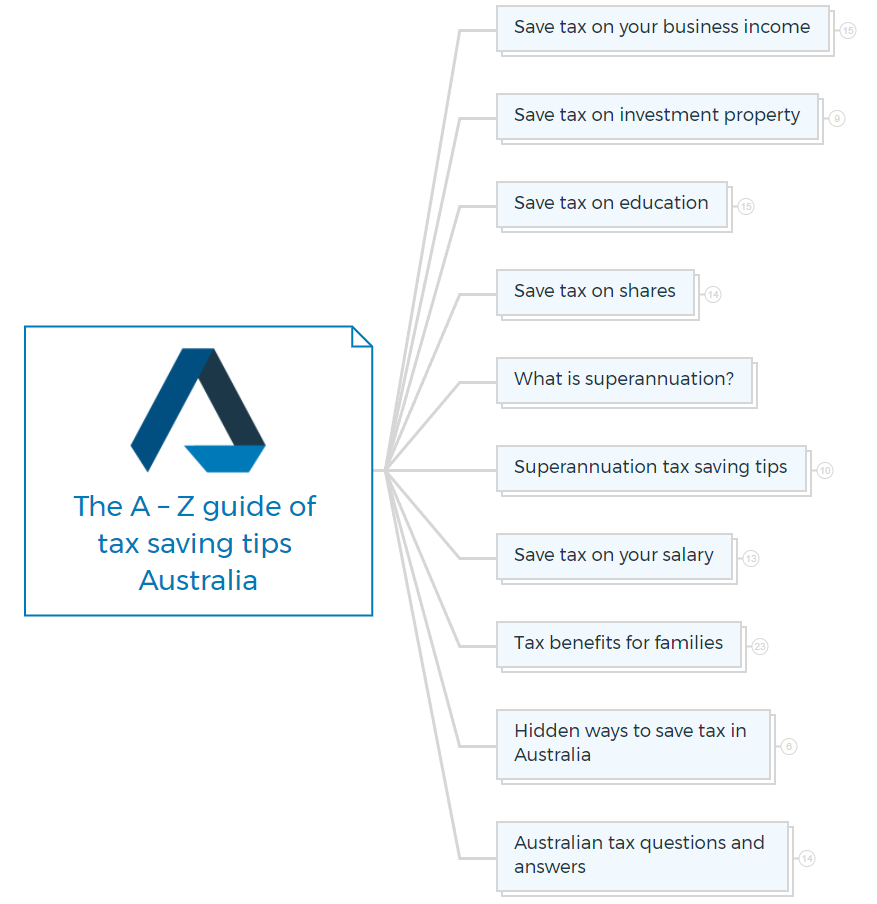

Your complete guide for saving tax in Australia

Imagine if there was a way to save thousands of dollars on your taxes each year, without having to do anything complicated or time-consuming. Sounds too good to be true, right? But it’s not – in fact, there are plenty of simple ways to save tax in Australia that anyone can use.

In this guide, we’ll show you how to save tax from A to Z. We’ll cover everything from the simplest tips (like making sure you claim all the deductions you’re entitled to) to more complex strategies like using trusts and self-managed superannuation funds.

So whether you want an easy way to reduce your tax bill or are looking for more sophisticated advice, this guide has something for you.

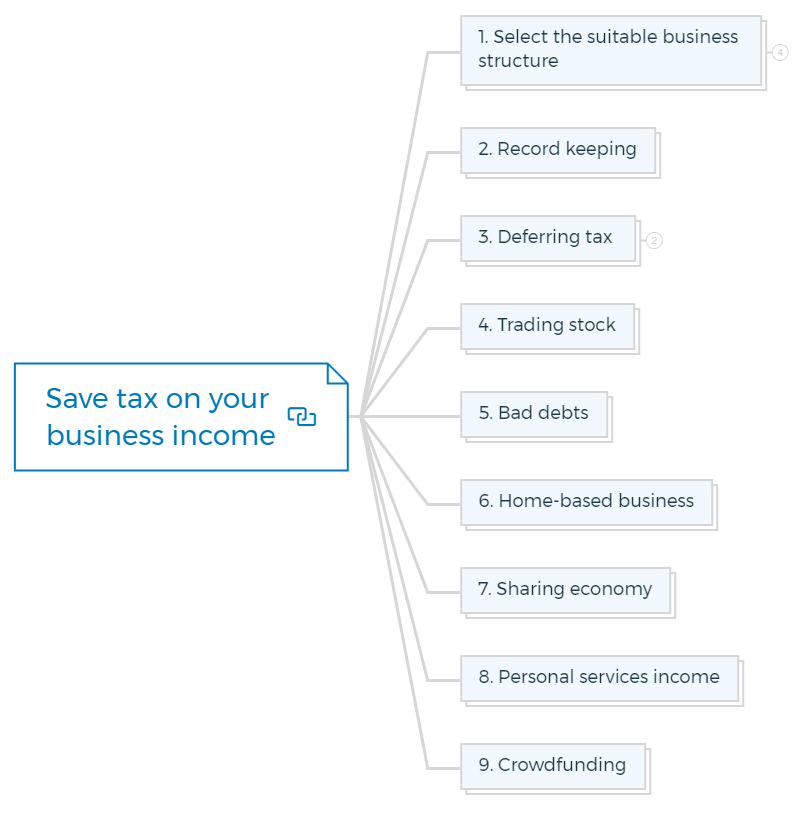

Save tax on your business income

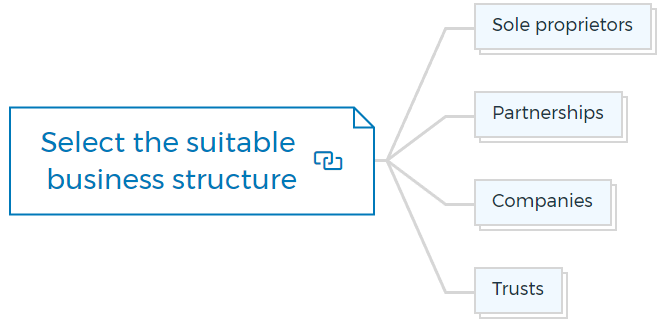

1. Select the suitable business structure

Sole proprietors

The taxation of sole proprietors is identical to that of persons. A company with healthy profits can anticipate paying tax at higher marginal rates. If you operate as a sole proprietor, you have no asset protection; therefore, be wary of "creditors and predators."

Partnerships

Husband-and-wife enterprises and situations where personal services are offered frequently choose partnerships. Their most significant drawback is that they don't provide asset protection.

Partnerships do not pay taxes on their own. Instead, each partner pays tax at their marginal tax rate on their portion of the net partnership income.

Companies

The most typical business form for running businesses is a private company, mainly when capital gains are unlikely and where small business capital gains tax incentives will not be applicable. Companies have limited liability, albeit occasionally, directors may need to provide personal guarantees.

Trusts

A family trust is an excellent tool for reducing a business's overall income tax liability. A trust can provide flexibility for estate planning objectives and assistance with managing assets and liabilities.

Family trusts are exempt from direct taxation. Instead, income tax is applied to the trust's beneficiaries' portion of the trust's net income.

2. Record keeping

While keeping company records for tax purposes is required by law, it is also a good practice to keep thorough records to maximize your income tax return claims.

Good record-keeping techniques include:

- Keep track of all information from your bank account in a cashbook.

- Maintaining proper records of employment.

- Preserving all paperwork in a secure location for five years.

- Meeting tax obligations like:

- PAYG tax withholding

- keeping track of all GST duties

- making superannuation contributions to superannuation funds.

Here is a quick list of what the ATO requires regarding record keeping.

Documents about employee payments:

- Payroll records for employees

- Summary of termination payments to employees

- Employees receive fringe benefits

- PAYG payment breakdowns

PAYG withholding data for payments made to businesses:

- PAYG withholding voluntary agreements

- Amounts withheld from payments where no ABN was specified.

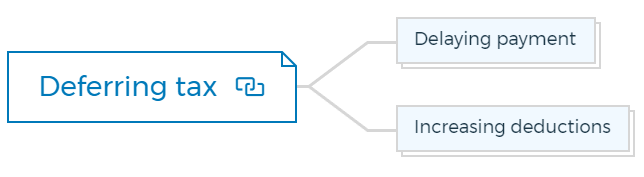

3. Deferring tax

Everyone must pay their fair share of taxes, but if there is a good reason to postpone the necessity to a different tax year, you should do so.

Any tax delay will improve cash flow because you may have an additional year before you must make a tax payment. Moreover, tax rates can be decreased in upcoming years.

There are two primary methods for postponing your taxable income to the following fiscal year: delaying the derivation of income and bringing forward deductions.

Delaying payment

You must understand how the ATO will initially evaluate your business income to determine the best approach to defer assessable income to subsequent tax years.

Most small enterprises will be evaluated using a cash basis, in which income is only recognized when cash is received.

The accruals basis, which recognizes income as it is earned rather than as it is received, is required for larger enterprises. You may choose to postpone your invoicing until the following tax year if your company runs on an accrual basis.

Increasing deductions

Pay any yearly expenses, such as subscriptions and insurance, due in July by June 30 to save on this year's taxes.

As a small business, you can take advantage of the prepayments tax concessions, which entitles you to a deduction for the amount you prepaid if the products or services are fully received within 12 months.

4. Trading stock

Anything you generate, manufacture, acquire, or buy for use in your business—including livestock—is considered trade stock, according to the ATO.

If your trading stock's value at the income year's end is:

- More significant than at the beginning of the financial year - the difference is added to your assessable income.

- Less than at the start of the fiscal year - the difference may be deducted.

There are just three techniques permitted for valuing your trading stock for tax purposes, regardless of how they are evaluated for accounting purposes:

- Cost

- Market selling price

- Replacement value.

The technique that yields the lowest trading stock value should be used to value stocks.

5. Bad debts

Customers who won't pay for your goods or services are one of the issues you will inevitably face as a business owner. Some clients will challenge the debt, while others lack the financial resources. Then some are just plain jerks and do not intend to pay you.

For tax purposes, most enterprises must report their income on an accrual basis. It means that even if they don't get any money, they must still report all sales as taxable income!

Paying income tax not received can significantly impact cash flow because some obligations to a corporation might be pretty sizable.

Similar to obsolete stock, the ATO will only allow your company to deduct income taxes for bad debts if all of the following conditions are met:

- The debt was in existence.

- It was physically written off before June 30.

- It wasn't good according to the terms of the agreement or other reasonable criteria.

- The debt was originally reported as income in the current or prior fiscal year.

You must record the amount received in the year of receipt as assessable revenue if your company lodges a claim for bad debt but the debtor later pays the debt.

6. Home-based business

Working from home has several advantages, including flexibility, reduced commute time, and additional tax deductions. A bonus is not having to pay any additional rent.

You might be able to deduct the following "running" costs in their entirety:

- Depreciation of home office furniture, fixtures, and equipment, including computers and desks.

- House telephone

- Heating, cooling, and lights

- A computer with an internet connection

- Stationery

- Furniture and fittings repairs for your home office.

The ATO is very picky when it comes to the reimbursement of "occupancy" costs for home offices. If your home is your place of business, the ATO will consider several considerations.

The location must meet the following criteria:

- Be easily identified as a place of business.

