Everything about financing your next investment property

Are you looking to get into property investment but don't know where to start? Or are you an experienced investor who's looking for the best way to finance your next purchase? Whatever your level of experience, this guide will teach you everything you need to know about property investment finance.

It covers all the basics, from mortgages and leasing to borrowing against your existing property. So whether you're a beginner or a pro, read on for essential information on how to get started in property investment today!

Finance, Finance, Finance

Like Location, Location, Location is true when buying an investment; Finance, Finance, Finance becomes the key factor in moving ahead.

Whether you're a first-time homebuyer or an experienced investor, whether you're thinking about plain simple buying, renovating, downsizing, upsizing, looking for a better deal, or consolidating, your ability to move ahead depends on the amount of loan or debt you can get, i.e. your borrowing capacity.

How can you increase that? This is what you are going to learn here.

Is property a good investment? Should I buy an investment property?

Buying an investment property is the best investment you will ever make.

Why so?

Because in most cases, when bought after careful research & due diligence, real estate is the only thing that makes you money while you sleep, especially over a medium to long term. Most investors use property investment as a long-term wealth-generation strategy.

Property Investment gives a solid overall return (which includes both continuous cash-flow income and the capital appreciation of property).

Solid Overall Return = Cash Flow + Capital Gains

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

Pros and cons of investing in real estate

Let's take a look at the pros and cons and some key concepts of real estate investment, so you can make an informed decision, keeping in mind your borrowing power to turbocharge your investment portfolio.

Pros of property investment

- Property values usually increase over time. If you purchase an investment property and hold onto it for several years, you will likely see a good return on your investment.

- Property is a stable and secure investment. Property prices are not as volatile as stocks and shares and are less likely to plummet overnight.

- Property investment is a great way to build wealth over time. With the right property investment strategies, you can see healthy returns on your investment that can compound over time.

- Although there are always risks associated with any investment, the property is generally considered a low-risk investment.

- Property investment can provide a regular income stream. If you rent out your investment property, it can provide a steady income each month.

Cons of property investment

- Property investment can be expensive. To purchase an investment property, you will likely need a larger down payment than you would for a primary residence.

- Property investment can be time-consuming. If you decide to self-manage your investment property, you will need to be available to show it to potential tenants and deal with any problems that may arise.

- Property investment may not be suitable for everyone. Before investing in property, you should consider your financial situation and your ability to take on additional risks.

- There are no guarantees with property investment. While there are many positive aspects to property investment, there are also no guarantees. Prices can go up or down, and you may not see a return on your investment.

How does equity work when buying an investment property?

When buying an investment property, equity is the amount of cash that the purchaser needs to put forth to cover the gap between the total appraised value of the property and the loan funding, i.e. total amount borrowed to close the purchase.

Post-purchase, any uplift in the property's value over time is also accounted for as equity.

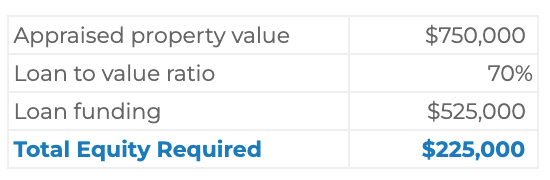

Equity example 1

Total appraised property Value = $750,000

Loan To Value Ratio (LVR) = 70%

Total Loan Funding = $525,000

Equity = Total appraised value of the property x LVR %

Equity = $750,000 - $525,000 = $225,000

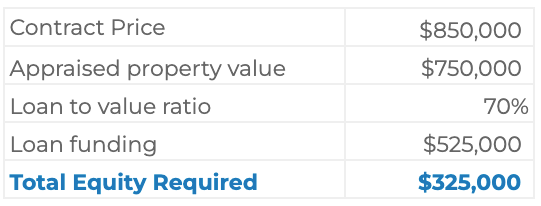

IMPORTANT: Note that I did not put Total Property Cost, instead I used Total Appraised Property Value. That's because you might have signed the purchase contract for $850,000, but if the bank's valuation says that the property is worth only $750,000, the bank will only loan you a percentage of what the bank valuation determines as the value of the property.

In this case, you will need to add another $100,000 as equity to close the purchase.

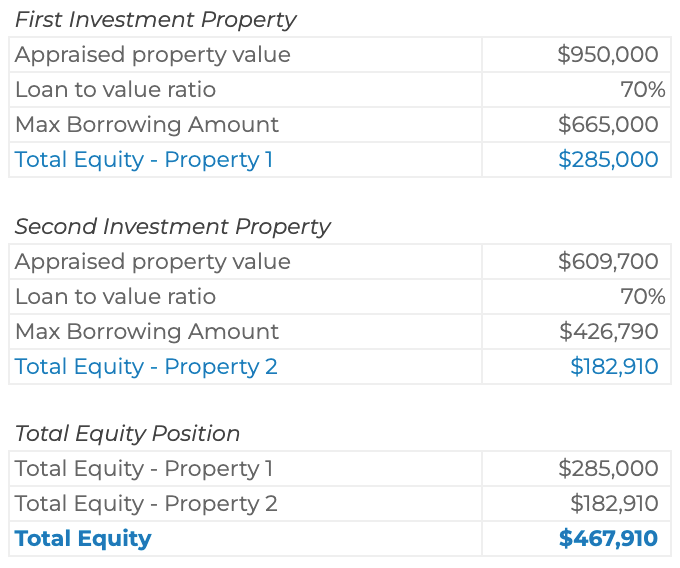

Let's assume the property market boomed for 5 years, and the property's appraised value is now $950,000.

You can calculate the total equity in your investment property as...

Total equity = Total Appraised Value - (Total Debt - home loan repayments of principal amount)

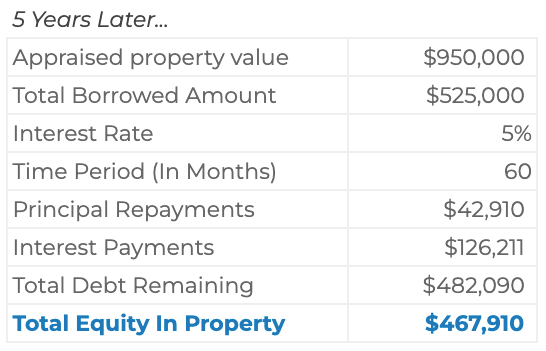

5 Years Later...

Appraised property value = $950,000

Total Borrowed Amount = $525,000

Interest Rate = 5% / Annum

Time Period (In Months) = 60

Principal Loan Repayments = $42,910

Interest Payments = $126,211

Total Debt Remaining = $482,090

Total Equity In Property = $467,910

What is LVR in home loans?

LVR stands for loan-to-value ratio aka Loan To Cost (LTC) - A percentage of the total appraised value of the property that the lender is willing to borrow you to complete the purchase.

In other words, it is the ratio of the amount you are borrowing to the property's appraised value.

In the example above...

- You will need to borrow 70% of $750,000, and your deposit will be 20%, i.e. $225,000

- The higher the LVR, the higher the risk for the lender. It is because there is a greater chance that you will not be able to repay the loan if the value of your property falls.

- Lenders usually charge a higher interest rate for loans with a high LVR.

- Lenders may also require you to take out lenders' mortgage insurance (LMI) if your LVR is above 80%.

How to leverage the equity in an investment property?

The main goal of property investors is to control as much property as possible with as little money of their own by leveraging their equity to borrow to continue to acquire more property responsibly.

Based on the above example,

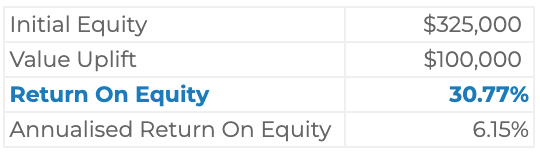

Your initial equity was $325,000. Due to a booming property market, your property value (capital gain) soared to $100,000, giving a return on equity of 30.77%, which amounts to an annualised return on equity of 6.15%.

Note: To keep the calculations simple, I have left out the principal & interest payments made over 5 years and have not accounted for any operating income generated by the investment property and tax deductions claims.

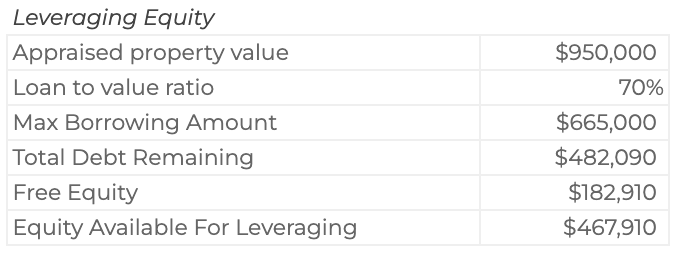

Buying an investment property for the first time

Based on an LVR/LTC of 70%, you can borrow $665,000 against your property. However, your remaining loan balance is only $482,090, which frees up $182,910 of extra equity. As explained earlier, the total home equity in your first investment property is $467,910.

Buying your second investment property

Continuing with 70% as your LVR (loan to value ratio) and your total available equity, you can borrow $1,559,700, using your existing property as collateral.

You already own a property worth $950,000, which leaves $609,700 as the maximum amount you can borrow for your second investment property without injecting any more equity or money to purchase your second investment property.

How to buy an investment property?

Considerations before investing in real estate -

- Figure out if property investment is right for you.

- Are you disciplined?

- Do you have time for research?

- Does property excite you?

- Get rid of any unnecessary debt & limit any wasteful expenses. If you don't know where to start, simply buy a book on "personal financial advice" and learn to manage your expenses and reduce your debt.

- See your accountant & get financial advice on the right structure for purchasing the investment property.

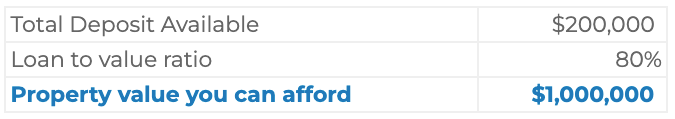

Can you afford the investment property?

