Property finance and home loans for property investors and first home buyers.

Understanding property finance and investment basics

Did you know 57% of Australians generate wealth using property as their vehicle? If you own a property, you are already among the top 57% & I applaud your accomplishment. Question now is, how do you go from where you are to a more FINANCIALLY FREE position where you are not doing any property investing mistakes. The answer lies in your property finance and investment strategy.

Simply purchasing a property without thinking will not generate wealth for you, at least not at a scale you are expecting. Over the long term, however, depending upon where you purchase the property, you may be slightly better off.

However, if you’ve purchased property without thinking, without having a well thought over property investment finance strategy, you will get caught out eventually and make financial mistakes.

If your portfolio does show growth & if your bank cross collateralised your investment properties, your bank will after a while start calling the shots on what you can or cannot purchase.

On the other hand if property investors have the right finance for your property, your investment property will out perform various other forms of investments. Let me explain:

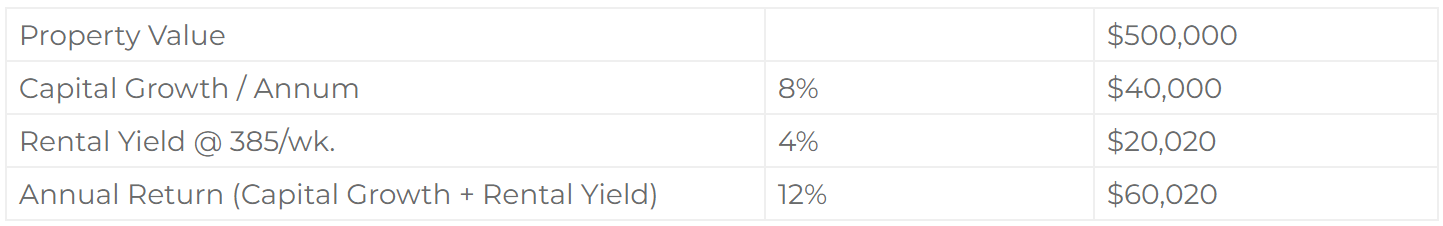

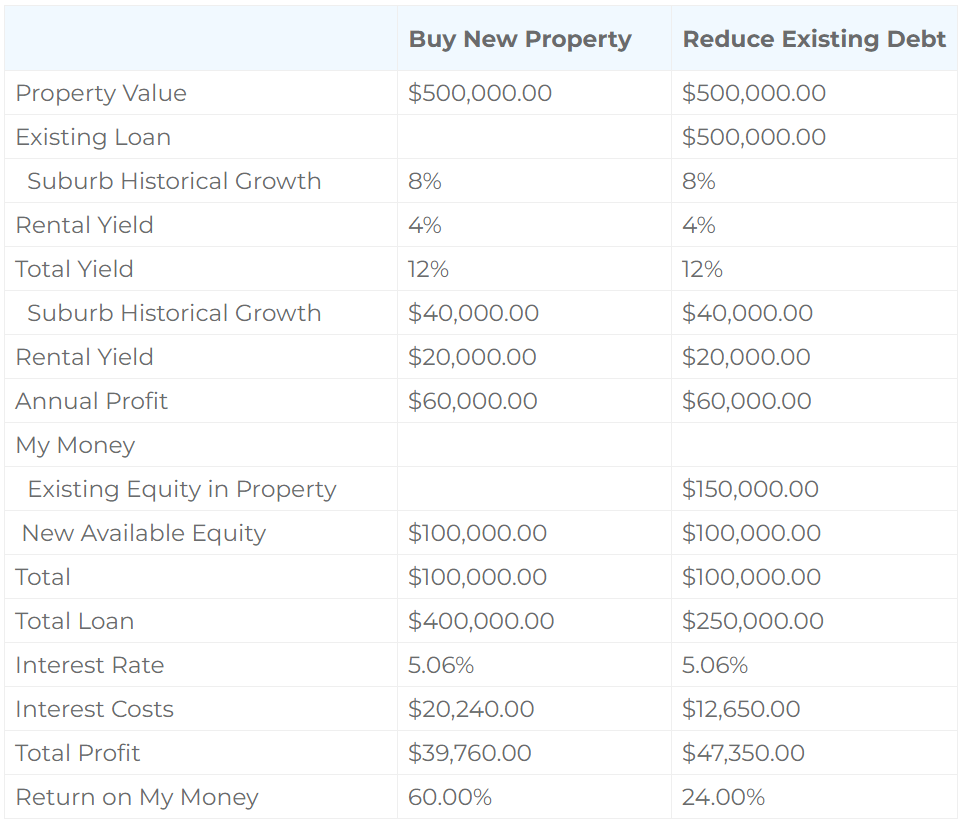

Let’s say the value of your investment property is $500,000 & the area you have purchased the property shows an annual capital growth of 8%. Post settlement, you plan on renting the property for $385/wk., which would give you a yield of 4% approx., which in-turn gives you an annual return of 12%.

See table below:

Since you are an astute investor, this is only the beginning of your journey. There will be high chances to make financial mistakes. Here is how it will unfold if you have a well thought out property finance and investment strategy in place.

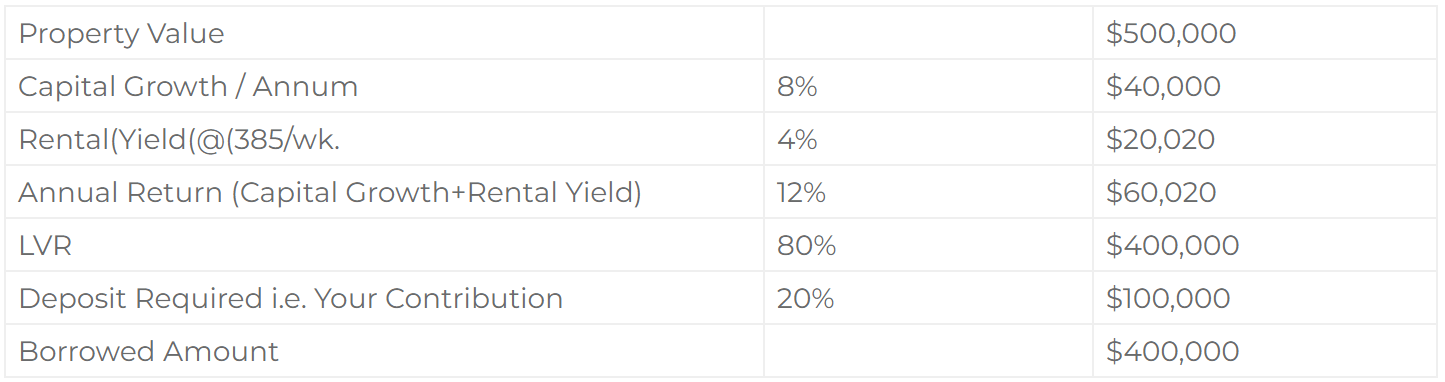

Banks usually can lend up to 80% of your property’s valuation, in other words LVR on a brick and mortar investment is 80%. Therefore, you only need 20% i.e. $100K of $500K to purchase that property.

Let’s continue with the table above.

