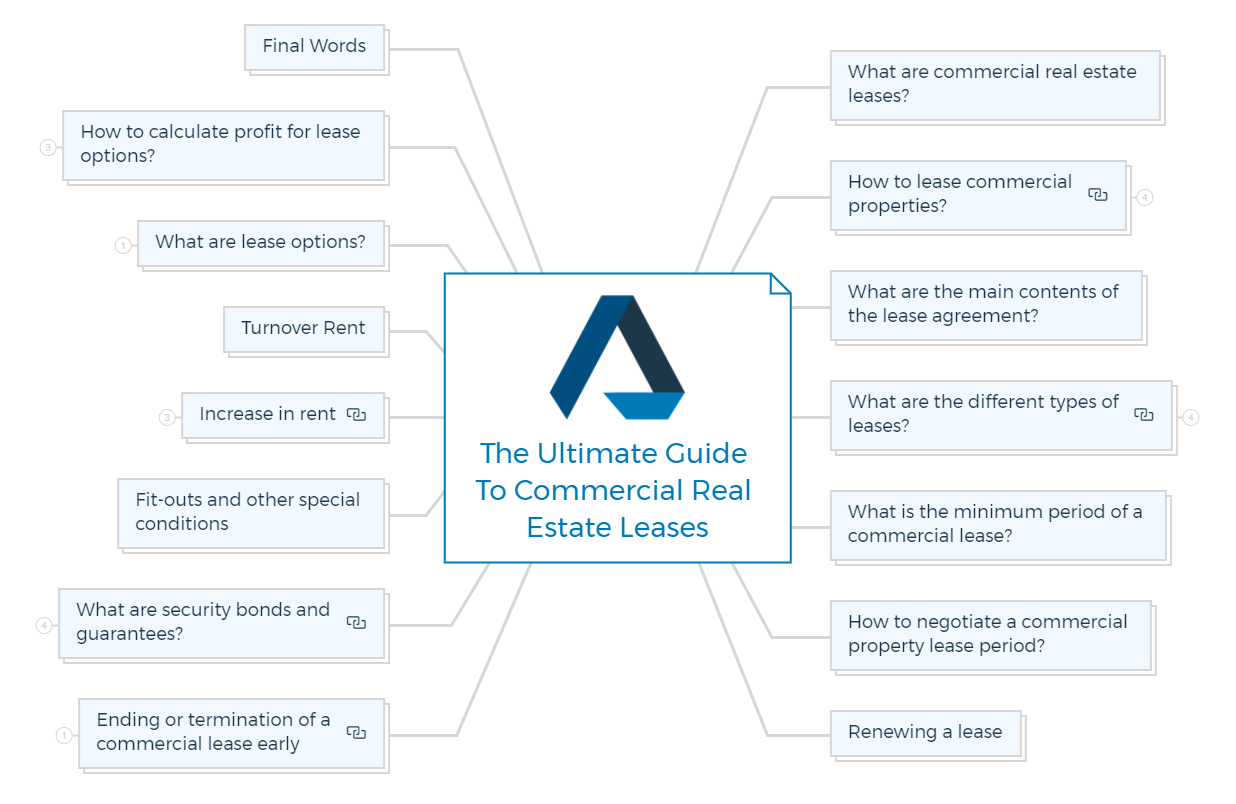

Guide to commercial real estate leases

As a property investor or developer, it's important to understand the basics of commercial real estate leases. By understanding what you're agreeing to when leasing commercial property, you can avoid costly mistakes and make the most of your investment.

Here are the key things you need to know about commercial leases. So, whether you're a seasoned pro or diving into Commercial Real Estate for the first time, read on!

Key Takeaways

What are commercial real estate leases?

Simply put, a commercial lease is an agreement between a tenant and landlord in which the tenant agrees to use and occupy property from the landlord for a specific amount of time in exchange for rent.

Once a lease is signed, neither the landlord nor the tenant can cancel it without the other's approval, or a penalty would be assessed. Commercial leases can be for office space, retail space or any other type of business property.

