Forecasting cash flow in real estate : 5 things you need to know

All investment decisions depend on forecasting. Every investment must be based on a future outlook because it will result in future earnings returns.

Whether or not cash flow forecasts are used to guide property and finance decisions, successful property investing requires an awareness of the variables that shape real estate market trends, cycles, and structural changes.

Learn the method of forecasting cash flow components for a property investment based on variables like economic expansion, construction cycles. Starting with the underlying economic variables, this considers the projected rent, vacancies, costs, and resale value.

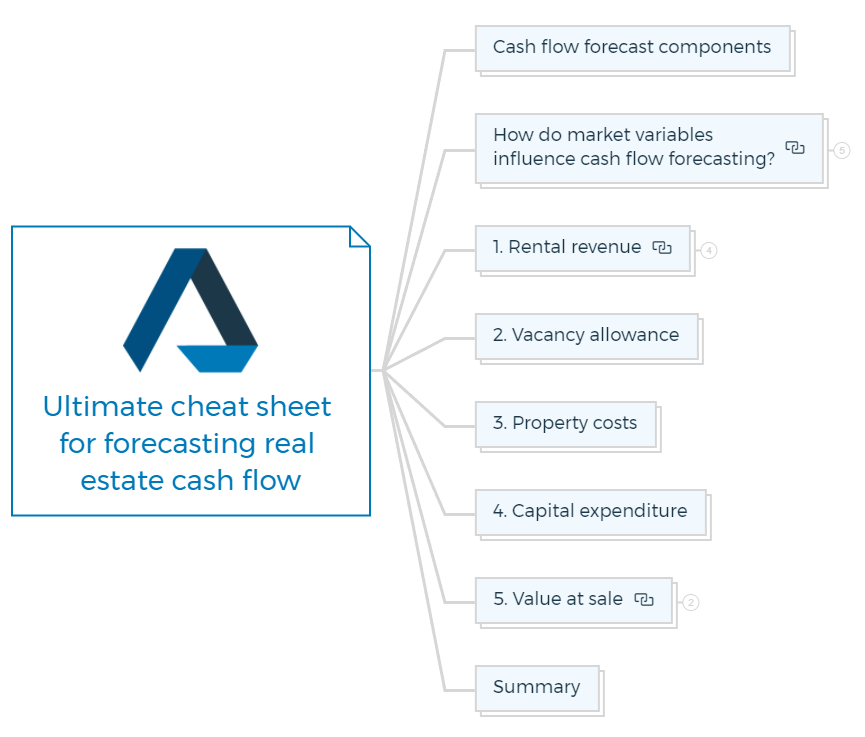

Components of forecasting cash flow

Cash Flow Forecasting is made more accessible by the ease with which short-term changes in variables like rentals, vacancy rates, and time on the market may be linked.

Although many of the specific elements in the cash flow are determined by longer-term background variables, such as predicted inflation rates and the prospects for regional economic growth, forecasting cash flow can be challenging.

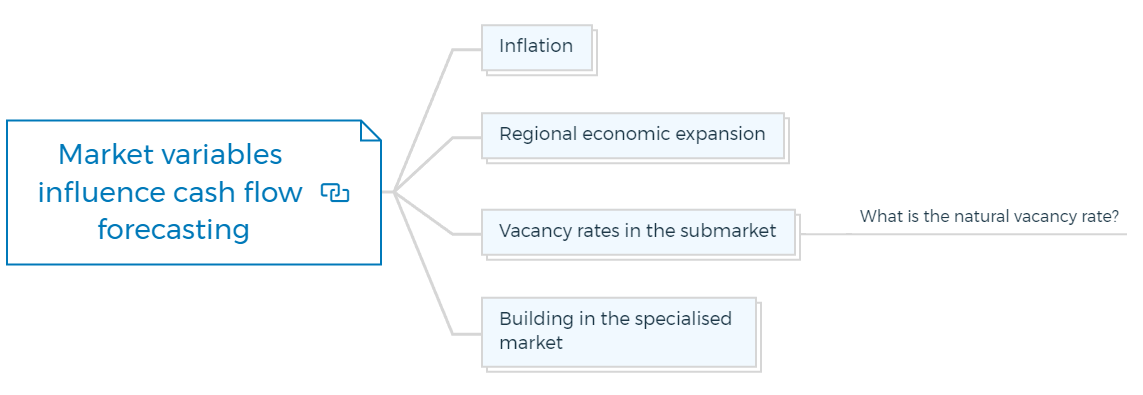

How do market variables influence cash flow forecasting?