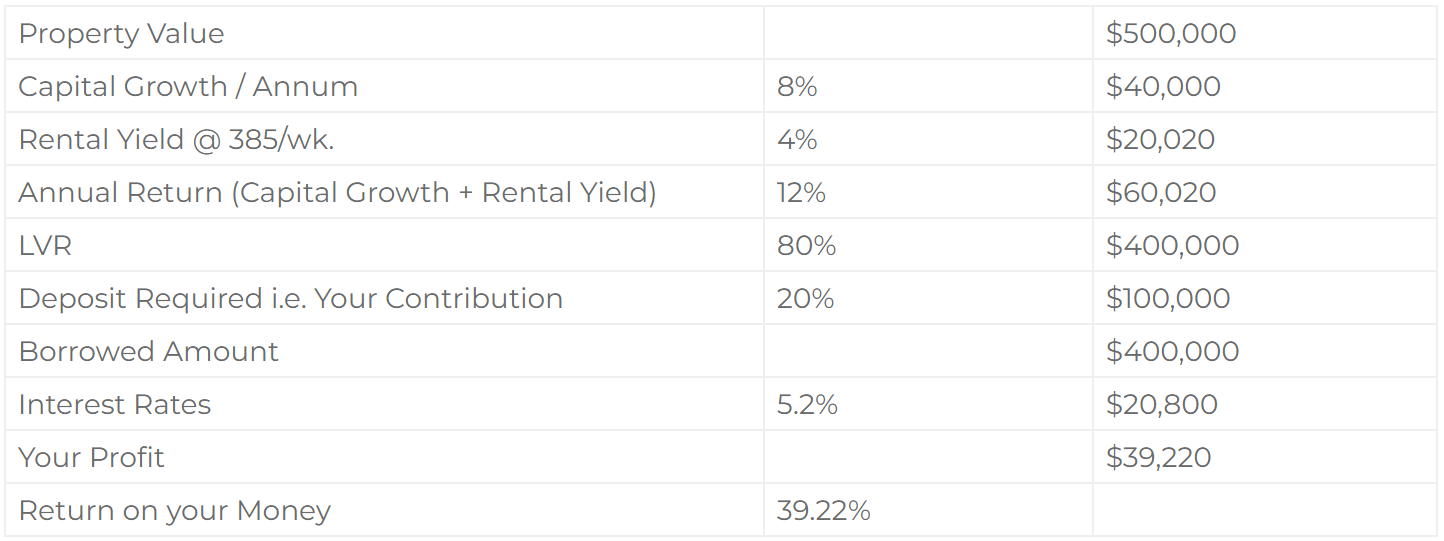

Your return on equity or the return on your money is 60%. You had only invested $100K & at the end of the year you generated $60K. This is where property investment outshines any other investment because of the way a property can be financed and leveraged over a long term.

This is what makes residential property a great investment. You would argue, what about the interest rates?

Let’s continue with the example above.

The fact that banks can lend 80% of the value of your property, enables you to leverage off bank money and achieve a greater return on your money. This allows you to grow your portfolio exponentially over time and create a substantial property portfolio.

Financial mistake 1: Not understanding why loan structuring determines the future growth of your property portfolio.

Most property investors spend time formulating an investment strategy to keep away from financial property investor mistakes. However, very few have a property investment finance strategy in place that allows them to reach their investment goals.

Your ability to get a loan that is flexible & that you have property finance buffers in place to carry you through rough waters in the event that you hit them is what matters the most.

Overtime, your circumstances and your needs would change & having a flexible loan can be the difference between slow and exponential growth of your property portfolio. So make sure that when you start you have a sound financial structure in place that lets you call the shots and not your lender.

To make sure that you continue growing your property portfolio, it is imperative that you understand loan structuring, so you can control & determine your future yourself.

Banks and all lenders are proficient at using ‘cross-collateralisation’ of loans. Cross-Collateralisation occurs when more than one property is used to secure a loan or multiple loans.

It is the practice of lenders using a property (whether owner occupied or investment) as security for other property that a borrower wishes to purchase. In other words if a borrower owns one property and is borrowing to purchase another property then the lender may take security over both properties.

The lenders argue that they are protecting their security position so that should a borrower have problems with one mortgage the lender can cover their own position by the additional security.

Some argue that in some instances this will over-secure the lender's position and that a borrower should not agree to it unless there is no other alternative. They argue that it can limit a client’s borrowing capacity, security position and limit investment opportunities.

Example:

Clients have a property with a value of $500,000 and have a mortgage on that property of $150,000. The clients could conceivably borrow an additional $250,000 and purchase an additional property with that borrowing and the LVR on the existing property for total borrowings would not exceed 80%.

However, the lender is likely to request that the two properties be cross-collateralized as the lender wishes to strengthen their security position.

The reason banks do that is to over secure themselves & would often lure clients by offering them lowered or no extra fees or a better interest rate. Novice property investors fall in this trap for short-term benefits without realizing that cross-collateralisation inevitably reduces the stability and flexibility of their property portfolio.

Cross-Collateralization = Giving Banks Too Much Power

Are your loans ‘stand-alone’ or are they ‘cross-collateralised’? Many property investors and business owners believe that their loans are standalone when in fact they are ‘crossed’ with other properties.

Recently, I came across a client from Brisbane, who had a huge amount of equity in their Owner Occupier home or PPR (primary place of residence) & a line of credit against it.

They found a positive property on rent in a 6 year lease giving them $900/wk. When they went to their bank to get finance for the next investment property, the bank tied everything up together and cross-collateralised both their properties.

If they had come to me earlier, I would have got their investment property financed from a different lender thus keeping both loans separate giving them far greater flexibility.

Cross-collateralising is a very common practice that the banks use to OVER PROTECT THEIR INTEREST. In fact I would estimate that around 95% of residential property investors have their loans and properties cross-collateralised.

“Cross-Collateralisation inherently only benefits the bank, not the borrower. Getting out of this growth hindering structure can be an expensive affair and can cause the investor to miss opportunities. Once the bank cross collateralized your portfolio, they call the shots.

In other words, banks will control the growth and the speed of your wealth generation.”

Enrol for my 1-On-1 property development mentoring program and I won’t let you perform any mistake in your development and investment journey.

Financial mistake 2: Property investors think that bank is your friend.

Banks are in business too, they are not your friend, they have shareholders and they need to make money from you. They may act like they are your friends and you may also get caught out in the LOYALTY TRAP with them, however, you are simply an opportunity for them.

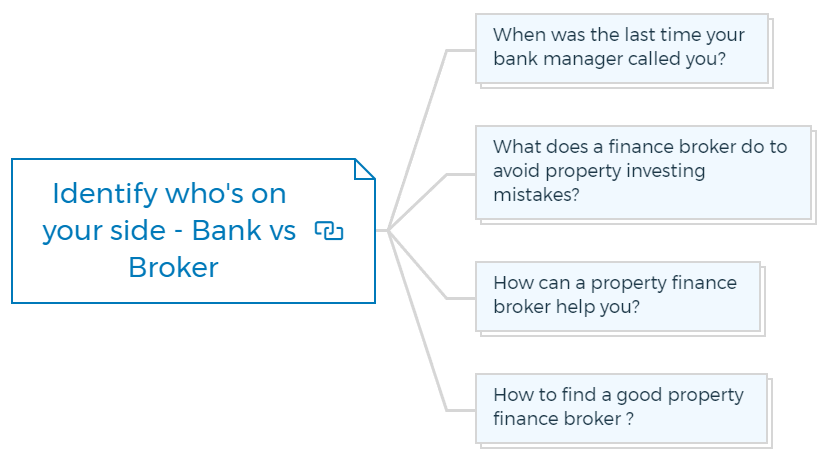

If your argument is that you get service from your bank, ask yourself or an experienced property investor this question.