- Be challenging to utilize for personal purposes

- Be used nearly entirely for business purposes

- Be frequently visited by clients or customers.

7. Sharing economy

The sharing economy has exploded over the past five years, with companies like Uber, GoCatch, Airbnb, Stayz, Spacer, Camplify, Car Next Door, HomeKey, and Airtasker rising to prominence not just in Australia but also around the world.

What matters most is that you have tax obligations if you offer your goods or services through any of these apps or websites. All payments you make through the sharing economy are subject to income tax after deductions for related costs.

You might need to register for Goods and Services Tax and submit quarterly business activity statements if your annual revenue exceeds $75,000.

If you have expenses for both company and personal usage, you can only deduct the amount of the expense that is relevant to your business. You can claim income tax deductions related to the income you receive. A sharing economy facilitator may deduct any fees or commissions they levy.

8. Personal services income

Suppose you're a contractor or consultant who operates through a partnership, firm, or trust. In that case, you must comply with the personal services income (PSI) requirements or risk being personally liable for tax on the income. Some contractor business expenses may not be deductible.

If most of your income comes from labor rather than materials or tools, you must follow PSI regulations. PSI regulations are waived if you pass the outcomes test, determining if you got income after obtaining a specified result.

To pass the outcomes test, you must meet all three conditions for three quarters.

- You are paid to obtain a result

- You offer tools and equipment for the job.

- You must fix work flaws.

If you fail the outcomes test, you must apply the 80/20 rule, which states you can't produce more than 80% of your money from one client and meet one of the following conditions:

- You've got money from unconnected clients (unrelated clients test)

- You hired or contracted people to help (employment test)

- Distinct business premises (business premises test).

9. Crowdfunding

There are tax repercussions for crowdfunding agreements with commercial or businesslike activity and a profit motive, such as raising money for your pet's operation.

If you borrow money, it's not taxable, but the interest you pay may be deductible, depending on how you spend it. The contributor's interest income is taxed.

If your firm gets disaster assistance payments from a crowdfunding platform and utilizes that money for business expenses, such as buying livestock feed, the net tax effect is $0. The ATO will not assess if the monies are utilized for personal emergency food and clothing.

Crowdfunded funds used to buy business assets are taxable. Suppose the purchases are not eligible during the interim, full expensing rules or below the instant asset write-off criteria. In that case, there may be a timing gap between the revenue received, and the depreciation claim lodged, resulting in an undesirable tax deficit.

Suppose a crowdfunding arrangement is structured as an equity-based fundraising model, where contributors donate money to the promoter in exchange for an equity interest. In that case, the funds will become part of the share capital and will not be accessible in the promoter's hands.

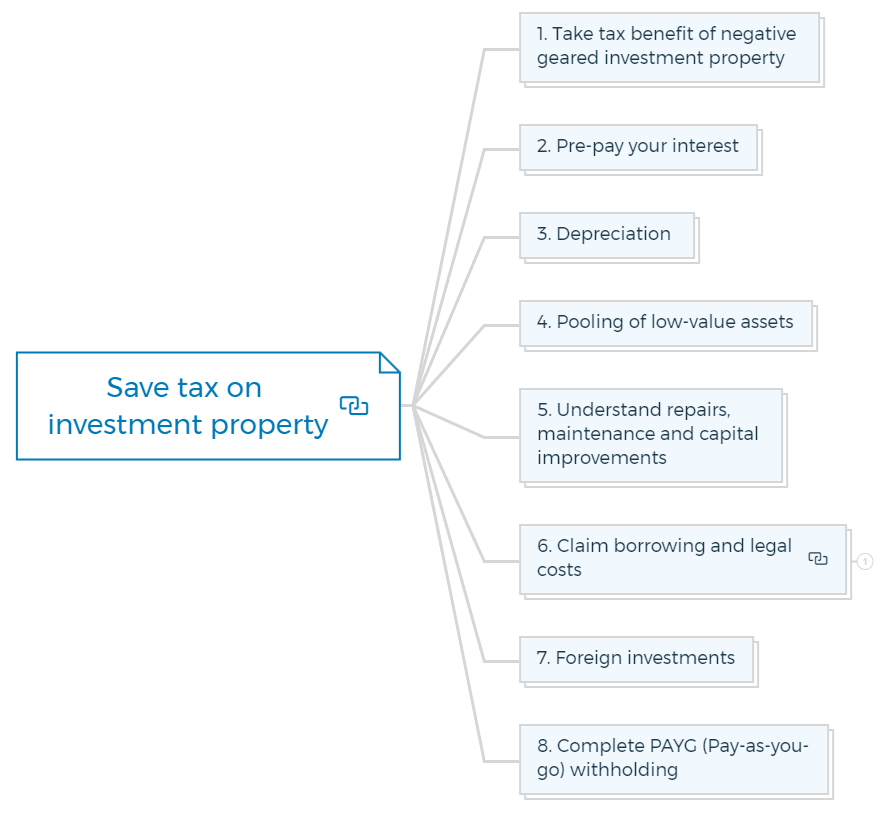

Save tax on investment property

1. Take tax benefit of negative geared investment property

When your investment property's expenses (such as rates, insurance, repairs, and interest) exceed the rent you earn, you're negatively gearing it.

Is this a bad thing? The answer is no. In fact, it's a great method to save tax on investment property.

The net loss is a tax deduction that will often result in a refund compared to other income such as salary, interest, and company income.

Negative gearing is more favorable to those in higher-income bands who pay tax at the top marginal rate in Australia because of the progressive tax structure.

However, as tax brackets have changed and tax rates have decreased over time, fewer people in the highest tax band can fully benefit from negative gearing benefits.

Fact - You may not know this, but in Australia, 60% of investment properties are "negatively geared."

Tax saving tip:

A positively geared rental property yields a better financial outcome after taxes than a negatively geared property, in which the rent received exceeds the property expenses. You must, of course, pay taxes. But I'd gladly pay $10,622 in taxes if it meant my bank account grew by $22,600 with no work!

2. Pre-pay your interest

If you take out a loan to buy a rental property, you can deduct the interest, or a portion of the interest, as a tax deduction.

You can claim interest on the loan you used to rent your property while it is rented or available.

- Provide funding for renovations (such as adding a deck or second floor)

- Buy assets that depreciate (such as an air-conditioner or stove)

- Cover the cost of repairs (such as roof repairs due to storm damage).

Tax saving tip:

All debt is bad debt. However, if you must have debt, make sure it is tax-deductible. Rather than making extra interest repayments on investment property loans, pay off your non-deductible debt (such as personal loans, home loans, and credit cards) first.

Once you've paid off your non-deductible debt, you can focus on getting rid of your tax-deductible debt.

You can also deduct interest on loans used to buy land for a rental property. You cannot claim the interest if your objective changes—for example, if you decide to use the property for personal reasons and no longer utilise it to generate rent or other income.

3. Depreciation

Depreciation is usually the second-largest deduction available to rental property investors after interest, but many don't take advantage of it.

The goods in your rental property endure wear and tear as they age, and their value depreciates. You can claim a deduction for depreciation on the following items:

- Machinery and equipment

- Began after February 27, 1992, for renovations or significant improvements

- The structure itself, if constructed after July 18, 1985 (and purchased before May 9, 2017, for previously used properties).

Depreciation Schedule:

A depreciation schedule is a document that outlines the decline in value of an asset over time. Investment property owners can claim depreciation deductions for the wear and tear of their property and any decline in value due to age or obsolescence.

The building write-off allowance (also known as the capital works allowance) is a 2.5 per cent deduction for the structural portion of a building, including fixed, immovable assets, that can be written off over 40 years.

When you sell your rental property, you must deduct the amount claimed for the construction write-off allowance from your cost base for CGT purposes.

When it comes to depreciating property for tax purposes, there are two options:

- High-end price (or straight line)

- Dwindling worth (or reducing balance).

The deduction for each year under the prime cost method is calculated as a percentage of the cost as follows:

cost x days owned/365 x 100% effective life of the plant (in years)

The deduction is calculated using the decreasing value technique as a percentage of the remaining balance to deduct:

Opening cost un-deducted x days owned/365 x 200% of the effective life of the plant (in years)

4. Pooling of low-value assets

In addition to adopting the decreasing value technique, investors can 'combine' depreciable assets with written-down values less than $1000 and depreciate them at a more favourable 'pool rate' of 37.5% to maximise rental property deductions in the first five years.

Tax saving tip:

Depreciable assets worth $300 or less usually qualify for an immediate deduction if they are not part of a set.

5. Understand repairs, maintenance and capital improvements

Investors are most confused by repairs and maintenance deductions. The best thing is you can claim an immediate deduction for both.

If you are replacing a worn-out or broken element and relate to wear and tear or other damage from renting the property then it is considered a repair.

When work is done to prevent or repair degradation, it is referred to as maintenance.

In most cases, this is deductible if the property:

- rented regularly

- stays available for rental but is uninhabited for a short time.

Repair costs may still be deductible if you no longer rent the property if:

- The repairs are tied to when the property generated income

- You earned income from the property during the year of repairs.

You can't claim repairs and maintenance costs in the year you paid for them if they weren't related to wear and tear or other damage from renting out your property.

6. Claim borrowing and legal costs

Borrowing costs for a rental real estate property loan are tax-deductible. Unless they're $100 or less, you can't claim them all in the first year. If your total deductible expenses are over $100, split the deduction over five years or the loan duration, whichever is less.

The first-year deduction will be prorated if you get the loan part way through the year.

The following are deductible borrowing expenses:

- Document preparation and filing fees

- LMI

- Loan establishment fees

- Broker fees

- Mortgage stamp duty

- Lender-charged title-search fees

- Mortgage loan appraisal costs.

Tax saving tip:

Stamp duty, preparation, and registration charges on an ACT lease are deductible if the property is rented. ACT properties cannot be owned freehold. They're usually leased for 99 years.

Legal expense

Some legal fees related to rental real estates are deductible, whereas others are capital and not deductible.

Included in deductible legal costs are:

- Preparing a tenant lease

- Evicting non paying tenants.

7. Foreign investments

Australians must pay tax on their worldwide income. It includes declaring revenue from a foreign property on your Australian tax return, even if it was taxed outside Australia.

An Australian foreign income tax offset may relieve double taxation if you've paid overseas tax on that income.

You can also claim interest, repairs, depreciation, rates, and insurance on foreign rental property.

You'll lose money abroad if your overseas property tax deductions exceed your overseas rental income. Foreign losses were sequestered for several years and could only be mitigated by future foreign income.

Many overseas property investors are unaware of a recent rule change. Since July 1 2008, foreign losses have been included in domestic income. You can now "negatively gear" overseas income loss to reduce Australian income.

9. Complete PAYG (Pay-as-you-go) withholding

Getting your refund at the end of the year forces you to save. If cash flow is constrained, execute a PAYG withholding variation application to minimise your monthly tax. The form estimates taxable income. You still need to file a tax return annually.

Tax saving tip:

Withholding should equal year-end tax liability. If you underestimate your income, you'll have a tax deficiency. Don't overestimate deductions to give yourself a buffer.

If your circumstances change after your PAYG variation is authorised, request a new variation. Otherwise, you may owe taxes at year's end.