Inflation

Before making a cash flow forecast for a specific property, property experts typically need future inflation estimates.

The appraisal of real estate investments is impacted by consumer price inflation in three ways.

- It first affects the discount rate because investors want a higher rate of return to offset inflation.

- Second, investors are aware that most real estate investments don't offer a 100% guarantee against unanticipated inflation; thus, there is a chance that the real return can be lower than anticipated.

- Thirdly, a lot of the factors that affect the probable income stream are influenced by inflation.

Future cash flow forecast assumes a high inflation rate and discounts it at a rate that accounts for a low level of inflation, for instance, is unsound and would overvalue the property.

Similar to this, if a property is thought to be a nearly perfect inflation hedge, estimates for rent and value should be in line with the anticipated inflation of consumer prices, and the inflation risk premium should be minimal.

Cash flow analysis typically cannot move further without a forecast of consumer price inflation during the holding period if it is assumed that there is a long-term relationship between inflation and property rents.

In most cases, professional forecasting bodies' recommendations are followed. Economists may offer predictions in the form of alternatives to those made public by research institutions, banks, or economists.

You can use the difference between the yields on nominal and index-linked Treasury bonds to estimate market expectations in the absence of, or to support, any expert predictions of inflation.

Regional economic expansion

Regional economic expansion is a significant underlying factor affecting rentals, vacancy rates, and property values.

Although it is highly challenging to measure how the state of the economy affects the demand for properties, it is frequently helpful to differentiate between types and regions that will benefit from strong, average, negligible, or no growth, or they are in markets where a decrease is likely.

It necessitates some comprehension of the state's, region's, or city's economic drivers, which can be verified using publicly available statistics. These figures are accessible from the State governments, business organizations, the Australian Bureau of Statistics, and others.

Residential building costs and prices are frequently correlated with economic activity that results in more employment, which encourages immigration.

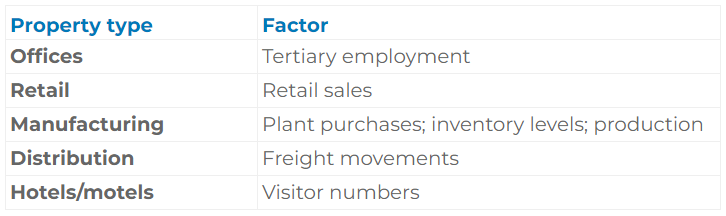

The information in the Table below summarizes factors that are frequently significant background variables for the major categories of non-residential assets.

Most non-residential property demand is impacted by business sentiment in the short term. When business sentiment is terrible, and investor sentiment tends to match the business sentiment, decisions about moving are frequently delayed.

Vacancy rates in the submarket

The percentage of vacant properties among suitable properties is typically the most crucial variable in short-term cash flow forecasts of market rents.

For these short-term cash flow forecasts, it is beneficial to focus on the "submarket" rather than the larger regional or city-wide market when analyzing supply and demand for real estate.

If most prospective tenants or buyers view the property as an alternative, the property is in the same submarket.

The first factor affecting rentals and prices in the submarket is availability and vacancy. However, demand may spread to associated niche markets.

The degree of vacancy is the most accurate short-term indicator of changes in market rents within a submarket. The percentage of vacant properties in the market is referred to as the market vacancy rate.

Because supply in each submarket is essentially set in the short term, landlords can raise asking prices when vacancy is low, and tenants can negotiate lower rents or more enticing lease terms when vacancy is high.

These factors are essentially fixed in the short run. Changes in rental rates are inversely and tightly correlated with current vacancies. Either now or throughout the following quarter. Considering whether the current vacancy rate is higher or lower than the equilibrium or natural vacancy rate can be helpful.

What is the natural vacancy rate?

The natural vacancy rate is the rate at which tenants can discover and move into new spaces without creating shortages or raising rates, but it does not give them enough options to bargain for lower rentals.

The average market vacancy rate over several years, or the vacancy rate while rents were stable, may be used to derive the natural vacancy rate.

Natural vacancy rates in many markets seem to be between 4 and 8%, but if the actual rate is above (below) this equilibrium, it is impossible to predict when and how much rents will increase.

Historic and current vacancy rates are provided for a variety of sites. These are made public by real estate organizations and some real estate brokers. The released data is occasionally not sufficiently broken down to give a complete view of a submarket.