The lease defines the relationship between the lessee (tenant) and the lessor (landlord) and ensures that both parties' expectations are recognised and documented.

A lease is good for both the tenant and the owner. The owner is happy to have a steady source of income for a long time, and the tenant is happy to have a long-term place where they can grow their business. But if one party wants to escape, it can be difficult.

As with all legal contracts, there are terms and conditions that both parties must agree to before signing a commercial lease. Let's take a look at some of the most important ones:

- Rent - This is usually determined by how much square footage the tenant will be occupying. The rent may also vary depending on whether it's an annual or monthly lease.

- Term - The length of time that the tenant will be occupying the property is typically specified in the lease agreement. It can range from as short as one year to several years or more.

- Use clause - This clause defines how the tenant can use the leased space - for example, whether they can run their own business or not, install signage etc.

- Modification clause - This allows either party to make changes (such as alteration) to the leased space provided that they receive written consent from each other first.

- Condition of Premises clause - This sets out who is responsible for repairing/maintaining any damage done to the property during tenancy - usually it's split 50/50 between tenant and landlord.

Now that we've covered some of the key points about commercial leases, let's look at how you can lease commercial properties.

How to lease commercial properties?

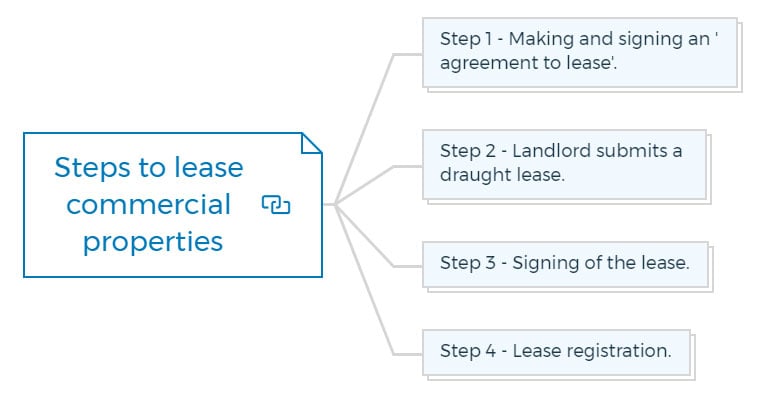

There are 4 steps to a commercial lease -

Step 1 - Making and signing an 'agreement to lease'.

You will do this before the formal lease. The agreement to lease is a promise to provide a lease in the future but not a right of possession.

Suppose the lessor does not own the land. The premises are not fully constructed or ready for occupation, the former tenant is still in possession, and the lease requirements have not been fully settled. The lease agreement is not legally binding.

Step 2 - Landlord submits a draught lease.

Their lawyer will prepare a commercial lease depending on the conditions in the leasing agreement. The lease is then sent to the tenant's lawyer for assessment and possible revisions. Also included is the lessor's disclosure.

The seller or landlord must give a disclosure statement detailing mortgages, covenants, easements, zoning, and outgoings. Registration and survey fees are the tenant's responsibility.

Step 3 - Signing of the lease.

After both parties have agreed, the landlord's counsel sends three lease copies to the tenant's solicitor. Followed by the renter signing all copies and returning them to the landlord for signature. It is when security bonds and guarantees are provided.

Step 4 - Lease registration

If the lease term is longer than three years, a memorandum of lease is drafted and filed with the Land Registry Services.

What are the main contents of the lease agreement?

Commercial leases must include the following information:

- Tenant information

- Description of the premises and use

- Guarantor information

- Bond information

- Lease start and expiration date

- Lease length

- Lease options

- Rent amount

- Details about rental increases and reviews

- Details of any outgoings the tenant must pay

- Who is responsible for repairs and maintenance - usually, the tenant

- Core trading hours and when the premises will be open for business

- The cost of building insurance

As a buyer, you don't need to know every aspect of the real estate lease because your solicitor will be an expert in contractual law and go over all the proposed terms and conditions with you.

