental yields of two different properties to decide which one is a better investment. Or, an investor might compare the net rental yield of a piece of real estate to the yield on a stock or bond to decide whether real estate is a better investment than other types.

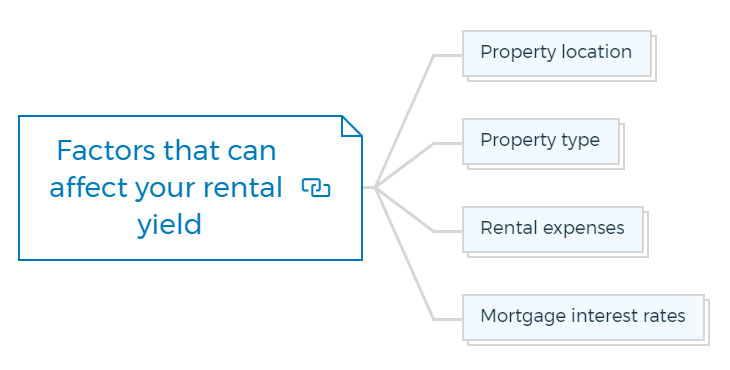

What are the factors that can affect your rental yield?

Several factors can affect rental yield, including:

Property location

Properties in prime locations typically have higher rental yields and value than properties in less desirable areas. It can offset other costs of owning a rental property, such as higher insurance premiums or taxes.

Property type

The type of property you own can also affect rental yield. For example, a single-family home will likely have higher rental rates than an apartment unit in the same area.

Rental expenses

Taxes, insurance, and other associated costs with owning a rental property will eat into your rental income and lower your rental yield.

Mortgage interest rates

If you have a mortgage on the property, the interest rate will affect your rental yield. Higher interest rates will increase the amount of money you need to pay each month, lowering your rental income and, therefore, your rental yield.

How to do rental yield calculation?

You can calculate rental yield in 2 ways: manually or using a rental yield online calculator. Let's take a look at how to do both!

Manual rental yield calculation

To calculate rental yield manually, you'll need to know the following information:

- Annual rent

- Property purchase price

- Any associated costs (mortgage repayments, taxes, insurance, etc.)

Once you have this information, follow these steps:

Step 1

Divide the annual rent price by the property's purchase price. It will give you the gross rental yield.

Step 2

Add up all of the costs associated with owning the property. Then, subtract this amount from the annual rent. It will give you the net rental yield.

Step 3

Divide the net rental yield by the property's purchase price. It will give you the net rental yield percentage.

Online rental yield calculations

Several online rental yields calculators can help you with calculating rental yield. All you need to do is enter the purchase price, rent price, and any associated costs. The calculator will then provide you with your rental yield percentage.

Let's understand the manual calculation in detail.

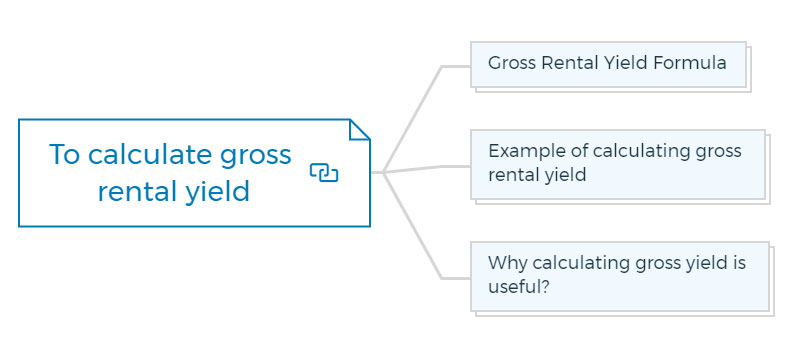

How to calculate gross rental yield?