When was the last time your bank manager called you?

If you can remember the last time your bank manager called you, it means that you are a high profit center client for the bank. If you are, try buying another investment property, without the bank cross collateralising it from you.

That is why it is imperative to have a good property finance broker on your team. An Investment savvy-mortgage broker will help you navigate the rough seas of potential lenders and plethora of lending products, saving you time, money, headache and even heartache.

What does a finance broker do to avoid property investing mistakes?

These days the lending process is less personal, more stringent and a lot more complicated. With literally hundreds of loan products available & the ever changing lending criteria, many property investors are overwhelmed by even the thought of getting a loan. A property finance broker acts as a medium between the lender and the borrower.

A finance broker’s job is to provide their clients with the best credit advice on the various options they have available and negotiate loan deals on behalf of their clients with various lenders.

As part of their continuous professional development requirements, property finance brokers by law are required to keep themselves updated on new rules and regulations. They have the latest information on a wide range of loans and through their industry software and can compare various loans to work out which product suits your situation better than others.

They represent you and shield you from banks, thus reducing your anxiety. The best part is that they get paid from the bank only when you get your loan. So it is in their best interest to make sure that your loan application is successful.

Different lenders have different criteria's for assessing loan application. These inhouse policies are not public knowledge, however, a good finance broker can save you a lot of time by only going to a lender who’s lending policies match your particular situation.

Your finance broker can also help you structure your loan portfolio so you can achieve the best leverage of the equity in your portfolio i.e. help you maximize your borrowing capacity & your ability to leverage off more properties.

How can a property finance broker help you?

1. Intimidated by paper work? - Let your broker handle all the paperwork. It’s in fact a better option, as a broker knows the lender’s requirements & your application is handled more swiftly.

2. Access to numerous lenders, a myriad of loan products and an in-depth knowledge and understanding of various finance packages.

3. When was the last time your bank manager called you? - Exactly my point. A broker can give you a very personalised service second to none, which your bank manager will never be able to provide, unless of course you are a multimillionaire.

4. A property finance broker will spend the time to understand your personal requirements & your long term goals, to determine which loan product from which lender would best suit your needs.

5. If you are an entrepreneur, in other words, you control your pay-check and don’t have a 9-to-5 job, having a credit advisor can help you catapult to property success.

6. Time - your broker can save you a lot of time and practically eliminate your legwork all together. This means that you can also access lesser known lenders and products which are not known to the general public.

7. Credit and General Advice - your finance broker, particularly, if they are an investor/developer themselves will provide you good advice all throughout your life, in terms of refinancing and the best way forward for your property portfolio.

How To Find A Good Property Finance Broker ?

There are brokers and there are property investors. While all of them can write loans, very few of them understand the intricacies of property investment, property development, construction and development finance, various tax structures and the pros and cons of each one of them.

Before you select a broker, you should determine whether or not they have an investment portfolio themselves or not. Do they have experience in settling on a property themselves? Have they done it before?

“To make sure that you never hit a finance snag in your wealth creation journey, you must have a property investment savvy finance and mortgage broker on your side.”

Financial mistake 3: Thinking that you need to sell your property to make a profit.

Contrary to what most property investors think, you don’t need to sell your property to make a profit.

According to the Australian taxation system, you as an investor do not have to pay tax on the increased value of your property i.e. the capital gain. However, if you sell the property you will need to pay capital gains tax.

Capital gain / loss = Cost of Acquisition - Sale Value of the Asset.

CGT is part of your income tax and is not considered a separate tax, although it is generally referred to as capital gains tax (CGT). If you make a capital loss, you cannot claim it against income but you can use it to reduce a capital gain in the same income year.

You can generally carry the loss forward and deduct it against capital gains in future years.

Some of your main personal assets are exempt from CGT, including your home, car, and most personal use assets, such as furniture. CGT also doesn’t apply to depreciating assets used solely for taxable purposes, such as business equipment or fittings in a rental property. If you’re an Australian resident, CGT applies to your assets anywhere in the world.

However, if you bought an investment property for long term holding & you’ve kept it for 12 months, you only have to pay CGT on 50% of the total capital gain.

Selling costs

Every time a property is sold, following costs are triggered:

- Income Tax or CGT

- Selling Costs

- Finance Costs

- Stamp Duty and Legal costs, if you purchase another property.

After paying these costs, there is hardly anything left and all your profit has just gone in paying fees and taxes. A smarter investor makes sure that they do not need to sell the existing property in order to purchase another one.

The smarter option is to refinance the property & draw out the cash against the increase in equity from the existing property.

So for example, your investment property has enjoyed a capital gain of $200,000, you should be approaching your finance broker to get an equity release loan. At any given time, you should make sure that your loan LVR is 80% of the current value of your property.

That way, you can continue reinvesting your capital gains rather than selling and incurring various costs.

Financial mistake 4: Getting the rug pulled from under you.

Banks will never tell you or property investors that they will only lend you a limited amount of money before they start considering you as a HIGH RISK, at which point they will start putting brakes on your borrowing capacity.

The concept called threshold

Threshold is a bank's internal risk rating that transforms you from being the best customer to someone they do not wish to see anymore. Sometimes, even when you can service the loan, the bank will view you as a high risk investor. This could be because your property portfolio has more negatively geared properties.

The solution to this problem and to make sure that your lenders do not start viewing it as high risk, you need to either invest in positive cash flow properties or you need to seriously start manufacturing some equity in your properties yourself.

Property Development is my favourite long term, sustainable equity manufacturing strategy, that I personally use to generate wealth.

A lot of people will acquire a negatively geared property, as it is easy to acquire and most of us have grown with the negative gearing concept.

Negative Gearing is when the rental income from your investment property does not cover your property expenses, like interest payment, agent’s commission, property upkeep etc. This shortfall, after all deductions including all your interest payments, can come off your rental income & can also be offset against your other sources of income including your wages.

In order to become an astute investor, you need to have at least neutrally geared properties, if you wish to continually grow your wealth.

In order to avoid hitting the financial brick wall and to prevent the rug from being pulled from under you, you need to make sure that your portfolio to the very least is neutrally geared i.e. you are generating wealth, but you are not paying anything for it.

CAUTION:

Negative gearing inherently only kicks in when you make a loss, even though some of that loss is offset against your taxable income, it is still a loss. This loss can only be recouped if you either manufacture equity in your property or your property enjoys some capital gains. Hence, the more negatively geared properties you have in your portfolio, the more wary the bank gets to lend you more money. Eventually, it will start tightening up the reins.

Financial mistake 5: Thinking that high credit card limit is good.

Credit cards are toxic.