Instead of asking yourself how much deposit do I need for an investment property, it is better to determine the total cost of the property that you can afford. Here's how you can calculate the affordable price of the investment property.

- Step 1. Determine how much money you have available as a deposit (cash + equity)?

- Let's say you have $200,000 as free equity and cash.

- Step 2. Call a home lending specialist to determine what percentage lenders borrow against an investment property? Usually, banks can borrow 70%-80% for direct residential investment and sometimes even more with a lender's mortgage insurance.

- Let's say you can get a home loan for 80% of the property value.

- Step 3. Now take your deposit money i.e. $200,000 & divide that by 20% (100%-80% LVR)

Voila, the maximum price of the property you can afford is $1,000,000.

This also means that with $200,000 as a deposit, the maximum amount you can borrow is $800,000

- Once you know how much you can borrow, you need to find the right type of loan for your needs. There are many different types of loans available, so make sure to do your research before choosing one.

- Once you've found the right loan, you need to negotiate the best interest rate possible. You can do this by shopping around and comparing rates from different lenders.

When comparing investment property mortgage rates, there are a few things you need to consider.

- Interest rate - You want to find a loan with the lowest interest rate possible. Make sure you check the comparison rate for each type of loan side by side.

- Term of the loan - You want to find a loan that has a term that suits your needs.

- The repayment schedule - You want to find a loan that you can afford to repay without putting too much strain on your finances.

- Finally, once you have the loan in place, you need to keep up with your repayments. Missing a repayment can negatively impact your credit score, so staying on top of things is essential.

Increasing your home loan borrowing capacity

Here are the top 9 ways to increase your borrowing capacity

- Improve your credit score & keep an eye on it. It will increase your chances of obtaining a loan. Keeping an eye on your credit score will ensure that you keep your credit history clean.

- Earn more, get a second job, do property development on the side. This will free up funds for a loan and generate the equity you need to use as a deposit.

- Reduce your other miscellaneous debts, like car loans, bridging loans, etc., and reduce your credit card limit. This will allow you to borrow more money.

- Apply with a lender that offers investor-friendly financing conditions. For example, amortise the loan over 30 years rather than 25 years. The longer the amortisation period, the lower your monthly repayments.

- Split debt by applying for loans with your spouse so that you can use your combined income to service the loan.

- Purchase investment properties that are cash-flow positive.

- Reduce your cash outflow, i.e. your monthly expenses. These days, lenders even check your total number of subscriptions for streaming services like Netflix, Disney+, etc. Each monthly subscription shaves off your borrowing capacity.

- Avoid family pledges or being a guarantor.

- Apply for a loan when you've been at your employment for more than six months.

What is lenders mortgage insurance?

Lenders Mortgage Insurance (LMI) is insurance that's paid by the borrower but covers the lender in case the borrower defaults on their payments and the property (collateral) is sold for less than the total debt on the property.

Lenders' Mortgage Insurance (LMI) is required if you're borrowing more than 80% of the property's value. LMI protects the lender if you default on your mortgage repayments and they need to sell the property.

Understand asset allocation strategies

You should have a strategy in place before making long-term financial commitments. Advisers talk about asset allocation or diversification while discussing financial planning.

Anything you've put in various types of investments, such as stocks and real estate (growth assets), or lending vehicles like bonds, cash, or term deposits (safety assets), is reflected in this allocation (income assets).

The asset allocation formula considers your age (but not your capacity to handle risk).

Subtract your age from 100. If you are 40 years old, you need to invest 60% of your assets in growth assets, i.e. property & shares.

If you wish to be more aggressive, you can add any percentage to 60% and increase that percentage so that your investment portfolio is weighted >60% towards growth investments and not other investments.

After you have bought an investment property

Safeguard yourself and your assets with insurance.

If you're planning real estate investment for building wealth, you'll need to be sure that you've got adequate insurance in place for yourself and your most valuable assets, including the following:

Home and content insurance

Don't worry about this insurance because your lender will ensure you have one. It safeguards you against financial loss in the event of a fire or other disaster that damages your house and covers your legal obligations in the event of damage.

Excess liability insurance

For your house, investment property, and automobile at a comparatively low cost, and it provides additional liability protection in the event of a large-claims lawsuit.

Income-protection insurance

The capacity to make a living in the future is the most valuable asset for most individuals in the workforce. If you're unable to work for a long period due to incapacitating sickness or injury, income-protection insurance pays a portion of your wages.

Life insurance offers a lump-sum payment in the event of death, and can help replace your income if you pass away.

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

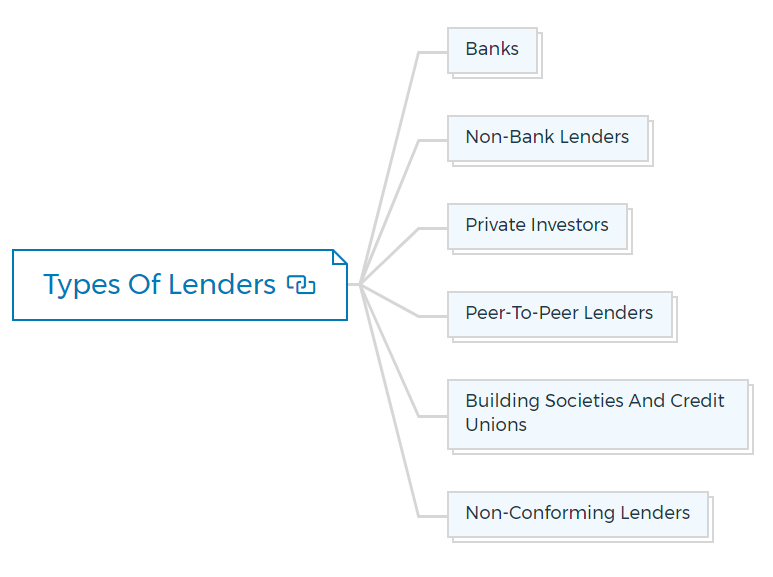

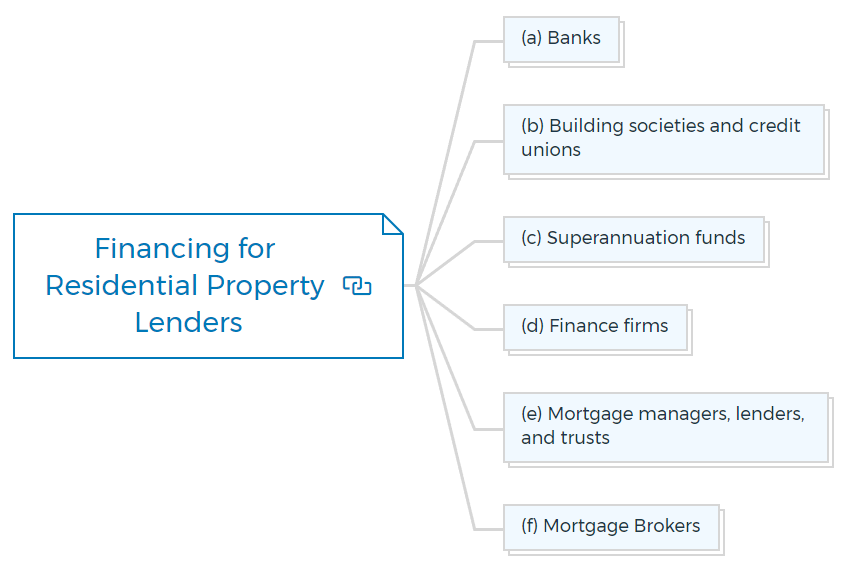

Types of lenders

There are a few primary sources of finance when it comes to property investments.

Banks

Banks are deposit-taking institutions; they offer different types of loans to customers, including home loans, business loans, and personal loans. They also give credit products like credit cards and lines of credit.

Banks typically offer lower interest rates for investment property finance than other lenders because they perceive the risks to be lower due to the property's security and the fact that it is an established market.

Non-bank lenders

These institutions don't take deposits but rather borrow money from investors to lend it out. Non-bank lenders typically have higher interest rates than banks, offering more flexibility with their products. It includes features like interest-only repayments and no early repayment penalties.

Private investors

Another source of finance for property investments is through private investors. These investors can be family and friends, or it can be through a crowdfunding platform.

Crowdfunding platforms are online platforms that connect borrowers with many small lenders. It can be a great option if you have trouble qualifying for a loan from a bank.

Peer-to-peer lenders

Peer-to-peer (P2P) lending is a form of financing where investors loan money to businesses or individuals through an online platform. P2P lenders typically have higher interest rates than both banks and non-bank lenders.

Building societies and credit unions

These are similar to banks, but they are mutual organisations owned by their members. They offer a range of products, including home loans, personal loans, and credit cards. Building societies and credit unions tend to have lower interest rates than banks because they don't need to profit.

Non-conforming lenders

Non-conforming lenders are banks or other institutions that don't conform to the rules set out by APRA (the Australian Prudential Regulation Authority). This means they can offer other forms of loans not available at mainstream lenders.

One example of this is a portfolio loan, an investment loan designed for borrowers with two or more investment properties.

Tip:

As far as possible, choose mainstream lenders. Other lenders include solicitors' funds, payday lenders, and private individuals, but their interest rates make profitable property investing difficult.

Are mortgage brokers worth it?

Investing in property requires building a team around you, and mortgage brokers for home loans can be a great resource when you're looking for home loans. They have access to various lenders and know about the products available.

The broker can compare the borrowing capacity using home loan calculators of various lenders and their rules while calculating acceptable income.