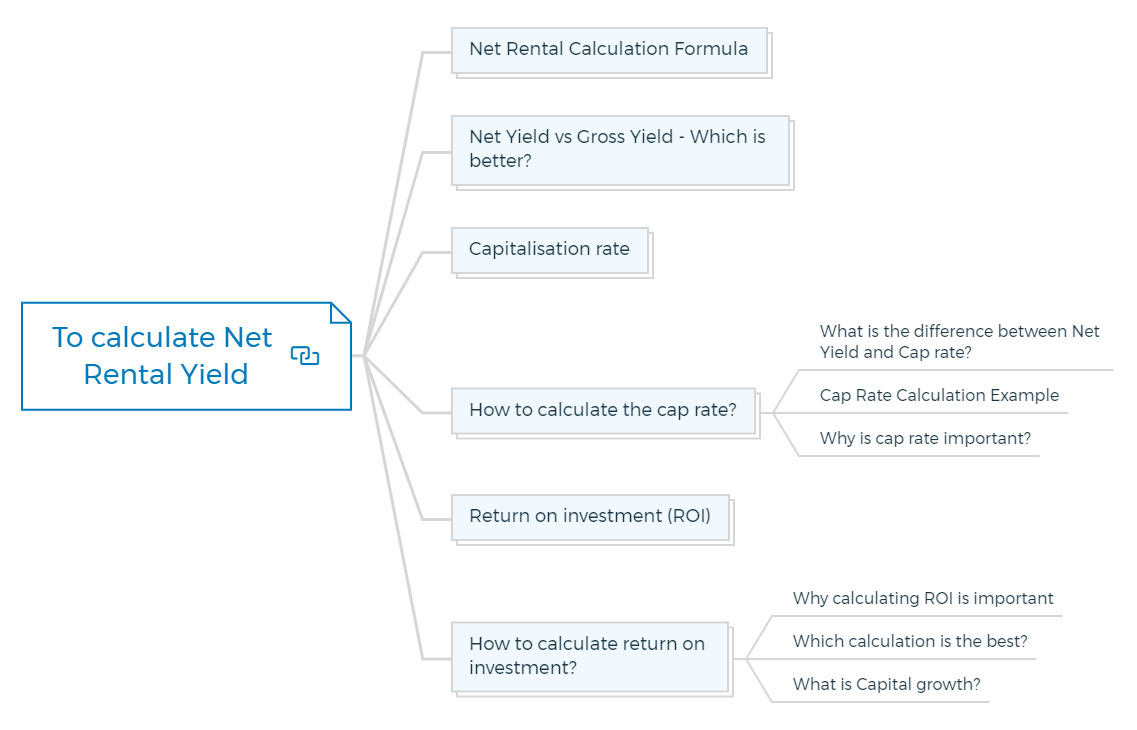

The annual rental income from a property is simply divided by the property's purchase price to get the gross yield.

Gross Rental Yield Formula

Example of calculating gross rental yield

Suppose you're looking at a property with a $700 monthly rent and a $120,000 purchasing price. The calculation for annual rent income is as follows -

12 X $700 = $8,400

Now we divide this by $120,000. It gives us a result of 0.07 -

or a gross return of 7% per annum.

Any other acquisition costs, such as stamp duty, legal fees, survey costs, and mortgage broker fees, can be factored into this gross return calculation. To do so, add these to the purchase price in the formula above at the bottom.

Why is calculating gross yield useful?

So, it's easy to compute, but what's the point?

Gross yield is a simple technique to compare several real estate assets. For example, if all other factors were equal, a real estate investor would prefer a property with an annual gross yield of 12% to one with a yield of 10%.

Second, it just requires a tiny amount of data to calculate. As a result, it's a simple and quick place to start when evaluating potential investment property offers.

On the other hand, the gross yield can ignore your upkeep expenditures. For example, it ignores the anticipated cost difference between houses and apartments, including service charges and ground rent.

Furthermore, two houses, one a new build detached and the other an old victorian terrace, could have the same gross yield. Still, the older property's repair expenses will be far greater. Which of these two properties do you think you'd rather own?

In a nutshell, gross yield is a very basic return statistic. It's one that property speculators talk about the most.

So, if the gross yield is only useful up to a point, let's look at some additional rental yield estimates to understand our likely investment returns better.

