How To Become A Property Developer?

How to become a property developer? or for our readers from United Sates... how to become a developer real estate? The questions and answers will remain the same, so I request that you substitute or read the word property as real estate.

Please use the table of contents above to quickly navigate to all frequently asked questions on how to become a property developer? You should also check out What Does it take to be a property developer?

How To Become A Property Developer In 10 Actionable Steps?

Without A Degree...

How To Become A Property Developer & Other Similar Questions answered in this section:

- How to Become a Real Estate Developer?

- How to be a property developer?

- How to be a real estate developer?

- What does a property developer do?

In order to become a developer real estate, you have to be an entrepreneur who understands the complete property development process as well as the financial and development related issues. Possess knowledge and skills to conduct financial feasibilities, due diligence, organise development finance, setup development entity structures, conduct market research and understand property economics, i.e. the demand and supply of stock surrounding the development.

Before we find out, about how to become a property developer, I think we should first understand...

What Is Property Development? /

What Is Real Estate Development?

What is Property Development?

Definition

Property Development, also known as Real Estate Development is a process that is both, a science and an art incorporating a large number of interrelated & interdependent parts that come together to respond to the demand and needs of the society by creating and utilising the factors of production.

Factors of production, as defined in property economics are four essential resources: land, labour, capital and entrepreneurship. A Property Development project can only come together when the entrepreneur i.e. the property developer uses his/hers entrepreneurial skills to bring together land, labour & capital in order to make a profit.

Of all the property investment strategies I have studied, I believe that property development is the best property investment strategy under the sun.

You can pursue property development around the year and through all market conditions - as long as you know how to change gears in your property development business.

Property Development is an industry with high stakes where fortunes are made and lost every year, irrespective of the market cycles.

Property development requires entrepreneurs i.e. the property developers who must be ready to put their skills to test and make hard and swift decisions.

With no barriers to entry, property development is now accessible to everyone, mums and dads and property investors who can use property development as part of their property investment strategy to exponentially grow their property portfolios.

LET ME SPILL THE BEANS AND LAY IT OUT FOR YOU, HERE ARE MY 10 STEPS ON...

How To Become A Property Developer?

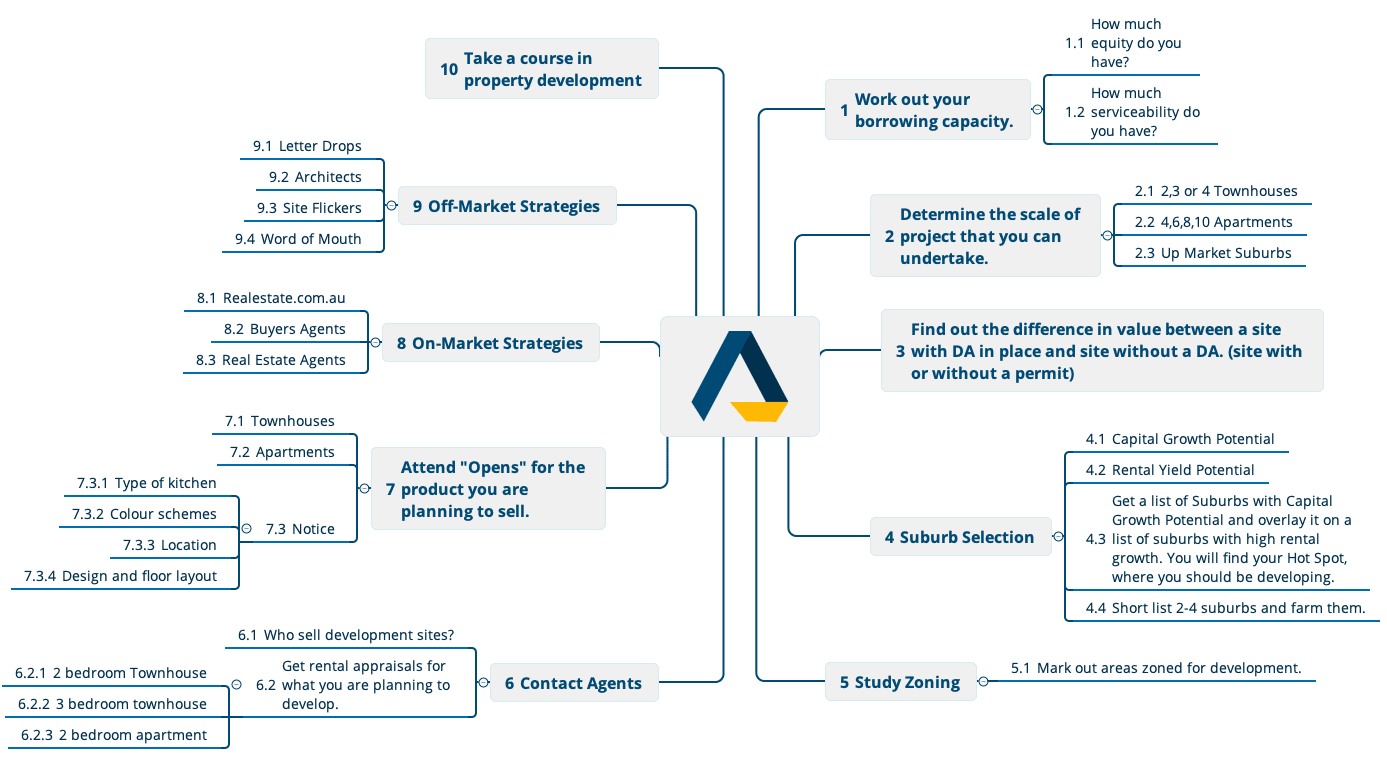

Step 1: Workout Your Borrowing capacity

Before you can even think about getting into property development, you as a property developer must determine your current financial position. Your property development financial position is the sum of cash that you have in your bank & your total borrowing capacity. To determine your borrowing capacity, you must answer the following questions:

- How much equity do I have?