Agents may be looking to lease properties that may become available soon; therefore, the vacancy level may differ from the available space. Tenants may attempt to rent extra space in some markets, particularly those with city offices; this should not be disregarded when determining vacancy.

Many markets record the amount of real estate for lease and sale; these statistics indicate the current supply. Changes in the time it takes to rent or sell a property and the amount of time it spends on the market that sells quickly are early indicators of rising or falling demand.

A decrease in the number of properties up for rent or sale is one indicator that rents or prices are about to increase. In contrast, an increase in the number of properties up for rent or sale or more extended periods on the market indicates that rents or prices are likely to decrease.

Building in the specialized market

Markets create extra space in response to shortages, even while present vacancies are the immediate supply. Buildings now under development will thereby increase supply in the medium term.

A realistic estimation of changes in stock up to the time to build is provided by current vacancy rates paired with information on the buildings that are currently under construction.

Local authorities keep records of the square footage and number of residences or units now under construction in each submarket. Still, these records are frequently only accessible by checking whether each site has received planning approval.

For areas for private non-residential building commencements, aggregate spending figures on government, private, and other construction are given.

Vacancies rise when rival structures are finished but fall when the vacant space is occupied or absorbed. For many non-residential properties, "pre-leasing" of spaces under development is typical, which aids in predicting absorption.

However, absorption forecasts are frequently inaccurate because it is more difficult to track the "back-filling" of any area left vacant when tenants go. Additionally, neither new tenants' requirements nor current tenants' decisions to give up or enlarge their spaces are made public.

We can draw only a broad generalization of future demands and vacancy rates from historical absorption rates. Sites with planning approval can only be used as additional supplies if construction starts.

Almost all planning permissions for single-family homes are promptly followed by construction, which is a reliable sign that the supply of homes will rise within the year. Negotiating planning approvals for non-residential and more significant residential projects can take years, and construction may not start immediately.

The most significant rise in supply in a year or two following the building phase can be suggested by monitoring these approvals, but be untrustworthy. Data on privately approved residential and non-residential construction projects are accessible by state.

Long-term land availability and constraints on building prices will limit supply, but these factors are typically outside of feasible projection periods for commercial properties. In the medium run, house building activity, prices, and rentals are considerably more clearly impacted by land availability and construction costs.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

Forecasting cash flow model's significant elements

1. Rental revenue

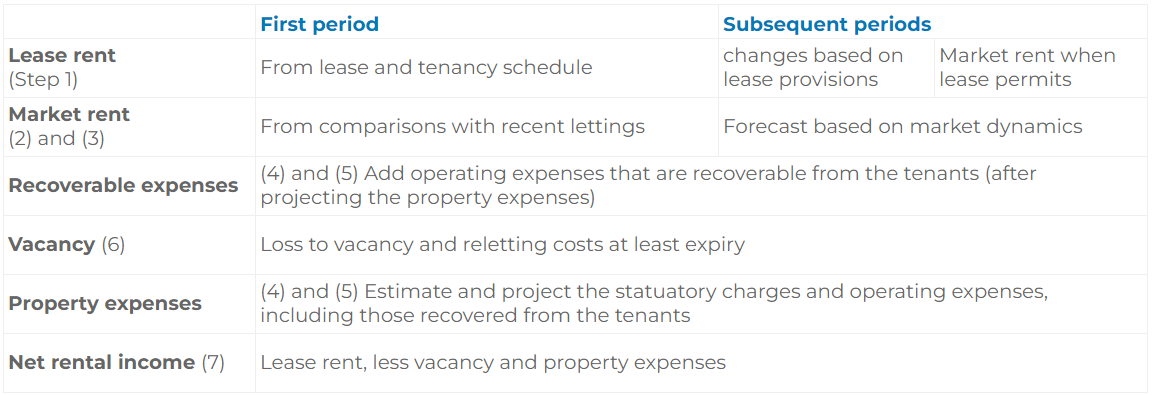

The forecast of net rental revenue is the most crucial element of the cash flow forecasting for income-producing assets or their equity before or after taxes.

How to forecast net rental income for investment properties?

A. A process for predicting rent

- Checking the leases is the first step. To learn how much rent the tenants are currently paying and when and how the leases permit rent changes, request a copy of the managing agent's tenancy schedule. Rent receivable depends on the market level at lease expiration or a market rent review.

- The second step is to determine the current market rent by looking for previous leases for properties that are similar to yours.