If you were to walk down the street, you would hardly come across anyone who does not have a credit card. Although convenient, in streamlining everyday expenses, credit cards can really limit your borrowing capacity.

RBA (Reserve Bank of Australia) estimates that all of us have a debt of $3250, but for some it may be a lot more. These days credit card debts have a serious impact on our borrowing capacities. Credit cards are unsecured personal debts, and unsecured debts can be the sticking point between getting a loan or your application being declined.

A credit card debt of just $5000 can have an impact of reducing your borrowing capacity by up to $25000. So if you have a $15000 credit card debt, you just wiped $75000 from your borrowing capacity.

Even if you owe nothing on your credit card, for a limit of $10000, the lender will consider $3600 per annum as your outgoings, further reducing your borrowing capacity.

Yes, credit cards are very handy and are embedded in our lives, however, you should consider getting a lower limit or only as much limit as you need and use it wisely. If you are making monthly repayments on your credit card, that means you are not in complete financial control.

You should consider paying off all your credit cards and get a visa debit card instead. This will not only keep a check on your spending habits, it will also save you money on the interest payments on the loan.

Financial Mistake 6: Having Your Financial Eggs In One Basket Is Convenient, Not Conducive To Your Finance Strategy.

In my day to day dealings with clients, I come across many property investors and other borrowers who think that keeping all their accounts, business accounts, personal savings accounts, credit cards etc. with one bank is a good thing.

They boast of lower fees or no fees facilities from their bank, which they think has been given to them as a sign of honouring a loyal customer. They somehow feel that they are privileged as the bank has granted them these facilities.

What every astute investor must remember is that the bank is watching your every move, your spending habits, your repayment habits, whether you make any extra payments and whether or not you have control over your finances.

The bank notices if your credit cards are paid and squared at the end of each month or are you making minimum payments.

Bank knows what you are making each month & it can infer if you are a saver or a spender. In fact it even knows where you shop for your groceries and where you stop every now and then to have a beer.

Let’s say, you lose your job and decide to only make the minimum payments on your credit card this month, instead of paying it in full like you usually do. You also have a mortgage with the same bank, so in order to survive the no-job period, you decide to make only the interest payments.

Unfortunately, you are unable to find another job for a long period and are now living off on your reserve. The bank notices that your savings account is dwindling & that you are not paying as much on your bills as you used to.

Always remember that the clauses on your mortgage agreement are in the favour of your bank, not you. So at any time, should the bank feel that you are becoming a high risk client & you miss a payment, however small that payment is, the bank can decide to call on any one or all of the loans with that particular bank.

At that time it doesn’t matter if you have missed a payment on your credit card, the bank may still call on your home loan and force you to either reduce your debt or pull the rug from under your feet.

In a nutshell, because that one bank you were so loyal to, knows about your entire financial position, you are totally at the mercy of that bank. And if you become nervous about your financial situation, it could sink you overnight.

Don’t have all your eggs in one basket

In other words, choose a bank for best internet banking, then choose another bank for the best savings account, then another one for your credit card etc. Spread all your accounts across various banks, so at any given time not one bank knows about all your incoming income and outgoing expenses.

I am in no way trying to hide anything from the bank. If the bank wishes, it can go looking for these details & can very easily find them out, but the bank that has your investment property loan, shouldn’t know that you stop at XYZ pub for a few beers every Friday night or that you shop at Target every month.

This is only to make sure that we do not reveal our spending habits to the banks. This ambiguity gives you power over whether a storm or a low period in your life, without the bank getting unnecessarily worried about it.

Financial mistake 7: Not conducting a thorough financial feasibility to avoid occurring a financial mistake.

If you are serious about property finance and property investment, you have to get in the habit of crunching numbers on your investment purchase by taking the help of expert property investors.

A financial feasibility gives you a thorough understanding of all costs involved. It allows you to work out whether your investment will be negatively geared, positively geared or will it be neutral when you settle on it.

Property investors must fully understand how to calculate the yield on your investment.

Let’s look at some financial costs that are involved in acquiring a property.

Acquisition costs

- Establishment Fees or Application fees

- Deposit

- Any renovation costs

- Buyer’s agent fees

- Building and pest inspections

- Legals (conveyance fees)

- Stamp Duty

Loan costs

- Establishment Fees or Application fees

- LMI - Lender Mortgage Insurance (only if you are borrowing > 80% LVR)

- Mortgagee’s Legal Fees

- Mortgage Registration

- Title Registration

Ongoing costs

- Council Rates

- Interest repayments

- Landlord Insurance

- Repairs and Maintenance

- Body Corporate Fees

- Property management fees

- Letting Fees

If you do not include all these costs, chances are that you will get an incorrect yield, which will lead you to make a wrong decision. If you spend any amount towards the purchase or upkeep of the property, it should give you a yield.

It is important that property investors use software like PIA (Property Investment Analysis), to get a thorough understanding about your next investment property purchase.

Mastermind Your First (Or Next)

Development With Industry Frameworks

Uncover "Secret Frameworks" That

Almost Nobody Knows About

That once in your hands can take ANYONE from a total newbie

to an astute property developer practically overnight...

Financial Mistake 8: Not Knowing What To Look For In An Investment Loan.

Most people when considering a home loan or an investment loan, only look at one factor, INTEREST RATES. They get blinded by all the other factors and their long term objective of acquiring investment properties to begin with.

They are not to be blamed for this. It’s just that psychologically as human beings we are trained to look for cheaper alternatives for the same value. And advertisers and lenders know that. Therefore, the media is always talking about cheaper interest rates and interest free periods to use as their main point of distinction.

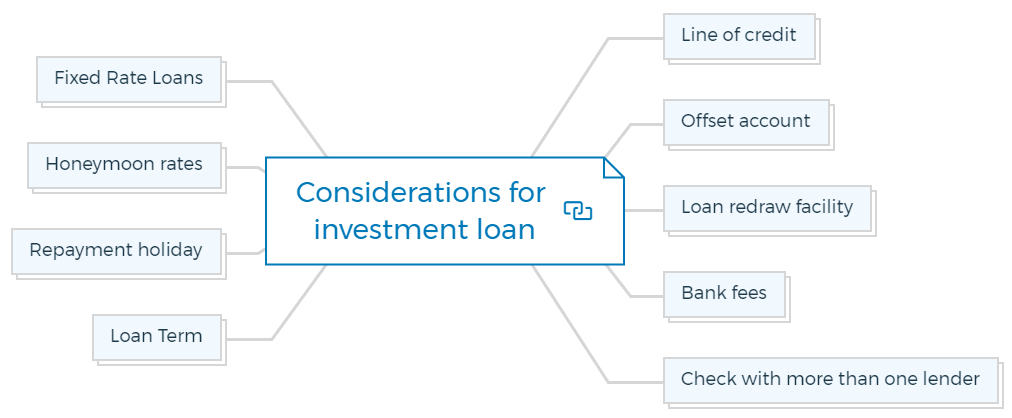

Considerations for investment loan

Property investors should consider the following features in a loan:

Line of credit

A line of credit is like having an overdraft facility which is secured by equity in your property. Interest rates on a line of credit are similar to any other loan facility that offers a variable rate. The limit depends on the equity that can be accessed in your home, which enables the LOC to have greater limits.