PAYG withholding variations aren't just for negatively geared landlords. They can also be employed when taxpayers' assessable income is lowered for tax-deductible expenses. It includes work-related automobile expenses, self-education fees, or margin-loan interest.

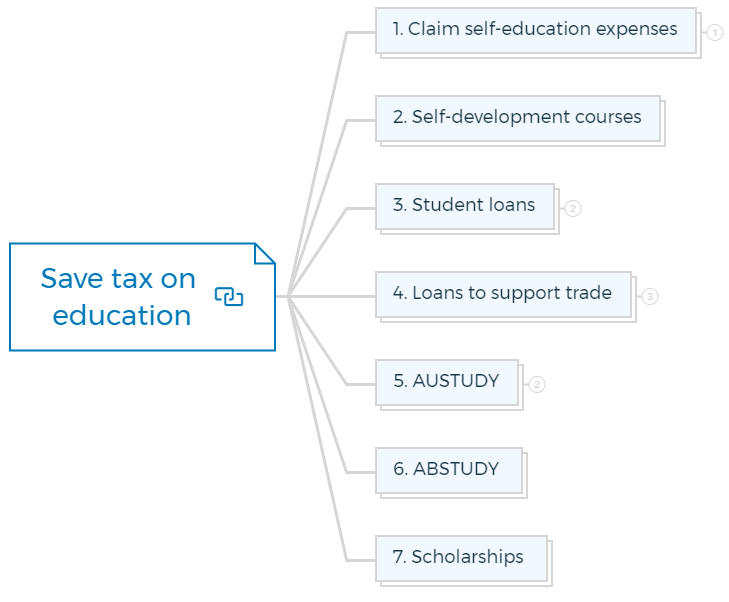

Save tax on education

1. Claim self-education expenses

The charges you incur to enrol in a work-related course of study at a school, college, university, or other accredited educational institution are known as work-related self-education expenses.

How to claim self-education expenses

According to the ATO, you may be eligible for a tax deduction for your self-education expenses if you work and study simultaneously, the course has a sufficient relationship to your existing employment, and it either:

- keeps or gains the precise abilities or information you need for your present job

or

- Results in or have a good chance of resulting in a raise in your current job's pay.

The necessary relationship between the self-education expenses and your income-earning activity does not exist if a course of study is too general in terms of your existing income-earning activities.

Tax saving tip for students:

Instead of tracking separate costs for heating, cooling, lighting, cleaning, and the depreciation of furniture, you can claim a fixed rate of 52 cents per hour of consumption if you have a room designated for work-related study purposes.

The following items are not tax-deductible:

- Daily living costs, such as lodging and food

- Repayments you make for debts you may have under the following lending programmes, whether they are required or voluntary:

- Student Financial Supplement Scheme

- HECS-HELP

- FEE-HELP

- OS-HELP (SFSS)

- Self-education expenses like tuition fees paid through HECS-HELP.

- The final leg of your journey from your home to your workplace or school.

2. Self-development courses

The ATO will only let you claim a deduction of tax on education expenses associated with courses that have a sufficient nexus with your income-producing activities, just like with university and TAFE courses.

According to the ATO, a course must have a significant connection to your current employment or both for you to be eligible for the benefits of a tax on education costs you pay.

- Keep up with or gain the specialised abilities and information needed for your current position.

- Lead to a raise in your income from your existing job, or be likely to lead to one.

When you enrol in a self-improvement or personal development course that has modules or components that you can directly tie to your current income-generating activities, you may be able to claim a tax deduction.

The following are acceptable subjects that are sufficiently particular to be categorised as income-related:

- Management

- Leading change

- Guiding employees

- Managing projects.

The degree to which the course is directly tied to your current income-earning activities will influence how much of a deduction you are eligible to make.

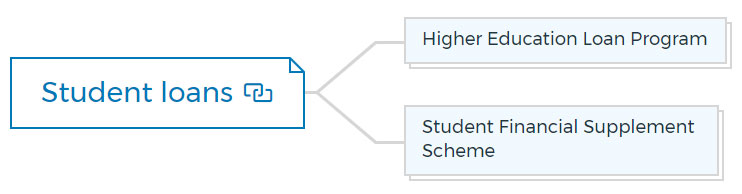

3. Student loans

Numerous government programmes offer financial aid while you enrol in college or pursue a trade.

Higher education loan program

Most college students are pretty poor and can barely pay their rent for next week, let alone their course fees. The Higher Education Loan Program (HELP) was established to help students pay for university tuition.

Although there isn't a specific interest rate for HELP debts, on June 1 of every year, a consumer price index (CPI) adjustment is applied.

According to the ATO, the average HELP debt among 2,203 million taxpayers is $22,140.

You must make required repayments after you begin working and your income exceeds a minimum repayment threshold, which the ATO determines using your income tax assessment.

Tax saving tip for students:

Ask your employer not to deduct additional amounts for HELP or SFSS debts if you only work full-time during university breaks or part-time while in school, as long as you don't anticipate earning more than the annual payback requirements.

Student financial supplement scheme

The Student Financial Supplement Scheme (SFSS) was a voluntary loan programme designed to assist tertiary students in paying for living expenses while enrolled in classes.

Although they shut down the initiative in 2003, the ATO still uses the tax system to recover outstanding financial supplement arrears. Like HELP loans, SFSS debts are subject to a CPI adjustment on June 1 of every year.

Based on the increased HELP repayment thresholds, SFSS loans are paid off after HELP loans. There is no benefit if you make a voluntary repayment toward your SFSS debt, just like there is for HELP debts.

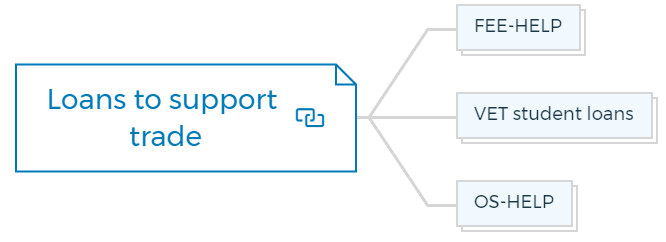

4. Loans to support trade

The Trade Support Loans (TSL) programme was created in 2014 to help young people to start and finish a trade.

A lifetime loan limit of $21,542 (indexed for inflation on July 1 of each year) is available to eligible Australian apprentices to help with living expenses as they finish their apprenticeship over four years.

To qualify for payments from Trade Support Loans, the apprentice must -

- Have a permanent visa or be an Australian citizen who resides in Australia;

- Be engaged in a:

- a certificate III or IV at the level required for employment on the National Skills Needs List

- Certificate II, III, or IV in agriculture

- while working in rural or regional Australia, with a Certificate II, III, or IV in horticulture.

- Satisfy the requirements for eligibility that the Australian Apprenticeships Centre evaluates after receiving a Trade Support Loans Application Form.

Tax saving tip for student:

Australian trainees will be eligible for a 20% loan discount after completing their apprenticeship. That should motivate you to work hard and learn your trade.

The loans become repaid if apprentices reach a certain level of global income, much like HELP loans for college students.

Once your income is above the minimum payback threshold for mandatory repayment, the TSL debt is reimbursed through the tax system.

FEE-HELP

FEE-HELP is a loan programme for qualified, fee-paying students enrolling at approved higher education institutions or Open Universities of Australia.

VET student loans

The Government offers qualified students enrolled in specific VET diplomas, advanced diplomas, graduate diplomas, and graduate certificate programmes of study at an approved VET provider an income-contingent loan under the Vocational Education and Training (VET) student loan programme.

Tax saving tip for student:

You may be eligible for a tax deduction for the cost of your tuition if you borrow money through FEE-HELP or VET student loans to cover your tuition costs.

OS-HELP

A loan programme called Overseas Study HELP (OS-HELP) assists students in paying for their travel expenses and living expenses while doing some of their studies abroad.

Tax saving tip for student:

You might be able to claim a tax deduction for some of the costs if you take out an OS-HELP loan to cover expenses related to studying abroad.

5. AUSTUDY

The government programme AUSTUDY, which Centrelink funds, offers financial assistance to students and apprentices.

If you are 25 years or older and enrolled in a full-time course at an authorised institution or doing a full-time Australian apprenticeship, you may qualify for AUSTUDY.

To be eligible for AUSTUDY, applicants must pass both the income and wealth requirements. No parental means test is required, in contrast to the Youth Allowance.

Tests of income

With the full AUSTUDY entitlement, you can make up to $437 per fortnight (before taxes). If your income is between $437 and $524 every fortnight, the payment is lowered by 50 cents, and if it is beyond $524, it is decreased by 60 cents.

Even if you are not paid every two weeks while receiving AUSTUDY, you are still required to report your employment income to Centrelink every two weeks.

Tests of Assets

Depending on your age and property ownership status, you will be evaluated against an assets test as an AUSTUDY applicant.

The assets test for AUSTUDY entitlements (and the majority of other government benefits and pensions) requires single homeowners to have non-housing assets worth less than $268,000, which rises to $482,500 for single non-homeowners.

For couples, the joint asset limit is $401,500 with property and $616,000 without. These limits apply when illness separated spouses.

If your assets are more significant than these sums, AUSTUDY is not payable. Payments may still be postponed even if you pass the assets test if your liquid assets exceed $5,500 for a single person or $11,000 for a couple or a single person without dependents.

6. ABSTUDY

To encourage Indigenous secondary or tertiary students or full-time Australian apprentices to continue their education, the Government offers ABSTUDY, a comparable benefit to AUSTUDY.

Students and apprentices who identify as Aboriginal or Torres Strait Islander people (and are acknowledged by their community) or who are of Australian Aboriginal or Torres Strait Islander ancestry may be eligible for ABSTUDY.

If the sole income you got was from the following:

- AUSTUDY

- ABSTUDY

- Similar payments providing financial help

You are not eligible for a tax deduction for self-education expenses.

According to the ATO, self-education expenses cannot be deducted from government aid payments, including AUSTUDY and ABSTUDY.

7. Scholarships

Whether or not scholarships are taxable will depend on how they are set up.

When a full-time student at a school, college, or university receives a stipend for a scholarship, bursary, educational allowance, or other educational support, the money is free from tax.

The student's education must, however, be the primary goal of the grant. Scholarship payments are exempt from tax if they meet specific criteria, including the following:

- They must be made to a full-time student enrolled in a school, college, TAFE, or university.

- They must be in the form of a scholarship, bursary, educational allowance, or educational assistance.

- It must be acknowledged that the scholarship selection process is merit-based and serves the necessary educational purpose.