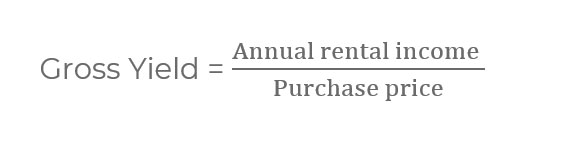

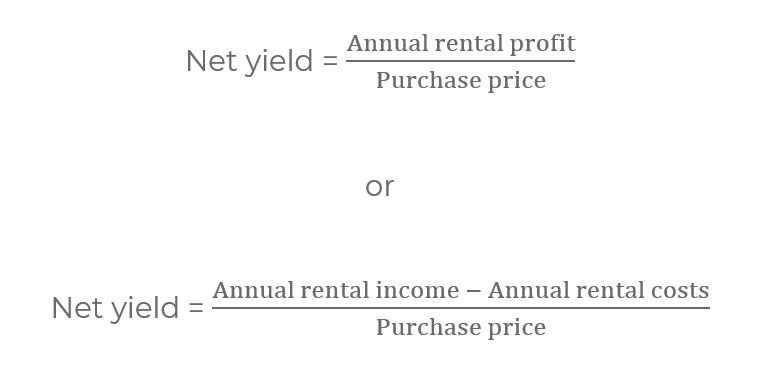

How to calculate net rental yield?

We need a more strong yield metric to provide a more accurate view of our return on investment. This is when the term "net yield" comes into play.

Let's start with the net yield calculation.

The annual rental profit divided by the acquisition price of the current property equals the net yield.

Net rental calculation formula

Assume we have $8,400 in annual rental income, $5,000 in annual rental charges, and a $120,000 purchase price. We divide the $120,000 purchase price by $8,400 - $5,000 = $3,400 to get the annual rental profit.

It gives us a result of 0.03; we've calculated a net return of 3% per year.

When determining the net return for possible property investment, we must factor in all property-related expenses throughout the year. For instance, property-related expenses include:

- home loan payments

- the expense of marketing

- letting agent commissions

- the expense of repairs and maintenance

- ground rent and service charges

- the cost of insurance (e.g. buildings insurance)

- a provision for vacancies (e.g. lost rent, utilities)

- additional administrative costs

To put it another way, we need to factor in everything we can think of in terms of costs to get the most accurate picture of our potential rental returns.

Gross (potential) Income

Less Vacancy Allowance

Gross Effective Income

Statutory Charges

- Local council rate & charges

- Water rate & charges

- Land tax

Operating Expenses

- Property Insurances

- Maintenance, servicing & repairs

- Management Fees

Less Total Property expenses

Net (Operating Income)

Less Capital Expenses

Cash flow from operations

Net yield vs gross yield - Which is better?

Net yield is a far better metric to utilise when comparing possible investments. It considers all your rental property costs, so it's calculated based on how much money you'll have left after all expenses are paid.

It also reveals any significant discrepancies in the operating costs of various properties, such as between flats and houses, old and new homes, etc.

As a result, it allows for a considerably more accurate assessment of potential investment returns across various property types.

You could be thinking that a net yield of 2 per cent p.a. isn't that appealing, given that you could get 0.5 per cent p.a. in your bank account. And, a 2% net return per year does not appear to be enough to pay you for the risks and hassles of beginning and running a real estate firm.

The amount of money you've put into the property investment journey is a critical issue that net yield overlooks. The net yield compares our annual rental earnings to the property's acquisition price.

However, we are unlikely to have paid cash for the house; we are more likely to have utilised a mortgage; therefore, we will not have put down 100% of the purchase price.

As a result, we may use a few different formulas instead of net yield that are far more accurate.

The first is a popular calculation among many investors in the United States.

Individual buy-to-let property investors in the UK are less likely to utilise it, but surveyors and large institutional investors do.

It's also the foundation for several valuation strategies. So, let's take a short trip through these calculations and formulas.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

Capitalisation rate

The capitalisation rate, or "cap rate," for a property is closely tied to net yield. Cap rate is a variation on the net yield that is probably far more relevant, and US real estate investors often utilise it.