A good feature of Line of Credit is that you pay interest only on the amount you draw down from the entire line of credit. It is always good to have a line of credit, that way if an opportunity flies past, you are ready to cease it.

In some facilities you can also capitalise the interest, which means that you may not even pay interest at all, until you have completely drawn the facility. All property investors will have a LOC in place even before they need it, so if you need it, it’s there & ready to go.

Offset account

Usually offered with most home loans. An offset account is a transaction account that can be linked to your home or investment loan. The credit balance of your transaction account is offset daily against your outstanding loan balance, reducing the interest payable on that loan. An offset account can reduce the term of your loan.

Loan redraw facility

Very similar to an offset account, A Redraw facility allows you to access additional repayments you have made on your loan above the required minimum repayments. Minimum redraw amounts vary from loan to loan. Redraw is not available on Fixed Rate Loans. Usually banks charge a small fee for the flexibility of redrawing the money.

Bank fees

Banks have various fees built into the loan. Before getting the loan, property investors must check the kind of fees that are built into the loan. Some of those fees could be:

- Application Fees

- Risk Fees

- Mortgage Discharge Fees

- Extra repayments fees

- Monthly account keeping fees

- Valuation Fees

Check with more than one lender

For some people this can be very daunting and time consuming. This is where brokers and expert property investors can, not only check but can also recommend you different options from various lenders who’s lending criteria best matches your borrowing needs.

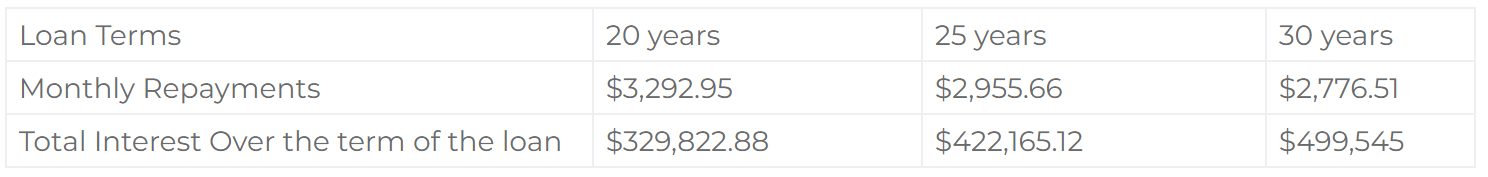

Loan term

As long as you are in your portfolio growth phase, it is better to stick with interest only payment. However, at some stage you will move into the consolidation stage and that’s when the length of your loan term will have an impact.

Let’s look at an example: Loan Amount: $500,000 Interest Rate: 5.3%

“Although monthly repayments for a shorter term are more, the difference between 25 & 30 years in interest payments is $77,379 approx. So just by paying the loan 5 years early, you can save around $77K in interest.”

Repayment holiday

Various lenders can offer a repayment holiday, where you can put your monthly repayment on hold till you sort out your career or your life. Man proposes, god disposes, so we never know what circumstances we could face down the line.

However, it is always good to know for property investors that your lender can provide you with this facility, if there is such a need.

Honeymoon rates

Some lenders will offer you a slightly lower interest rate, usually for the first 12 months. The best way to utilize this period is to keep paying the same size installments that you would if you were on a normal interest rate.

That way property investors can create a buffer that can be re-accessed at a later date depending upon the type of loan.

Advantage

- Guaranteed rate, even if interest rates go up, your repayments will remain unaffected.

- Usually at the end of the term, the client has an option to renew their fixed term or switch to a variable rate loan.

Disadvantages

- If you pay your loan early, an Early Repayment Adjustment (ERA) fee will often apply.

- An ERA or an admin fee may also apply, where the borrower decides to switch to another interest rate option.

- Restrictive due to their nature

- Usually the lender goes to the money market & borrows the money over a similar period.

- Due to this fact, lenders restrict the additional repayments

What’s your property finance & investment strategy?

The kind of loan you get will depend upon what you intend to do with the investment property & how long you intend to hold it for.

If you are developing, would you be looking at holding what you develop or would you be looking at selling after your development is complete. Or would you prefer to sell enough and retain others for the long term.

So your financial strategy will change depending upon your decision.

When you look at the bigger picture, you will notice that interest rates are merely a suggestion in the bigger scheme of things. The ultimate aim for an astute investor is to grow its wealth and generate equity to be able to keep growing their property portfolio.

Financial mistake 9: Paying off your mortgage too soon.

Most people when considering a home loan or an investment loan, only look at one factor, INTEREST RATES. They get blinded by all the other factors and their long term objective of acquiring investment properties to begin with.

The thumb rule for creating a multimillion dollar property portfolio, is to be able to control as much property as possible with as little of your own money as possible.

The key to amassing a property portfolio overtime is to keep refinancing your existing portfolio, to keep accessing the increased equity. Then use that equity as a deposit to buy further properties.

Your own principal place of residence (PPR) or your owner occupier home is not included in this strategy as interest payments on your PPR are not tax deductible.

However, for residential investment properties, there is no reason to pay them off. In a nutshell, the aim should be to have them re-valued, access new equity, and use that equity as a deposit to pay off another property.

Example:

Amelia has an investment property worth $500,000 with a mortgage of $350,000. She receives an inheritance of say $100,000 from her father. She now has 2 options.

She can either use that $100K to reduce her debt on existing property or she can use that money to purchase another property.

Let’s look at both scenarios:

My question: Why would amelia use the $100k windfall from her father to pay off the existing mortgage?

If Amelia pays off her mortgage, she loses the leverage she has which in turn reduces the return on equity or return on her money. Which basically means an inefficient use of her money to bring more money in.

As an investor you should look at every dollar you own as a soldier, everyday you send out your soldiers to capture & bring more soldiers back. If property investors are not utilizing your soldiers in the most optimum way, you are essentially losing the leverage that your soldiers can provide you.

From the table above you will notice that although Amelia made a higher profit in that one year, she lost almost 2/3rd of the leverage she had on her money.

Don’t get me wrong, if you have a PPR with debt, it would make sense to pay off the mortgage for your owner-occupier home first, as interest payments are not tax deductible.

However, if you have an investment property, mathematically it makes sense to buy another property, rather than reduce debt on your existing investment property.

Here is another important insight to take away, the only way you can generate wealth without contributing your time and money, in essence while sleeping, is by achieving capital growth.

And to achieve maximum capital growth you need to make sure that you control as much property as possible with as little of your own money as possible. And in order to do that you need to make sure that every soldier you own, goes out everyday to bring back more prisoners.