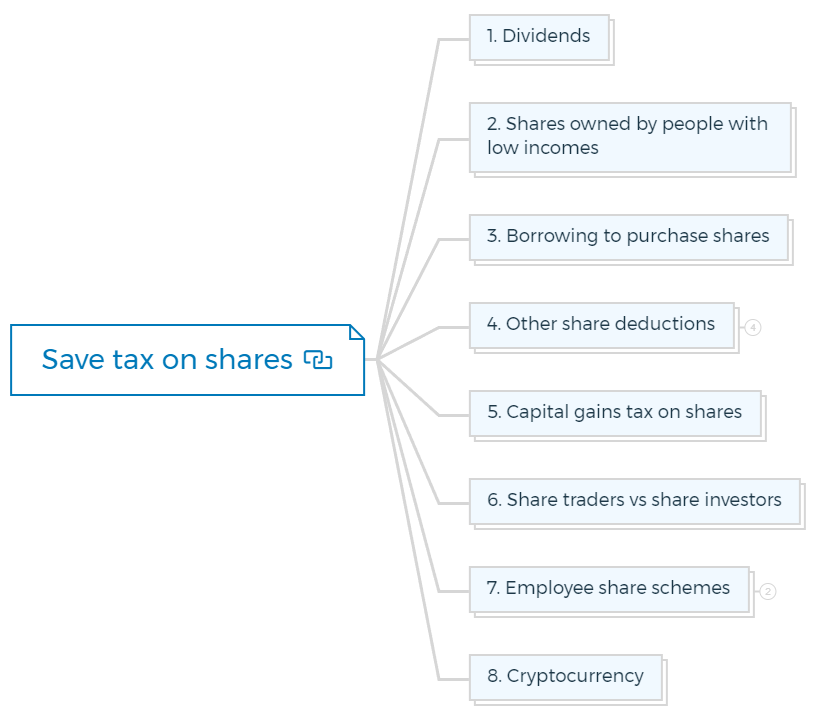

Save tax on shares

Shareholders may need to consider several key tax concerns while owning shares.

If you own shares, the ATO mandates that you maintain accurate documents for tax purposes, such as:

- Contracts to "purchase" and "sell" for five years following the sale of your shares.

- Dividend statements for five years following the filing date of your tax return.

1. Dividends

You are entitled to a portion of a company's profits, which are often distributed as dividends if you are a shareholder.

There are two sorts of dividends that you can assess for tax purposes in Australia:

- Franked dividends are payments made by Australian businesses from previously taxed profits. Fully franked dividends are dividends that are eligible for tax credits on the whole amount of the dividend.

- Unfranked dividends are those that Australian businesses pay out of profits that haven't had any corporate tax withheld from them.

Tax Saving Tip:

Generally, bank fees and any interest paid on money borrowed to buy shares are tax deductible.

2. Shares owned by people with low incomes

Because dividends (and capital gains) are taxed at a reduced rate, keeping shares in the spouse's name with the lesser income can have considerable advantages.

Tax Saving Tip:

Franked dividends are nearly tax-free for those making less than $120,000 because they receive a credit for the 30% already paid in company tax, comparable to the marginal rate at that level.

You can use the excess franking tax offsets to lower your tax liability from other sources of income, such as net taxable capital gains, or even be refunded if you have a lower marginal tax rate.

3. Borrowing to purchase shares

Borrowing money to purchase shares, typically through a margin loan, has been a popular but dangerous investment strategy employed by share investors.

Similar to the tax regulations for investment properties, if you borrow money to purchase a share portfolio, you can claim a tax deduction for the loan interest as long as you expect the investment to generate assessable income (dividends or capital gains).

Only the interest paid on the portion of the loan utilised to buy the shares will be eligible for reimbursement if the loan contains a private component.

Tax Saving Tip:

Prepaying interest on your margin loan 12 months in advance before year-end is a great strategy to consider if you anticipate having a lower income the following tax year. It will maximize your tax deduction based on the higher marginal tax rate.

A capital-protected borrowings method is employed by some investors, in which shares are purchased utilising a borrowing arrangement. In this, the borrower is wholly or partially covered against a decline in the market value of the investments.

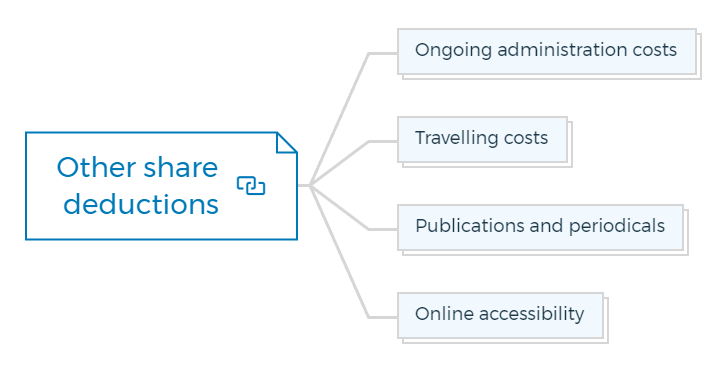

4. Other share deductions

You may be entitled to deduct the following expenses when claiming income from shares.

Ongoing administration costs

Ongoing management fees are eligible for deductions. However, only a portion of the cost is deductible if the advice relates to investments that don't generate assessable revenue or deal with non-investment concerns.

Travelling costs

To the extent that the trip's main objective is to attend an annual general meeting or stockbroker, all related travel expenses are tax deductible. Only the expenses related to serving your portfolio will be eligible for a tax deduction if the trip is primarily private, such as a vacation.

Publications and periodicals

You can deduct the cost of specialized investing magazines, publications, subscriptions, or share market information services from your investment income.

Online accessibility

The cost of internet access will be deducted to the extent that it is used for managing your portfolio over the internet, such as when purchasing and selling shares online. Private use cannot be claimed and must be added back.

Tax Saving Tip:

Based on the percentage of your total computer use related to managing your assets, you can deduct the proportion of the fall in the value of your computer and printer.

5. Capital gains tax on shares

Capital gains tax CGT, which can potentially go to 47 per cent, can significantly reduce the net return on investment. It is a tax levied on profits obtained from the sale of assets purchased after September 19, 1985, typically shares or investment properties.

Any time a net capital gain occurs, it is added to your taxable income and is taxed at the marginal rate.

The capital gain is determined by subtracting the proceeds from the sale of your shares from the price you paid for them initially. Your cost base includes brokerage.

Tax Saving Tip:

Keeping the investment for longer than 12 months is the most simple strategy to lower CGT. Since September 1999, shares held for more than a year are eligible for a 1% discount on capital gains.

A capital gain or loss is realized when shares are sold back to a firm under a buyback agreement. For income tax purposes, a portion of the buyback price can be regarded as an assessable dividend.

A class ruling is typically made if the repurchase is from a publicly traded corporation to help shareholders with potential tax consequences.

6. Share traders vs share investors

For tax purposes, there is a difference between share traders and investors, which affects how gains and losses are handled.

If your business operations aim only to generate income from buying and selling shares, the ATO will classify you as a share trader.

Losses incurred are handled the same as any other business losses, and if the non-commercial losses conditions are met, a direct deduction from other taxable income is allowed.

It is common for taxpayers to classify themselves as share dealers during financial years when equities plunge.

If you:

- invest in shares with the sole purpose of receiving income from dividends and capital growth

- are eligible for the 50% CGT discount on gain

- claim losses incurred as a capital loss and not as an immediate deduction

- carry forward capital losses to be used as a credit against future capital gains

Then the ATO will consider you to be a share investor.

The critical element in handling losses in the current tax year is how you handled your investing activities in earlier tax returns. You should continue to approach your investments the same way in the current year if there has been little to no change in your investing behavior.

7. Employee share schemes

Some businesses offer discounted shares, rights, or options that employees can purchase as part of employee share schemes (ESS), allowing them to participate. Both the employee share plan rules and the CGT regime may apply to the taxation of ESS interests.

The tax regulations for the various ESS kinds are as follows:

Taxed upfront

- The reduction you obtain is taxable in the fiscal year you purchased the ESS interests.

- If your adjusted taxable income is less than $180,000 and you don't own or manage more than 5% of the company, you are qualified for a $1000 tax credit.

- The stake is assumed to have been acquired at market value on the day it was initially acquired for CGT purposes.

Deferred taxes

- The tax on any discount is postponed until the "delayed taxing point," which is either 7 or 15 years after you acquire the share/right or when you leave your job. If you acquire less than $5000 worth of shares via salary sacrifice or if there is a genuine danger of forfeiture.

- The market value of the ESS interests at the deferred taxing point, less the cost base, will determine the amount assessed.

- The "30-day rule" states that if you sell an ESS interest within 30 days of a deferred taxing point, the date of that sale replaces the earlier date as the delayed taxing point.

- To evaluate any eligibility for the 50% CGT deduction, the interest is taken to have been reacquired immediately following the deferred taxing point.

8. Cryptocurrency

Although it varies from cryptocurrency to cryptocurrency, the ATO believes that they are taxable assets under CGT legislation and not "money" or "currency."

Non-fungible tokens (NFTs), units of data kept on a blockchain or digital ledger that can represent unique digital objects (such as art, audio, video games, and other types of creative work), are the newest technology trend being traded.

Tax Saving Tip:

The ATO has not yet formally announced how they would approach NFTs in terms of taxes, but it doesn't imply they won't tax any gains generated from trading them. If the ATO treats them as collectibles under the CGT laws, you may be permitted to overlook any capital gains if you purchased the NFT for less than $500.

For capital gains tax purposes, only capital gains from assets purchased for personal use and cost more than $10,000 are taxable. However, all capital losses are ignored on assets used for personal purposes.

What is superannuation?

Superannuation refers to funds saved aside throughout your working career to support your retirement.

It's many Australians' second-largest asset, after the family house. Super Funds can be invested in real estate, shares, term deposits, and managed funds.

They also receive substantial tax breaks, complying with super funds and obtaining preferential tax treatment over businesses and people making more than $18,200.

Here are various strategies for boosting your super and the most tax-efficient ways to access it.

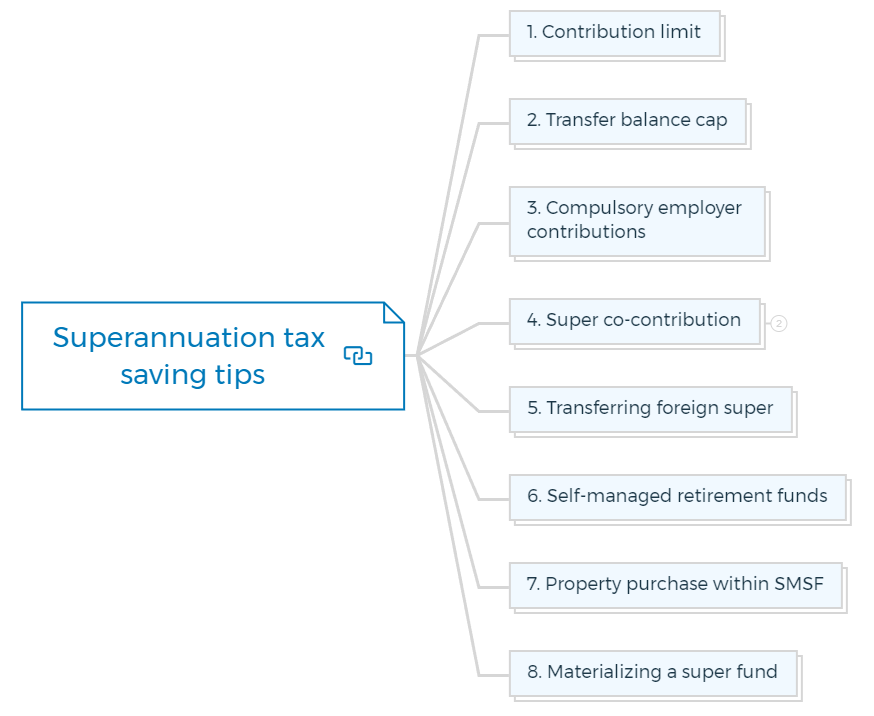

Superannuation tax saving tips

1. Contribution limit

Making consistent, sizable donations to the fund over time—and then reaping the rewards of seeing money grow—is the easiest way to increase your super fund balance.