For example, some of the following sources of income are not acceptable to every lender, or the lender may decide to use only a percentage of the applicable income to make the deal work:

- commissions

- shift work

- casual income

- second job

- part-time work

- short-term contract

- overtime

- salary sacrifice

- salary packaging

- bonuses

- rental income

- negative gearing (if any)

- maternity leave

- pensions (like carers' pension, disability pension)

- Centrelink (support like Family Tax Benefit Part A and B)

- child maintenance payments

- fringe benefits (like a car allowance & taxed car allowance)

- franked dividends

- deductible interest

- self-employed add-backs (including depreciation)

- TAC

- work cover

- study allowance

- trust distributions

- Annuity

The broker can aid the borrower by selling the proposal to the lender and persuading them to lend the borrower money. Some debtors require extra aid.

Giving the lender a lot of statements and expecting a loan isn't enough. Good brokers work hard behind the scenes to outline the loan's strengths and construct a picture for the lender. They pursue the deal and have the proper contacts. A lousy broker does none of the above.

When choosing a mortgage broker for a home loan, choose an accredited broker with a good reputation. You should also check the comparison rate before choosing one.

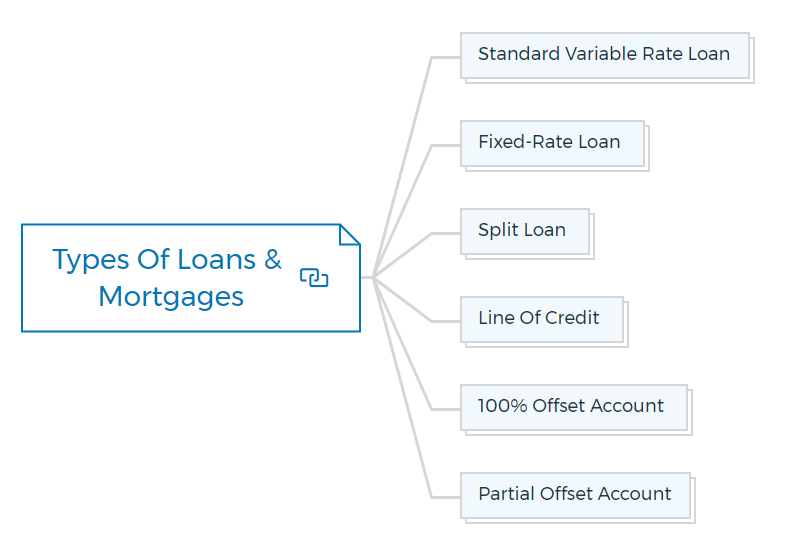

Types of loans & mortgages

Investing in the property must be aligned with your financial goals. Before choosing a loan, seek expert advice on the best package for you. There are different types of loans for investors; first, home buyers and a home lending specialist can help you understand different products for various investment properties.

Remember that your needs may change over time. Below are different types of property loans that you should know -

Standard variable rate loan

The interest rate on this loan will go up or down, depending on the market. This can make budgeting difficult as your repayments may increase.

Fixed-rate loan

The interest rate on this loan is fixed for some time, usually between one and five years. It can make budgeting more accessible as you know what your repayments will be during that time.

It is when the loan is split into two or more loans. Each part can be on a fixed or variable rate. Some lenders will let different applicants be on each loan split without putting the other borrower's loan split at risk. It can help you to manage your repayments if the interest rates rise.

Line of credit

A line of credit is essentially a loan with a variable interest rate. Because it is secured against a property, it usually has a greater limit than a credit card. If monies are parked in the LOC, there is no need to make repayments on that amount.

Only the amount of the lending facility that has been utilised (drawn down) would be subject to interest. It can be helpful if you want several properties investment over time.

100% offset account

An offset account is a second standalone account connected to the loan account. The primary objective is to reduce loan interest repayments and allow fast access to any accrued savings.

It offsets the loan balance by the amount in the account at any given moment. Interest is computed on the loan's principal amount, less any funds parked in the offset account, known as the loan's balance.

It is a powerful instrument that many borrowers overlook; depending on the amount in the account and the size of the loan, it may save hundreds or thousands of dollars every year.

Partial offset account

This account is also mortgage-linked, but only part of the money offsets your loan's interest. It can be helpful if you don't have enough money saved to cover your entire mortgage repayment.

Other types of loans include investment loans, construction loans, and refinancing.

- Investment loans are for people who want to purchase an investment property.

- Construction loans are for people who are building a property.

- Refinancing is when you get a new loan to pay off an existing loan, usually from a different lender.

How does an investment loan help real estate investors?

An investment loan is a specialised mortgage type designed for real estate investors. These loans offer several benefits, including:

- Low-interest rates – Investment loans typically have lower interest rates than traditional mortgages. It can help you save money on your overall investment.

- Flexible terms – Investment loans are often more flexible than traditional mortgages regarding terms and conditions. It can give you the ability to tailor your loan to your specific needs and goals.

- Tax benefits – The interest you pay on an investment loan may be tax-deductible. It can help you claim tax deductions and save money on your yearly taxes.

Investment loans can be a great way to finance your real estate investment goals. If you are thinking about taking out an investment loan, shop around and compare offers from multiple lenders. It will help you get the best deal possible.

How does a construction loan help real estate investors?

A construction loan helps investors build or renovate a property. You can also use a construction loan to purchase an investment property already under construction.

- This type of loan allows you to draw down the money you need when you need it, rather than borrowing the entire amount upfront.

- Construction loans are typically interest-only loans, which means you only need to pay interest on the amount you've drawn down. It can help keep your monthly repayments low.

- The interest rate on a construction loan is also usually variable. It can make budgeting difficult, allowing you to save money if interest rates fall.

After completing construction, you will need to switch to another type of mortgage (usually a standard variable rate loan). It might not be easy, so choosing the right lender and mortgage product is essential.

Make sure you understand all the costs associated with a construction loan. There may be early repayment penalties if you pay off the loan before it's finished or administrative fees if you switch to another type of mortgage.

For example, if you're building a duplex, you may need to take out two construction loans, one for each property.

Construction loans can be a great way to finance an investment property. Just make sure you understand all the costs and risks involved before applying.

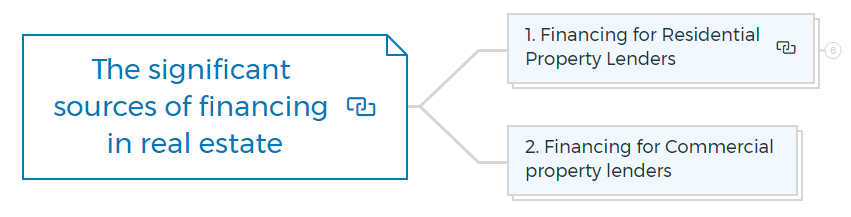

What are the significant sources of financing in real estate?

1. Financing for residential property lenders

(a) Banks

Retail (or "trading") banks have long dominated the residential real estate lending market. Historically, they have used customer deposits and more recently, they have "securitized" some loans.

They are eager to take advantage of their large customer base with bank accounts and strive to offset their disadvantage of having staffed banking facilities' high overhead costs.

Other financial companies provide loans with banking licenses, such as those using online banking and some investment (or merchant) banks.

Learn More

(b) Building societies and credit unions

Although these businesses aim to employ deposited savings for personal and home loans, many also provide loans to investors in residential real estate.

The Authorized Deposit-taking Institutions comprise banks, banking societies, and credit unions.

(c) Superannuation funds

A few superannuation funds offer loans; however, they might only be available to their members and owner-occupiers. A small component of the portfolios of several of these investment firms is made up of investment property lending.

(d) Finance firms

Retail banks now own the majority of finance companies in Australia. Some still provide residential real estate loans, although they focus more on lending for residential construction.

They frequently consider lending to investors who might not match the bank's lending requirements, approving "low-doc" and non-conforming mortgages.

They frequently issue debentures or other medium-term interest-paying instruments to finance their loans.

(e) Mortgage managers, lenders, and trusts

Mortgage managers, sometimes known as "mortgage originators," act as middlemen between investors and borrowers who want to profit from a pool of residential mortgage-backed securities (RMBS).

Due to the mortgage manager's administration of the loans, which includes collecting loan payments and sending out loan statements, the borrowers are likely unaware that their mortgages are included in a pool of securitized loans.

(f) Mortgage Brokers

Mortgage brokers are available to help customers get the best deal for their unique situations. As brokers, they look for financing options rather than approving loans.

Although borrowers are typically not charged a price for this service, they should know that the lenders compensate the brokers through commissions.

This compensation structure has raised questions about whether some brokers' recommendations may influence their connections to lenders.

2. Financing for commercial property lenders

Commercial finance in real estate financing is the process of providing funding for commercial real estate projects. You can use this type of financing for various purposes, including purchasing property, developing new projects, or refinancing existing projects.

Banks and other financial institutions typically provide commercial finance, but several private lenders provide this type of financing.

Many mortgage originators and brokers focus on loaning investors and developers for non-residential properties. There is no easy-to-find, comprehensive database of lenders willing to finance non-residential assets.

Some lenders only lend money to certain types of homes or regions of Australia. Some cultivate specific clientele and build connections with investors, particularly those with property holdings.

The process of commercial finance in real estate financing typically involves several different steps.

- The first step is to identify the property that will be purchased or developed.

- Determine the required amount of financing. You can do this by estimating the project's total cost and then subtracting any funds that are already available.

- Submit a loan application to the bank or other lender.

- Wait for a decision on the loan application.

- The last step is to close on the property if the loan is approved.

Commercial finance in real estate financing can be a great way to fund your next real estate project.

How to refinance an investment property?

When you refinance an investment property, you take out a new loan to pay off your old loan. This new loan may have a different interest rate and term than your old loan.

- You can use a refinance to access more money for investing in other properties or reduce the interest you're currently paying on your investment property.

- You can also use a refinance to consolidate your debt into one loan, making it easier to manage your repayments.

