12 Proven strategies to make money in real estate

If you're tired of hearing false promises about making money from your property, now is the time to learn how real estate actually creates wealth and why everybody wants to become rich with real estate.

This article focuses on several proven ways (traditional and modern) and the latest opportunities that property gurus use to make money in real estate.

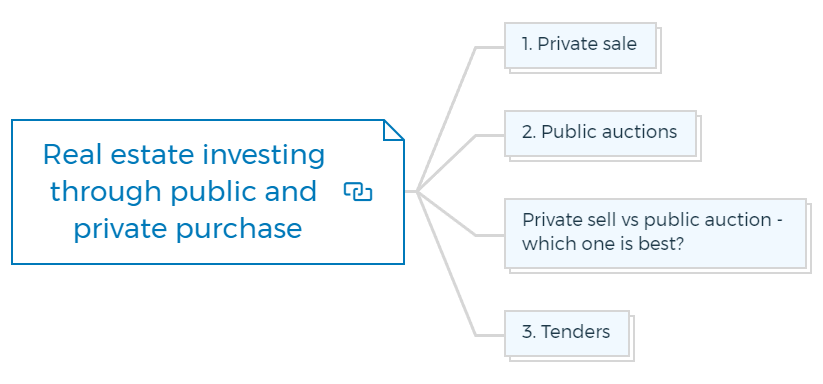

Real estate investing through public and private purchase

Every town or suburb presents hundreds of options for real estate investment. Hire a real estate agent to sort the wheat from the chaff and pick a property that interests you.

In the real estate market, properties are sold in three major ways -

- Private Sale

- Public Auction

- Tenders

There are some unusual options that you can also use to buy an investment property.

1. Private sale

Private sale or private treaty sale is most common in Australia for any real estate property transaction. The owner or the seller sets the asking price on the property and then waits for others to come up with counteroffers.

You can always negotiate in a private sale according to the property value in that market. It can last for days or weeks.

Usually, most people selling a property start with a price slightly higher than what they think is their lowest price.

Here are some helpful ways for effective negotiation -

- Hire an advocate in your team and let them discuss things with the seller's agent. Advocates know the tricks of agents and vice versa.

- You can negotiate the price by pointing out the property's flaws and the cost to fix those problems.

- The seller's real estate agent can also help you. Agents are interested in the sale first and a high price second. They won't get compensated for a large commission on a home that doesn't sell. The agent still gets paid if the sale is $20,000 less than the vendor wanted.

There is no risk to your money. You can use the cooling-off period to get out of the sale contract. It starts at midnight when the property contract is signed and goes on for up to five business days.

You might have to pay a small fine if you decide to use your right to a cooling-off period. Sellers don't have this chance.

2. Public auctions

Public auctions are a great way to make money in real estate. An auction is a public sale of the property to the highest bidder. Many property agents in Melbourne, Sydney, Perth, Adelaide and Brisbane use public auctions for real estate transactions.

But how does that help you make money? First and foremost, auctions create opportunities.

An auction may be the perfect place for you if you have ever wanted to buy a property but didn't have the necessary funds. There is no minimum bid at a public auction so properties can sell for much less than their fair market value.

It provides an opportunity for real estate investors with limited capital to purchase properties they otherwise would not be able to afford.

Tips for buying properties in the public auction -

- Set strict boundaries for yourself.

- Perform your due diligence at least 3-4 weeks before an auction.

- Before the auction, determine the property's market value. Then bid no higher.

There is no cooling-off period in public auctions. Of course, some risks are involved in buying at auction, so it's essential to do your homework before bidding.

But if you're prepared and know what you're doing, public auctions can be a great way to snag a bargain on a piece of real estate.

Private sell vs public auction - which one is best?

If you're an experienced investor with plenty of capital, then a public auction may be the way to go. But if you're new to real estate investing or don't have much money to spend, a private sale may be your best bet.

Here's a closer look at each option:

Private Sale:

- Usually takes longer to complete than an auction

- It may be more expensive than purchasing at an auction

- Gives the buyer more time to inspect the property and make a decision

Public Auction:

- It can be an excellent opportunity to get a property at a below-market price.

- Requires the buyer to be prepared and have financing in place before bidding.

- The sale is final once the gavel falls, so there is no going back once you've made your bid.

3. Tenders

Every state has a slightly different process when a real estate transaction is done through a tender. Generally, the buyer submits a bid in a sealed envelope, which is opened after a deadline.

These bids are known by different names, such as - set sales, expressions of interest, and set dates. The tender process is most suitable for commercial investment properties, specifically higher-valued properties. It is rarely used for residential investment properties.