- What is my borrowing capacity, i.e. how much serviceability (your capacity to service the debt) do I have?

- How much money do I have?

For Some, A More Appropriate Question Would Be...

How Much Money Do I Need To Start Property Development?

You can be part of a development with other property investors and in this scenario, you may only require $100,000 to $150,000 or even less in some scenarios, specially if you are part of a property syndicate and depending upon the financial compliance requirements in your country.

However, if you are planning on doing your own developments, your equity or cash contribution will depend upon your borrowing capacity and the size of your development. A developers money requirement for a project depends upon the maximum amount they can borrow for the development, in other words the Loan to Value Ratio offered by your lender for your development.

For example, let's say the total development cost of your project is $1000,000 and the maximum that your lender will borrow you is $700,000. This means that you will need $300,000 of your own money to get into your development project.

For more details, please read How to finance your property development project?

Step 2: Determine The Scale Of The Project That You Can Undertake

The above questions will help you determine the size of your development financially. It will help you determine, whether or not you can initiate a 2, 3 or 10 Townhouse / Apartment / Unit development.

This will also be a deciding factor when selecting the location for your developments. The scale of your project constitutes the total costs which include land value.

By determining the size and scale of your development depending on your financial position (total cash in bank + borrowing capacity), you will be able to determine whether you can develop in a low, medium or up market location.

Step 3: Understand The Development Potential Of A Site

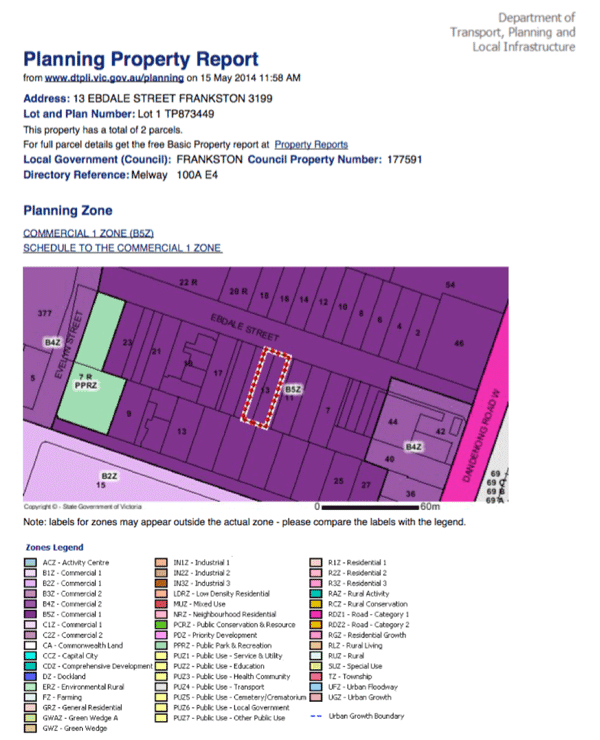

Understand the difference between the value of a site that has a DA (Development Approval aka Town Planning Permit) and the site without one. You can increase your understanding by studying the local zoning maps.

The development potential of property, whether its residential, commercial or industrial - will be determined based on its location or suburb, improvements made or potential for improvements, zoning and overlays, local employment and unemployment, and the availability (or lack of availability) of other similar properties i.e. supply and demand of competing stock.

Step 4: Suburb Selection - Property Development Hot Spots

Your next step is to determine the right suburb or location for your development. Will you be targeting a location for its capital growth potential or rental yield? To find out the best location or your property investment hot spots, get a list of suburbs with Capital Growth Potential and overlay it on a list of suburbs with high rental growth. You will find your Hot Spot, where you should be developing.

Short list 2-4 suburbs and farm them. Farming a location means that you monitor these locations for price fluctuations, design intent, neighbourhood character, what's selling, what's not and the historical sold prices in the area.

Step 5: Study Zoning

Spend some time to study your local town planning and understand the zoning determined by your LGA (Local Government Area) or council. A good understanding of your local town plan will help you determine the highest best use for your development site and its potential.

Step 6: Contact Local Agents

Find out who are the agents, who sell development sites in your area. Get rental and market appraisals for similar kind of properties that you are planning to develop. This exercise will you give you a very good understanding of the potential sites available on the market as well as the end sale value of your developed stock.

Step 7: Attend "Opens" For The Product That You Are Planning To Develop And Sell

You must attend the opens for the existing stock that on sale in the market. This will give you an understanding of what your target audience / potential clients are looking for. You can very easily determine the type of kitchen accessories liked by potential buyers as well as colour schemes, preferred streets, design and floor layouts.

