Tips to increase real estate cash flow

If your real estate business is growing at a crazy fast rate and your profits are going up yearly, you're definitely on the right track.

But don't let down your guard!

Even huge companies and real estate investors face cash flow problems if their finance, operations, and investments aren't working well. It is challenging to keep your business afloat without a steady cash stream.

Earning money from your real estate properties extends beyond property acquisition but necessitates a strategic vision to optimize your investments. There are various strategies you can utilize to improve cash flow.

What is cash flow?

Cash flow is the money left after all the expenses associated with owning and operating a rental property have been paid.

It includes mortgage payments, insurance, taxes, repairs, and more. If money is left over after all these expenses have been covered, that is considered positive cash flow.

Positive cash flow is essential for any real estate investor because it allows them to continue to invest in their properties and grow their business.

Certain factors can affect your property cash flow are -

- Tenant Turnover

- Repairs and maintenance

- Vacancy rate

- Missed rent

- Property taxes and insurance

Ways to increase real estate cash flow?

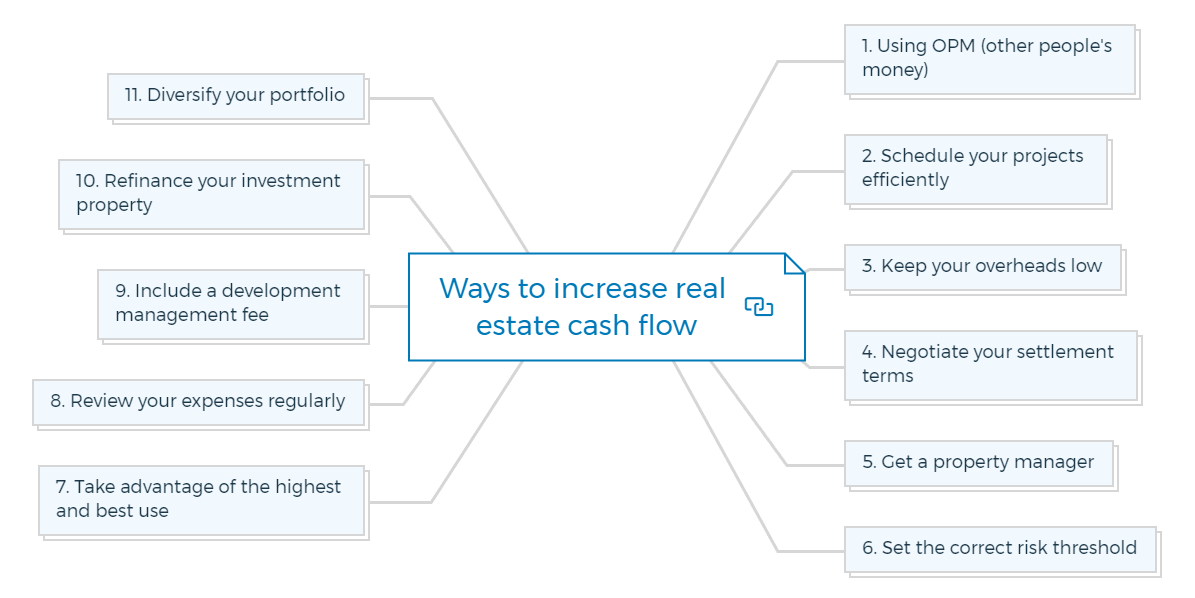

1. Using OPM (other people's money)

Other People's Money, or OPM, is exactly what it sounds like: investing and controlling more and bigger assets with money and capital that belongs to other people.

Using OPM (other people's money), you can increase cash flow and have more available capital to purchase more investment properties. Additionally, since you're not putting your own money at risk, you're minimising your financial risk while maximising your potential profits.

OPM is a great way to get started in real estate investing and development, and it's a strategy that can be used regardless of your experience level or budget.

There are several ways to do this, such as partnering with other investors on a deal or getting a loan from a private lender.

Using OPM will help you stretch your dollars further and enable you to make more investments. Just be sure that you have a solid plan in place and that you're comfortable with the terms of the agreement before moving forward.

So if you're looking for a way to increase your income and build long-term wealth through real estate, then using OPM should be part of your real estate investment strategy.

2. Schedule your projects efficiently

Keeping a steady stream of projects (the cash flow and profits that come with them) is challenging if you only have enough equity to build one project at a time.

Once you have the development approval and some presales, you may be able to do an "equity redraw" and bring in external debt or equity to replace and free up some of your existing equity.

You can then use the money you get back to buy the land for your next project without waiting until the current one is done.

This method uses your equity to make it work more efficiently. It also brings the cash flow streams forward and maximises them over the project's lifecycle.

If you are a property developer, scheduling your projects efficiently is essential. By grouping similar projects, you can save both time and money.

For example, if you need to repaint the exteriors of three properties, you can do them all at once instead of doing one at a time. It will not only save you time, but it will also allow you to get discounts from contractors for bulk work.

All this can set you up for a smooth transition into future projects and improve your cash flow by shortening the time between projects.

3. Keep your overheads low

One of the best ways to boost your real estate cash flow is to keep your overheads low. It includes things like property taxes, insurance, and utility bills.