Superannuation Tax Tip:

If your annual income is under $250,000, you can contribute up to $27,500 to super and pay only 15% tax. Even if you don't have access to it right now, the money is yours, and by investing it now, you can increase your net worth faster than by paying up to 47% in taxes.

There are two different ways to contribute to a super fund:

- Concessional contributions (before tax)

- Non-concessional contributions (after tax).

Concessional contributions are before-tax contributions because the giver, typically an employer, can claim a tax deduction. Concessional contributions are taxed at 15% (or 30% if the individual earns more than $250,000).

The amount of non-concessional contributions you can make each year without incurring additional tax is capped by the ATO at four times the number of concessional contributions, or $110,000.

Additionally, only those having superannuation balances of less than $1.7 million at the end of the prior fiscal year are eligible for the non-concessional cap.

The untaxed plan cap of benefits within a super fund that has not been subject to contributions tax is $1,615,000.

2. Transfer balance cap

The transfer balance cap is a cap on how much superannuation can be transferred from your accumulation super account to a tax-free "retirement phase" account; it is currently set at $1. 7 million. It will be rounded down to the nearest $100,000 and linked to CPI.

Go over your transfer balance cap. You might have to pay tax on the notional earnings associated with that excess and convert a portion of your retirement phase income stream into a lump sum accumulation account.

Tax savings Tip:

Some assets that surpass the $1.7 million transfer balance cap must be transferred back into accumulation mode.

If an SMSF uses the segregation of assets method, moving assets back into accumulation mode could allow the SMSF to keep assets.

These assets might incur a capital gains tax liability in pension mode while transferring assets that are unlikely to incur a capital gains tax liability or will produce lower income (cash and fixed interest investments) into accumulation mode.

3. Compulsory employer contributions

When employed, your employer must pay SG (superannuation guarantee) contributions into a conforming super fund. Since 1992, when SG became mandatory, Australians' superannuation savings have soared.

Your company contributes 10% of your ordinary earnings to the maximum contribution base every quarter. Payments count toward your concessional maximum.

You can choose the conforming super fund this super is paid into.

If you are 18 years or older and make $450 or more before monthly taxes, you are only eligible to have SG contributions made on your behalf by your employer.

For super payments to be made on your behalf, if you are under 18, you must work more than 30 hours per week.

Contractors who are paid exclusively or primarily for their labour are regarded as workers for SG purposes and are subject to the requirement to have 10% SG payments paid on their behalf as employees.

Any SG contributions due from employees are calculated using their regular hourly wages. They typically consist of allowances, bonuses, commissions, and any over-award payments and represent what you make during your regular working hours.

4. Super co-contribution

You can benefit from the super co-contribution payment if your annual income is less than $56,112 by contributing a maximum of $1000 in personal super to your super fund. Then, up to an additional $500, the government will match by 50%.

Only those having a total superannuation balance less than the transfer balance ceiling of $1,700,000 at the end of the prior fiscal year are eligible for the super co-contribution. Additionally, it is not available if your annual non-concessional contribution cap has already been met.

You only need to make real personal super contributions to your super fund and file your income tax return if you are eligible for the co-contribution.

You must meet the two income requirements listed by the ATO to qualify for the super co-contribution:

The income threshold test.

According to the ATO, the government will match your $1000 post-tax contribution to your super fund with an additional $500 if your total income is less than $41,112 per year.

The super co-contribution gradually phases out to zero at the higher income threshold of $56,112.

The 10% eligible income test.

According to the ATO, at least 10% of your total income must be derived from employment-related activities or business operations to qualify for the co-contribution.

You are not eligible for a super co-contribution for any personal payments that you have chosen to make and that have been accepted as a tax deduction.

5. Transferring foreign super

You might be permitted to transfer money from a foreign super fund to either an Australian super fund that complies with the criteria or to yourself, depending on the restrictions of your foreign super fund.

Tax Savings Tip:

Your fund will pay the tax on the amount at a rate of 15%, which may be less than the marginal rate of tax that you must pay if you choose to include some of your applicable fund profits in your super fund's assessable income rather than your own.

6. Self-managed retirement funds

As member balances grow and individuals get more experience managing their retirement funds, SMSFs are becoming more and more popular.

The $259 annual SMSF charge is paid to the ATO in advance.

Tax Savings Tip:

Your fund will pay the tax on the amount at a rate of 15%, which may be less than the marginal rate of tax that you must pay if you choose to include some of your applicable fund profits in your super fund's assessable income rather than your own.

7. Property purchase within SMSF

Many claim they don't trust super and would invest in real estate to pay for retirement. However, more and more people are becoming aware that they can utilize their SMSF funds to purchase real estate.

Superannuation Tip:

Within your super fund, make an investment property purchase. When you can buy a property for only 15% down, please don't pay for it with post-tax money, which can be as high as 47%. Additionally, paying 10% or even no tax on capital gains is preferable to paying 23.5%.

Superfunds are increasingly favouring the asset class of real estate. It is partly because of the favourable tax rates, but because super fund balances increase over time, buying a home through an SMSF becomes easier.

Superannuation is a safe vehicle for asset protection because it is typically safeguarded from "creditors and predators."

8. Materializing a super fund

An SMSF can purchase a portion of an asset outright and borrow the balance using an installment warrant.

The asset is kept in trust while the debt is owed, but the SMSF retains its beneficial interest. Through the payment of installments, the SMSF will have the option but not the responsibility to acquire ownership of the asset legally.

The dividends that an SMSF earns while purchasing a portfolio of shares through an installment warrant are often used to reduce the loan.

Superannuation Tip:

Take out a loan from your super fund to buy a share portfolio. The super fund's interest payments will be tax-deductible and reduce any dividend income.

Franking credits may be applied to other fund earnings. Additionally, depending on the final sale of the portfolio, there may not be any capital gains tax.

Superfunds may gear up to 75% (depending on the borrower's constraints), but you should consider dropping asset values and cap borrowing limits at 50%.

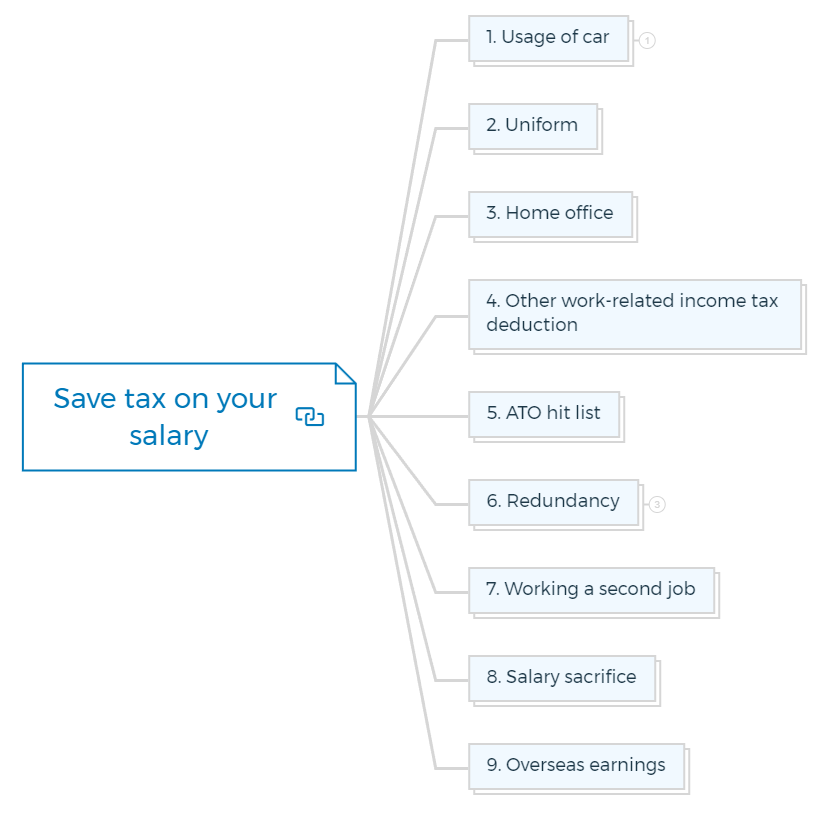

Save tax on your salary

Employees can reduce taxable income each year and receive a tax refund at their marginal tax rate by deducting work-related expenses. Here is how -

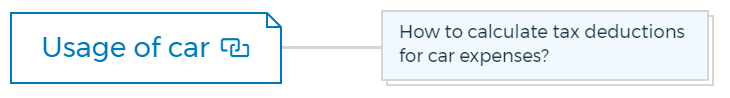

1. Usage of car

You can reduce your taxable income taxes if you use your automobile to travel.

The following are tax-deductible expenses -

- While on duty, from your regular place of employment to a different place, such as a client's location, and then returning to your regular place of employment or going straight home.

- Traveling from your home to a different workspace for work-related objectives, followed by a trip back to your regular workplace or your home.

How to calculate tax deductions for car expenses?

The 12-week logbook technique - If you choose to use the logbook method, buy a logbook from a newsstand. Fill it out for 12 weeks, and keep track of all expenses related to maintaining your vehicles, such as gas, registration, insurance, servicing, repairs, lease payments, batteries, tyres, and other related costs.

The effort is worthwhile because, unless you change jobs or cars, you only need to complete a new logbook every five years, and deductions can amount to thousands of dollars.

According to your percentage of use for work-related purposes, you can use the logbook method to recover a portion of the car's running costs, including depreciation and interest.

Cents per kilometer method - According to the cents per kilometer approach, regardless of engine size, you must estimate the number of kilometers you have driven up to a maximum of 5000 and multiply that number by a fiat rate of 72 cents per kilometer.

You must demonstrate to the income tax office that you did the trip to generate money and that your claim depends on a reasonable calculation.

2. Uniform

You can claim a tax deduction for certain types of professional attire and the price of purchasing or changing clothing, uniforms, and footwear.

But only the following uniform types qualify for a tax deduction:

- A non-compulsory uniform that has been listed on the Register of Approved Occupational Clothing

- Protective

- A uniform that is compulsory for work.

If you do your laundry, you can claim $1 for each load as long as it only contains eligible garments and covers all necessary steps for washing, drying, and ironing. It drops to 50 cents for each load if additional laundry is done.

If your total laundry expenses are more than $150, you must provide proof of your claim.

3. Home office

Nowadays, more and more people work from home as a convenient way to reconcile the competing demands of job and family.

Even if the space is not designated exclusively for work-related activities, you may be eligible to deduct the expenditures associated with maintaining your home office if you conduct some of your business there.

There are three ways, according to the ATO, to deduct your home office operating costs:

Actual cost method - The portion of your actual expenses that correspond to your work.

Fixed cost method - Fifty-two cents per hour for heating, lighting, and cooling, the depreciation of home office furniture, and the portion of other home office costs that are relevant to your work.

Shortcut method - Eighty cents per hour for the expedited procedure.