Step 8: On-Market Strategies

When looking for potential sites, you can go with two options. First one being, the On-Market Strategies. These are potential development sites that are available on the market and are up for grabs publicly.

The downside is that you will be competing with other people who also wish to become property developers and are looking for their first development.

The upside is that although the site is publicly listed on property selling websites and with agents, more information about the property will be available publicly. You can approach buyers agents, real estate agents and check out the property listing websites in your area.

Step 9: Off-Market Strategies

You can also try off-market strategies to acquire a site by contacting architects in your area, flippers (people who acquire a site, add value and simply flip them), word of mouth and by doing a letter drop in your area. The biggest upside to this strategy is that you have the time to negotiate price and favourable terms.

Step 10: Take A Course In Property Development

Here you are, you have just acquired your first property development project and are now truly on the way to becoming a property developer. However, you now need to spend some time and invest in property development education. Property development is very similar to a business venture, only more lucrative.

And we all know the success rate of most businesses. Since you are going to have a considerable amount exposure in terms of your money invested and the debt required to complete a development project, I would highly recommend, that you spend some time in learning everything about property development.

If you are merely starting out and are looking for a short course in property development, I would recommend my Quick-Start course.

List Of Property Development Courses Online

Checkout a catalogue of my property development courses before deciding which one helps you the most now. However, if you think that you are ready and would like to know everything there is about doing small and medium size development, I would recommend my Property Development System course, which not just teaches you the complete property development process in detail, it also gives you the two financial feasibility tools that you need in order to become a property developer. This is a complete course in property development that simply makes you a property developer.

We've answered every possible Property Development FAQ for you at Edge.

Step 1: 👉 Beginner Property Development FAQs

Step 2: Get the Edge - Register Free

How To Become A Great Property Developer?

Part 1: Good Vs Great property developers

Following is four part video series that shows how you can become a great property developer. It also showcases the differences between a Great Property Developer and Good Property Developer.

Part 2: Good Vs Great Property Developer

Step 3: Good Vs Great Property Developer

Step 4: Good Vs Great Property Developer

You are missing out if you haven't yet subscribed to our YouTube Channel

Frequently Asked Questions On

How To Become A Property Developer?

What Does A property Developer Do?

What Does A Real Estate Developer Do?

Real estate developers are like symphony orchestra conductors who unlock hidden profits in sites (land) through their effort, vision & entrepreneurship... bringing together the individual instrumental parts of real estate development to create a new symphony.

A real estate developer or property developer is an entrepreneur because they combine the skills and resources, i.e. land, finance and labour to create a finished product whose value is greater than the sum of all input costs. A property developer will take the risk by getting into the project (business venture) with an expectation to achieve an economic return that adequately rewards them for taking the risk.

So to become a property developer, you must understand the overall picture of what needs to happen as well as when and what you have to be careful of, i.e. have a thorough understanding of the property development process. You need to understand how everything comes together to profit from your business venture.

What strategies to use and when? When to get a development approval or planning permit and flip & exit, how to control the property without ever owning it and when it is beneficial to go all the way and get your development built and then cash out. A property developer must then be able to make the right decisions based on all this information, due diligence and financial feasibility.

What Qualifications Are Required To Become A Property Developer?

Property developers or real estate developer come from varied backgrounds in terms of education and industry. There have been property developers with no education at all who have done well. And there have been property developers with all the relevant degrees who have failed. What separates the failed property developers from the successful ones are their entrepreneurial qualities & their level of education.

Does A Property Developer Also Need To Be A Builder?

There is no rule mandating that a property developer must be a building contractor as well. A property developer does not have to be an architect, building or land surveyor, construction contractor or builder, a quantity surveyor, a geotechnical expert etc. or an economist. I haven't heard of rich economists, architects or builders as much as I have heard of wealthy property developers. Having a background in any of these professions is a plus, but not necessary.

How To become a developer real estate?

To become a successful property developer or to be a successful property developer you must have the following:

- Property Developer’s mindset - You must be driven, in terms of your desire to achieve your financial goals, troubleshoot problems and have an obsession to keep going forward. This becomes a lot easier if you really enjoy property development. Because, property development is full of challenges and problems that need to be resolved and or contained. If you don't really enjoy what you do, inevitably you will not last very long in this industry.

- Life Long Learner - Irrespective of your educational qualifications & experience, you must be willing to learn everything about property development. This education will never stop as property development requires and involves many disciplines, so chances are that you will come across something new in every development project.

- You must have the right Property Development Team for the kind of project your are undertaking. You don’t have to have the most expensive consultants, you just have to have the right consultants and professionals for the size of your project.

- A Property Developer needs to understand all facets of the property development process. From conducting property development feasibility, determining the highest best possible use of the site to identify profitable opportunities. Understand the property market cycles, conduct market research & due diligence, to engaging the property development team and orchestrating & facilitating the entire development process from inception to delivery.

Before you enter into the realm of property development, I strongly recommend that you assemble a team of property experts and knowledgeable consultants.

Why Do I Need A Property Development Team?