- Predicting the expected changes to the market rents is the third phase. These changes determine the "lease rent" or rent due only when the leases permit. It is reasonable and practical to assume that most residences are rented out on six-month leases.

- Finding out the current statutory charges and running expenses, ensuring they are reasonable, and including all anticipated ongoing costs, whether or not they may be recovered from the tenants, constitute the fourth phase.

- Projecting these property expenses throughout the remaining analysis periods is the fifth step.

- The sixth phase estimates vacancy losses, probable bad debts, and re-leasing costs. A percentage of the total rent is typically used to represent the vacancy allowance.

- The seventh and last stage is calculating the present and predicted net rental income.

The gross rent is subtracted from the estimated operating costs and vacancy allowances to determine the net rental income for each analysis period.

B. Calculating the current rental rate

The best way to determine current market rents is to compare them to recent new lettings of similar properties with comparable lease covenants and to the current asking rents for nearby competing properties.

Estimates of the current market rent, however, could not be accurate when there is little documentation of comparable lettings, there are numerous unoccupied properties, or when substantial "leasing incentives" are provided to tenants.

Some examples of leasing incentives or inducements include rent-free periods, financial assistance with the expenditures of the tenant's interior design, or the option to break an existing lease.

Modest inducements are the standard in most of Australia's commercial and industrial markets but vary depending on the level of demand. These are frequently stated as a certain number of months with no rent for each contract year.

The rent payable, which is the rent stated in the lease or "face" rent, may be significantly higher than the "effective" rent in those markets where leasing incentives are given to tenants to entice them to sign leases.

Until the rent review, the effective rent is a consistent recurring payment equal to the face rent, less any concessions made to the tenant.

When the rent payable exceeds the effective rent, the analyst must exercise extra caution when predicting how the rent will change at mid-term rent reviews and the end of the lease.

If the lease contains an "upwards only" or "ratchet" clause, the present rent due may be the minimum at a mid-term rent review; however, if market rents are not anticipated to have grown to the face rent by the time the lease ends, the rent due may decrease.

C. Projection of market rents

Knowing the current state of the submarket, impending changes, notably in the supply of competing properties, and more general regional or national trends are necessary for forecasting the rent over the holding period.

A timeline of the submarket's historical rental growth pattern is an excellent place to start, ideally with an explanation of the variations.

Several real estate agencies compile and publish time series of rents in numerous non-residential property markets. In their property market outlooks, you can also find them on some banks' websites.

The Real Estate Institutes in each State compile and publish median residential rentals for suburbs and regional cities.

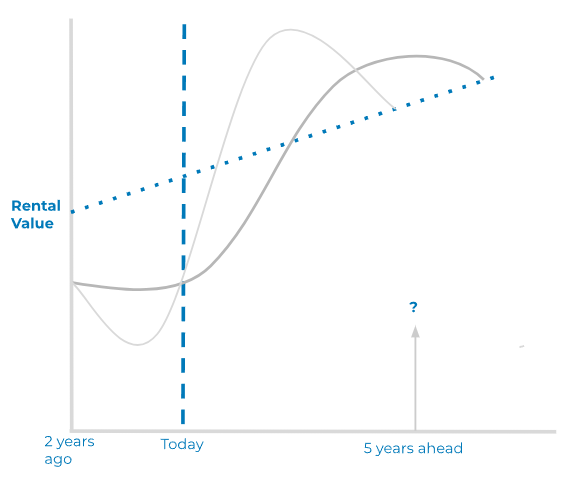

If the rents are graphed, the general effects of one or more cycles in the rental growth rates should be seen. In many commercial markets, recent cycles have been characterized by shorter periods of stagnant rent increase, followed by one or two years of exponential expansion.

The cycles may coincide with cyclical patterns in regional economic expansion or construction volume, indicating the stage of the cycle the market is in. The historical trends might point to a general trend in the rental growth rates during the holding term.

As shown in the diagram below, the prediction of the rental value for a five-year holding period is significantly impacted by various opinions about the length and severity of the present cycle.

The thin and thick lines show two different interpretations of recent rental data. It would be helpful to have more historical data, including entire cycles; however, each market cycle may differ in duration and vigor.

As the diagram shows, it might be challenging to spot the turning points in rental growth, even though doing so is essential for accurate cash flow forecasting.

Estimating the submarket's vacancy levels over the first two or three years of the analysis can be used to foretell future changes in rent. In most markets, current vacancy numbers are either publicized or can be inferred.