However, it is critical to be conversant with all lease terms to get a better property and negotiate effectively.

In a commercial real estate lease, almost everything is negotiable. Your primary concern should always ensure that your property is a sound investment with a reliable long-term renter as a landlord.

What are the different types of leases?

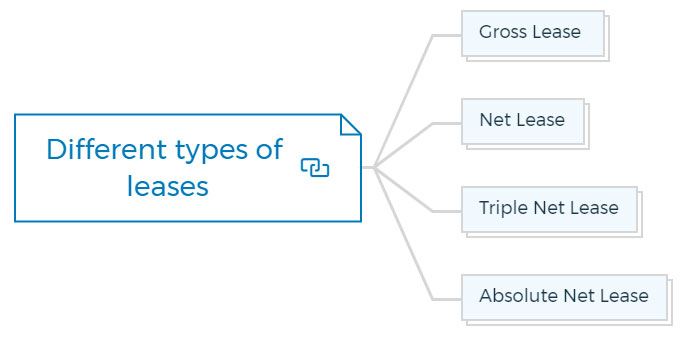

There are 4 types of leases in real estate - Gross leases, Net leases, Triple net leases, and Absolute net leases.

Gross lease

A gross lease in real estate is one where the tenant pays a fixed rent amount each month, and all other expenses such as property tax, building insurance, and repairs are paid by the landlord.

This type of lease is popular with small businesses and is easy to understand and administer.

Because the landlord can't raise the tenant's rent until it's up for review, this can impact their yield, making their original projections on the property's profitability wrong.

Net lease

A net lease in commercial real estate is where the tenant pays rent plus a portion of the property's operating expenses such as council rates, insurance fees, and repairs.

The landlord usually charges a lower rent for the tenant to take on these additional costs. This type of lease is popular with larger businesses and corporations.

There are further two types of leases - single net lease and double net lease.

In a single net lease, the tenant is only responsible for paying property taxes in addition to the rent. The renter pays rent plus property taxes and building insurance payments under a double net lease.

Single net lease definition :

A single net lease (also called a modified gross lease) is one where the tenant pays rent plus property tax. The landlord covers all other expenses, including insurance and repairs.

Double Net lease definition:

In double net leases, the tenant pays rent plus their proportionate share of the building's property taxes and insurance. The landlord is still responsible for all other expenses, including repairs.

If the property is multi-tenanted, each tenant is responsible for their share of the outgoings, as specified in the lease.

The benefit of a net lease for you as the property owner is that the tenant will pay any increases in outgoings, ensuring that your cash-flow projections stay accurate.

Triple net lease

A triple net lease, also known as a NNN lease, is where the tenant pays rent plus all three of the following expenses: property taxes, insurance, and repairs.

Triple net lease in commercial real estate is very common in the United States.

Absolute net lease

An absolute net lease in commercial real estate leases is the most landlord-friendly type of lease. The tenant pays rent plus all expenses associated with the property, such as property taxes, management fees, and structure and maintenance fees.

This type of lease leaves the landlord with little responsibility for the property and is usually favoured by investors.

As a tenant, you should be aware that an absolute net lease gives the landlord more negotiating power when it comes time for renewing your lease or increasing your rent.

What is the minimum period of a commercial lease?

Leases can be for any time, although most small and medium businesses will have a lease term of one to five years.

- Because the renter is hesitant to commit to a longer-term, it's more likely to be one to two years for start-ups.

- For well-established enterprises, leases might last anywhere from three to five years.

- Leases for national chain tenants, such as large shopping malls, hardware stores, gas stations, and well-established fast-food restaurants, are often seven to twenty years long. These are long-term leases.

Leases are often for three, five, or ten years, and they typically feature numerous terms and renewal options. For example, '3+3+3' means three three-year intervals. The renter can renew their lease at the end of each period.

It's important to remember that a commercial lease is a legally binding contract, so both parties should take care in reviewing and agreeing to all the terms before signing.