Property development is complicated and covers multiple disciplines. You can’t possibly have all the knowledge yourself. Even after you have become an experienced property developer, you will still rely on the skills and knowledge of qualified and experienced property development consultants.

Who Should I Include In My Property Development Team?

As a bare minimum, your property development team will include the following consultants and professionals:

- Accountant

- Finance Broker

- Land Surveyor

- Architect

- Structural Engineer

- Quantity Surveyor

- Civil Engineer

- Mechanical Engineer

- Geotechnical Engineer

- Building Surveyor etc. to name a few.

How Do Property Developers Make Money?

Other Similar Questions answered in this post:

- How do real estate developers make money?

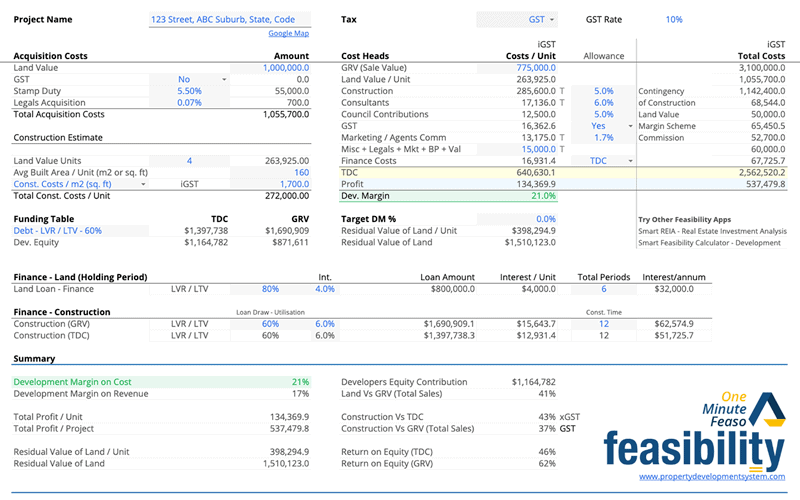

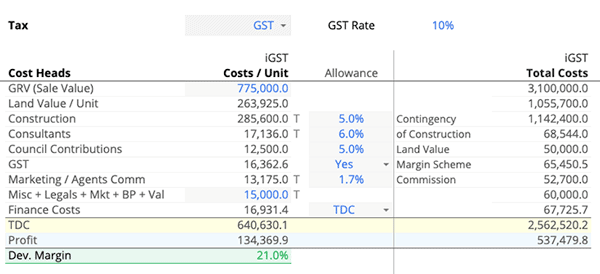

Property developers make a margin on the cost of the development called the Development Margin. It is no different than a manufacturer making a margin on the cost of producing “xyz” product. The Total Development Costs (TDCT) include the land, government taxes like stamp duty, GST or VAT as well as development and construction costs.

When the developed units, townhouses or apartments are sold, all costs are deducted from total sales or the GRV (Gross Realisation Value) and what is left is the property development profit. Property development profit can then be expressed in a percentage, which is the Development Margin.

Typically for small to medium size developments the property development profit can range from $30,000 to $200,000 per unit. In the example below, the per unit profit is $100,451.40 with a development margin of 18.4%

How Much Money Can You Make From Property Development?

How Much Does A Property Developer earn?

The amount of money a property developer can earn varies depending on the size of the development. Your earnings as a property developer will vary based on the project profit. Smaller projects can return about $100,000 in 12 months and larger projects don’t have a ceiling. Every property development project is different. In fact, the financial feasibility that you start off with will rarely be exactly the same at the end of the project. The amount of money that you can make from a project is not always the correct measure of a successful property development project.

Unless you are a development manager working for a company for a wage, which can range anywhere from $80,000-$150,000 depending upon your experience.

How much money do real estate developers make?

The amount of money real estate developers can make depends on 3 things:

1) What Real Estate Developers can charge the project as a development management fee?

Real estate developers, also known as General Partners or GP would normally charge a development management fee to the project for managing the project.

2) Project Performance Based incentive

Often general partners, GP or real estate developers will also be paid based on the project performance based on IRR hurdles, minimum desired returns for investors, cash on cash return or a combination of both.

3) Property Development Profit

Depending upon the equity held by real estate developers, they will also be entitled to a share of the project based on the percentage of equity held by them in he project. If the project is owned by them 100%, then the entire project profit is for them to keep.