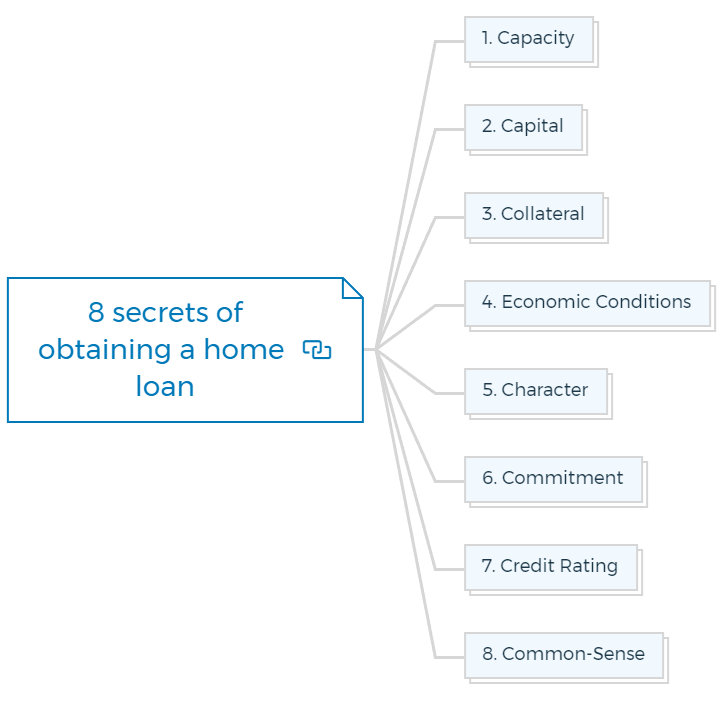

Financial mistake 10: Not understanding the 8 secrets to getting property investment finance or home loan.

We are all in the business of making money & banks/lenders are no different. They are also out to make money. So when they lend money, they need to make sure that first and foremost they don’t lose any money and secondly, they must make money.

So to make sure that the loans they give out are paid back, lenders need to have enough evidence on borrowers capacity to repay the loan.

For that reason, every lender goes through their secret process of risk elimination & mitigation from the borrower. If you understand the following 8 secrets, you will be able to obtain your home loan or any kind of finance for your investments.

Following are the 8 secrets to being loan worthy:

1. Capacity

Capacity to repay the loan is the most important secret that every lender will scrutinise at various levels as it answers the question - “Can the client afford the loan?”.

If you were to lend money to someone, wouldn’t you wish to know how they are going to repay you back? The lender is no different, it seeks to find out exactly how you are going to pay back the loan.

To determine your capacity to repay the loan, the lender will consider the following:

- Source of Income

- Cash at bank or your savings

- Your business or other financial commitments

- And the timing of repayments of your prior financial commitments

Income verification needs to be presented to the lender in an up-to-date, accurate and complete manner.

2. Capital

Capital is the money the client has personally invested into assets or a business along with the cash offered in the form of a deposit for the new loan. It is an indication to the lender of how much the client is willing to place at risk. You may call it HURT MONEY or skin in the game.

For Business loans, usually all lenders expect to see a contribution from the client’s own assets and that the client has some personal financial risk to establish the business before asking the lender to commit any funding.

If the borrower has some SKIN IN THE GAME, the lenders believe the client would be more likely to do whatever it takes to make the business successful.

3. Collateral

Collateral refers to the security that the client can provide the lender. If for some reason, the borrower cannot make repayments, the lender wants to secure the debt against a secondary avenue.

Lenders can consider both business and personal assets as collateral for a loan. Nonetheless, the lender will assess if the security offered can be sold on a short notice & will retain its current value.

That’s where LVR or Loan to Value Ratio comes in. Some lenders may require such a guarantee in addition to collateral as security for a loan.

4. Economic conditions

Economic Conditions like interest rates, stock market fluctuations, the real estate industry’s fluctuating prices, natural disasters etc all play a part in the ability of the client to service their commitments. For example, when the GFC hit, most banks squeezed all lending.

5. Character

Character is the first general impression of the client on the potential lender via the broker’s interpretation and presentation of supporting documents. That’s why any borrower must select a finance real estate broker carefully, and make sure that the broker does everything to create an impression on the lender. The lender through the information presented will form a subjective opinion as to whether or not the client is sufficiently trustworthy to repay the loan.

- If it’s a business loan - the lender will consider the following to form a subjective impression.

- Educational background of the borrower

- Experience in business and in their industry

- Business references and quality of references

- Background and experience of employees may also be taken into

- consideration.

- Client’s character is always assessed in combination with the other secrets so it is important the broker closely examines what is provided to him.

6. Commitment

A client needs to demonstrate commitment to repay the loan, which can be demonstrated from a stable employment history, educational commitment, and long term residence.

7. Credit Rating

A Credit Rating is held on every adult in Australia who has ever bought something on credit. To get any loan across the line, the client must be able to demonstrate their worthiness to credit.

From the lender’s perspective a good credit rating means the client is able to pay their debts on time. Payment history on existing loans & financial commitments is also considered an indicator of future repayment performance.

8. Common-sense

‘Common-sense’ focuses on the intended purpose of the loan sought by your client. That is, the application and intended purpose of the funds needs to make sense to the lender.

A lender will not look upon the application to handle favourably if it appears that the loan is an attempt to fix a problem rather than to improve the client’s situation.

If the reason for the loan is to consolidate debt, the lender will need to feel confident that the client will not be in the same situation a short time down the track.

If property investors are looking for a home loan or looking for any kind of property investment finance, you need to make sure that you have made all efforts to address each of the 8 Secrets to getting property finance or home loan approved with any lender.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

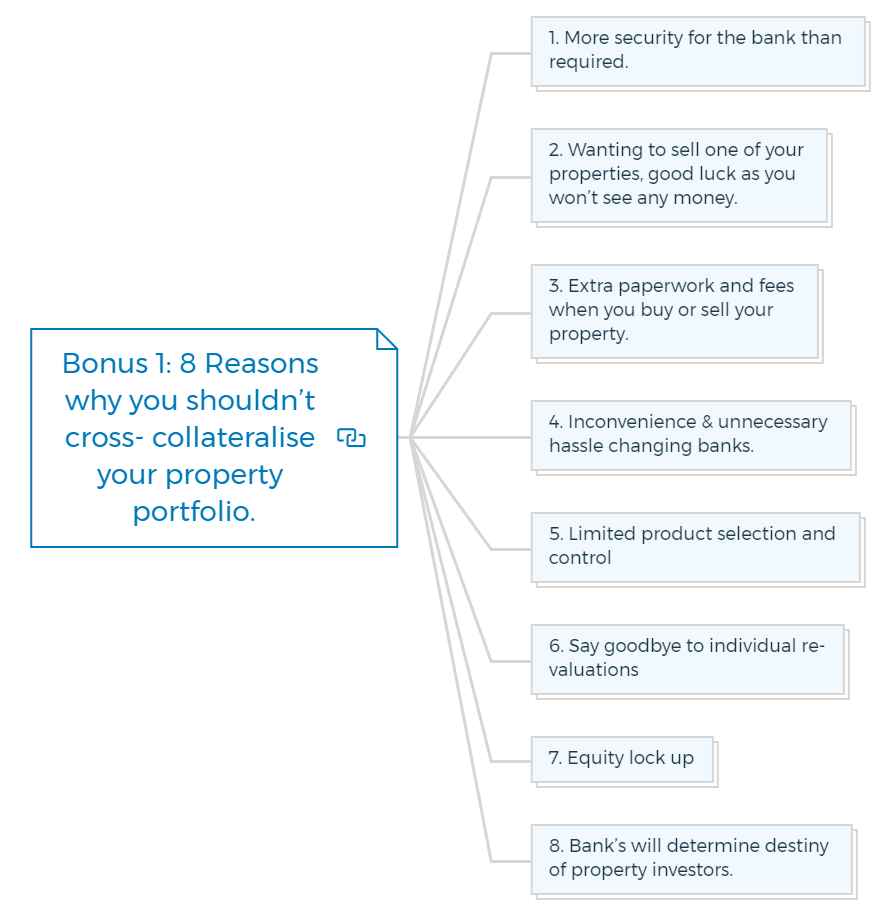

Bonus 1: 8 Reasons why you shouldn’t cross- collateralise your property portfolio.