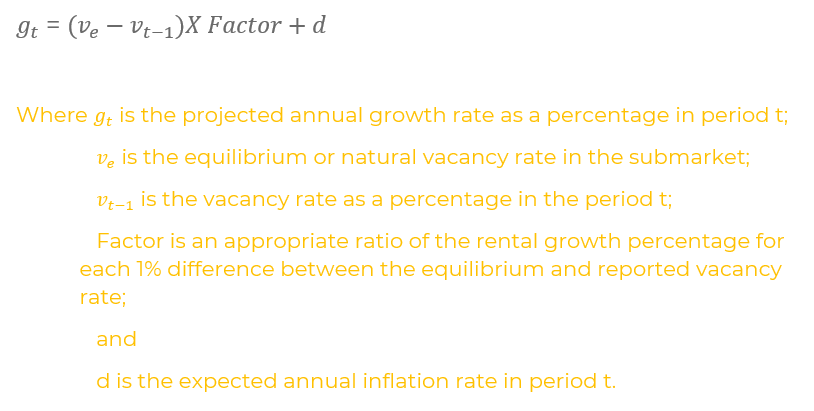

You can project future vacancy levels based on planned absorption and the completion of new buildings. You can use a mathematical relationship to illustrate the inverse relationship between vacancy and rental increase.

Suppose past data from the submarket indicates that rental growth above the inflation rate only happens when vacancy is below an equilibrium level in the previous period. In that case, this may be useful for rent forecasting.

The difference between the present and equilibrium vacancy rates, maybe more significant or less than the percentage rate of rental increase. The factor assumes a linear link between rental growth and vacancy in the prior period in this equation, which may not be suitable in many submarkets.

The relationship between the vacancy level's impact and rental growth rate may be linear or have a longer lag.

The relationship between rents and vacancy levels may not yield accurate longer-term estimates since vacancy rates cannot be accurately projected much farther than the time it takes to build buildings in the submarket.

In the future, rental growth may be predicted using historical long-term average yearly growth rates, which have been modified to account for the cycle's position and anticipated medium-term regional economic growth and inflation rates.

2. Vacancy allowance

The cash flow analysis's vacancy allowance must align with the building's recent performance and the present and anticipated market vacancy rates. The holding period's vacancy factor should also be connected to lease expirations.

If the renter may not renew their lease, a period without rent may be permitted for a property with a single tenant or a few tenants under lease for several years.

Adopting an annual overall vacancy percentage is more practicable for buildings with many tenants or short-term leases. Each set of tenants, such as retail categories or tertiary employment types, might be segmented with a vacancy rate.

The analyst must decide if current tenants will likely renew leases that expire during the analysis period and determine how much it will cost to recruit new renters. It must be in line with anticipated shifts in the market's vacancy rate and the nature of the tenants' enterprises.

A departing tenant may cause a lengthy vacancy for specialized properties, possibly lasting several years.

The cost of any leasing incentives that will need to be provided to tenants to persuade them to sign new leases should be added to the original outlay if a portion of the building is vacant at the time of analysis.

The costs of finding new tenants should be recognized in the cash flows if there is expected to be a vacancy during the study period. The analyst can either utilize anticipated "effective rents" for cash flows after leases expire or estimate the cost of leasing incentives after vacancies.

Operating costs must typically be paid during rent-free times under net leases, whereas these expenses are covered by the landlord when the property is vacant. Which is anticipated should be made evident by the cash flow assumptions.

For numerous residential units with lease renewals every six to twelve months, the gross rental income is often reduced by the percentage of vacant units as if they were completely leased.

The vacancy rate reflects sporadic bad debts and brief tenancy gaps, which could be several weeks or longer if there are too many units. It could have a fixed proportion throughout the research, or it might alter to account for anticipated changes in the market.

3. Property costs

The current statutory charges, operational expenses, and those from recent years are typically available for a property being offered for sale. It's essential to frequently ensure that claimed costs haven't been overstated or that repairs haven't piled up because the present owner planned to sell.

Suppose the vendor has declared an unusually high level of running expenses. In that case, it should be evident by comparing the property expenses of similar properties, both as a unit cost and as an expense ratio.

Although renters reimburse property costs under net leases, rises in property costs can only be automatically passed on to tenants in the short term. Tenants evaluate total occupancy costs during market rate reviews and lease renewals.

Those properties with more significant than average expenses may appear less desirable, limiting the net rent that can be realized. By projecting both net rentals and property expenses, it may be possible to determine whether the analyzed property may become more expensive to occupy than neighboring comparable properties.