- When you refinance an investment property, you must pay stamp duty and other associated costs.

- Just make sure the loan meets your goals. Ensure the lender offers you a better rate repayment figure and meets your goals.

- Keep all papers well-organised to make refinancing or obtaining finance accessible.

- Consider refinancing fees. Paying off a fixed-rate mortgage early may result in penalties, whereas paying off a 'variable rate' mortgage usually results in a few hundred dollars in administrative expenses.

The main benefits of refinancing are saving you money on interest payments, giving you access to more money for buying an investment property, and making your repayments more manageable.

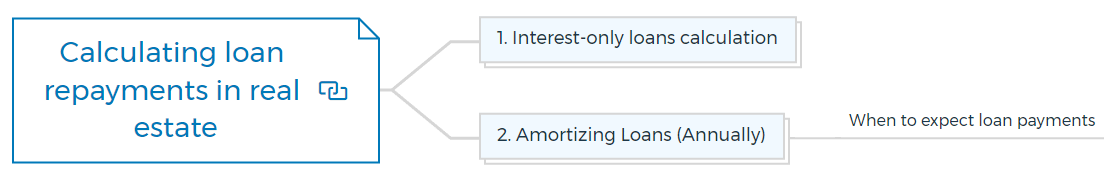

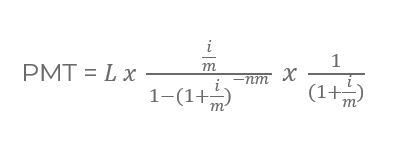

Calculating loan repayments in real estate

There are 2 ways to calculate loan repayment in property development.

1. Interest-only loans calculation

Calculating interest-only payments involves calculating the home loan amount by the annual interest rate and dividing the result by the number of payments made each year.

For example, $2,636.67 would be due each month for a loan of $452,000 with monthly installments of 7% annually:

$452,000 x 0.07/12 = $2,636.67

The final payment would cover the loan balance of $452,000, totaling $454,636.67 as the last monthly installment.

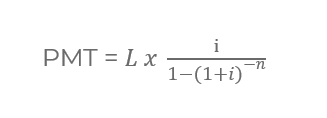

2. Amortizing loans (Annually)

The investment property loan amount, the interest rate, loan term, the frequency of installments, and the method of repayment all affect how much must be repaid.

Most loans that amortize have equal loan payments made each period, including interest on the loan balance and some of the original loan's principal repayment.

You can use the following formula to determine the equal payments that will result in no principal remaining after the last payment:

- PMT denotes the monthly (or, in this case, annual) loan payment.

- L stands for the investment loan sum.

- I is the annual interest rate on a loan.

- N is number of loan periods.

For instance, a $452,000 loan amortized over 15 years at an annual interest rate of 7% would demand $49,627.17 in payments at the end of each year.

Creating an annual amortization schedule for such loans is relatively simple (especially if this is prepared on a computer spreadsheet).

The annual interest rate equals 7% of the loan balance at the beginning of the year. The excess of the repayment over the interest is the principal repaid for the year.

The initial balance less the principal repaid over the year represents the loan balance at the year's end.

It is possible to determine the payments for a partially amortizing loan with a balloon payment at the end of the loan as interest-only payments on the balloon and amortizing payments on the remaining portion of the loan.

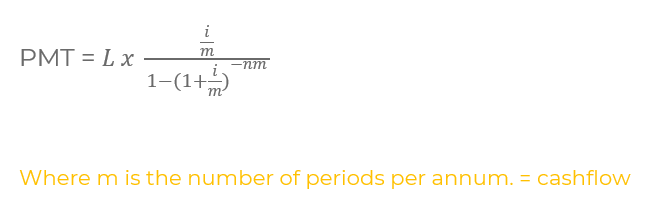

Monthly amortizing loan payments

If the mortgage repayments are made at the end of each month, you can use the below calculation to determine the number of payments necessary to fully amortize a loan with compounding and more frequent payments than once per year.

It is customary to divide annual interest rates by the number of periods to convert them to shorter ones.

If there are m periods per year, the number of periods is determined by multiplying the number of years of the loan by m, and the interest rate per period is determined by dividing the annual loan interest rate by m.

The yearly interest rate in this situation is referred to as the "nominal" annual rate.

If this periodic rate accrues compound interest, the "effective" yearly rate would be higher. The nominal conversion-based periodic rates are marginally higher than the effective conversion-based periodic rates.

Below, a nominal conversion is utilized, with monthly "rests" or recalculations of the outstanding principal.

Typically, the payments are calculated based on payments made at the end of each period.

For instance, a $452,000 loan amortizing over 15 years at an annual interest rate of 7% would call for monthly payments of $4,062.70.

A very little difference in the payment is produced by using an interest rate of 0.6667 percent each month. If the payments are due at the beginning of each month (also known as an "annuity due"), change the calculation formula -

Each payment would be $4039.14 if it were due at the beginning of each month for the same loan.

Payments in advance are a little lower than in arrears because each payment is paid earlier, resulting in less interest accrued.

When to expect loan payments

Loan payments are generally made monthly but occasionally more often. It is typical to assume that you need to make the required payments at the end of each month, the compounding frequency will be monthly, and the interest rate will compound at nominal annual rates.

Most Australian lenders for residential properties use a complicated combination of daily interest charged to the borrower and monthly amortizing payments on an agreed date in the middle of the month.

Payments for non-residential loans must typically be made at the beginning of each month.

If the investor has a choice, the most convenient payment schedule is one where loan payments occur roughly a week after the significant tenant(s)' due dates for rent.

How can I get a 100 percent loan for an investment property?

The most common way to get a 100 percent loan for an investment property is to use a combination of debt and equity financing. You can also get the investor guarantor loan to get approval for a 100% investment property loan.

What is a guarantor loan?

A guarantor loan is an unsecured loan where a family member or friend agrees to cover the repayments if you can't. It means that even if you have a bad credit history, you may still be able to get a loan.

Guarantor

If a creditor refuses to offer a loan to an individual, they may ask for a guarantee. You are the 'guarantor' of a loan if you sign one for a friend or family member.

You do not own the property or items bought with the loan. You have no rights, but you are entirely liable.

Co-borrower

A co-borrower is someone who signs a loan with someone else. In most cases, both co-borrowers are personally accountable for the whole loan.

If the co-borrower cannot pay their share of the loan, the other is usually responsible for both.

One lender will assign a share of obligation to each borrower, but this may not prevent repossession if one of the borrowers defaults.

Considerations before guaranteeing anything

You should just agree to be a guarantor if:

- You're in a good financial position and can easily make the repayments yourself if needed

- You trust the borrower to make the repayments on time

- You're comfortable with the risks involved

- You understand what you agree to.

When you take out a loan, you will need to decide whether to repay the principal and interest (the actual amount you borrowed) or just the interest.

If you choose to repay the principal and interest, your monthly repayments will be higher, but you will own the property at the end of the loan term.

If you choose to repay just the interest, your monthly repayments will be lower, but you will still owe the principal at the end of the loan term. You can also choose to roll over the principal into a new loan, which means you'll continue to pay just the interest on it.

What is an interest-only loan?

An interest-only loan is where you only pay the interest on the amount you borrow each month. You can't repay the principal (the amount you borrowed initially) until the end of the loan term.

This type of loan can be helpful if you want to invest in property but don't have enough money saved up to cover your entire mortgage repayment.

- The borrower only pays the interest on the mortgage and does not have to pay back any of the money borrowed.

- It can help first-time homebuyers manage their cash flow by reducing their repayment commitment and reducing the cost of furniture and moving.

- It may be easier for would-be investors to afford negatively geared properties.

- I/O loans can be very useful in calculating the borrowing capacity on serviceability calculators.

Disadvantages of interest-only loans

- The monthly repayments do not reduce the loan principal. If property prices fall, the borrower may find it challenging to sell the property or refinance the loan.

- If the borrower does not make regular extra repayments, they may end up with a larger loan principal at the end of the interest-only period than when they started.

- Interest-only loans can be very useful in calculating someone's borrowing capacity on serviceability calculators. The downside of Interest-only loans is that many borrowers may be caught off guard if they have too many interest-only loans.

When their interest-only period runs out, the monthly repayments for some borrowers could jump up to two or three times the amount of their current repayment.

Above all, pay off the mortgage and consider not having an interest-only loan. If you have a home loan debt, consider making an investment loan interest-only, but consider reducing your investment debt if you paid your home loan debt.

What is a principal and interest loan?

A principal and interest loan is a loan in which you repay both the principal (the amount you initially borrowed) and the interest on that amount each month. Your monthly repayments will be higher than if you choose an interest-only loan, but you will own the property at the end of the loan term.

- You will need to repay less than 1% of the loan principal each month, so these loans have higher repayments than interest-only loans.

- There are no tax benefits if the borrower has a home loan and the loan is not for investment purposes, so many borrowers prefer to pay down their home loan first before paying down debt for an investment property.

- The majority of repayment is an interest with some principal. They charge interest not only on the loan amount but also on the interest charged on the loan amount 'every day until the repayment.

Disadvantages of principal and interest loans

- The monthly repayments are higher than if you choose an interest-only loan. It may take longer to save up for a deposit on another property, or you may have less money available each month to put money into other assets.

- Your loan balance will not go down during the interest-only period, so you may owe more money at the end of the loan term than when you started.

What is bridging finance?

Bridging finance or a bridging loan is a short-term loan used to 'bridge' the gap between buying a new property and selling your old one. Property investors can use a bridging loan for a variety of purposes, including:

- To buy a new property before your old one has sold.

- To buy a property at auction.

- To release equity from your property to use as a deposit on another property.

- To pay for renovation costs on a new property.

- To cover the cost of stamp duty and other purchase expenses.

Bridging finance is usually a short-term loan (between 6 and 12 months) at a higher interest rate than a traditional home loan.

