Close your real estate loan in 6 easy steps

Do you dream of closing your next real estate loan without stressing out over paperwork? Whether you’re a seasoned property investor or an aspiring property developer, having an organized plan to tackle the technical aspects of a real estate loan can help make life easier.

With these 6 easy steps, you can easily prepare yourself and close your upcoming project with minimal effort – all while freeing up more time for discovering new prospects!

What is loan closing in real estate?

Loan closing is the final step in real estate transactions and involves signing a loan agreement, collecting all necessary documents, and disbursing funds to all parties involved.

This process typically takes place after an appraisal has been completed and the real estate loan officer is satisfied with their due diligence review of the borrower’s financial information. Loan closings can be either residential or commercial, depending on the type of property being purchased or developed.

When it comes to real estate development loans, most lenders require that borrowers provide proof of construction costs along with detailed plans for the project before they will consider approving any real estate loan requests.

The lender must ensure that the borrower has enough money to complete the project as promised and that there will be no issues during the property development process. Once all of the requirements have been met, loan closing can take place and funds can be disbursed to cover construction costs.

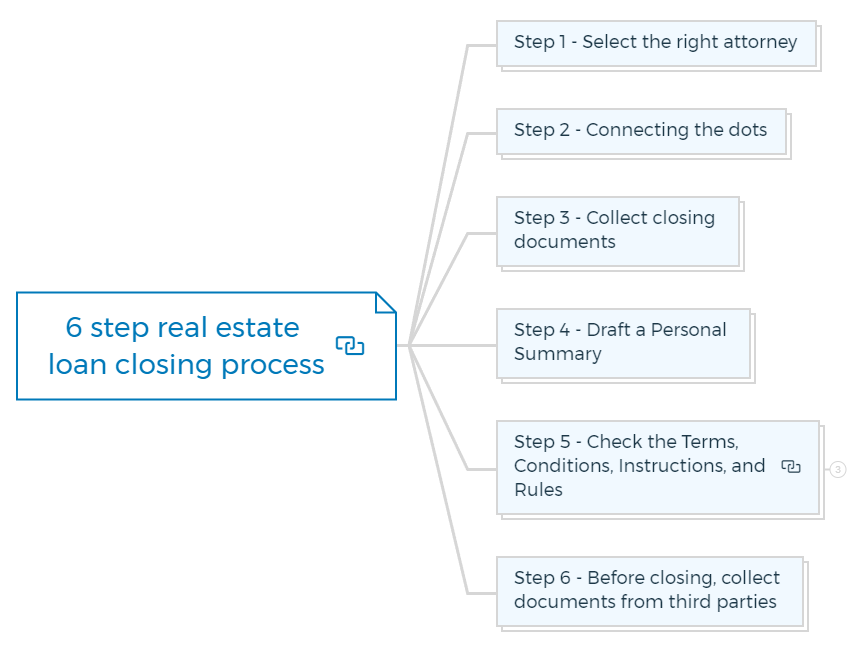

6 step real estate loan closing process

The loan closing process typically consists of the following 6 steps:

Step 1 - Select the right attorney

Real property law is so complex that there are attorneys who only write and review commercial leases.

It includes those who work on residential landlord-tenant law, those who focus on property taxes reductions and tax credits, those who focus on environmental issues, those who only do closings, those who litigate in court, and those who only write construction managers and contractors' contracts, and others.

No matter how overtly simple the project appears, a trained, experienced attorney is essential because of the depth and scope of expertise and experience required to protect the lending institution, especially in creating the documentation for a development loan.

Too frequently, a senior officer of a small lending institution would insist that their real estate lenders engage a particular legal firm because they know one or more of their attorneys or have worked with it previously in the credit industry.

If everything goes well, the real estate attorney will carry on handling real estate deals. However, the lawyer's errors or omissions may be very problematic if things go wrong.

Although choosing the correct real estate attorney is not difficult, it does involve some judgement and, like a job interview, can result in a top candidate who later proves to be less qualified than first believed.