The following expenses related to your place of residence are usually not tax deductible if your income is provided to you in the capacity of an employee:

- Municipal fees

- Homeowners' insurance rates

- Mortgage interest

- Rent

Only in cases where your home office is regarded as a place of business are you able to deduct occupation costs.

Tip:

Keep a diary (for a minimum of four weeks) to track how much time you spend working from home. You can then use the cents per hour approach to calculate a depreciation deduction for electricity, gas, and home office furniture.

4. Other work-related income tax deduction

Other work-related costs you as an employee may incur besides those already listed include:

- Briefcases

- Personal organizers and calculators

- Logbooks and diaries

- First-aid training

- Income-protection insurances

- Interest on borrowed funds used to pay for business-related expenditures

- Cellular phones

- Postage

- Professional workshops, conferences, and seminars

- Paper goods

- Specialized periodicals, journals, and magazines

- Tools for the trade

- Dues to unions.

Tip:

Instead of claiming deductions related to work, having your company pay for them is best. You only receive a portion of every expense you incur back, not the total amount, based on the marginal tax rates.

FAQs

Question: Can you submit a claim for costs incurred from purchases made through the National Disability Insurance Scheme?

Answer: Unfortunately, you cannot deduct any costs you incurred (or assets you bought) in connection with any exempt income, including money from the NDIS.

5. ATO hit list

The ATO releases a "hit list" of professions each year that will be subject to scrutiny for work-related costs based on a study of prior returns.

In general, the ATO carefully examines a variety of deduction requests, including those for travel, self-education, and auto expenditures. Additionally, it examines tax returns from prior years to identify specific professions to "bring under the microscope" where:

- Average claim amounts are large

- The number of people making claims has increased.

- Many individuals are making claims for the first time.

The ATO uses that data and writes to those who work in those professions believing that prevention is far preferable to treatment. The ATO has provided simple guidelines for submitting your work-related expense claim correctly.

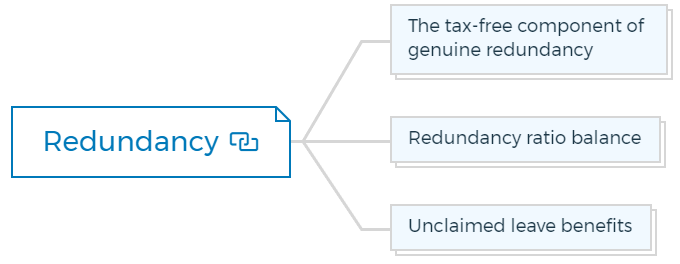

6. Redundancy

The tax-free component of genuine redundancy

You must take a legitimate layoff tax-free portion in cash. The tax-free maximum for the 2022–23 financial year is $1,331, plus an additional $5,672 for each year of service that has been performed.

Redundancy ratio balance

Any amount above the tax-free threshold is regarded as an "employment termination payout."

If you are over 58 or under 59, the first $225,000 is taxed at 17% or 32%, respectively. Any additional payment is subject to a 47% tax. Only the portion of a payment that, when added to other taxable income, does not exceed $180,000 is eligible for these tax advantages.

Unclaimed leave benefits

Regarding leaving accrued before August 16, 1997, just 5% of any unused annual or long-service leave is taxed at your marginal rate. If you quit a job due to an actual layoff, disability, or early retirement plan, the remaining payment is taxed at 32%.

You can't carry over any unused leave entitlements into your super fund.

7. Working a second job

The first $18,200 of your annual taxable income is tax-free if you are considered an Australian resident for tax purposes. This is referred to as a tax-free threshold.

The payer who pays the highest wage should be used to claim the tax-free threshold. Your second employer must withhold more tax from your salary if you receive more revenue.

Suppose you currently claim the tax-free threshold with one payer and want to do so from a different payer. In that case, you must complete a withholding declaration notifying your existing payer that you no longer intend to claim the tax-free threshold.

You can tell a payer to withhold more tax if inadequate taxes are withheld from payments. If your payer withholds tax at the prescribed rates, you're not required to increase it.

At the end of the financial year, you are not subject to any penalties other than the requirement to raise more funds for your tax payment.

You can arrange for a PAYG withholding variation form to be filled out and lower the amount withdrawn from your regular pay if you believe that too much tax is being deducted from one of your payments.

A significant tax refund is available if you wait until the end of the year.

8. Salary sacrifice

Salary sacrificing is a great way to reduce your taxable income and increase your take-home pay. It is highly typical for employees to set up a salary-sacrificing agreement with their employer and "bundle" a portion of their future salary or wages in exchange for comparable perks offered by their employer.

There is no cap on the quantity or kinds of perks that can be forfeited as long as they are included in your compensation. They are merely substituting for what would have otherwise been given as wages.

Under an effective salary sacrifice agreement, employees' payments to a superannuation fund are taxed as employer contributions at a rate of 15%.

If you are paying the highest marginal tax rate, doing this is a better tax savings option than paying 47% tax on your cash wage.

It is well known that the ATO disapproves of any agreements made after the work has been completed, including unwritten agreements.

You are permitted to enter into a verbal agreement, but should the taxman perform an audit of your finances, it might be difficult for you to prove the realities of your agreement.

9. Overseas earnings

If you live in Australia, your income is also subject to taxation. You must report any international earnings on your income tax return as assessable income, and any foreign taxes you have already paid may be deducted from your foreign income tax.

Non-residents are solely subject to tax on their income earned in Australia.

If your employer meets the following criteria, you may be entitled to an exemption from Australian tax on this employment income if you are an Australian resident working abroad for a continuous period of 91 days or longer.

- It delivers official development aid from Australia.

- Manages a public fund for disaster aid for citizens of underdeveloped nations.

- has no Australian income tax to pay

- There is an authority within the Australian Government that has sent you abroad as a member of a disciplined force.

If you have lived in Australia but then emigrated, you should be aware of the following:

- Any income derived from Australia is still subject to tax there.

- For capital gains tax reasons, any abroad assets are regarded to have been disposed of, which could result in a tax liability.

- The indexation of any HELP or SFSS debts will continue.

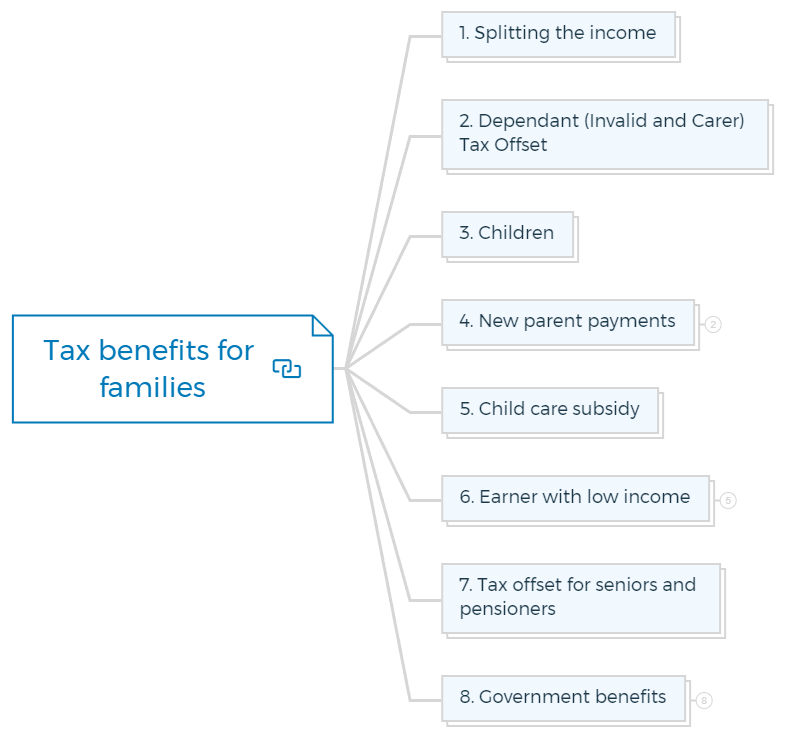

Tax benefits for families

1. Splitting the income

Income splitting is one of the top tax-planning strategies that is also one of the simplest to adopt. There are a few easy tactics you can apply, and they all revolve around you and your spouse's marginal tax rates, both now and in the future.

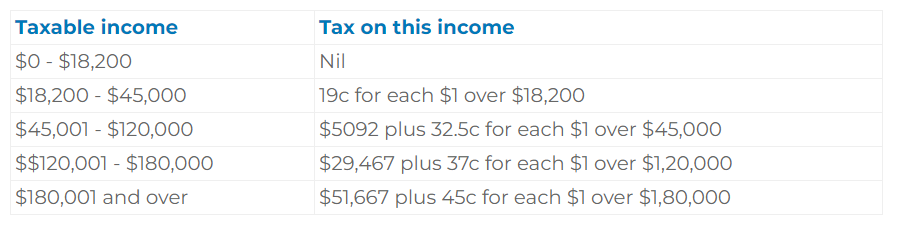

The table below shows the individual tax rates, excluding Medicare and other levy contributions.

The idea is to strive to level couples' incomes to pay the same marginal tax rate. While you can not transfer your earnings (such as your salary) to the other partner, you can transfer passive income from investments, provided the assets are held in the name of the lower-earning spouse.

With the $1.7 million transfer balance cap on superannuation, spouses can split contributions to maximize their respective thresholds before retirement.

Tax savings tip:

Invest under the name of the lower-earning spouse to take advantage of reduced tax rates (significantly the first $18,200, which is tax-free). Put all passive deductions, such as charity gifts, in the higher-earning spouse's name, as they may get up to 47% back.

A low-income investor has the best tax outcome. They might earn up to $21,884 tax-free, get imputation credits refunded, and pay fewer capital gains tax.

Example:

An investor paying the top marginal tax rate of 47% would pay $23,500 in tax and Medicare levy on a $100000 capital gain on an asset held for more than 12 months. A $100,000 capital gain would cost an investor with no other income $7467, a savings of $16033.

Risk -

You may lose any tax benefit from transferring an income-producing asset between spouses if CGT is due on assets purchased after 19 September 1985.

Transferring an income-producing item to your spouse may require a professional valuer. It is because the transaction is neither independent nor arm's length. Either party could influence or dominate the other in this transaction.

If you don't have a spouse or are both in the highest tax rates, consider starting an investment company taxed at a flat rate of 30%.

2. Dependant (invalid and carer) tax offset

The dependant (invalid and carer) tax offset (DICTO) is only accessible to taxpayers who have a dependant who cannot work due to a caregiver's responsibility or disability.

The DICTO has harmonized the following tax offsets:

- Invalid spouse

- Carer spouse

- Housekeeper

- Housekeeper (with child)

- Child housekeeper

- A parent or a parent-in-law

If you meet the following criteria, the ATO may consider you eligible for the DICTO:

- You help to support your spouse financially.

- Your dependant was compensated in some way:

- an invalidity service pension, disability support, or a special needs disability support

- a carer allowance for a 16-year-old kid or sibling

- Your taxable income as the primary wage earner was less than $100,000

- The adjusted taxable income of your dependent was less than $11,546

- You and your dependents lived in Australia.

You can claim the maximum dependant (invalid and carer) tax offset of $2,816 if you meet the requirements above and your dependant's adjusted taxable income was $285 or less, and you maintained him or her for the entire year.