How does a bridging home loan work?

A bridging home loan works similarly to a standard home loan; however, the interest rate is usually higher, and the loan term is shorter. You will make regular repayments on the loan, and at the end of the term, you will need to either sell your property or refinance to a longer-term loan.

Repayments

Repayments on a bridging loan are usually interest-only, which means that you will not reduce the amount you owe during the loan term.

It can be beneficial if you are trying to save for a deposit on another property, as you will not have to make repayments on the principal (the amount you borrowed).

Interest

Interest rates on bridging finance are usually higher than standard home loan interest rates. The loan is for a shorter period, and the lender takes on more risk.

Security

Bridging finance is usually secured against your property, which means that the lender can sell your property to repay the loan if you default on the repayments.

This makes it essential to make sure that you will sell your property or refinance the loan at the end of the term.

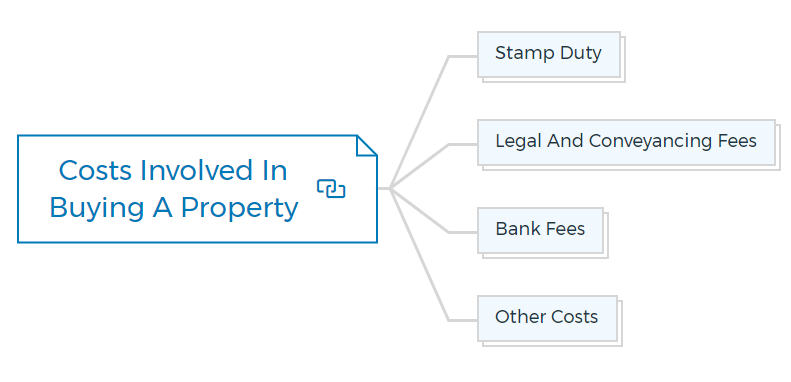

Costs involved in buying a property

When buying a property, you need to budget for various costs.

These costs can include:

Stamp duty

Stamp duty is a tax paid when purchasing property or land in Australia.

The stamp duty depends on the property's value, state or territory, and whether you're a first home buyer.

You can use a Stamp Duty Calculator to estimate how much stamp duty you need to pay.

Legal and conveyancing fees

These are the fees your solicitor or conveyancer charges for their services about your property purchase.

Bank fees

You might face charges of bank fees, such as a loan application fee, an establishment fee, and ongoing fees.

Other costs

You need to consider maintenance costs, building and pest inspection fees, removalist costs, and furniture and appliance costs if you're buying an unfurnished property.

Acceptable income types

You can use a few types of income to qualify for property investment finance. The most common income and how the lender treats these are:

- Overtime - Some lenders will use a percentage of your overtime income, while others will not consider it.

- Casual Income - 50%

- Rental Income - 75%

- Shift work - 25-50%

- Deductible Interest - Some lenders will consider that the interest on your loan is tax-deductible. It can increase your borrowing power by up to 30%.

- Salary Packaging - Use 50% of pre-tax

- Second Job - Use 50% of income

- Pension - 100%

If you have other types of income, such as income from a trust or property investment, you will need to speak to your lender to find out how they are treated.

Tenure

- Full-time and Part-Time and Contract - Six months of full-time or permanent part-time work in the same role with the same company is generally considered appropriate. One day at a new job is fine. A lender will even accept an employment contract and its income before the person starts the new work. Probation is appropriate up to 80% LVR but should end at 80%.

- Contract employment - Lenders accept unemployed people on a contract basis. Depending on the lender, they will use either the contract value or a percentage of the contract value. The minimum contract length is usually 3 months.

- Living expenses - Lenders will consider your living expenses when assessing your application for property investment finance. It includes things like your rent, food and utility bills. You will need to provide proof of your living expenses to the lender.

What is the comparison rate?

A comparison rate is a tool that lenders use to compare the cost of different loans. It includes the interest rate and other fees the lender may charge you. The comparison rate can help you compare different loans and find the best deal for you.

Valuations

A property valuation is an opinion of the value of a property. The valuer will consider the property's location, the condition of the property, and recent sale prices of similar properties.

A property valuation is different from a market appraisal, which estimates the value of a property based on the current market conditions. Before approving your loan, your property investment finance lender may require a property valuation.

The property valuation assesses the property's value and ensures that the property is worth the amount of money you are borrowing. A property valuation can be useful for other reasons as well.

For example, if you want to sell your property, a property valuation can help you set a price for your property. A valuation can be free as well as comes with a fee. Some property investment finance companies offer free property valuations for their customers.

If the valuation is low, the buyer has six options:

- Renegotiate the price with the seller

- Cancel the contract and get their deposit back

- Ask the seller to pay for the property to be revalued

- Ask the bank to finance the difference to continue with the purchase

- Walk away from the deal

- Buy the property at a lower valuation.

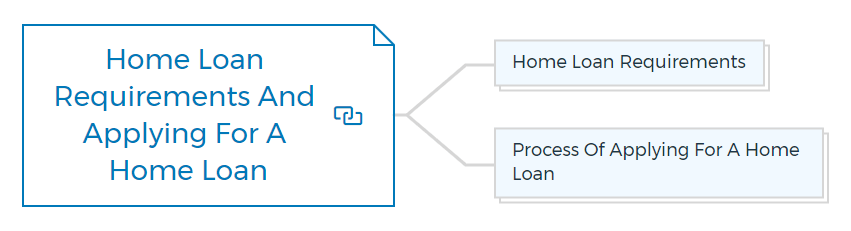

Home loan requirements and applying for a home loan

A home loan is a loan taken out to finance the purchase of a property.

Home loans are available from banks, building societies, and credit unions.

Home loan application requirements

To qualify for a home loan, you will usually need to -

- Two to three forms of ID

- Two or three types of income evidence

- Self-employed full documentation loan, 1-2 full financial years tax returns, and assessment notices for company/trust.

- 6 months of repayments statements of any mortgage debt (if refinancing)

- 3 months personal loan and car loan statements

- Credit card statements of 3 months.

- Notice of Council Rates for Refinances, sometimes required to prove other properties.

- To complete a purchase, you will need the purchase contract, land transfer, deposit receipt, and proof of funds.

- Rental statement/lease agreement or rent appraisal if buying vacant property.

- Full 'stamped' trust deed, if one exists.

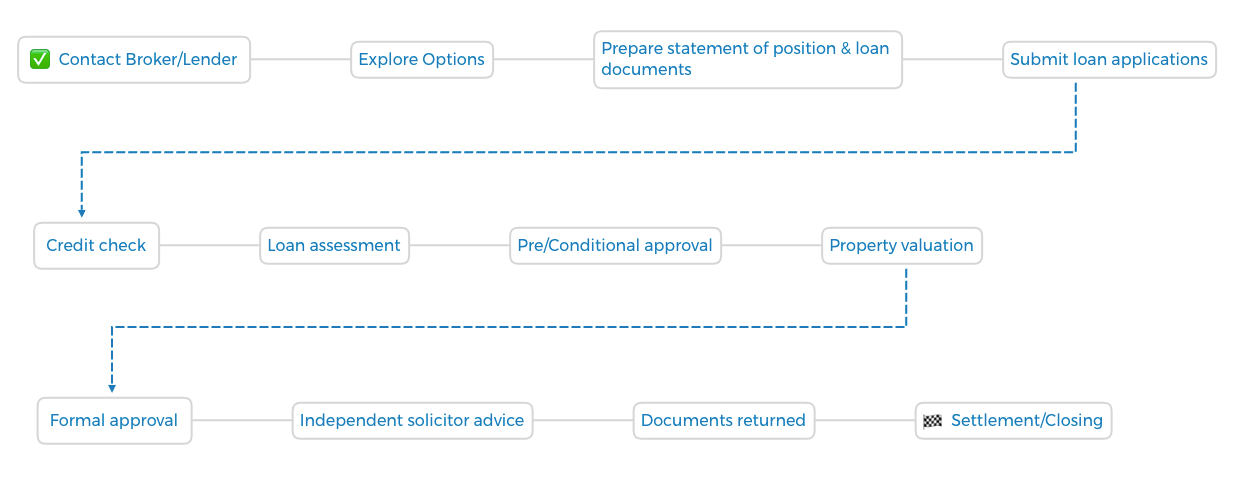

Process of applying for a home loan

When you're ready to buy a house, apply for a home loan to help manage your property expenses.

- Firstly, collect all required paperwork. Tax returns, pay stubs, and bank statements are some examples. You'll also need to know your credit score. The better your credit score, the better your loan interest rate.

- You can now start applying for home loans. There are numerous lenders, so comparing rates and terms is critical. Ask about origination fees and prepayment penalties.

- After selecting a lender, you must submit a loan application. It usually involves completing a loan application and providing basic personal information like name, address, and Social Security number.

- The lender will then assess your loan eligibility. So the lender will likely send an appraiser to value your home. After the appraisal, the lender will make a loan offer.

- You can now accept or reject the loan offer. If you accept, you'll need to sign paperwork and pay a deposit. If you reject the offer, you can look for another loan.

Applying for a home loan does not have to be difficult or stressful. With a little planning and knowledge, you can get the best loan for property investment.

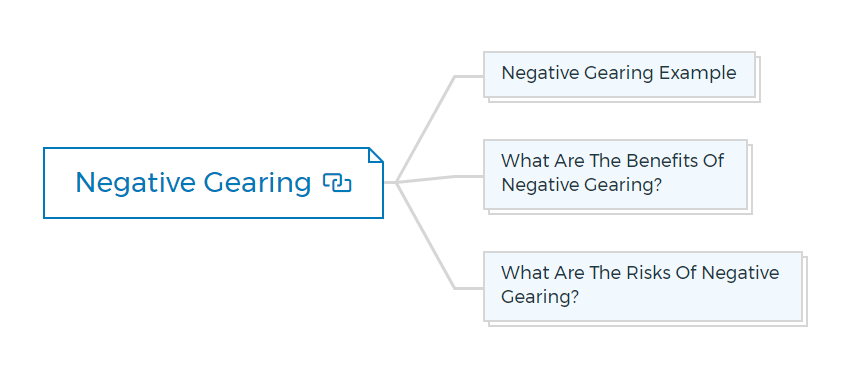

What is negative gearing?

