Why invest in Australian Real Estate Investment Trust - Get the best ROI for your money

When it comes to real estate investment trusts (REITs), there are many options out there for property developers and investors. You can invest in REITs focusing on the United States, Europe, Asia-Pacific, or South Africa.

However, if you’re looking for a strong return and stability, Australian real estate investment trusts (A-REITS) should be at the top of your list.

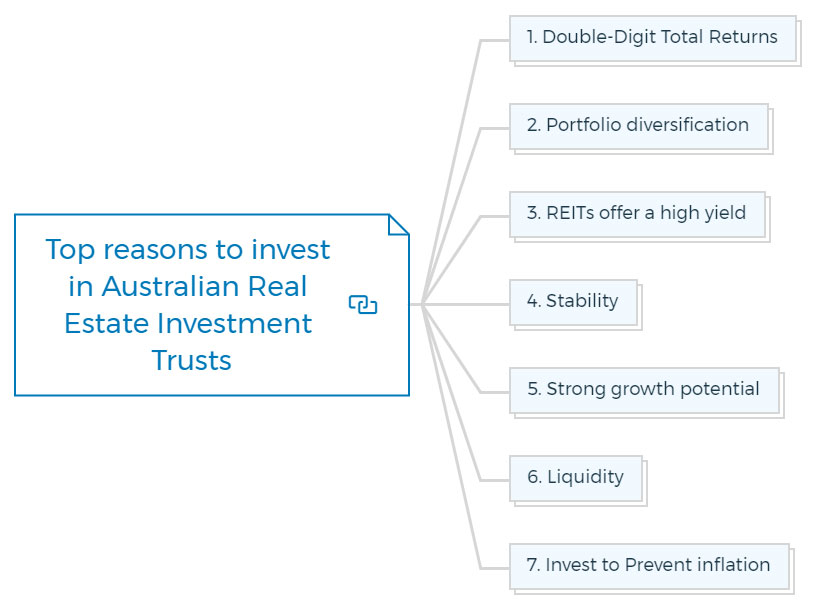

Here are the top 7 reasons why A-REIT should be your go-to investment in real estate.

What is A-REIT?

A-REIT is a type of investment trust that focuses on Australian real estate. They are listed on the Australian Stock Exchange and are required to have a minimum asset value of $250 million.

A-REITs must also have at least 25% of their assets in real estate and at least 75% of their income must come from property-related activities.

Top reasons to invest in Australian Real Estate Investment Trusts

In contrast to government bonds and other assets, REITs offer appealing dividend returns that drive many investors to purchase them.

There are other additional, equally compelling reasons to incorporate REITs into a well-balanced portfolio, though. These include that REITs often have higher total returns.

Investing in REITs has been shown to minimize risk and boost returns on a portfolio of stocks and bonds, which is a crucial reason. REITs are a tool for diversification.

1. Double-digit total returns

One of the main reasons to invest in A-REIT is because they have a history of delivering strong total returns. In fact, over the past 20 years, A-REITS have delivered an average annual return of 11.0%.

It is well above the Australian share market (ASX 200) returns and global REITs.

There are a few key reasons why A-REITs (Australian real estate investment trusts) have been so successful in delivering double-digit returns:

- They tend to be diversified, which means they spread their risk across various asset types and geographies. It reduces the overall volatility of their portfolios and makes it more likely that they will hit their target return over the long term.

- A-REITs also tend to have low leverages, reducing overall portfolio risk.

- The management teams of these trusts are typically very experienced and focused on creating value for shareholders.

They understand the property market well and know how to identify opportunities to create value and generate growth. Total returns on a stock investment are dividends plus price appreciation (or depreciation) throughout ownership.

2. Portfolio diversification

Another reason to consider investing in A-REITS is for diversification purposes.

By investing in A-REIT, you’ll be exposed to a variety of different property types, including office space, retail centres, warehouses, industrial property and residential properties.

Diversification includes a specific investment in a portfolio to boost projected returns while lowering risk. This type of diversification can help reduce your overall risk when compared to investing in just one type of asset.

Investing in Australian property trusts is essential because it helps protect your investment from any particular sector going through a downturn.

For example, if the office sector were to experience a slump, your investment in real estate would still be safe because of the other sectors that make up the A-REIT.

A-REIT also offers investors exposure to a variety of geographical locations. For example, you could invest in an A-REIT with properties all over Australia. It means you would not be as exposed to any particular location.

REITs are a tried-and-true strategy for portfolio management diversification, as shown in numerous studies by numerous illustrious financial advising firms utilizing varied approaches and data sources.

Diversification benefit is possible since real estate and, consequently, REITs are one of the three asset classes for investments, along with stocks (also known as equities) and bonds.

Real estate investments encourage diversified portfolios since they have distinct drivers and cycles distinct from those of other equities and bonds.

Fact:

A $1,000 portfolio with an allocation to equity REITs will generate higher returns and have lower risk than a $1,000 portfolio with just stocks, bonds, and equity REIT shares.

3. REITs offer a high yield

A-REITs typically have a higher distribution yield than other types of REITs. You will receive more income from your investment. In addition, the distributions from A-REITs are usually taxed at a lower rate than other types of investments such as shares. So, this way, you will get a tax deduction on your investment.

REITs pay out a more significant portion of their income to shareholders. As a result, real estate investors can expect to receive a higher return on their investment.

If a Real Estate Investment Trust has well-located assets that are competitively managed and a balance sheet that is prudently leveraged, REITs are a desirable investment for those seeking current income stream.

When a REIT has these characteristics, it can often maintain—and ideally increase—the dividend it pays to shareholders.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

4. Stability

Unlike other REITs that are subject to the stock market's volatility, A-REITS are not. They must distribute at least 90% of their taxable income to shareholders each year. It makes them an excellent option for property investors looking for a stable investment.

5. Strong growth potential

A-REITs have the potential to provide investors with solid capital growth. They can reinvest a portion of their income into the business, leading to higher rental income and lower vacancy rates; as a result, investors can see their growth over time.

6. Liquidity

Using publicly-traded Real estate investment trusts in Australia, property investors can increase their real estate profits without taking on the liquidity risk associated with direct real estate ownership.

It is because publicly-traded A-REITs on Australian stock exchanges can be instantly purchased or sold through a financial advisor or internet trading services, much like other equities.

In comparison, selling a direct real estate investment may take months or even years. Investors can thereby participate in real estate-based assets in a liquid manner through publicly-traded REITs.

7. Invest to prevent inflation

Leases govern how Equity REITs rent their real estate assets to tenants. It generally shields the margins of the REITs from the consequences of inflation.

Most leases allow landlords to charge renters for certain expenses (utilities, taxes, insurance, landscaping, etc.) once incurred. In triple-net leases, the landlord is not responsible for covering these operating expenses; tenants are.

Landlords of apartment buildings often have one-year leases and are permitted to mark up their rental income (also known as "marking-to-market") to keep up with rising costs.

In times of inflation, A-REIT income can keep up with growing prices, albeit with some lag, thanks to their capacity to pass along increases in operational costs.

As a result, REITs produce inflation-adjusted earnings, which makes their stocks desirable investment options when inflation is high.

Conclusion

There are many reasons to invest in Australian real estate investment trusts. They offer diversification, exposure to different geographical locations, and a high distribution yield.

In addition, they tend to be less volatile than other types of investments. So, if you're looking for a safe and stable investment, then A-REITs is for you.

Take your next move to start preparing for your first development project. Get the insider knowledge and mastermind your next development project with confidence.

FAQs