3. Children

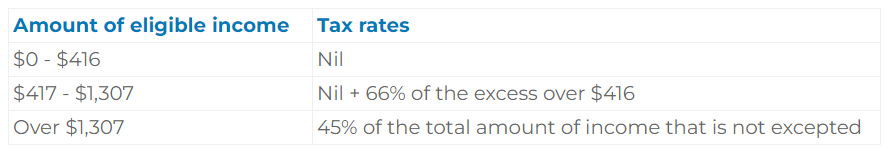

Wages from after-school employment are considered exempt income and are taxed at the general adult rates regardless of your child's age. Minors do not enjoy the same tax-free thresholds on 'eligible income' as adults.

The table below shows minors' taxable income tax rates.

Minors under 18 are taxed at the highest marginal rate for 'eligible income' exceeding $416 per year. Your child will pay regular rates on excluded income and the higher rate on qualified income.

Children with less than $41 in assessable income don't need to file. If an investment firm or employer withholds tax from them, they must file a return to receive it.

Tax saving tip:

If your adult child works while attending university or TAFE, they may be allowed to deduct certain expenses if their course and income are sufficiently connected.

Some possible expenses include:

- Computer, desk, and bookshelf depreciation

- Magazines

- Photocopying, printing costs

- Stationery

- Textbooks

- Commute from work to school

They wouldn't be allowed to deduct HELP tuition or HELP debt repayments.

Earnings from a child's investments must be declared by the person who owns and controls them, not the person whose name they are held, regardless of whether the funds are used for the child's benefit.

4. New parent payments

There are government payments for parents.

Paternity leave

Working parents of newborns or adopted children may be eligible for paid parental leave. The salary is for up to 18 weeks at the national minimum wage (currently $753.80 per week before taxes). You can apply for paid parental leave three months ahead of time.

1. Paid parental leave is taxed, and it may impact other government benefits, including child support, health care cards, and public housing. The Newborn Upfront Payment and Supplement, on the other hand, is not taxed and is not considered income for family assistance or social security.

2. Parents can't 'double-dip' in parental leave by receiving employer-funded benefits at the same or higher level as the government scheme. They'll only get the difference if employer-paid leave is less.

3. Family Tax Benefit Part A recipients may be entitled to a $570 Newborn Upfront Payment and $1709.89 for a Newborn Supplement (reduced to $1140.57 for future children), paid fortnightly over three months. They are not taxable.

Dad and partner pay

It's a one-time payment of up to two weeks' minimum salary (currently $753.80 before tax). To qualify, you must have worked at least 330 hours in 10 of the 13 months before giving birth, and your yearly earnings must be less than $150,000.

Tax saving tip:

Families may also be eligible for paid parental leave and the Family Tax Benefit. The qualified partner must file claims. You can claim dad and partner pay three months in advance or a year after birth or adoption.

Services Australia administers and pays this entitlement, so employers are not compelled to pay it.

5. Child care subsidy

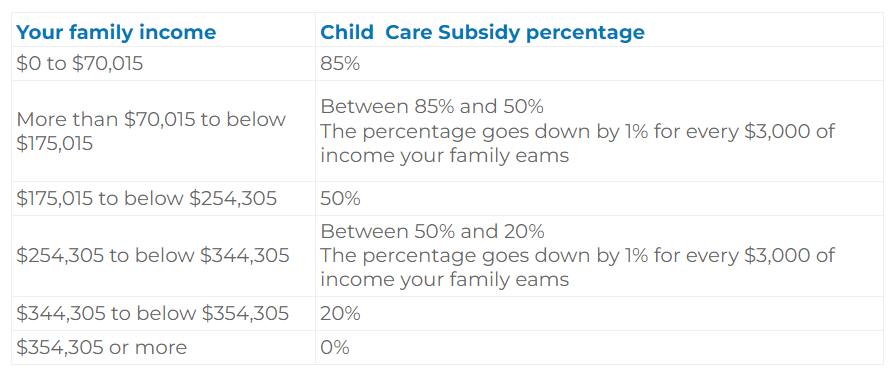

Child care is the highest expense for parents of young children. If your child attends government-approved child care, you may qualify for the Child Care Subsidy (CCS).

Tax saving tip:

If you have already identified yourself as eligible for the Child Care Subsidy. You can file a lump-sum claim with the Family Assistance Office if you have not received it. You must do this within two years after the end of the financial year for which you are filing a claim.

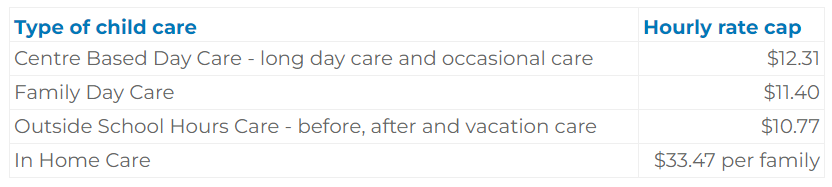

As shown in the table below, families with combined adjusted taxable earnings under $70,015 will get a Child Care Subsidy of 85% of the hourly cap, dropping to 20% for families with incomes over $344,305 with no subsidy for those over $354,305

To avoid the possibility of overpayment, Services Australia withholds 5% of your child care subsidy upfront due to the intricacy of fluctuating incomes.

The Department will finalize your family's annual child care subsidy and pay any outstanding amount when filing your tax return.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

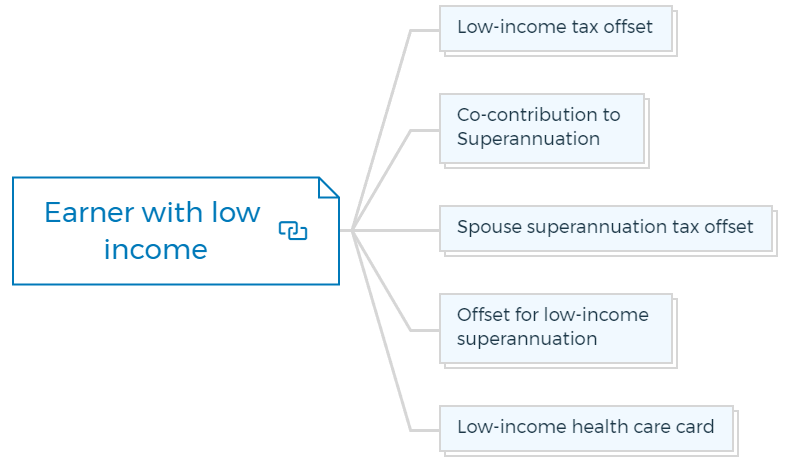

6. Earner with low income

Low-income earners, such as part-timers, can get tax breaks.

Low-income tax offset

LITO is a tax rebate for low-income individuals. The offset is decreased by 5 cents each dollar over $37500 up to $45000. The offset is reduced by 1.5 cents for every dollar beyond $45,000 before disappearing at $66667.

You must file a tax return to qualify for LITO. The ATO will immediately apply the offset to your assessment if you're eligible. Unearned income earned by minors isn't eligible for the LITO.

Tax saving tip:

After the LITO of $700, low-income individuals can earn $21,884 tax-free. If your partner isn't working, you can save $10,723 in tax by sharing income.

Co-contribution to Superannuation

If your superannuation balance is under $1.7 million and your income is under $41,112, the government will match your post-tax contribution of $1000 by 50% with $500.

At $56,112, the super co-contribution fades out (3.333 cents each dollar).

Spouse superannuation tax offset

If your spouse's assessable income and reportable fringe benefits are less than $40,000, you can claim a $540 rebate on superannuation contributions.

18% of the lesser of:

- $3000 decreased by $1 for every dollar your spouse's salary and benefits exceed $37,000

- spouse contribution total

According to the ATO, tax offsets and tax deductions are not the same. Tax offsets are deducted from your taxable income, whereas tax deductions are deducted from your assessable income.

It is utilized in the tax calculation. So, regardless of your taxable income, each $1 of tax offset means you pay $1 less tax.

Offset for low-income superannuation

The government would contribute up to $500 yearly to the superannuation accounts of workers with adjusted taxable incomes. This income is up to $37,000 to avoid tax on superannuation guarantee contributions.

Low-income health care card

Over eight weeks, your weekly gross income must be below specific restrictions to qualify for a low-income health care card.

A single person without children can earn up to $636 per week (or $1094 for a pair). It rises to $1,094 per child ($1,128 per couple) and $34 for an additional child. There is no requirement to pass an assets test.

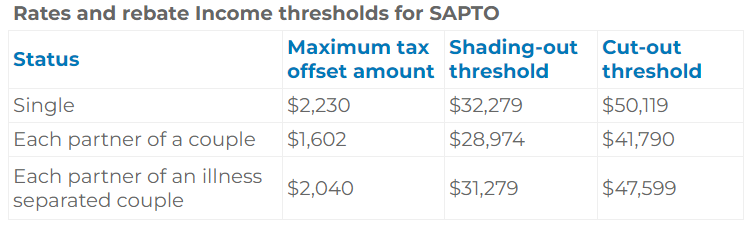

7. Tax offset for seniors and pensioners

Seniors or pensioners may qualify for an offset to earn more before paying tax and the Medicare levy. Under the pension age (now 66, rising to 67 in 2023 and 70 by 2035), you can earn up to $21,884 tax-free.

When you reach pension age, you may be entitled to access more generous tax-free thresholds, known as the senior and pensioner tax offset (SAPTO).

The table below displays SAPTO thresholds.

Tax saving tip:

Senior Australians who earn less than $32,279 for singles (or $28,974 for couples) do not pay income tax. Senior Australians who draw income from a share portfolio are encouraged to file a tax return because they will receive a refund from their excess franking credits.

Using SAPTO and LITO, a single person can earn up to $32,279 (or $28 974 for a couple) in non-super income without paying any tax. Taxed superannuation benefits are tax-free.

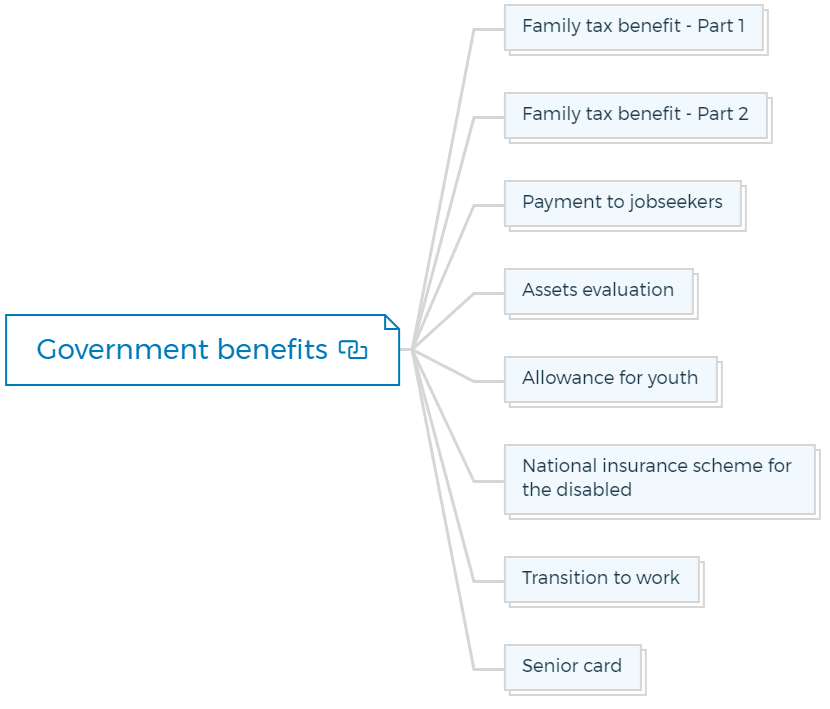

8. Government benefits

Family tax benefit - Part 1

This benefit helps raise children and full-time students under 18 years old. In addition to family income, the number and ages of your dependents affect the benefit amount. It's only paid until your teen's senior year.