While buying property through the tender process, you will need to put your value for the property. Perform detailed property valuation by comparing prices for similar properties or hire a qualified valuer.

Most of the time, you only get one chance, so the price you put in your envelope should be close to the most you're willing to pay.

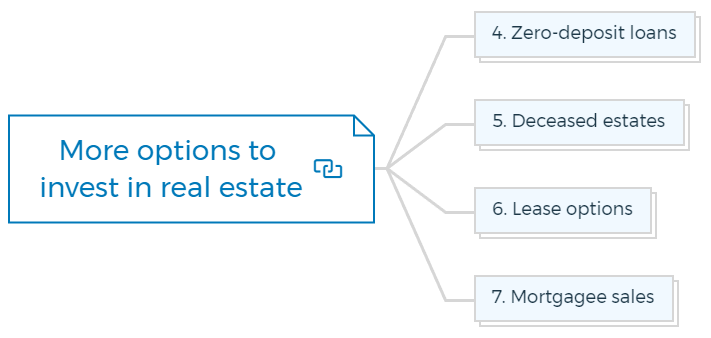

More options to invest in real estate

More than 99% of all property sales in Australia take place through private sales, auctions, and tenders. However, you can make a property investment in other ways. These methods include -

4. Zero-deposit loans

Zero deposit loan is a financing that makes it easier for home buyers to enter the property market.

5. Deceased estates

A deceased estate is a property left behind by someone who has died. When someone dies, their estate must go through a legal process called probate.

Probate can take several months to complete when the property is usually left vacant. It can create opportunities for savvy investors to purchase the property below market price.

If you're interested in making money in real estate, keep an eye out for properties sold as part of a deceased estate.

6. Lease options

With lease options, you can negotiate to buy a property at a specific price at a later date.

A lease option requires the vendor to sell the property at a later time but does not force the buyer who is renting it out in the meantime to buy.

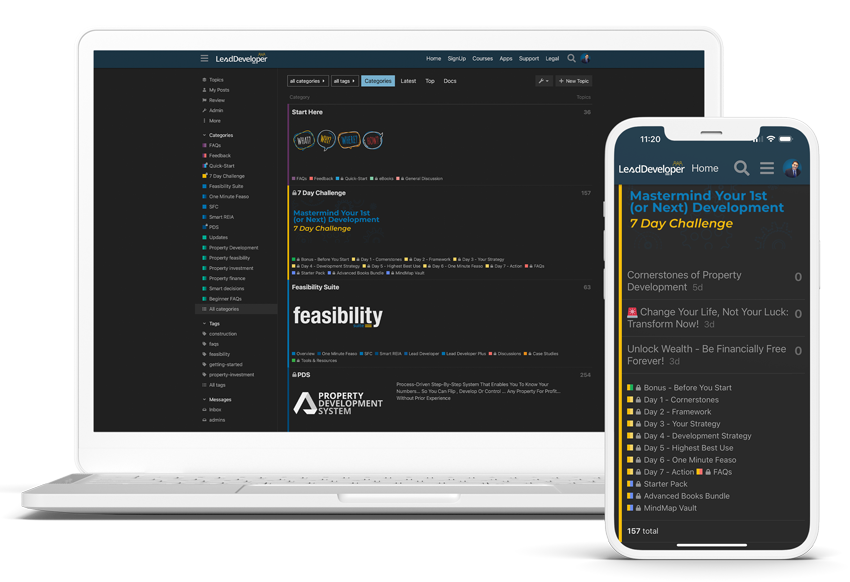

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

7. Mortgagee sales

Mortgagee sales are when the mortgage lender sells a property to recoup their losses after the borrower defaults on their loan.

When owners don't pay back their loans according to the terms of the loan, usually because they're a few months behind, the bank may seize control as the mortgage holder and try to sell the property to get their money back.

Most of the time, these properties are sold at auction, but sometimes they are sold privately.

This sale can be an excellent opportunity for buyers, as properties are often sold below-market prices.

Make money from residential real estate investing

Over the long term, property prices are increasing about 2 to 4 per cent above inflation. This increase is a stable appreciation rate for property investors with long-term investment planning who prefer buying and holding investment strategies with their assets.

The buy-and-hold investment property strategy is the basis of wealth-building in real estate.

With the limited availability of new and existing real estate properties, the demand and prices are escalating. Thus real estate developers and investors are appearing with a buy-and-flip strategy.