Negative gearing is when your rental income doesn't cover the cost of your mortgage repayments, and you have to make up the difference from your own money.

The property is known to be negatively geared property if the outgoings, such as mortgage repayment, rates, insurance, agents, commission to manage the property, and any body-corporate expense and maintenance, are larger than the income.

Negative gearing example

If you earn $30,000 a year and your rental property costs you $27,000 a year in expenses, your property is negatively geared by $3000 a year.

The ATO will allow you to deduct this amount from your taxable income, which means you'll only be taxed on $27,000 instead of $30,000.

It can reduce your tax and may even bring you into a lower tax bracket.

What are the benefits of negative gearing?

The main negative gearing benefit is that it allows you to offset some of your rental losses against other income, such as your salary or wages.

It can reduce the amount of tax you pay.

It can also help you build up equity in your property more quickly, as your rental income may not cover your mortgage repayments, but the rent you're charged will usually be more than the interest on your loan.

What are the risks of negative gearing?

- The main risk of negative gearing is that you may lose money if your rental property doesn't increase in value or if rents go down.

- You could also end up with a property that is hard to sell, as you may need to sell it for less than you paid for it.

It's important to remember that negative gearing is a long-term strategy, and you should only put your money in the property if you're comfortable with the risks.

If you're unsure whether a negative gearing investment property is right for you, speaking to a financial advisor is good.

What is positive gearing?

Positive gearing is where your rental income covers your mortgage repayments and other costs, such as maintenance and insurance. You also receive a tax deduction for the interest payments on your loan.

It can result in a cash flow positive situation, where you're receiving more money than you're paying out each month.

What are the benefits of positive gearing?

There are several benefits of positive gearing, including:

- The ability to generate a passive income stream

- A tax deduction for the interest payments on your loan

- The potential for capital growth on your property as the value of your property increases.

What are the risks of positive gearing?

There are also several risks associated with positive gearing, including:

- An increase in your tax liability if you make a profit on the sale of your property.

- The potential for negative cash flow if rental prices fall or interest rates rise.

- The possibility that you may have to sell your property if you can't afford the repayments

What is capital gains tax on real estate?

Capital gains tax (CGT) is a tax on your profit when you sell an asset for more than you paid for it. You're only liable for CGT if you make a profit, and you don't have to pay CGT on any losses.

The main assets subject to CGT are shares, managed fund investments, and real estate.

When do I have to pay CGT?

You only have to pay CGT when you sell an asset, and you usually have to pay it within 30 days of the sale. However, there are some exceptions, such as selling your home or being a foreign resident.

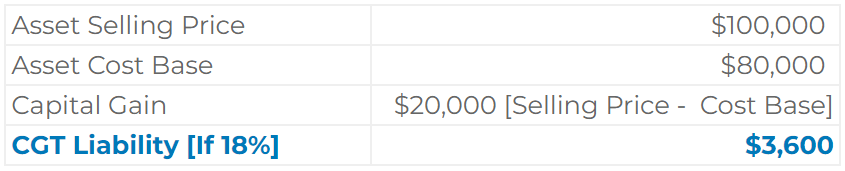

How is capital gains tax calculated?

CGT is calculated on your profit from selling an asset, not on the total sale price.

For calculating capital gains tax liability, you need to know the following:

- Cost base of the asset (what you paid for it plus any costs associated with buying or selling it)

- Capital gain (the difference between the cost base and the sale price)

- Capital gains tax rate (currently 18% for most assets)

You then apply the CGT rate to your capital gain to calculate your CGT liability.

For example, if you sell an asset in Australia for $100,000 and your cost base is $80,000, your capital gain is $20,000. If you're a resident for tax purposes, you will pay 18% on your capital gain, which means your CGT liability would be $3600.

What are the main exemptions and concessions?

The main exemption from the CGT tax rate is your home, as long as it is your main residence.

You can also claim several concessions, such as the following:

- CGT discount (if you've owned an asset for 12 months or more, you may be eligible for a 50% discount on your capital gain)

- Main residence exemption (if you sell your home, you may be able to exempt all or part of the capital gain from tax)

- Private use assets exemption (if you sell an asset that you've used for personal use, such as a boat or a painting, you may be able to exempt some or all of the capital gain from tax)

The 6-year rule in Australia

You won't be eligible for the CGT discount if you sell an asset you've owned for less than 12 months. However, if you've owned the asset for more than 12 months, you may be eligible for the discount if you meet certain conditions.

One of these conditions is the "six-year rule", which states that you must have owned the asset for at least six years before claiming the discount.

The six-year rule encourages long-term investment in assets, as it provides a greater incentive for people to hold onto their assets for longer periods.

Do I have to pay CGT if I’m not a resident for tax purposes?

If you're not a resident for tax purposes, you may still have to pay CGT on any assets you own in Australia. However, several exemptions and concessions may apply, such as the following:

- Foreign resident CGT exemption (if you're not a resident for tax purposes, you may be exempt from CGT if you sell your main residence in Australia)

- Temporary residents concession (if you're a temporary resident, you may be eligible for a concession on any capital gains you make when you sell your assets before you leave Australia)

If you're not sure whether you're liable for CGT, it's good to speak to a tax advisor.

What is equity release for investment properties?

Equity release is a way to access the money tied up in your home without moving out.

You can take out a loan against the value of your home or sell part of your property in exchange for a cash lump sum or regular payments. Equity release is available to homeowners over the age of 55, and you don't have to be retired to qualify.

There are two types of equity release -

Un-controlled equity release/cash out

With Uncontrolled Equity Release/Cash Out, you can take out as much money as you want, whenever you want, but the amount of money you can borrow decreases as you get older.

The interest rate is usually fixed, so you'll know exactly how much your repayments will be each month.

Controlled equity release/cash out

With Controlled Equity Release, the amount of money you can borrow doesn't decrease over time, but there are limits to how much you can take out.

Equity release can be a great way to boost your retirement income, but it's important to understand how it works before making any decisions.

What are self-employed loans?

Self-employed loans are a type of loan specifically designed for self-employed people. People can use them for various purposes, including starting or expanding a business, making home improvements, and consolidating debt.

Self-employed loans typically have higher interest rates than traditional loans. Still, they can be a good option for people who have difficulty getting approved for a loan through a traditional lender.

There are a variety of lenders that offer self-employed loans, including banks, credit unions, and online lenders. Be sure to compare interest rates and terms before you choose a lender.

Low doc self-employed loan for property finance

- A low doc loan for self-employed is a home loan that does not require you to provide evidence of your income.

- This can be beneficial if you are self-employed or have a complex income situation.

- To apply for a low doc loan, you will need to provide proof of your identity and assets and evidence of your ability to repay the loan.

- It may include tax returns, bank statements, and asset valuations.

- The interest rate on a low doc loan is usually higher than a standard home loan, as the lender has more risk.

This loan type is also known as alt-doc, lo doc, low doc, and low documentation.

Full doc self-employed loan for property finance

- A full doc self-employed loan is a home loan that requires you to provide evidence of your income.

- To apply for a full doc loan, you will need to provide payslips, tax returns, and other documentation to prove your income.

- The interest rate on a full doc loan is usually lower than a low doc loan, as the lender has less risk.

- This loan type is also known as a standard home loan or a conventional home loan.

What is a deposit bond when buying a house?

Deposit bonds can be a practical option if you do not have the cash for a deposit or if you want to keep your savings in an interest-bearing account.

- A deposit bond is a type of insurance that can be used in place of a cash deposit when buying a property.

- An insurance company and guarantees issue the deposit bond to the seller.

- If the buyer does not pay the deposit, the insurer will pay the seller.

- Real estate investors can use deposit bonds for both residential and commercial properties.

- They are usually valid for up to 12 months, but this can vary depending on the insurer.

How to get private funding for real estate investing?

Private funding is an alternative to traditional lending in which a group of private investors pool their funds and lend them to a borrower for a limited period.

Most borrowers seek private funding since they don't qualify for traditional loans. It includes a lack of security, a desire for speed, or it's just too complicated or complex.

- They're 6-24 month terms with interest-only payments required at 1% above market rates, up to 6% monthly.

- The minimum amount you can borrow is usually $50,000 with no maximum.

- Try contacting your local real estate investors' association or searching online directories to find private lenders.

- Private funding LVRs are typically 60-75 per cent, equivalent to commercial finance.

Learn More

What is the off-the-plan purchase?

Buying Off-the-plan properties can be a great way to get into the property market, as you can often buy properties at a discounted price.

- An off-the-plan purchase is when you buy a property that has not yet been built.

- You usually deposit and then make payments during the construction period.

- Once the construction is complete, you will need to pay the purchase price balance and take possession of the property.

However, more risk is involved, as the property's value may not be as high as you expect it to be when completed.

Benefits of buying off-plan property

- You can often buy the property at a discounted price.

- There is no need to pay stamp duty on the purchase price.

- You may be able to get a better loan deal from the lender.

- They are mostly in the city or high-density developments in good suburbs within 20 km of a CBD.

Risks of buying off-plan property

- The property's value may not increase as much as you expect.

- There may be a delay in the construction of the property.

- You may not be able to get your deposit back if you change your mind about the purchase.

- There would be no transparency between the building's investor versus owner-occupier split, so proceed cautiously.

The off-the-plan market is booming in many Australian cities, so do your research before taking the plunge.