How to negotiate a commercial property lease period?

The conditions and alternatives in the 'agreement to lease,' followed by the lease, are usually the starting point of a landlord-tenant negotiation.

- The landlord will try to negotiate longer terms with options because this adds value to the property.

- A startup or tenant with a newer business will want shorter terms with many options to renew.

On the other hand, shorter initial terms may be worth considering if you want to get a somewhat higher rent.

It's critical to know the local market and comparable properties and what they're renting for while bargaining. Let the tenant know about previous lease terms used on similar properties to set reasonable expectations.

Renewing a lease

If the renter wants to renew the lease, the property owner normally has two months to dispute the request. If you grant the request, you can now negotiate additional terms.

To determine a new rental fee, you'll need an independent valuation. The tenant can stay in the property if the lease is secured (with bonds and guarantees) while the new conditions are negotiated.

If it's unsecured, the tenant has no right of occupation after the expiration date of the existing lease, and the owner can demand they move immediately.

Ending or termination of a commercial lease early

There are several reasons why you might terminate a commercial lease before the end date.

Normally, both parties have to agree to terminate the lease agreement.

Some common reasons for commercial leases ending early are bankruptcy, foreclosure, damage to the property, or change in use of the property.

When one party wants to end the lease, they have to provide written notice to the other party. The notice must include the specific reasons why they're terminating the lease and the date that they would like it to end.

If the tenant doesn't leave by the specified date, then the landlord can take legal action to evict them.

An owner may terminate a lease early if the property requires extensive reconstruction, repair, or restoration (especially if it is uninhabitable). In this instance, the owner must advise the tenant why the property requires extensive repairs.

What is assignment of leases and rents?

If your renter sells their firm, they'll likely have to guarantee that the new owner will continue to pay rent.

The former tenant's guarantee still applies if the new firm fails. Leases are legally binding; assigning the leases protects you, the landlord.

It prevents a renter from selling their business for a low price and leaving. Your solicitor must assign the lease to the new owner if your tenant sells their business.

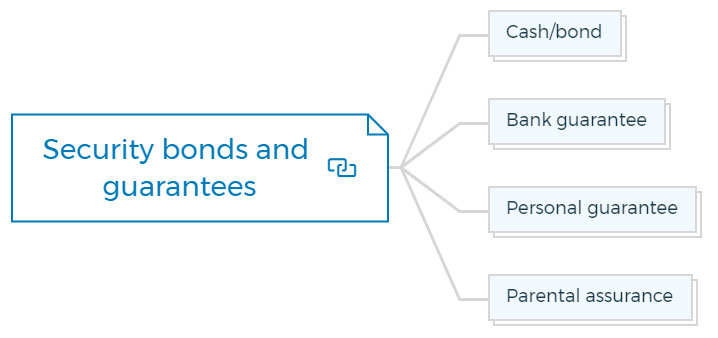

What are security bonds and guarantees?

Commercial landlords commonly need security deposits from tenants to protect themselves in case of lease default.

Security bonds and guarantees ensure that the tenant complies with the lease terms. A tenant usually pays one to six months' rent as a cash deposit/bond.

Other options include cash deposits or bank guarantees. Let's review these sorts of security immediately. When assigning a lease, a bond and guarantee are preferred.

Cash/bond

A cash deposit or bond is a sum of money paid by the tenant at the start of the lease.

- The bond usually goes to the new owner if the property is sold. Depending on the state or territory, you may be required to post a monetary bond with a government agency.

- After the lease expires, you must refund the cash bond plus interest to the renter (if stipulated by the government entity or in the lease).

- The main benefit of accepting a cash bond is that it is quick to collect and avoids dealing with a bank, delaying security.

Bank guarantee

For non-compliance with the commercial leasing agreement, the tenant's bank issues a bank guarantee.

Landlords want bank guarantees for many reasons:

- A third party provides them.

- The bank must honour any withdrawal request without first consulting the renter.

- Bank guarantees survive a tenant's bankruptcy, lowering the risk to the landlord.