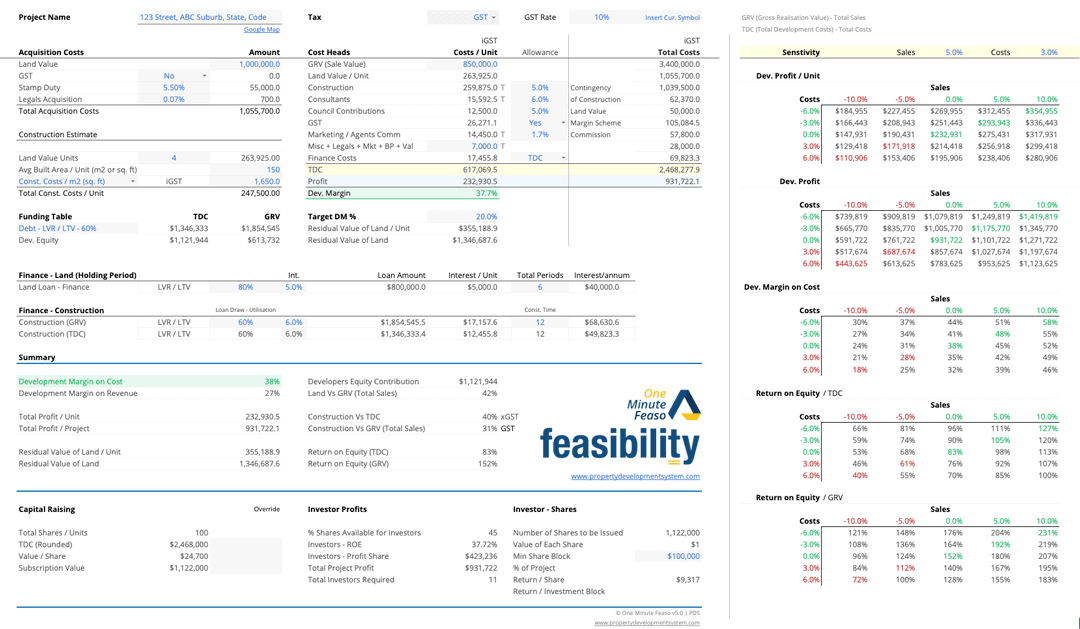

Property Development: Measures Of Success

There are two main measures of success. The first one is Development Margin and you should strive to make sure that your projects makes a minimum of 10% development margin on cost. The second measure is Return on Equity (ROE) or Cash on Cash Return (COC).

This is the amount of profit you make the money that you invest from your pocket. This does not include the money that you borrow from the bank. As a thumb rule, I never take on projects with less than 20% ROE.

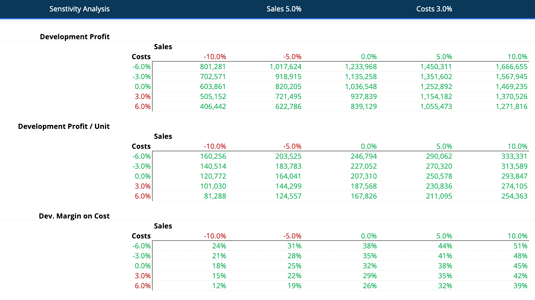

This is the reason, that in order to become a property developer, you need to understand the property development feasibility study as well as the sensitivity analysis. Continuing with the example from the image above, below is the Sensitivity analysis that both my property development feasibility softwares and training courses include.

In the above example, if everything goes right the project makes $100,451 per unit as development profit, 18% as Development Margin and the Return on Equity will be 45% or 61% depending upon whether the LVR or LTV (Loan to Value Ratio) was against the Total Development Costs or Gross Realisation Value.

This means, that you managed to borrow more money and your maximum loan was determined against GRV your ROE will be 61% and if you were allowed a lower maximum lend, i.e. your LVR was determined against TDC, your ROE will be 45%.

You will be make 61% return on your money if you borrow against GRV and 45% return on your money if you borrow against TDC. The sensitivity table below shows how your profitability, development margin and return on equity will be impacted if your Sales and Costs were to fluctuate in 5% and 3% slabs.

How Much Does A Property Developer Earn A Year?

Other Similar Questions answered in this post:

- How much do property developers make?

- How much do property developers earn?

- How much money do property developers make?

- How much money does a property developer make?

- How much does a property developer earn a year?

- How much profit do property developers make?

- How property developers make money?

A good property developer can earn anywhere between $80,000 - $200,000 per annum doing smaller townhouse developments. If you are looking to for a career change and are looking to replace your income doing property development project part-time, you should get my Property Development System that not only shows you how I did it starting from zero, but also gives you a system that you can follow.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

How to Become A Property Developer With no Money?

I discuss the answer to this question in detail in one of my other articles Property Development With No Money & through my extensive property development course "How To Become A Property Developer With no Money?"

How Do I Get Into Property Development?

If someone ever asked me what is that “One thing” that has helped me become successful Property Developer, I would say it’s my property development mindset.

Property Development is the most lucrative and the fastest way to generate equity that I know. I have been to many seminars and completed various property development courses, studied many different property investment strategies & even obtained diplomas in the field of property. If there is that one strategy that gets me results, the quickest, it has to be Property Development.

However, because of its very nature, it requires a very strong mindset. Because it is full of problem solving, trouble shooting and managing risks. However, I can guarantee you that if you have the right mindset, you will be very successful in this industry.

If you already have the right mindset there is a very good chance, you may be underestimating the power it can bring to the table or the level at which it is required in property development.

Let’s find out whether or not you have the right mindset for property development. Ask yourself if you suffer from the following:

- You Have a “Fear of Success”

- You Dwell on Too Many Options

- You Quit When the Going Gets Tough

- You Don’t Take Your Money Situation Seriously

- You Let Others waste Your Time

- You Avoid the Hard Work

- You Tell Yourself Negative Stories

- You Don’t Take Responsibility – you look for someone else to blame.

- What would you rather do? Get Ahead or Get Even.