The following checklist is a helpful guide for choosing an experienced lawyer:

- At least three of the firm's attorneys should focus entirely on real estate.

- The primary lawyer should have at least seven years of real estate law experience.

- Several construction and development loans should have been closed by the lawyer.

- It is essential to check out references from other lenders and borrowers thoroughly.

- The business should be known for operating around the clock. There should always be someone on hand.

- The firm must have extensive experience in the specialized field and demonstrate it if a given credit requires unique expertise, such as environmental, landmark, or condominium issues.

- The offices of the law firm should be attractive. They will be seen as an extension of your lending institution since real estate closings and discussions will occur there.

- The lawyers should be approachable but also steadfast when required. Through their negotiation skills, they'll represent and defend you.

- Lawyers should clearly and concisely explain legal and business concepts to you and your coworkers clearly and concisely.

- Cost shouldn't be a significant consideration, as the borrower will eventually be responsible for paying all legal fees.

Depending on the type of credit, it makes sense to retain more than one real estate lawyer.

A few loan terms may need to be renegotiated at the closing, and it may be necessary to determine the senior credit officer of your institution's intentions when approving the loan's final terms and conditions. You must reread your notes and the loan approval memorandums to memorize the facility's key details.

Step 2 - Connecting the dots

After the lending officer has done their underwriting and gotten final approval from his institution, they usually don't have anything to do with the preclosing process unless there are issues with the appraisal, the environment, or a consulting engineer. It involves them, the borrower, and the borrower's lawyer.

The lender's attorney typically creates a checklist to ensure everyone follows the rules and assigns particular responsibilities. Only 3 items must be provided by the lender (QRS).

They are the QRS Closing Statement, the Construction Consultant Plan and Cost Review, and the Construction Budget and Project Cost Statement.

The overall development cost and the amount of the loan allotted to each cost item are broken down in the construction budget and project cost statement.

Subject to any potential simple revisions, it was completed by the loan officer in their credit memoranda and needed only to be copied or emailed to the attorney.

The Plan and Cost Review is a report written by the lender's consultant engineer. The Lending Officer need only send a copy of the Construction Budget and Project Cost Statement following its evaluation and potential modifications.

The loan administrator creates a document called the QRS Closing Statement. The statement, which is a list of the sources and uses of funds that will take place at the close, is then given to the lawyer, who frequently works with the administrator to complete it.

The lending officer has a relatively minor role between the loan approval and the loan closing. They might occasionally be asked to make judgments about operations, credit, and business, but those choices are typically straightforward and largely reactive.

Step 3 - Collect closing documents

The next step in the closing process is collecting all necessary closing documents. This includes things like your loan application, tax returns, pay stubs, and bank statements.

The lender will use these documents to verify your income and assets. Your closing binder should include the following index of closing documents -

- Contract of sale for the purchase of property

- Notice of assignment of contract to the property owner

- Assignment and assumption of the contract of sale

- Bargain and sale deed with covenants

- Property transfer tax return

- Seller's Certification as to Vacancy of the Property

- Seller's Certification of Nonforeign Status

- Seller's Certification as to Resolution and Corporate

- Incumbency

- Affidavit for smoke detecting alarm

- Notes and invoices

- Post-closing letter

- Loan commitment

- Mortgage Note

- Security Agreement

- Completion Guaranty

- Material Guaranty

- Indemnification Agreement

- Security Agreement

- Financing Agreements

- Assignment of leases and rents

- Assignment of contracts

- Management Agreements

- Legal Opinion of Borrower's Counsel

Closing binder:

All the documentation created by a real estate transaction is collected in a closing binder. They are collated into a book and bound. Depending on the lending institution's policy, the attorney or the lender will keep the binder with the original documents in a secure location.

Step 4 - Draft a personal summary

Making a one-page "cheat sheet" containing the critical loan conditions and any special operational requirements soon after the closure is clever because even a simple development loan creates a lot of paper.

You may readily go to it and recall or refresh your memory of the critical loan phrases whenever the need arises. You won't understand even the most basic details of the loan after the first year.