The bank requires a cash deposit, a mortgage or other asset to secure the lease or another minimum-balance facility that ties up the tenant's funds and normally costs more to operate.

Personal guarantee

A personal guarantee is an assurance from the tenant's directors or shareholders that the tenant will honour the lease.

Personal guarantees compel guarantors to pay defaulted amounts from their finances or assets.

Parental assurance

A parent company guarantee may apply if the tenant is a subsidiary of the parent or holding firm, such as a franchisee. It's better than a personal guarantee, but even publicly traded corporations can go bankrupt.

Increase in rent

Most annual rental increases are equal to the Consumer Price Index (CPI) or 2 to 5%. To match the market, you can renegotiate the rent at the end of the lease period.

Shorter leases are less important, but longer leases (10 to 20 years) require that rent reflect market conditions.

The amount is frequently based on a "market evaluation" of comparable rents when renewing a lease. The renter can then accept and renegotiate the lease.

It's ideal for both parties if the rent increases gradually rather than in a lump sum at a later date. Some buyers seek substantial annual increases, like 5%, which can annoy tenants who can't renegotiate until they extend or renew their lease.

Reviewing your properties' rents at the end of their lease durations is critical to your cash flow. The rise must benefit both the tenant and the owner, as they drive the investment's profitability.

It's advisable to find a new renter if the current one isn't succeeding or adding value.

Before you read about the strategies to review and increase rent, you must explore the 13 easy real estate market analysis steps.

The following strategies are commonly used to review and increase rent:

1. Consumer price index (CPI)

The CPI is a measure of inflation for all Australians. It only tracks price changes for private households. The CPI is a key economic statistic used by the Reserve Bank to set monetary policy.

It's the standard for business lease rent rises in Australia. In addition to the property market, the CPI is the most accurate approach for long-term forecasting.

A rent review can include both CPI and a fixed increase, such as 'CPI + 1%'. Prevent CPI-only increases to avoid limiting rental growth (especially if CPI turns negative).

2. Fixed increases

Fixed rent increases give both the landlord and the tenant security but can often lead to rents out of line with market rates over time. Fixed increments are typically 2%, 3%, or 5% annually.

3. Market review

Most agreements provide market rent reviews during the lease period or upon option exercise. After that, the lease will have either fixed or CPI increases or both.

Generally, the landlord pays the market rent, but the tenant can challenge it. You may hire a valuer to provide a rental valuation if they do.

The rent should be calculated by comparing the average rent per square metre with other rental properties in the area. In most leases, the valuer's decision is final and binding.

The new rent cannot be less than the previous years' rent; this should be stated in the lease. During economic crises, landlords often help renters lower rent to ensure both sides' long-term success.

Turnover rent

Turnover rent is commonly used in major retail shopping malls to evaluate rent. The amount will be a proportion of the leased business's revenue. This is typically used with a half fixed rent.

The tenant must submit monthly audited financial statements to prove their revenue. Strict rules control how and to whom landlords can release turnover information.

Smaller businesses can afford the rent, permitting retail malls to have a good mix of tenants. This blend will improve client diversity and foot traffic to their complex.

What are lease options?

Lease options are lease agreements that give you the right to purchase a property at a set price during the lease term. The option fee is typically non-refundable, but it gives you the right to buy the property at a set price, no matter how much the property's market value has increased.

How do lease options work?

A lease option (also known as a "lease-to-own" or "rent-to-own") is a type of contract used in residential real estate transactions. It allows the tenant to rent the property for a specified period of time, with the option to purchase it at a later date.

The terms and conditions of a lease option vary from one deal to another, but they usually allow the tenant to purchase the property for a price that is lower than the market value.

This can be an attractive option for people who want to own their own home, but don't have enough money saved up for a down payment.