While it is appropriate for the ratio to fall during cyclical upswings in the market and to grow during troughs, a cash flow forecast that suggests a declining expense ratio should be examined.

Operating expenses might be anticipated to rise in line with the change in the CPI if there are no signs to the contrary. It may be a sound basis for estimating property costs in the long run but in the short to medium term.

(i) statutory expenses are linked to rent levels and subject to political influences.

(ii) most operating expenses, such as building repairs and plant servicing, tend to rise as the building ages.

(iii) other operating expenses, like management fees, are linked to rent levels.

4. Capital expenditure

There may be a requirement for capital expenditures throughout the analysis period, such as the replacement or significant overhaul of structural, interior, and plant components.

Although some operations may straddle capital and continuing spending, this can be distinguished from routine maintenance and service.

Although both are cash outflows, the distinction is essential for tax purposes and to achieve recovery from tenants. Engineers' reports on the structure and building services are ordered as part of the "due diligence" procedure when institutional investors and property funds purchase real estate.

These reports typically include a list of the probable works, their estimated cost, and the anticipated deadlines for each item. The cash flow analysis can include these projections.

The analyst may need to make tough estimates regarding the timing and magnitude of future expenses for subsequent acquisitions. The Australian Tax Office's Schedule's Effective Lifetimes of Plant and Equipment indicates average usable lives.

If capital improvements are not made, obsolescence may advance to a point where finding or keeping tenants is challenging. Lower rent and more vacancies should be displayed in the cash flow analysis if the capital expenditure is not included. This alternative, which carries more significant risk and potential reward, can be modeled.

5. Value at sale

You have two options for estimating the property's resale value:

(i) The (percentage) change in value between the time of purchase and selling.

(ii) Discounting the projected income from the resale date can be used to determine the property's resale price.

Checking that the two ways provide a consistent resale price is often worthwhile, as is being able to justify why one strategy should be rejected.

Variation in value

Price indices, available in Australia for premium commercial properties, homes, and other types of residences in the major cities, are typically used to make forecasts based on the historical pattern of price fluctuations in the submarket.

Forecasting analysts should be mindful that the process used to create the indices may impact the reported price changes over time. The majority of indices and published averages neglect both the obsolescence of specific properties and changes in the quality of the properties sold throughout each period.

Forecasts for residential properties should take pent-up demand that could not be supplied by limited land availability into account and changes in household formation, such as when immigration grows or falls.

Cash flow forecasts should consider that affordability, typical loan payments as a percentage of average wages, could eventually cap price growth. However, it could not do so for several years.

Capitalized value at resale

The alternate strategy of discounting rental income after sales is more common for properties that generate income. A later buyer's perspective is used to determine the resale value of income-producing property and the value of the anticipated income stream following the resale.

The first period following expected resale starts discounting income. It is typically understood as capitalizing the net income in Australia immediately after the following resale at a rate modified from the present capitalisation rate.

For the sake of simplicity, the resale value may be predicated on an initial yield, which is a capitalisation rate that ignores reversions. The current capitalisation rate, capital market cycles, and obsolescence have a significant role in choosing an optimal capitalisation rate.

You can estimate the resale capitalisation rates from the existing rate for the property and how far the capital market cycle may have advanced because capitalisation rates fluctuate as capital markets go through their cycles.

Capitalisation rates typically drop when money is easily accessible, and investors are confident because they expect rents and values to rise quickly and are content with lower risk premiums.

When capital is scarce, borrowing money is more complex, interest rates on securities go up, and rental growth and the local economy are likely to decrease. The result is a rise in capitalisation rates.

Renewing or renovating the building also shortens its lifespan. Therefore, it is wise to capitalize the revenue anticipated after resale at a higher rate than the existing capitalisation rate, excluding the impacts of cycles.

It is essential to ensure that the capitalisation rate at the time of sale is compatible with anticipated market yields, even if the resale price and rental income are projected independently.

Summary

Successful property investment requires understanding real estate market patterns, structural changes, cycles, and short-term moves. Construction cycles, business cycles, consumer price inflation, and obsolescence affect long-term property market activity and returns. Capital markets provide finance for property investment and development; capital availability swings affect prices and sales volume.

Before forecasting cash flow of a property, it's vital to forecast inflation, economic growth, and vacancy rates. Inflation and interest rate estimates might depend on economists' and bankers' judgments or market expectations.

Get the green light for your next property development project with Property Development Feasibility Study Bundle.

FAQs