Self-managed super fund (SMSF) loans

If you're looking to finance a property using your SMSF, there are a few things you need to know.

- You can only borrow for investment purposes, not for personal use.

- The loan must be secured by an eligible asset, such as commercial or residential property.

- The asset must be held in trust for the benefit of the SMSF.

- You can only borrow up to 80% of the property's value.

- You must pay the loan within a maximum term of 30 years.

- You will need to pay interest on the loan and fees.

SMSF loans are a great way to invest in property, but make sure you understand the rules and regulations before taking out a loan.

Security restrictions for SMSF loans

- Owner-occupied property, construction, second mortgage, over 5 hectares, and vacant land are unacceptable scenarios for lenders.

- Interest rates are high, roughly 1.6-2% above a standard variable home loan rate.

Debt service/borrowing capacity for SMSF loans

A key consideration when determining whether to use SMSF borrowed funds to invest in property is the debt service obligations and borrowing capacity of the SMSF.

Several factors will determine the capacity of the SMSF to service the loan, including:

- The income and expenditure of the SMSF

- The interest rate on the loan

- The term of the loan

- The repayment structure of the loan (e.g. interest only or principal and interest)

- Any other investments held by the SMSF

It is important to seek professional financial advice to determine whether your SMSF can service a loan before proceeding with any investment.

Lenders use two basic methods to assess a borrower's borrowing ability.

Net surplus ratio (NSR)

The net surplus ratio (NSR) measures the SMSFs ability to service the loan from its current income.

To calculate the NSR, the lender will take into account:

- The projected after-tax earnings of the SMSF from all sources (e.g. salary, investment income, pension income)

- The projected after-tax expenses of the SMSF (e.g. loan repayments, running costs, insurance premiums)

- The NSR is generally expressed as a percentage and will usually be calculated annually.

For example, if the SMSF's projected after-tax earnings are $50,000 and its projected after-tax expenses are $40,000, the NSR would be 50% (50,000/40,000).

The SMSF has enough income to cover its expenses and still has $10,000 leftover (the surplus).

The higher the NSR, the more comfortable the SMSF is servicing a loan.

Debt service ratio (DSR)

The debt service ratio (DSR) measures the SMSF's ability to repay the loan over the term of the loan.

To calculate the DSR, the lender will take into account:

- The projected principal and interest payments of the SMSF over the term of the loan

- The projected assets and liabilities of the SMSF at the end of the loan term

The DSR is generally expressed as a percentage and will usually be calculated every month.

For example, if the SMSF's projected principal and interest payments are $2,000 per month and its projected assets and liabilities are $100,000 at the loan term, the DSR would be 2% (2,000/100,000).

It means that the SMSF's monthly repayments will eat up 2% of its total assets over the life of the loan. The lower the DSR, the more comfortable the SMSF is servicing a loan.

As a general rule, the SMSF's NSR should be greater than its DSR.

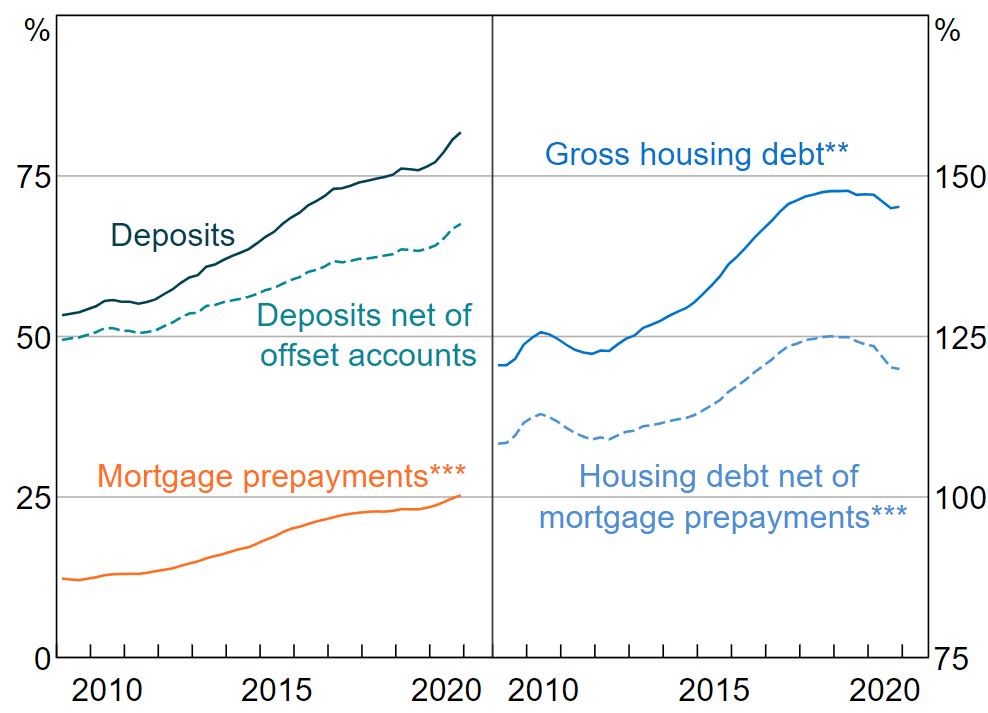

Share of household disposable income

If there is a little surplus, always ask how much you should borrow instead of how much you can borrow. As a buffer, add 2% to 7.25% to the debt cost.

Anyone who has borrowed money recently might consider basing the out-of-pocket cost of any property loan on a 7.2 per cent rate (the average interest rate over the last 20 years). Don't let debt consume more than 40% of your household's income.

Who can lend to SMSF?

Most major lenders, plus a few specialist lenders, are now offering SMSF loans.

- Regular Lenders

Any lender can fund an LRBA. Most major banks currently lend to SMSFs.

Using a major lender has advantages such as sourcing funds, drafting loan agreements, and performing most legal checks.

The disadvantages include higher interest rates than you would get if you borrowed in your name.

- You, as a lender

You can become the lender of the borrowed fund to your SMSF.

If you have excess funds in your name and your super fund cannot afford the home, you may consider this. Another reason could be that you can't find a typical lender ready to lend against the property you want to buy.

- Expert guidance is highly suggested when lending money to an SMSF.

- The amount of money loaned to an SMSF is not capped.

- If an individual is willing to lend the SMSF the whole purchase price plus legal fees, they may do so.

What are family pledge loans?

A family pledge loan is when a family member uses their property to secure your loan. It can be a great way to get into the property market if you don't have enough money for a deposit. Normally, principal and interest are repaid. LVR can go up to 110%.

In many cases, the pledge provider is legally responsible for their portion of the obligation. There are some risks involved, so make sure you understand the pros and cons before taking out a loan.

Pros of family pledge loans

- You can often get a lower interest rate than a standard loan.

- Your family member's property is used as security, so the lender has less risk.

Cons of family pledge loans

- If you default on the loan, your family member's property could be at risk.

- You may not be able to get the loan if your family member's property is not suitable as security.

What is a split contract?

A split contract is an agreement between a property investor and a builder to complete part of constructing a new property.

- The investor provides finance for the builder to start work and then agrees to buy the finished product from the builder after its completion.

- This type of arrangement can be helpful for investors who want to get involved in property development but don't have the funds to finance a project from start to finish.

- You can also use this contract to purchase an investment property already under construction.

- Understand the builder's track record and get a fixed price for the finished product.

Be aware that there may be some risk involved, as the builder may not complete the project on time or to a high standard. Make sure you have a solid contract in place that protects your interests.

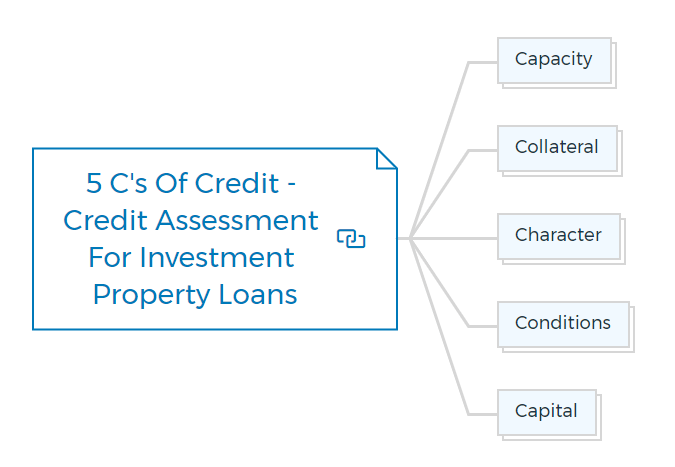

5 c's of credit - credit assessment for investment property loans

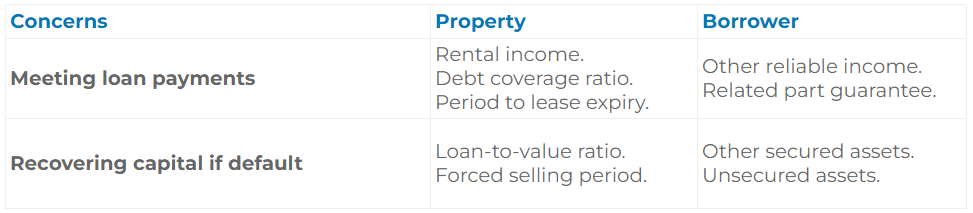

When applying for an investment property loan, the lender will assess your creditworthiness using the Five Cs of Credit.

The Five Cs of Credit are:

- Capacity: Can you afford the loan repayments?

- Collateral: What asset are you using as security for the loan?

- Character: Are you a good borrower?

- Conditions: What are the economic conditions like?

- Capital: How much equity do you have in the property?

Lenders will look at all of these factors when assessing your loan application. It's important to understand each one to put your best foot forward.

Capacity

Capacity refers to your ability to make the loan repayments. The lender will assess your income and expenses to see if you can afford the loan.