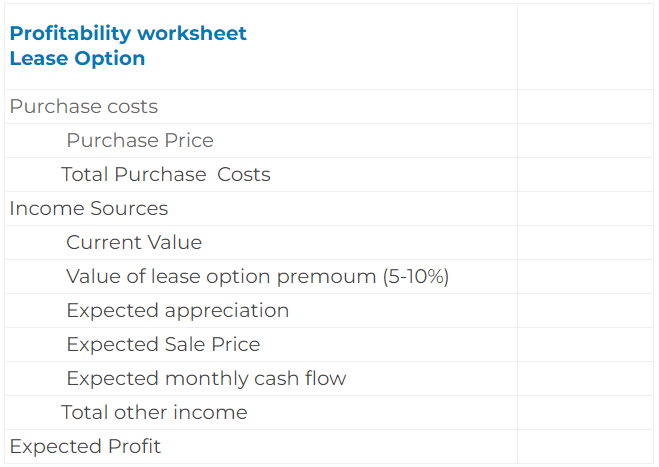

How to calculate profit for lease options?

Start by constructing a worksheet to calculate the lease option's profitability.

You will need to approximate appreciation because it cannot be predicted with precision.

Newspapers are a fantastic resource for local appreciation rates. Base your projections on the forecasts made by the real estate boards or local journalists.

Use 5% when figuring up your option premium in neighborhoods or condo complexes where all the houses are identical in size or model. The comparables should be available for the appraiser when you attempt to sell the home, and you may use up to 10% if the community is quite diverse.

Determine the cash flow or rental values as well. Similar to sales comparables, you may also use rental comparables. Here are three methods for finding comparable rentals:

- Read the local paper. Verify all of the nearby rentals. These are your comparables, or "comps."

- Consult members of the local landlords' group. The MLS does not list a lot of rentals.

- Are the statistics from the first two sources insufficient? Make a trial newspaper ad. Too many phone calls. You might be charging too little. Too few. You might be charging too much. Like fishing, you can try changing the bait to see what occurs.

Worksheet for calculating profits for lease options

Profit calculation examples for real estate investor

Let's understand the calculation with two different examples.

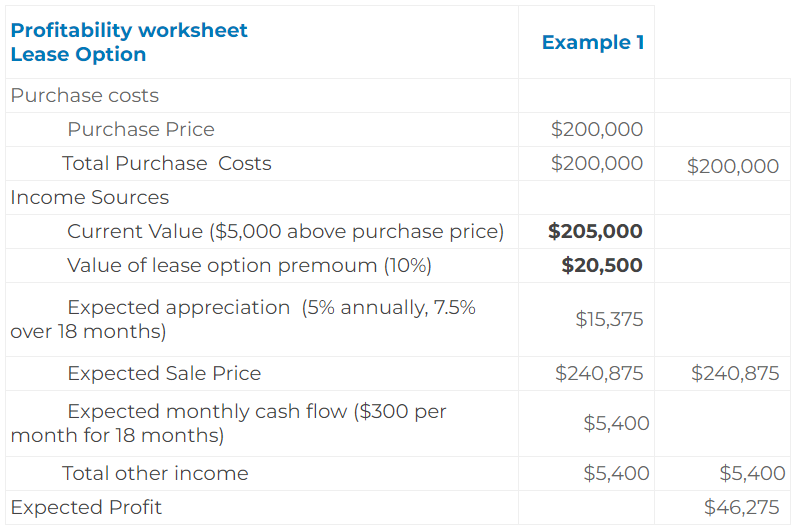

Example 1

For $200,000, the seller will sell you the house. At this time, it is valued $205,000.

The rate of appreciation is 5% annually. The price will increase by 7.5 per cent (5 per cent x 1.5 = 7.5 per cent) because it will be sold with an 18-month option. This results in an appreciation value of $15,375 ($205,000 x 7.5%) over the 18 months.

Rent will cost you $1,500 to the property owner. You may rent it out for $1,800, generating a $300 monthly income.

This area has a wide variety of distinctive residences. From $180,000 to $300,000 is the price range.

As a result, we can include a more significant option premium of 10%, or $20,500. The home's retail value has increased by $35,875, thanks to the $20,500 option premium and the $15,375 appreciation.