1. More security for the bank than required.

For instance, Your PPR is worth $550,000 with a loan balance of $50,000. You have an investment property valued at $300,000 with a loan balance of $100,000 (secured against your home).

You wish to purchase your second investment property worth $570,000 with a loan balance of $370,000 (secured against your PPR and your 1st investment property. If you do your math right, you will notice that the bank's exposure is under 40% which is far more security than necessary for any lender, considering they can easily lend on 80% LVR.

2. Wanting to sell one of your properties, good luck as you won’t see any money.

When a property is sold in a cross- collateralised structure, accessing the funds for yourself is harder than you expect. The bank may request some or all of your funds to go back against the existing loans you have with them to strengthen their position or they may ask you to reduce the debt.

The irony is, it’s your properties, it’s your money, but the bank does not need your permission to gobble any proceeds that come from the sale. Bank was smart enough to get you to give them permission when you first accepted the loan terms.

All the bank has to say is, “Sorry, it’s our credit policy & you’ve already signed your acceptance on it”.

3. Extra paperwork and fees when you buy or sell your property.

Every time you try and sell your property, the bank will require a revaluation on your entire portfolio (sometimes at your cost) to determine their risk exposure & to determine the extra money they can take from your sale.

After the revaluation you also have to complete additional paperwork known as ‘Variation of Security’. The same process will repeat itself, if your property has gone up in value and you wish to access more equity in it. Any guesses, what would happen if the revaluation shows that your property portfolio value has gone down?

4. Inconvenience & unnecessary hassle changing banks.

The more properties your bank has cross-collateralised, the harder it becomes to change banks. If you move banks, you may be subject to exit fees, break costs depending upon the kind of loans you have with them.

5. Limited product selection and control

If you’re with only one bank. Having multiple loans with a single bank hinders your options on the kind of loans and facilities you may have. This may cause problems when you want to borrow again.

For example, the bank may force you to take “Principal+Interest” loans in order to reduce their debt with you. This is quite common when the dollar value of your debt is high with one lender, regardless of your overall asset position.

Having at least two lenders lets you play one off against the other. Competition keeps both lenders on the edge.

6. Say goodbye to individual re-valuations

Once cross-collateralized, you will lose the ability to revalue properties individually to obtain equity. Let’s say you have 2 investment properties in your portfolio.

One property for some reason, goes down in value and another goes up in value. In this scenario, the bank will consider a zero effect in valuation in your property portfolio, as they have all in one basket.

However, in an uncrossed structure, you could increase the loan balance on the property that has increased in value without the lender considering the other properties.

7. Equity lock up

Every now and then, property investors find themselves in this situation. This situation typically occurs when property investors have low LVR to begin with and you approach the bank to release some more equity & the bank simply refuses to release that equity.

This could happen due to the bank's policy, their risk exposure in the suburb you have your property in, your financial position, rising interest rates etc. If property investors have crossed all your properties with a single bank, the only way to get what you want would be to break out of that bank, which can be expensive and time consuming.

8. Bank’s will determine destiny of property investors.

In other words, banks will control the growth & the speed of your wealth generation. That’s what they essentially want. They don’t care if property investors make money, or grow - all they want is a maximum number of people who keep earning to keep paying their installments.

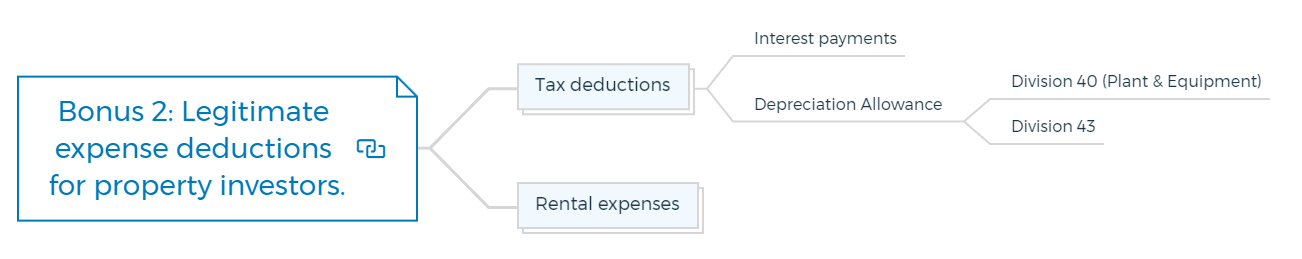

Bonus 2: Legitimate expense deductions for property investors.

Tax deductions

Any income that you earn from your investment property(s) is taxable. Since that income can be taxed, there are genuine costs & expenses incurred to earn that income that are tax deductible. Let’s look at a few:

Interest payments

Most property investors will have some sort of a loan or borrowing against their investment property or any other property. Irrespective of what property you borrow against, the interest on that loan is an expense for that investment which is making you money.

Therefore, this interest is deductible from your total income for tax purposes, including any salary that you earn from your day job. Since interest payments are the biggest expense in any investment, it’s great to know that the government allows you to deduct these expenses from your total income.

Depreciation allowance

I like to call this the BONUS, as it doesn’t cost you the property buyer, anything extra at all. This is where it really starts to show how much our government loves property investors. Most of us buy property for capital growth & in essence, property goes up in value over time.

However, the government lets us assume that the actual building i.e. the constructed portion or the structure of the property loses its value over time. In fact, as per the taxation office, all properties built since 17th July 1985 will lose all of their value in 40 years.

This however, only applies to the built up area which will age due to wear and tear and will be worthless in 40 years. The fixtures & fitting can however, be only depreciated over a shorter period.

In order for a property to be qualified for depreciation allowance against your total income, it should meet the following criteria:

- It must be built after 17th July 1985.

- It must be used as an investment property for rental purposes

The total depreciation allowance is 2.5% of the built cost.

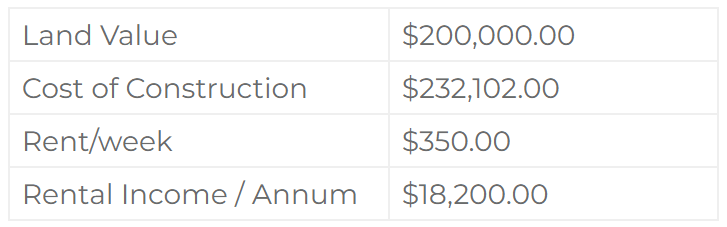

Let’s look at an example:

If you buy an investment property today with a built up area of 180sq. metre, the standard built cost will be approx. $232,102.

For personalised depreciation schedules, you should contact a specialised tax depreciation or a quantity surveying company.

Let me explain further as I want you to thoroughly understand this.