Family tax benefit - Part 2

This benefit helps families with one main income if the primary earner makes less than $100,000. Before the benefit is reduced, the lower-earning parent can earn up to $5,767. Family Tax Benefit Part 2 diminishes when the secondary earner earns more than $28,671 per year.

Parental payment

Primary caregivers receive this payment. It's income and asset-based.

Payment to jobseekers

If you're unemployed, between 22 and the Age Pension age (currently 66), or sick or injured and can't work, you may be eligible for the JobSeeker Payment from Services Australia.

Maximum fortnightly payments range from $620.80 for single jobseekers without children to $850.20 for single significant careers.

A waiting period of 1 to 13 weeks will exist, depending on how many liquid assets you have. You will be ineligible for the Jobseeker Payment if your other income or assets exceed certain thresholds.

Assets evaluation

Single homeowners must have assets worth less than $268,000, with a couple's total assets worth $401,500. Non-homeowners' thresholds rise by $214 500 ($482 500 for singles and $616 000 for couples).

Allowance for youth

Youth Allowance is a government payment for 16-to-24-year-old students, apprentices, and job seekers. It's based on the teen's and parents' income.

The allowance is taxable and must be reported. Youth Allowance beneficiaries can't deduct study-related expenses.

National insurance scheme for the disabled

People aged 7 to 65 with a permanent intellectual, physical, sensory, cognitive, or psychosocial disability may qualify for National Disability Insurance Scheme funding (NDIS).

The NDIS has teamed with early childhood partners around the country to offer the Early Childhood Early Intervention programme.

Transition to work

Transition to Work helps young job searchers ages 15 to 24 who aren't studying or working. Eligibility is limited to those without a Year 12 (or equivalent) or Certificate III.

Senior card

Each state and territory offers a free Seniors Card that gives travel concessions and discounts at participating businesses. To qualify, you must be a state resident, 60 or older, and not working more than a defined number of hours per week (less than 20 in NSW and 35 in Victoria and Queensland).

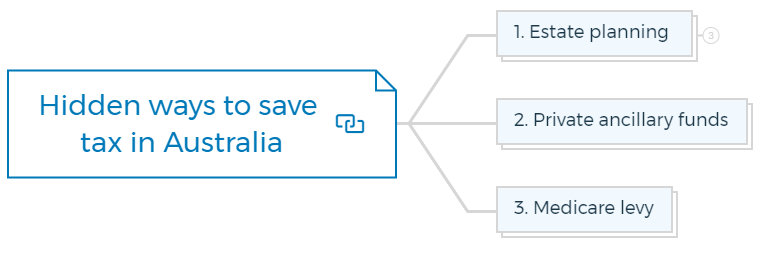

Hidden ways to save tax in Australia

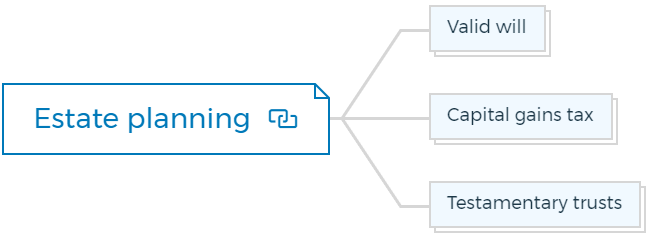

1. Estate planning

There are various definitions of estate planning, but you can understand it as the tax-effective intergenerational transfer of wealth from one generation to another.

It entails creating a plan for handling your assets when you pass away using the legal tools and frameworks you put in place, like a will, to transfer your assets to your beneficiaries in the case of your passing.

If you like to be in charge of your possessions, effective estate planning may enable you to do so even after you pass away.

Valid will

Without a legal will, a person is said to have "died intestate," and their assets are divided according to Australia's state and territory inheritance laws.

In this instance, there is a chance that the decedent's unstated intentions about their estate may not be adequately carried out.

Capital gains tax

Intestacy may result in overall inequality in the distribution of an estate due to greater tax rates by some beneficiaries, depending on the marginal tax rates of various beneficiaries.

An otherwise kind-hearted decision to leave half of an estate in cash to one beneficiary on a low income (effectively tax-free) and the other half in a share portfolio with significant unrealized capital gains tax to another beneficiary on the highest marginal tax rate might serve as an illustration of this.

Effective estate planning can prevent this outcome. The will creator and their advisors can consider ways to manage the tax consequences for beneficiaries while creating a will.

Testamentary trusts

A testamentary trust is a covert method of looking after your family's finances after your passing. Testamentary trusts provide significant tax advantages, including that distribution to minors is taxed at the more advantageous adult rates, which is their significant advantage.

To file a tax return for a deceased estate, you'll need a new tax filing number.

2. Private ancillary funds

Private ancillary funds (PAFs) may not take gifts from the general public and are founded and sponsored by a person, a family, or a small group of donors.

Private ancillary funds are tax-advantaged entities established by a trust deed comparable to SMSFs because they cannot operate businesses or pay their founders/trustees.

Still, they have several reporting requirements and must make a minimum distribution each year.

Consider creating your private auxiliary fund and making a tax-deductible donation if you experienced a sizable windfall gain throughout the year to lower your prospective tax liability.

A private auxiliary fund must distribute at least 5% of the market value of its net assets at the beginning of each financial year, except the year the fund is founded.

3. Medicare levy

If you or your dependents don't have private health insurance and your 'adjusted taxable income is above a specific threshold, you may have to pay an additional 2% Medicare levy fee.

The Medicare levy surcharge is an additional 1.5% on your adjusted taxable income.

- taxes

- super donations

- financial losses

- fringe benefits reported

- tax-paid family trust distributions

Having private health insurance may qualify you for a tax rebate. Even if you don't pay tax, you can get a refund. This private health rebate is affected by taxable income, marital status, and age, like the Medicare levy surcharge.

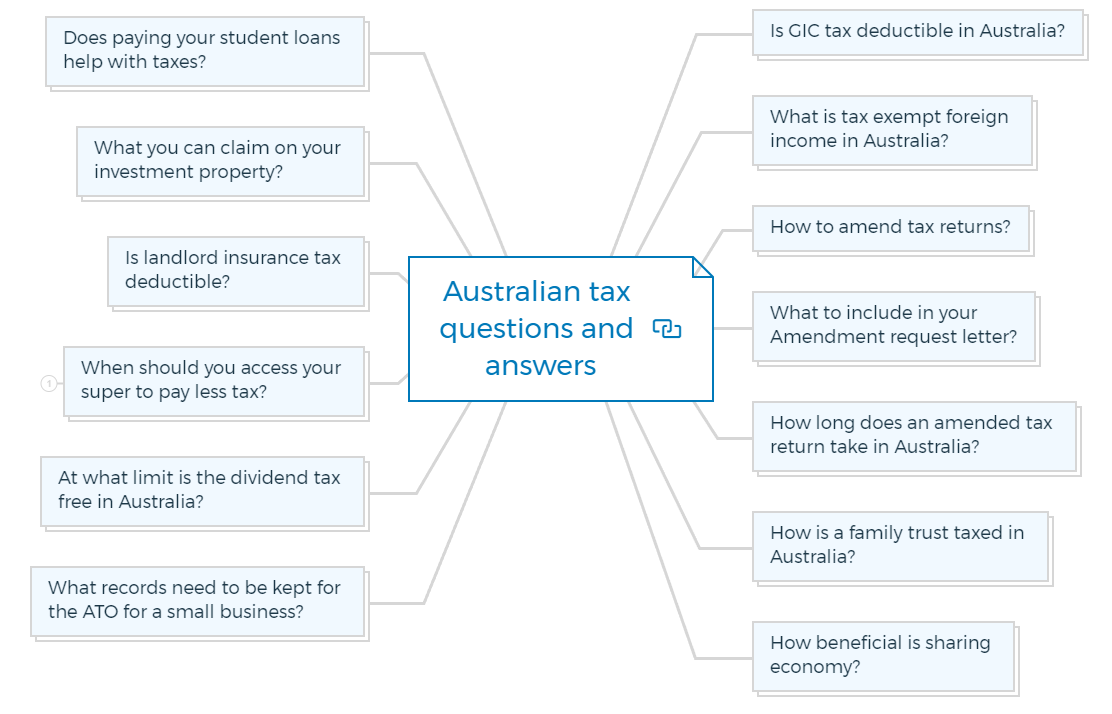

Australian tax questions and answers

Is GIC tax deductible in Australia?

Any expenses incurred in the course of generating income are tax deductible. So if you can demonstrate that the money you spent on GICs was in fact spent on generating taxable income, then you should be able to claim a deduction for those expenses.

What is tax exempt foreign income in Australia?

There are a few different types of foreign income that may be exempt from tax in Australia. These include certain types of investment income, such as interest, dividends, and royalties.

There may also be exemption for foreign pensions and annuities. To claim an exemption, you'll need to provide evidence to the Australian Tax Office (ATO) showing that the income is indeed taxable in the country where it was earned.

How to amend tax returns?

Even after your initial return has been filed and assessed, you can still submit a request to the ATO to alter it if you believe that you have missed out on interest income or a deduction.

The ATO has the authority to alter returns for up to four years following the initial return filing. You can obtain and complete the ATO form Request for amendment of the income tax return for persons from the ATO website if you need to make changes to your tax return.

You can write the ATO a letter or download the ATO amendment request form.

What to include in your Amendment request letter?

The following details should be there in your amendment request letter:

- Your name, postal address, and phone number

- Your TFN

- The income tax year to which the modification applies.

- The explanation for the return's modification

- The tax return's item number that has to be amended

- The size of the change

- A statement that you have the appropriate receipts and other evidence to support your amendment claim and that all the information provided, including any attachments, is true and correct.

Additionally, you must date and sign the letter.

How long does an amended tax return take in Australia?

The ATO generally takes about 6-8 weeks to process an amended return. If you're expecting a refund as a result of the amendment, it will take longer - up to 12 weeks.

This is because your original tax return needs to be processed and the associated refund paid before your amended return can be actioned.

How is a family trust taxed in Australia?

There are two types of family trusts in Australia: discretionary trusts and testamentary trusts. Discretionary trusts are set up during a person's lifetime, while testamentary trusts are established through their will after they die. Both types of family trust are taxed differently.

Discretionary trusts are taxed at the top marginal rate, plus a 2% surcharge. This means that if the trustee is a high-income earner, the trust will be subject to a higher tax rate than if it were an individual taxpayer.

Testamentary trusts, on the other hand, are simply taxed at the beneficiary's marginal tax rate.