- You Spend All Your Time Planning

- You Don’t Cut Yourself Any Slack

- You Talk yourself down.

- You have poor self-image.

If you have answered yes to any of the above, my guess is that you self-sabotage yourself.

Your behaviour is said to be self-sabotaging when it creates problems and interferes with long-standing goals. It's when part of your personality acts in conflict with another part of your personality. So in order to get into property development, you must have a very strong mindset. There is an old African proverb, "If there is no enemy within, the enemy outside can do you no harm".

How To Become A Successful Property Developer?

- You must have a Predictable System in place that you can follow, over and over again without thinking.

- You have to be willing to push through your comfort zone.

- You can never allow your “self-doubt” to stop you from achieving what you truly deserve.

- And you need to play the game to win. Are you playing the game to win or are you playing the game, so you don’t lose?

In property development, there are winners and there are losers and then there are people who haven’t learned how to win yet. All they need is the right system, the right course in property development for them to move forward. However, no amount of property development courses can help you, if you don’t have the right mindset.

There is an old African proverb, “if there is no enemy within, the enemy outside can do you no harm”.

So if you know that you have the right mindset, if you think you are ready to take the leap from being a property investor to a property developer, if you think that you are ready to learn the property development process and the strategies involved, then it’s time for you to move forward and take the next step.

This means that you have the first “HOW” of How to get into property development. You start with working on your mind, you spend time listening to audiobooks or mindset programs, whatever rocks your boat and when you are faced with challenges, you push through them, you create a big enough WHY i.e. all the reasons of why you want to get into property development.

How To Find Your First Property Development Project?

I get a lot of emails everyday and from experience I can conclude that the one thing every developer absolutely must master is, their ability to find lucrative property development deals on a consistent basis. This is the number 1 skill that you need in order to stay ahead of the competition.

And if you haven’t got it packaged into a system that you can follow every time, you will either get frustrated, because you will spend numerous hours looking for deals that don’t stack or you will end up paying too much for the site and shoot yourself in the foot.

This is a very important video for anyone starting out in property development and you must pay attention if you would like to become a master at finding deals.

Because Bad Deals = No Profit

3 Major Mistakes Made By Property Developers When Getting Started In Property Development

Property Development Mistake 1:

Following The Heard

Have you ever noticed a newbie say, “Everyone is developing here, so should I”. Or “Everyone is buying here and so should I”. That’s how novice property developers make decisions. It’s the heard mentality and it only works in the short term, only for as long as the property market is in an upward trend. This approach, however does not work over a long period of time or in other words, if you wish to be able to continually keep developing as your source of income, you need to take this to the next level and have a system behind it.

If you don’t have a replicable system behind your systematic property research, you will never know where to start in property development.

Why do you plan on developing in Melbourne, Sydney or Brisbane and why aren’t you developing in Perth, Adelaide and so on. The answer to this question shouldn’t simply be, “because I live here”.

For example, I am from Melbourne, however, my first development was in Brisbane and it was based purely on my market research and nothing else.

You have to dig deep on the macro level, chose the state first, then zoom in further to suburb level, and then finally to street level. Most, novice developers cannot back their answers with market research and facts. And over the years in my property development career, the more I have based my decisions on research and numbers, the more successful my projects have been and the more detached I have been from the projects I undertook. So everything I did during the project contributed straight towards the bottom line of the project.

Property Development Mistake 2:

Listening To Negative Media

The second mistake, novice developers make, when getting into property development, is to listen to negative media. There are two things that you must always remember, 1st only “Bad news sells” – so everyone talks down the property market. 2nd you must not pay attention to the news sites who hire content writers to spin negative stories.

Their job is to amplify the negativity. Because, I assume, you are going to be into property development for a long time, you need to have a property research system that you can fall back on to so you are making decision based on facts not just negative media.

Property Development Mistake 3:

Blindly Believing The Economists

- Have you ever seen a rich Economist? – I haven’t, & I don’t think they even fall in the top 100 disciplines that make people rich.

- Have you seen a rich property developer? I am sure you have and I am pretty sure I have too.

Here are two more articles that I would recommend that you read:

So What Is It That The Property Developer Knows That An Economist Doesn’t?

Property developers know the rules of property development and property economics and take action by following a replicable system of research and property development. They do their research and understand the difference between the demand and supply of various suburbs. They understand the various factors that play a role in determining house prices. They know exactly where to start and they maximise their up side and cover their downside.

To be exact, they have a working knowledge of Property Economics. In a nutshell, they understand that a deal is a deal – no matter where it is, what suburb it is in. If it stacks up, it stacks up.

They understand the important concepts that you need to understand in order to find your first lucrative property development project.

So before you get into property development, here is what you need to get proficient in. Don’t worry, if you don’t know what these are or how they work, check out one of my property development courses to get started in property development.

Property Economics For Property Developers

Property Economics – A working understanding of New Govt Policies, Unemployment Rate, Impact of Interest & inflation rate, population growth, house price index, Australian dollar and the over all state of the economy are essential for any property developer starting out.

Property clock & market cycles – an understanding of property clock and the ability to read signals for Maturity, Decline, Bottom & Recovery

Listening for Signals – The ability to separate the Gossip & the Hype from what exactly is happening in the market, is another important skills every novice starting out in property must understand. Another complimentary skills required to efficiently listen for signals involves, leveraging the internet to hear for side kicks and other important announcements that impact property prices.