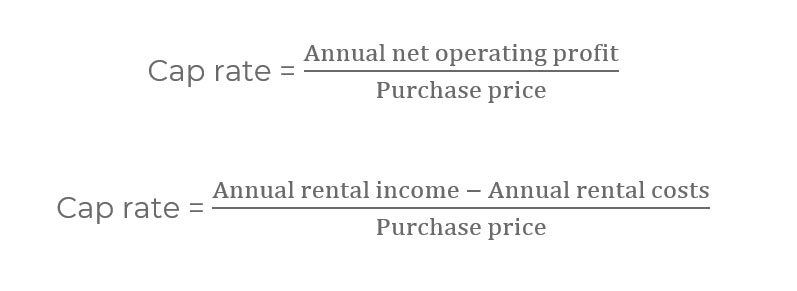

How to calculate the cap rate?

The cap rate in real estate is computed by dividing the annual net operating profit from the property by the property's purchase price, assuming the investor pays cash for the property.

As a result, mortgage costs are not included in the calculation.

Use the following formula to calculate the capitalisation rate:

What is the difference between Net Yield and Cap rate?

The main difference between net yield and cap rate is that cap rate does not consider mortgage payments. All other expenditures, such as marketing costs, letting agent fees, repair costs, service charges, ground rent, insurance costs, and so on, must still be factored in.

Cap rate calculation example

We have $8,400 in annual rental income and $2,000 in annual rental costs, excluding mortgage payments. The price we paid for the house is still $120,000.

To get the annual net operating profit, we divide the $8,400 -$2,000 = $6,400 by the $120,000 purchase price.

This gives us a result of 0.053 or a 5.3 per cent annual cap rate.

Why is cap rate important?

The cap rate is useful because it does not include mortgage charges. The cap rate calculation is completely dependent on the rental property's profitability, not on the mortgage financing used by the buyer to purchase the property.

In practice, many investors employ various deposit amounts and access various mortgage financing options.

As a result, mortgage costs will vary depending on the investor, and two investors may come up with different net return figures for the same home. On the other hand, the cap rate is not altered in the same way.

Because cap rate assumes that you acquire a property outright with no debt or mortgage financing, it gives investors an estimate of the rental returns they may expect if they owned the property outright with no debt.

It helps investors to compare potential property purchases while deferring financing choices consistently.

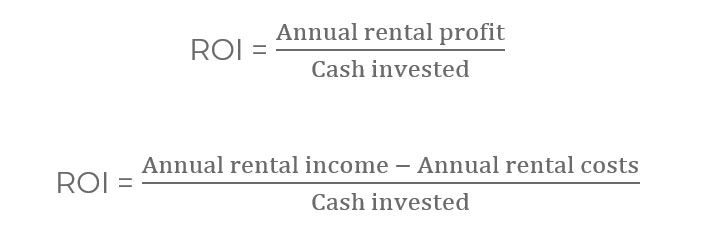

Return on investment (ROI)

Return on investment, or ROI, is a second calculation used instead of net yield. This formula compares the rental profits to the amount of money we put into the real estate deal.

How to calculate return on investment?

The annual rental profit from the property is divided by the amount of money you put into the agreement. This would be the same as the cap rate if you bought a property with cash instead of a mortgage.

However, if you used a mortgage, you would have put far less of your own money down.

Using the previous example, you now have a house with $3,400 in annual rental revenues after subtracting the mortgage payments. You paid $120,000 for the house, but you had to borrow 75% of the money from the bank to do so.

That implies you only put $30,000 of your own money into the project. Let's figure out what your return on investment will be.

Divide the annual rental profit of $3,400 each year by $30,000. This gives us a result of 0.11 or an annual return of 11%. That sounds like something worth getting out of bed for.

In practice, you must factor in additional expenditures such as stamp duty, legal fees, surveys, broker fees, etc. You should add all of these to the "cash invested" in your ROI calculations above because they are all actual cash charges that must be paid upfront.