Maximising property depreciation deductions requires a clear understanding of how the different parts of a rental property qualify for Division 40 or Division 43. A property depreciation report needs to be structured so that deductions are maximised and accelerated when needed.

This is achieved by creating an effective balance between assets that qualify for Division 40 and Division 43.

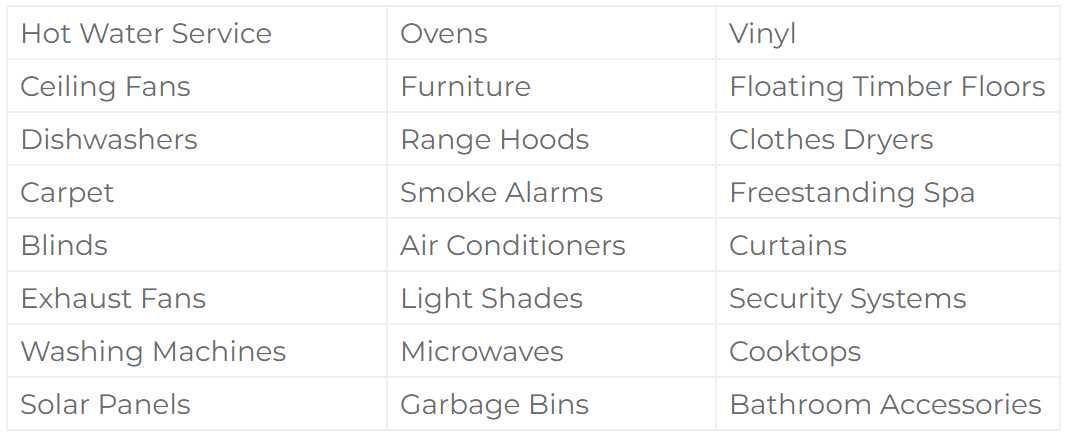

Division 40 (Plant & equipment)

Division 40 is the legislation that covers the depreciation of “plant and equipment”, i.e. the removable fixtures and fittings within an investment property.

Each plant and equipment item has an effective life set by the Australian Taxation Office (ATO) and the depreciation deduction available on that item is calculated using this effective life.

Some of the Division 40 items commonly found within a property include:

Division 43

Otherwise known as ‘Capital Works Allowance’ or ‘Building Write-Off’, Division 43 covers the deduction available to owners for the structural elements of a building and the items within the property that are deemed irremovable.

It includes the foundations, walls, ceiling, roof and also includes fixed assets like tiles, toilets, built-in cupboards, windows and doors. Properties qualify for this allowance depending on their age and type; either 2.5% or 4% of a property’s historical construction cost or estimated cost can be claimed by a relevant professional such as a Quantity Surveyor.

The difference

The main difference between Division 40 and Division 43 is that Division 40 items depreciate faster. For example, while the building structure (Division 43) can be claimed at a rate of 2.5% over 40 years, carpet (Division 40) in a residential property depreciates at a rate of 20% over 10 years (using the diminishing value method).

Some items can create confusion when categorizing them into a Division 40 or Division 43 deduction. For example, an air conditioning unit will fall under Division 40, whereas the ducting throughout the house for the same air conditioner falls under Division 43. A swimming pool falls under the Division 43 allowance, however the pumps for the pool qualify for Division 40.

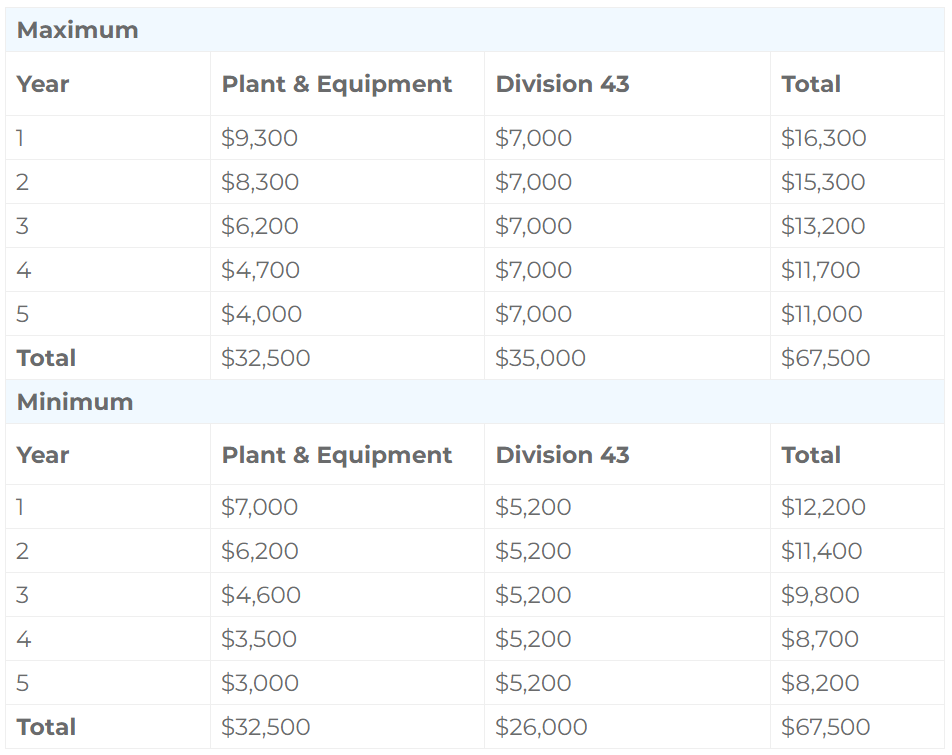

The figure of 2.5% per annum doesn’t look huge, however, as you can see from the table above, the claimable depreciation can amount to one third of your income from rent being tax free.

Let's break it down:

*Excerpt from taxreporter.com.au

You can claim a minimum of $5200 or a maximum of $7000 as depreciation allowance against your rental income under Division 43, which is almost 1/3rd of your rental income. If it is a new construction, which it is in this scenario, you can claim almost $16,300 in the first year as a depreciation allowance.

What if you own a property that was built prior to 1985?

In 1985, ATO introduced two things, the building depreciation allowance and the Capital Gains tax. The key to understanding the two is to understand that the building depreciation compensates for what the Capital Gains Tax takes away.

If you buy an investment property that was built before 1985, you still have to pay the capital gains tax if you sell it, but you do not get the trade off benefit of building depreciation allowance.

Rental expenses

Rental Expenses can be claimed for the period your property is available for rent or has been rented out to tenants. Some of the common rental expenses are:

- Interest on loans

- Repair & Maintenance expenses like

- Cleaning

- Pest control

- Painting

- Any electrical or plumbing repairs

- Gardening

- Council Rates

- Sewerage supply from your water authority

- Land Tax

- Property Management Agents fees

- Bookkeeping costs

- Any costs that you incur for the upkeep, maintenance or management of your investment property.

As you grow and start becoming a serious investor, you will be able to claim a lot more expenses against your property investment business without property investing mistakes.

For example, if you have properties interstate, you can claim your travel costs to those cities for upkeep of your property. If you have a home office, you can claim part of those expenses as well. If you spend money on educating yourself on property, all those courses, books and cd’s will become tax deductible as well.

FAQs