What is the projected profit for the next 18 months? Let's look at how to calculate the dealer's profit:

The resulting profit from this transaction, fewer transfer fees, title insurance, and potential option credits from the investor (you) to the buyer would be about $46,275 if all payments were completed throughout this option period and lasted the whole 18 months.

Does this generate the profit you need? Move forward with these terms if that is the case. If not, you can either reject the offer or continue the negotiations.

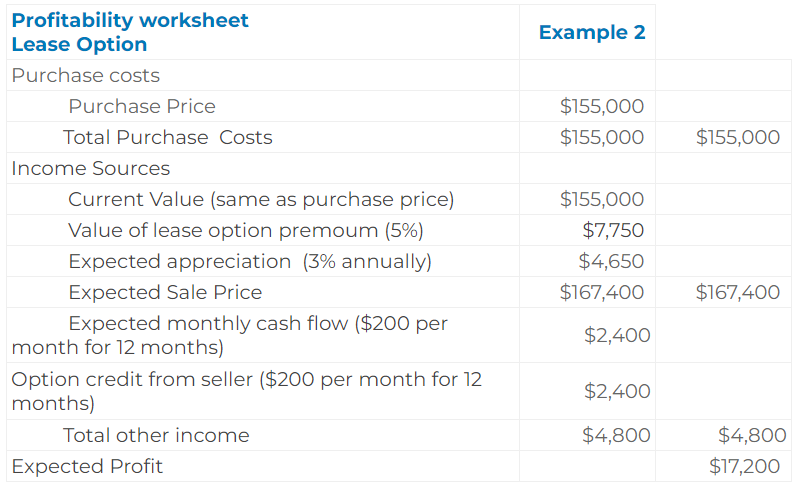

Example 2

On a 12-month option, the seller will sell you their house for $155,000. It is valued at $155,000. If the appreciation is 3 percent annually, there will be an extra $4,650 ($155,000 x 3 per cent) after one year.

This house is located in a neighborhood where all the houses are identical and cost between $150,000 and $158,000. This yields a more reasonable option premium of only 5%, or $7,750 ($155,000 x 5%).

($4,650 + $7,750) The appreciation plus the option premium is $12,400. The property owner will receive $1,200 in rent from you, and you'll charge $1,400 for the rental.

You can also get a $200 monthly credit from the seller toward the purchase of this house.

Let's examine the anticipated annual profit:

For an investor, this transaction would not be nearly as profitable. Before closing fees, it would only make $17,200, leaving little room for unforeseen issues. This opportunity might fall short of your minimum profit standard.

There are, however, methods for renegotiating the agreement with the seller. It must be more of a buyer's market with a low appreciation rate.

You ought to be able to haggle over the cost and the terms. Request a lower price and more monthly financing for the property purchase.

You can also request a buy-down of the mortgage's equity during the option period. You would receive the $10,000 credit that was paid on the mortgage balance during the option period since you had been making that mortgage payment during that time.

For instance, if the seller owes $100,000 on the house at the beginning of this option and only owes $90,000 at the end, you would receive that $10,000 credit.

Allow the transaction to stall if the seller refuses the new conditions until they become sufficiently motivated to accept them and the deal meets your profit criteria. It must achieve your bottom line and produce a win for both the buyer and the seller.

Final words

Leases are important commercial contracts and should be reviewed by a lawyer specialising in this area.

If you're a tenant, it's important to know your rights and what to expect from your landlord. If you're a landlord, it's important to understand the commercial tenant's perspective and be reasonable when setting rent increases.

So, what is a commercial lease? How do you go about leasing a property for your business? What should be included in the lease agreement? And finally, what are some of the things that can happen during a lease agreement – like rent increases or early termination? Hope this article has answered all of those questions and more.

If you're still unclear on any aspect of commercial leases, don't hesitate to get in touch. Register for Free Quick Start Property Development Course, and take the steps for successful property development.

FAQs