They may also consider whether you have other debts that could affect your ability to repay the loan.

Collateral

Collateral is the asset you're using as security for the loan. The lender will assess the asset's value and whether it can be sold to repay the loan if you default.

Character

Character refers to your history as a borrower. The lender will look at your credit report to see if you've made late payments or defaulted on loans in the past. They may also consider your employment history and financial stability.

Conditions

Conditions refer to economic conditions, such as interest rates and inflation. The lender will assess how these factors could affect your ability to repay the loan.

Capital

Capital refers to the equity you have in the property. The lender will look at how much money you've put towards the property's purchase price and whether you can increase your equity if the property value decreases.

Does a property investor need to register for GST?

You must register for GST if you are carrying on an enterprise and your GST turnover is above the registration threshold. If you purchase property as part of your enterprise, you will need to pay GST on the property finance.

When owning the property, as a property borrower, you should be GST registered to avoid paying taxes on the interest earned from your investment. GST registration also allows you to claim tax deductions, which can offset the cost of your loan repayments.

If you are not GST registered, you may find that the interest you earn on your investment is subject to GST. It can significantly increase the cost of your loan repayments.

What is arrears payment?

Arrears payment is a type of payment made when the amount owed is more than what is currently being paid. It can result from missed payments, interest charges, or other fees.

When making an arrears payment, it is important to ensure that all of the correct information is included so that the payment can be processed correctly. It may include the account number, the amount being paid, and the payment date.

Arrears payments can be made in various ways, including by check, online, or over the phone. You can also make these payments through a debt consolidation program. It can help lower the monthly payments and make it easier to catch up on the outstanding balance.

Arrears payments can significantly impact your credit score, so it is important to make them on time and in full. If you are struggling to make arrears payments, contact your lender or creditor as soon as possible to discuss your options.

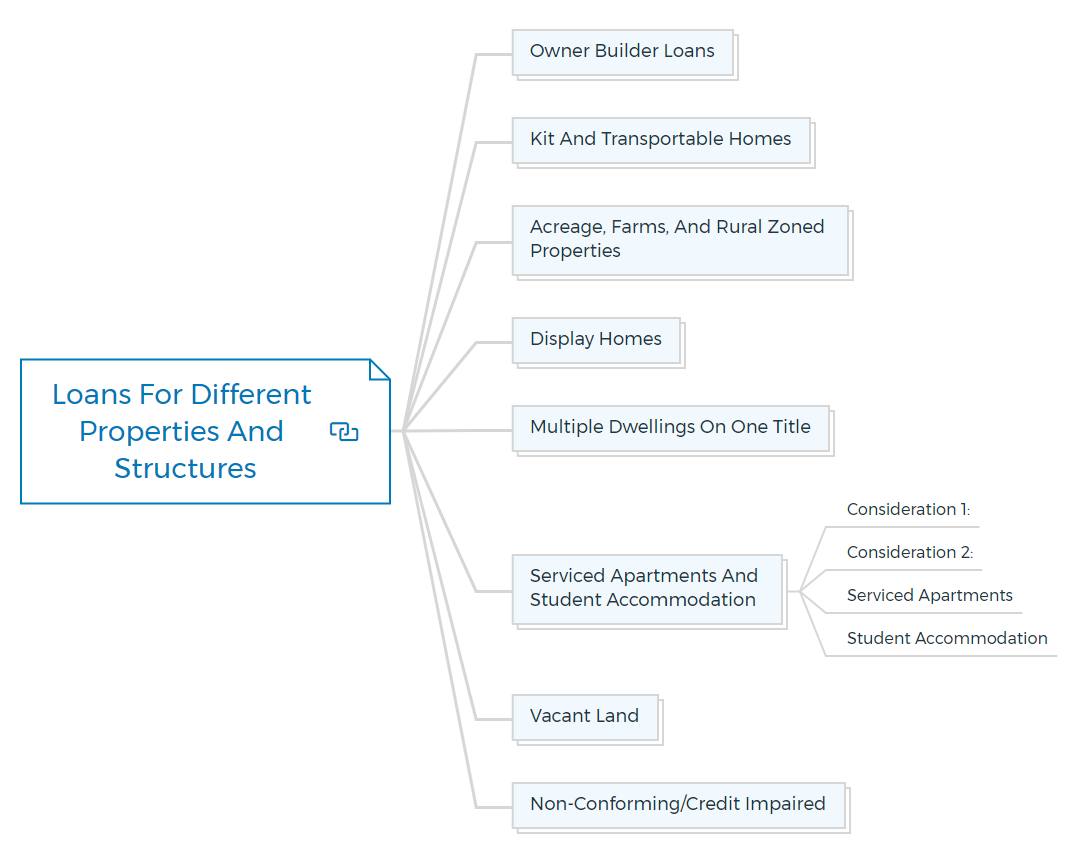

Loans for different properties and structures

There are a variety of loans available for different types of property and structures. Whether you're buying a house, a commercial property, or a development project, there's likely to be a loan that fits your needs.

Some of the most common types of loans for property purchases include:

Owner builder loans

Owner builder loans are a type of construction finance that allows you to finance the construction of your new home as an owner-builder. It can be a great option for those who want to build their own home but don't have the funds to do so outright.

There are a few things to consider before taking out an owner builder loan, such as -

- Whether you have the necessary experience and skills to build your own home.

- You'll also need to factor in the cost of materials and labour and any permits or inspections that may be required.

Kit and transportable homes

A kit or transportable home is a prefabricated home that can be transported to your property and assembled on site. These homes are usually less expensive than traditional stick-built homes and can be a great option for those on a budget.

There are a few things to keep in mind when considering a kit or transportable home, such as

- The cost of transport and assembly

- Permits or approvals that may be required.

Acreage, farms, and rural zoned properties

Some lenders consider this a residential loan. Obtaining a commercial loan is often preferable, especially if the property generates or has the potential to generate income.

In the event of a repossession, the lender would take the borrower's property and the location from where the income is made. Acreage, farms, and rural zoned properties present a unique set of challenges regarding financing.

There are several different loans available for these types of properties, including:

- Rural development loans

- Farm loans

- Agricultural loans

Each of these loans has its requirements and conditions, so it's important to do your research before choosing one.

Display homes

A display home is a property that a developer or builder builds specifically to display their work. These homes are often used as model homes or show homes and are usually located in new developments or subdivisions.

Display homes can be a great option for those looking to invest in a property, as they often come with several features and amenities that aren't typically found in other homes.

There are a few things to keep in mind when considering a display home, such as

- The cost of the property

- Whether the property is furnished or not

- The terms of the lease, if applicable.

Multiple dwellings on one title

You will see multiple dwellings commonly on the Australian Landscape. Multiple dwellings on one title refer to any property with more than one dwelling unit on a single piece of land. It can include duplexes, triplexes, and quadplexes.

Financing for multiple dwellings can be more complicated than for single-family homes, as there are a few different options to consider. Some of the most common loans for multiple dwellings include:

- Secured loans

- Unsecured loans

- Development finance

Serviced apartments and student accommodation

Investing strategies abound. Some tactics yield good cash flow or capital growth, while others waste time and damage an investor's property goals.

Many consider student housing and serviced apartments to be bad investments.

Consideration 1:

Banks rarely lend more than 60% of either type of property value. It is one of the riskiest residential investment property decisions an investor can make, and lenders do not want to take that risk.

Consideration 2:

Because lenders normally only consider 60 per cent LVR (loan-to-value ratio), an investor must contribute 40% plus fees.

It is a waste of money. These funds may have gone to alternative investment properties with higher capital growth potential, up to 95% LVR.

The resale market is far smaller than the usual property market, which is terrible enough for the investor.

There would be many fewer consumers willing to chip in 40%. Like the initial investor, they would have difficulty obtaining financing, as only a few lenders will lend on such security.

So the vendor can't demand the price they desire. It would always be a buyer's market (i.e. sellers would not be in a strong position to negotiate).

Few investors want to put 30-40% of their funds, and many won't have that much.

So don't think about whether you can afford it; think about how many people can afford it - the answer is not many.

Serviced apartments

The capital growth potential of serviced apartments is linked to the property's rental increase. Some serviced apartment contracts include rent hikes over time.

- Leasing increases capital growth. The increase represents a capital gain.

- Be aware that the value may not rise at the same rate as a regular unit.

Services apartments present additional risks such as management service quality, use of the flat, and whether it can be owner-occupied. Lenders dislike them because they are burdensome, restrictive, controlling, and costly.

Student accommodation

Student accommodation can be profitable, although it is usually significantly smaller (under 50 square meters) and riskier.

Depending on location, student housing contracts may be less demanding. Some investors rent out rooms in a house, but it is still a suburban home.

This is preferable to designated student housing since it permits standard debt amounts to be borrowed if the property is valued before locks are installed on each bedroom door.

Lenders regard it as a house and are unaware that they may purchase the property to rent to students.

Vacant land

When there is no construction contract on land smaller than 5 acres, many lenders will only finance up to 90% plus LMI. Later on, a loan increase of up to 95 percent LVR may be possible, allowing for construction.

Lenders frequently require that water and electricity be connected to the land to make it more marketable.

Non-conforming/credit impaired

Many lenders finance property investment for people with non-standard credit. Loans may be available up to 95% LVR and often do not require any deposit.

Credit impaired or "non-conforming" finance is a type of lending typically used by people who have had some financial difficulties in the past. This can include things like defaults, bankruptcies, and other credit problems.

Non-conforming finance is often more expensive than traditional finance because lenders see it as a higher risk. However, it can still be a good option for people who might not be able to get approved for a regular loan.

Suppose you're thinking about applying for non-conforming finance. In that case, it's important to compare different lenders and make sure you understand the terms and conditions of the loan before you sign anything.

- Credit Hits

Your credit file is hit by:

- An enquiry every time you apply for finance;