If you can find ways to save money on these expenses, you'll be able to keep more money in your pocket.

For example, you may be able to get a discount on your property taxes if you have them paid early. And there are several ways to save on your utility bills, such as energy-efficient appliances and weatherstripping.

A very effective strategy that many small and medium-sized developers use is to hire only a few outside consultants for each project.

By doing this, the cost of those consultants is directly tied to a particular project, and the developer doesn't have to pay them regularly as part of his fixed costs.

In some cases, it may also be possible to delay part of the cost payment so that it lines up with a project milestone, further improving the property's cash flow.

4. Negotiate your settlement terms

At the beginning of typical real estate development, the part that costs the most money is settling the development site. By negotiating good settlement terms, you may be able to delay paying for the property until a large amount of risk has been removed.

The most common risk you can remove this way is Approval Risk, which you can manage by including the date of development approval as an "operational date" under the contract.

Here, many developers strike a win-win deal by allowing the seller to stay in the house until the site is ready to go. As a result, the time and money spent waiting for official approvals will go down, improving the project's funding and cash flow in real estate.

5. Get a property manager

Having a good property manager is essential if you own rental properties. A property manager can take care of all the day-to-day tasks of running a rental property, freeing up your time to focus on other things.

And most importantly, a good property manager will help you maximize your rental income and keep your tenants happy. Happy tenants are more likely to renew their leases, which means more money in your pocket!

Get The Edge Now!

Discover the transformative power of our FREE EDGE platform and

unlock a world of opportunities at no cost!

Your Real Estate Toolkit Awaits!

Free eBooks, Courses & Feasibility Suite Trial—Join Today!

✓ Unlimited FREE Trial: Experience the full power of our Feasibility Suite with hands-on demos

—explore without limits, no time pressure & without commitment or credit card!

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalised feedback.

✓ Free Resources Galore: Access a treasure trove of free resources,

eBooks & courses to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

6. Set the correct risk threshold

Consider the appropriate level of return in light of the risks involved if you are considering property development at the regional location or launching a market-first product.

Projects with similar risk profiles are recommended to consider ROCs of at least 30%. In contrast, a lower ROC of, say, 16-18% may be considered if the project has been substantially de-risked through several means, including but not limited to:

- Fully pre-sold/purchase take-out.

- Fixed-price D&C delivery from a major contractor.

- Similar reasons.

7. Take advantage of the highest and best use

Regarding real estate investing, the highest and best use is vital. This means that you should be using your property in the way that will generate the most income.

For example, if you have a vacant lot, you could build a rental property and earn income from the tenants. Or, if you have an unused room in your house, you could turn it into a rental space and charge by night. You can maximize your profits and boost your real estate cash flow by taking advantage of the highest and best use.

8. Review your expenses regularly

Finally, it's essential to review your expenses regularly. It will help you identify any areas where you may be able to save money.

For example, you may be able to get a cheaper insurance policy by shopping around or bundling your policies. Or, you may be able to negotiate better rates with your contractors. Regularly reviewing your expenses ensures that you're not spending more than you need to and that your cash flow stays strong.

9. Include a development management fee

You can guarantee yourself a steady flow of funds throughout the project's development by adding a Development Management Fee to your project's feasibility.

One common way professional fees are paid is by periodic advances from the loan, with the approval of the first-ranking lender in construction financing. Remember that it should be fair and in line with your abilities and the value you provide to the project.

10. Refinance your investment property

If you have an investment property with a good amount of equity, you may be able to refinance the loan and pull out some cash.

You can use this money to make repairs or improvements on the property, boosting its value and rental income potential. Or, you can use the cash for other purposes, such as investing in other properties. Just be sure to shop around for the best rates and interest possible.

11. Diversify your portfolio

Another great way to boost your real estate cash flow is to diversify your portfolio. It means investment in different types of properties in different locations. You'll be more likely to generate a consistent income by spreading your risk.

And, if one property isn't performing as well as you'd like, the others may make up for it. So, don't put all your eggs in one basket – diversify your portfolio and enjoy the benefits of increased cash flow through real estate.

How can you determine if a property can generate cash flow?

You can determine if a property can generate cash flow through the 1% rule, you'll need to know two things:

- the property's purchase price

- the estimated monthly rent.

Then, multiply the purchase price by 0.01. It will give you an estimate of the monthly cash flow that the property should generate.

For example, if a property costs $100,000, you expect it to generate $1,000 in monthly cash flow.

Just because the property you want to invest in satisfies the 1% rule does not imply you should rush into signing a contract and making a financial commitment. You need to check and verify several factors, including -

- Mortgage

- Vacancy

- Repairs

- Dues

- Taxes

3 Steps to calculate your cash flow

#1 - Identify your gross income

#2 - Deduct all expenses related to the property

#3 - Take the difference between above two values

You will get the property's cash flow.

Cash Flow = Gross rental income - All expenses and cash reserves.

Bottom line

When things run smoothly and efficiently, they bring in a lot of cash. Following these simple tips can quickly boost your real estate cash flow.

Just remember that it takes time and effort to see results. So don't get discouraged if you don't see an immediate increase. With patience and perseverance, you'll be raking in cash in no time.

FAQs