8. Buy and flip

Buying and flipping houses is a strategy where an investor buys a property, makes some changes, and sells it quickly in the hope of some profit.

The buy-and-flip strategy works for existing as well as for new residential properties. Growing demands create opportunities for buyers to make money in real estate easily by putting down a deposit on the property.

They bet that by the time the house is finished, the property's market value will have increased enough that they can make a quick profit by selling their stake before the deal finishes.

You can use the buy-and-flip approach for existing properties. Buy the investment property below market price, make some simple improvements, and sell it at a full market value.

Flipping existing properties is risky because the costs of buying and selling in Australia are usually around 10% (stamp duties to buy and agent and advertising fees to sell), even before a capital gain might be taxed, but it can also be rewarding.

9. Buy fix and flip

Though the buy-and-flip strategy is perfect, here is a lower-risk strategy of buy, fix, and flip. Find distressed properties to which you can add value through upgrades, improvements, or repairs and convert them into well-maintained properties.

And that's it.....You are all set to make money in real estate by investing less in an old property and earning more by selling it at a competitive price.

This method is less risky than betting on future supply issues and provides a higher chance of making money in real estate.

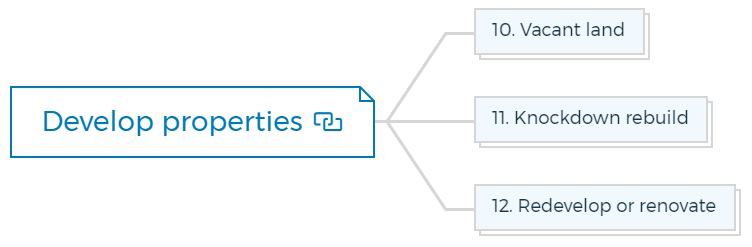

Develop properties

One of the best ways to make money in real estate is by becoming a property developer. Property developers buy land and build houses, apartments, or other structures. They then sell these properties for a profit.

Becoming a property developer is not a get-rich-quick scheme. It takes time, effort, and money to make it in this business. But if you're patient and willing to work hard, it can be a very lucrative career.

Steps to becoming a property developer

If you're interested in becoming a property developer, start learning about the business as much as possible. Follow these simple steps and become a successful property developer.

Step 1: Get started with our free signup and an optional starter pack

Step 2: Pick any one of these -

Step 3: Get our flagship Property Development System

Step 4: Try our Lead Developer Feasibility Suite

Step 5: Start your first or next property development project.

Common Development Options

10. Vacant land

Vacant land is the most common and readily available property for beginners in real estate development.

The seller places the land on the real estate market without the council's approval for development. Before you start negotiations, hold on.....First, investigate what approvals you will get for development on that land.

Look for the approved construction in that area recently. It will give you an idea of what the council, residents, or renters are prepared to accept.

Always remember that "preparation precedes success and reduces risks." Knowing everything about the land before signing the deal increases your chances of successful development.

11. Knockdown rebuild

Knockdown rebuild is when a property developer buys an old or run-down property, knocks it down, and then builds a new one.

This development can be very profitable for developers, who often sell new properties for much more than they paid for the land. It can also be a great way to make money in real estate if you're willing to take on the risk of buying an old property.

Knocking down a house or cutting trees on a property requires a local council permit. Before investing, consider the time approval may take, then plan development and profits accordingly.

12. Redevelop or renovate

By buying an old or run-down property and redeveloping it, developers can add value to it and then sell the property for a profit.

Redeveloping a building requires significant construction work, which is costly while renovating a building means doing some minor changes at minimum cost.

Updating bathrooms, laundry, and kitchens can convert a run-down property into a desirable place to rent or sell.

Real Estate Investment Trusts (REITs), (Mortgage-backed Securities) MBSs, Mortgage Investment Corporations (MICs), and Real Estate Investment Groups (REIGs) are some significant alternative income sources in real estate.

Thus there are lots of opportunities in real estate to increase your wealth quickly. Money always comes with some risks, and so does property development. Get aware of the risks involved in property development before investing anywhere.

The bottom line

Making money in real estate is not easy. It takes time, effort, and patience. But if you're willing to put in the work, there are plenty of opportunities for those interested.

Consider becoming a property developer, investing in properties sold as part of the deceased estate, or something else from the above options.

Just keep your expectations realistic, and do your homework before investing. Whew! You are on your way to becoming a millionaire through real estate.

Anytime you feel stuck in your development project, I am just a click away. Join my 1-ON-1 Real Estate Mentoring Program and get my help for executing your first or next development project.

FAQs