Why calculating ROI is important

The return on investment (ROI) is the best estimate of how much money you'll make. As a result, you may compare it to returns on non-property assets, such as interest on a bank account or dividend yield on a stock.

It demonstrates how hard your money works for you and how this compares with other options.

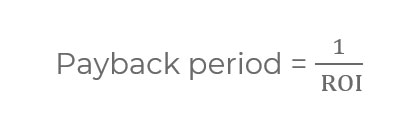

Which calculation is the best?

Most investors' most relevant of these figures is the return on investment (ROI). It considers all of the investment's operating costs and the financing strategy you're utilising.

It also gives us an idea of how long the investment will take to pay off, that is, the payback period for an investment.

Let's look at our prior case once more. With an annual return of 11%, we may expect our investment to pay for itself in 10 years. If it returns 11% of the money invested each year, it will have returned 100% of the money in 10 years.

In investment, the payback period is an important concept. It shows us how long we'll have to hold the investment before it pays us back the money we put in.

As a result, if we don't think the investment will be successful for at least that long, we should pass on it.

- In short, gross yield is important for screening possible investments early in the due diligence process.

- The cap rate is useful for property comparisons and property valuation studies.

- However, the ultimate metric is the return on investment, and it's the one you'll most likely use to make your investment selections.

Most investors, to be honest, don't utilise net yield at all.

What is Capital growth?

All of the numbers we've looked at have simply considered rental income. However, many real estate investors invest in real estate for capital growth. So, how do we account for this?

The increase in the value of a property over time is known as property capital growth.

It's commonly believed that capital growth is where the real money is generated in real estate. While this may be true, the amount of capital gain you can expect and the timeframe for this growth to occur are intrinsically unknown.

Nobody knows how the future will turn out, and anyone who claims to do so is usually simply seeking your money.

However, certain studies also reveal that capital growth does not follow a straight path. There have been times when property values have soared, times when they have plummeted, and times when they have just plodded along.

There are significant geographical variances underneath the surface, adding to the intricacy. There are differences from one street to the next, even within the same metropolis.

As a result, when evaluating a real estate deal, most property investors eliminate capital growth from their calculations.

However, depending on how they feel about the capital gain possibilities and the riskiness (or not) of a specific transaction, investors will frequently adjust the criteria they employ to accept or reject a contract.

Although the capital gain isn't expressly integrated into rental yield estimates, it might be considered in the entire decision-making process.

What's a good rental yield for an investment property?

There is no set answer to what is considered a "good" rental yield. It will vary depending on the factors mentioned above and your personal goals and risk tolerance.

A general rule of thumb is that a rental yield of at least 12% is considered good. However, if you're willing to take on more risk, you may be able to find properties with lower rental rates but higher appreciation potential.

Understand this with a simple rental example -

Which of the following properties would you buy?

- Property No. 1 boasts an annual return of 10% and is situated near a commuter town in a pleasant family neighbourhood.

- Property No. 2 offers a lower annual return of 6%, but it is in the city's heart and has significant capital growth potential.

When it comes to property investment, there aren't always clear-cut options. Your unique investing choices and preferences will determine what constitutes a strong ROI or capitalisation rate.

In practice, many real estate investors are willing to accept a lower return on investment and capitalisation rate if they believe a property or location will develop in value in the future.

Why is rental yield important?

Rental yield is important for landlords to consider as it gives them a good indication of how their rental property is performing.

A high rental yield means that your rental income is covering most (if not all) of your costs, while a low rental yield indicates that you're not earning enough rental income to cover your costs.

Keep in mind that rental yields can fluctuate over time, depending on the state of the property market. For example, if there's an increase in demand for rental properties, you may be able to charge higher rent and achieve a higher rental yield.

Cash flow analysis

Cash flow calculations are always of key importance. Even though the long-term profit potential is significant, the entire investment is in danger if the mathematics doesn't work out.

You must ensure that you can make it through the next 12 months, which is more important than the outcome of the next 12 years.