Understanding Statistics – new developers do not need to be statisticians to read market signals, but they must understand the 8 most important stats to get the pulse of the market.

Understanding Capital Growth – An understanding of capital growth, how it impacts property prices, how it is related to other forces in the market helps in identifying Suburbs with greatest growth potential. There are 6 important metrics that determine a capital growth trend. An understanding of these metrics will help you with suburb selection.

Demographics - Why do people move and how to find out where are they moving now is a very important insight for any property developer. Understanding, this not only helps developers refine what they are you going to develop, but also determine the expected demand for a certain kind of design. And the ability to forecast demographic movement sets them apart from “wanna be” property developers.

Validating Signals – know all of the above signals is not enough. The ability for novice developers to find proof for market indicators is another important skill that you need to know before starting out in property development.

Auto Alerts – And on top of all of the above, automating the entire process using web and technology will give you an edge over any developer in the market.

Here Is What Is Important For Any Newbie To Get Into Property Development:

- Do not base your development decisions on what every one else is doing. i.e. do not follow the heard.

- Do not listen to negative media.

- Do not blindly believe what the economists say, always do you your own research and find data to determine whether it applies to your particular suburb.

Invest time to understand the following important concepts and develop a property development research system:

- Property Economics

- Property clock & market cycles

- Listening for Market Signals

- Understanding Statistics

- Understanding Capital Growth

- Demographics

- Validate the signals you are getting

- Automate the entire process using web and technology.

Getting started in property development requires a lot of things, Due Diligence is one of the most important skills that you need, when you are embarking on your property development journey.

Following a due diligence system that you can REPLICATE, over and over again.

This article discusses, the Property Development Due Diligence process that you must following when getting started in property development.

Location Analysis

Location Analysis covers more than just the site. It is everything about how your site is located relative to amenities that your prospective buyers perceive as desirable.

Let me explain, for instance, everyone needs to travel for work, so if your site is located near a train station or public transport, it is perceived as desirable by the end buyer. Another example would be, proximity to schools, shopping centres, shopping streets, groceries, infrastructure and various other activity centres desired by investors and or first homebuyers.

Determining the demand and supply in the area is paramount for location analysis. You can do so by contacting the local council’s website to find out the development pipeline.

As a thumb rule, I have always developed projects within a 200m radius of activity centres. In fact, I have filters in place to flag prospective sites that fall in my selection criteria. This leads into a discussion about Supply and Demand.

The more desirable the location of your property development project will be, the higher the demand for the units you can expect. In other words, when getting started in property development you must have the skill to conduct a rock solid location analysis.

Has everything to with the actual site. Making sure that the site is not on a slope is the first thing that I look for in a site. A sloping site for me means more costs in retaining walls, which means lesser profit.

A sloping site may also attract various other costs that you should avoid when starting out in property development. The second thing that I look for in site analysis is the tree(s) on the site. More trees could mean either of three things for me and I like to avoid them as much as I can, if not completely.

Two other important things that I am always wary of are the width of the site and the depth of the site. The reason being that they both directly impact the ability to maximize the site.

Zoning And Overlays

Zoning defines the permitted and prohibited use of land. Zoning determines whether a block of land can have a low, medium or high-density design.

In simpler terms, it stipulates the FAR or Floor area ratio. It is important because it tells us whether we can put townhouses on a block or we are allowed to develop apartments, just increasing the population density on that block of land.

It is imperative for any property developer to find out the zoning for a potential site, as this information forms the basis of calculating a sites’ yield. All financial feasibilities are then based on the yield.

Overlays are mapped within local planning schemes and they provide more information about the land. There are various kinds of overlays, like Design and Development Overlay, Vegetation Protection Overlay, Heritage Overlay etc. if your site falls within an overlay, you will be required to meet other planning requirements for your site.

Highest Best Possible Use

This is all about gathering all the above information first, and then maximising the foot print and the height of your development to accommodate the maximum number of saleable units, apartments or townhouses that meet the planning scheme requirements. This is a vital skill that you must know when getting started in property development.

If you don’t know what how to do this, you must engage and town planner and architect who work together to maximize the land utilisation so you can get the best possible returns.

In my property development course, I discuss various examples of maximising the land so you are not leaving dollars on the table.

Data Collection

Now you may ask why do I need that?

Well, this is so you can determine the end sale value of what you are planning to develop. That value is then used in your financial feasibility to find out whether or not your project works on paper.

This data collection would include collecting sales history within 500m-1km of your site for last six months, it would include the ON SALE data for similar units around your site and it would also include a list of properties that are available for rent around your site to determine what you could rent them for or use the same data in your marketing efforts to show prospective buyers a list of comparable sales in the area.