Although most lending institutions need a one-page summary of the loan proposal at the beginning of a loan file, this summary typically focuses more on the transaction's credit components than the credit's operational side.

You may also insert subjective and private notes on your summary sheet. Only use it for reference.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

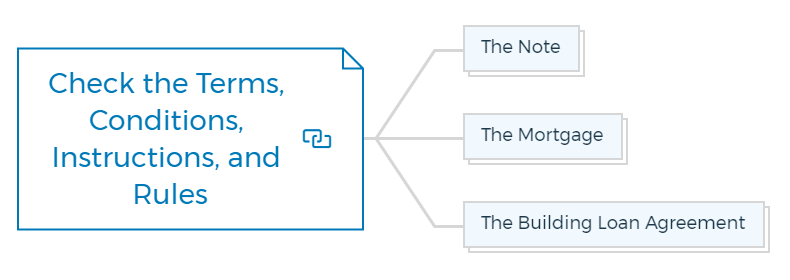

Step 5 - Check the terms, conditions, instructions, and rules

Most legal documents in a closing binder are simple and uncomplicated. Even a cursory look reveals what they represent and their inclusion's purpose.

Every professional should know where to find a few essential documents in a lending binder. The note, the mortgage, and the construction loan arrangement are the three that a development lender has to comprehend the most.

The concise summaries that follow concentrate on these texts from an operational standpoint.

The note

The note is a guarantee by the borrower to repay the lender, and typically, regardless of the loan size, it is no longer than 10 pages. It outlines fundamental terms like loan extension options (if any), the jurisdiction the documents apply to, and borrower waivers, such as the right to a jury trial.

It also includes the principal amount of the loan, the interest rate and how it is calculated, when the loan matures, default rates, and late fees. It serves as debt proof in court.

From a practical standpoint, it is helpful to search the fundamentals quickly. Due to its briefness, it is frequently bound with the mortgage paperwork.

The mortgage

The mortgage is the loan's rules and regulations manual, which might be 50 pages or longer. Look at the note first to learn the loan's interest rate.

Suppose you want to know what happens whether a property is damaged by fire or water, condemned, if an escrow fund has been set up to collect property taxes and how it works, or if rental goals are not fulfilled.

When to get estoppel certificates from tenants, what rights a second mortgagee has, and when to file operating statements with the lender. Who to send notices to, default events, and other rules, regulations, and covenants. For all this information, you should look at the mortgage.

The mortgage demonstrates an interest in the property as collateral for the loan in a legal sense. After it is recorded at the appropriate municipal office, its precedence over other current and future claims on the land are determined.

The building loan agreement

The construction loan agreement is specific to a development loan, in contrast to the note and the mortgage, which are common to all loans backed by real estate.

The administration of the loan, including, of course, the conditions and procedure for making loan advances up to and including project completion, is covered in detail in the instruction manual.

Every lender for development loans should learn at least a basic understanding of the BLA because it is specific to development loans.

A definitions section that almost all BLAs begin with can be quite beneficial in understanding a complex transaction. Reading through this introductory definition section can be a helpful learning experience even for individuals in the development loan industry for many years.

Step 6 - Before closing, collect documents from third parties

Copies of the paperwork finished before the first loan advance are included in the building loan agreement. Usually carried to the closing, these papers include third parties' attestations, warranties, and commitments.

Unfortunately, there are frequently borrowers who are unaware of the intricacy and interdependency that a construction loan entails, especially on smaller projects with inexperienced development teams.

The borrower and the lender have a continuous and active interaction in a development loan. There is also, to varying degrees, a relationship between the lender and the borrower's architect, engineer(s), construction manager, general contractor, and others.

Bottom line

You should be able to find all the crucial details of a loan in the BLA, mortgage, and note. Most lenders do not produce copies of these three documents because they essentially serve as a replica of the loan presentation.

Instead, they favor referring to a summary document they created for themselves after the loan closed and the approved loan presentation they wrote. Typically, this yields similar results.

FAQs