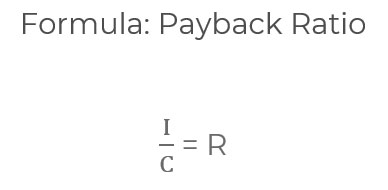

Payback ratio

A good place to start is with most investors' first question: How long will it take to recoup my investment from net cash flow?

The payback ratio indicates how long it will take for investors to recoup their initial investment, usually a down payment on a home.

Payback ratio formula

Here,

I - Investment

C- Net Cash Flow

R - Payback Ratio

For example, if an investment requires a $50,000 down payment and generates $5,450 in annual net cash flow (rents minus operating expenses and debt payments), the payback ratio is:

$50,000/$5,450 = 9.1 years

The payback ratio is a great way to compare two options. This is a favourable indicator if one investment pays off faster than another.

You may, for example, consider buying two residences for $200,000 each. One is a single-family home with a $5,450 annual net cash flow, while the other is a duplex property with a $6,100 annual net cash flow.

The payback ratio will differ if both properties require a $50,000 down payment. The single-family home has a 9.1-year ratio, whereas the duplex has an 8.2-year ratio.

Now, let's understand the different real estate investment calculations required to calculate rental yield.

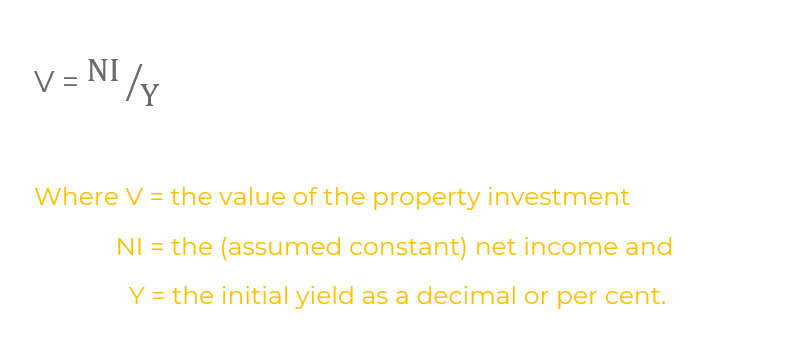

Initial rental yields

The current income net of operational expenses is converted to its capital value by discounting the income as if it will continue indefinitely, a typical method of determining rental property prices.

Divide the income by the required rate of return to find the present value of a "perpetuity" (as a decimal).

Here,

V = value of the investment property

NI= Net Income (assumed constant)

Y = Initial Yield

It is typically computed using annual income and yield (or return) per annum.

Cash-on-cash yield

Cash-on-cash yield is a cash flow related calculation. The equity dividend yield is another name for this ratio. It is a calculation used in pooled programmes like real estate partnerships to determine the return.

The ratio, which is usually limited to programme evaluations based on first-year cash flow forecasts, is useful for comparative analysis.

Like all investors, limited partnerships and similar programmes are concerned with annual cash flow, and they try to raise investment capital by presenting cash flow projections.

Studying the relative health of cash flow is one method of analysing and comparing the cash flow risk of different programmes. This can be accomplished in two ways: historically and by projections.

The actual results recorded by a program are known as historical cash-on-cash yield, whereas projections are forecasts for the future.

Cash-on-Cash return calculation formula

C/I = R

Here,

C = Annual Cash Flow

I = Invested Cash

R = Cash-on-cash Return

You can also utilise cash-on-cash returns to compare homes you're considering buying outright.

Compare the cash-on-cash returns for the two properties, a home and a duplex rental property, in the preceding example of the payback ratio.

A $50,000 down payment was required for both. The home had a first-year cash flow of $5,450, while the duplex had a cash flow of $6,100. These properties' cash-on-cash returns would be 10.9 per cent and 12.2 per cent, respectively.

It supports the payback ratio's conclusion: the duplex provided more cash flow for the same down payment. (In addition, the duplex gives some protection in the event of vacancies, as both apartments are unlikely to be vacant simultaneously, whereas the house's occupancy is either 100 per cent or zero.)