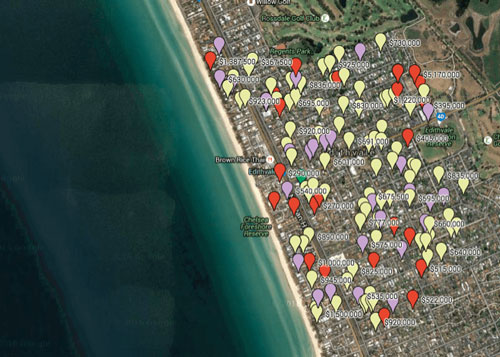

Spatial Analysis

Spatial Analysis is optional, but a solid property development system, would not leave any stone unturned. So I take the extra step to plot all the data that I have collected on a map to figure out where my site is at in relation to the comparable sales around it. This helps me to ascertain visually what I can approximately hope to achieve for my development.

Conduct a property development feasibility using Smart Feasibility Calculator and vet real estate development projects quickly and easily.

I have developed various financial feasibility study calculators to run numbers on my potential property development sites. My financial feasibility applications are included in my property development course. There are two different versions of financial feasibilities that I do for any project.

Preliminary Development Feasibility Assessment

One Minute Financial Feasibility – the above image shows a screenshot of my one-minute feaso or quick feaso. This feaso tells me what I can expect to make for each unit. For example, the above image is from my recent 16 townhouse development. So if you look carefully, I have designed this financial feasibility to quickly tell me what I should be paying for land in order to achieve the Target DM (Development Margin) %. It is so easy to use that even people starting out in property development can use easily; there are only 10 input fields that you may have to fill out to get answers. So as you can see, it is ridiculously simple to run numbers using my financial feasibility applications.

Lead Developer Feasibility Suite – involves a lot more details and helps break down costs further in lot more detail. It also takes in to account the time value of money, for example, the cost of interest is calculated based on the time it is injected into the project rather than a flat per annum rate.

Risk Management

If you are in property development, it is simply unavoidable to have no risk at all. Let me put it this way, there are inherent risks when driving on the road. However, we all take those risks everyday, to the point we don’t even think about the bad the stuff that can happen on the road when leaving our house.

We do that because, we follow a system, we that because we are going to follow rules. Property Development is no different. There are rules and systems to follow at each step to manage risks. In fact, everything that I have discussed in this article is to manage risk, avoid it, minimize it or contain it.

But above all, you must always have an exit strategy from your project at hand. Following is a list of various types of risks that everyone should be aware of when getting started in property development. Not all of them apply to all developments and it is your responsibility as a property developer to identify them and mitigate them for each project. Read more about managing risks in property development.

Decline In Property Values

- Market could take a down turn and the end value of your development may not be the same as in feasibility.

Obtaining Planning Permit

- There is a possibility that the council may

- Decline the planning permit application.

- Add conditions to the planning permit, which may add costs that may not be included in the feasibility study.

Delivery Risk

- There is a risk that cost overruns may exceed the contingency amount or that the builder is bankrupted during the course of construction.

Economic And Political Risks

- In the course of the development, the property developer could be exposed to the direct and indirect consequences of political, economic and social changes in the investment environment.

Legal, Tax And Regulatory Risks

- Legal, tax and regulatory changes in the Australian investment environment, or otherwise, may occur during the investment term which could have adverse effect on the return of the development.

Investment Risks

- Time delays, building disputes, unforeseen litigation, planning and environment controls, loss of sales, competition for similar developments, adverse market conditions are just some of the problems which may confront the project.

Time Delays

- Development approvals, slow decision making by counter parties, complex construction specifications, changes to design briefs, legal issues and other documentation changes may give rise to delays in construction completion, loss of revenue and cost over runs.

- Other time delays that may arise in relation to construction and development include supply of labour, scarcity of construction materials, lower than expected productivity levels, inclement weather conditions, land contamination and unforeseen environmental issues and industrial action that may arise from Occupational Health and Safety issues, which may give rise to difficult site access and industrial relations issues.

- Objections raised by community interest groups, environmental groups and neighbours may also delay the granting of planning approvals or the overall progress of a project.

Design Risk

- There is a risk that design problems or defects may result in rectification or other costs or liabilities which cannot be recovered.

Risk Of Counter Parties

- There is always a risk that, notwithstanding appropriate safeguards, parties with whom you as a developer has dealings with, may experience financial or other difficulties with consequential adverse effects for the relevant project or asset.

Force Majeure Risks

- Acts of terrorism and events of force majeure may affect projects and insurance may not fully cover these risks.

So before you get started in property development, make sure that you understand the Due Diligence process in its entirety. Watch the video above to understand these concepts in detail.

If you would like to learn more and get a better understanding of the complete Due Diligence process, I would highly recommend that you checkout one of my property development courses that can help you get started in property development.

So to conclude this post, here is what is important to get into property development and become a property developer:

- Location Analysis – make sure you understand the suburb that you planning to invest into thoroughly.

- Site Analysis – a thorough analysis on the actual site to make sure that you are not buying a lemon is essential.

- Understanding zonings and overlays is essential to determine the highest best possible use of the site. i.e. determining if you can accommodate the maximum number of units that make you profit on a site is the basis for any financial feasibility.

- Data Collection and Spatial analysis go hand in hand. Gathering and organising data visually that speaks to you about the past sales, rental information and currently on sale properties will help you determine the end value of the units you are planning to develop.

- Risk Mitigation – always have an exit strategy and make sure that you have identified all risks and have a plan for each one of them.