When analysing a specific investment property, calculating discounted cash flow is one of many analytical procedures that can be valuable.

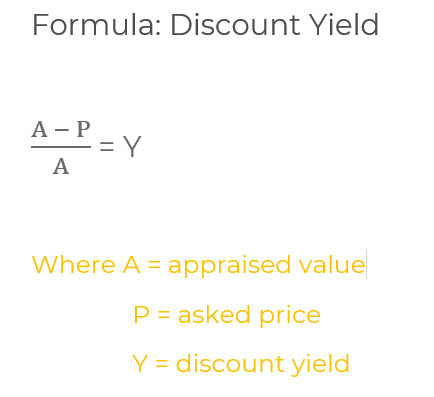

Calculating discount yield

Another return estimate that every property investor may find useful for investment property is the discount yield.

It's a term that's more typically heard in the bond market. Bond investors want to assess their discount yield because they can purchase the bond at a discount to their par value.

This is accomplished by multiplying the discount by the face value.

A discount yield of 5% would be obtained by purchasing a bond at 95 (a discount of five). This differs from the current yield, calculated by dividing the reported interest rate by the bond's real cost.

When individual properties are purchased at a lower price than their appraised value, you can use discount yield in real estate.

You may make a comparable case for employing this technique in real estate by comparing the assessed value to the par value. This formula could be handy if you want to keep track of the different types of discounts you can get on properties.

Real estate discount yield calculation formula

Here,

A = Appraised Value

P = Asked Price

Y = Discount Yield

Let's say you're thinking about purchasing two residences. The seller, in both circumstances, had a recent appraisal on hand. (Alternatively, you may have made an offer subject to an appraisal being completed.)

On the one hand, the asking price for the property is the same as the appraised value; on the other hand, the asking price for the property is $150,000, which is $7,000 less than the $157,000 appraised value, indicating that an offer might be made at a lower price.

When using the formula,

[$157,000 - $150,000]/$157,000 = 4.45%

In this case, you got a 4.45% discount yield by buying the investment property for less than its appraised worth. Because market supply and demand factors, seller attitudes, and the availability of appraisals when an offer is made will all limit your ability to find such discounts, you can't use this equation in every situation.

It is a practical examination as a technique for appraising a succession of property investments. It's the same as buying the stock at a lower price than it's worth.

For example, employees may be given stock options at a fixed price that they can exercise at any moment. Shares can be purchased at a discount if and when the stock's market price increases above that price.

There's no reason why real estate investors shouldn't be able to evaluate properties bought below appraised value in the same way. Nevertheless, discount yield is just one of many useful computations you may use to analyse your real estate investment portfolio.

How to use rental yield calculation to fix your price?

You can use the above rental yield estimates to determine the maximum amount we're willing to pay for a home.

Assume you've determined that a particular property must generate an annual return of 8% to pique your interest in making a sale. You can adjust the pricing until the ROI equals 8% every year in your calculating worksheet. It is then the highest price you're willing to pay.

Of course, there's no guarantee that the seller will agree to sell to you at that price. However, this technique can assist you in determining your walk-away point before entering discussions.

Final thoughts

You've now become an expert in rental yield calculations.

These rental yield calculations discussed above will soon become your best friends. They'll compel you to clarify your return expectations and offer you enough to talk about at those crucial property networking events.

The payback ratio is another Jedi mind trick. It can help you focus on long-term investment opportunities and rule out particular properties.

You can accept or reject offers based on your beliefs about future capital growth possibilities. You should seek a higher ROI or cap rate where capital growth prospects are weak.

Finally, it's worth noting that the primary criterion for accepting or rejecting a real estate deal is a positive cash flow.

By understanding how to do rental yield calculation, you can better assess the potential profitability and make sure you're comfortable with the level of risk involved before making any offers.

With a little bit of research and effort, you can be well on your way to earning a healthy return on your investment.

Enrol for Property Development Feasibility Suite to know your numbers well and get profit from your property.

FAQs